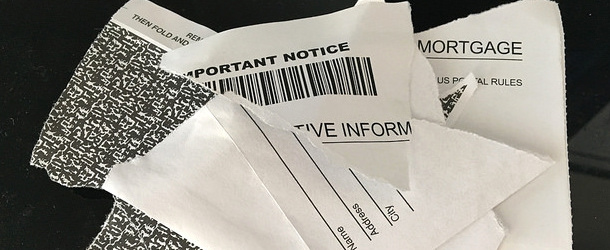

Look Familiar?

This probably goes without saying, but I’ll say it anyway because I recently received a very pressing letter in the post.

It said “Important Notice” on the top left and then something about there being “time sensitive information regarding your mortgage” across the front.

If that wasn’t enough to make me stop what I was doing and open it immediately, it also had three perforated sides. When a letter is adorned with perforated sides you know it’s no laughing matter.

Usually such a letter comes from the IRS or another major agency, and generally it’s not good news, so to delay the opening is not to be tolerated under any circumstances.

Obviously I opened the thing instantly, carefully removing the perforated strips one by one as not to tear or damage the important document in any way.

Once finally unfurled, it was, lo and behold, a mortgage solicitation telling me I could lower my interest rate. It even had my original loan amount on it to make it appear all the more official.

Oddly enough, the mortgage refinance offer enclosed was pretty lackluster. The company said they could lower my rate by about a quarter percent from the existing rate. And perhaps even at no cost to me!

While some might be happy enough to shave a .25% off their rate, I wasn’t too impressed. When I glanced at the fine print, I noticed the mortgage APR was pretty sky-high too. That didn’t surprise me in the least.

[The Mortgage Refinance Rule of Thumb.]

Here’s the Important Notice

I decided to touch on this seemingly mundane issue because these types of advertisements are often intentionally misleading, and since mortgages are fairly complicated, you have to be careful when you receive such solicitations.

The fact that it looks like an “official document” may lead a homeowner to believe that the notice is coming from some trustworthy organization, not just another mortgage lender or broker.

Additionally, there’s nothing on the outside of the envelope that indicates it’s an ad or a solicitation. Even inside there’s nothing about it being an ad, though it might be apparent.

For the uninitiated, this could lead to some confusion and perhaps a bad deal if they simply took the lender up on their offer without shopping around or determining if a refinance even made sense.

I fully understand that companies need to be clever with regard to their marketing materials when most people are so quick to just throw away mail unopened, but personally I’d rather work with a forthright lender from the start.

Questionable Tactics Upfront Speak Volumes

What does this type of marketing say about the mortgage company in question?

If they’re sending stuff like this, are they going to play games with you during the loan process as well?

Will you get the mortgage interest rate they mentioned in the letter, or something a lot higher once it’s all said and done?

What kind of fees might they charge? And will they be transparent about them? Who knows?

How did they even get your information to begin with, via a trigger lead?

For me, this type of dubious solicitation is a bad first impression.

You’re opening what appears to be an important letter with some personal information sprinkled in, only to be sold on a refinance you may not want/need/benefit from.

But if for some reason such a letter does intrigue you, be sure to take the time to research the company before moving forward.

Read more: Is this mortgage lender legit?

- Rocket Mortgage Completes Redfin Takeover, Offers $6,000 Home Buyer Credit - July 1, 2025

- Mortgage Rates Quietly Fall to Lows of 2025 - June 30, 2025

- Trump Wants Interest Rates Cut to 1%. What Would That Mean for Mortgage Rates? - June 30, 2025