How Much Lower Should Mortgage Rates Be to Refinance?

- Unfortunately there is no one-size-fits-all answer to this question

- Because no two loan scenarios (or homeowners) are the same

- You have to factor in existing home loan details along with old rate vs. new

- And future plans/financial objectives/expected tenure in home, etc.

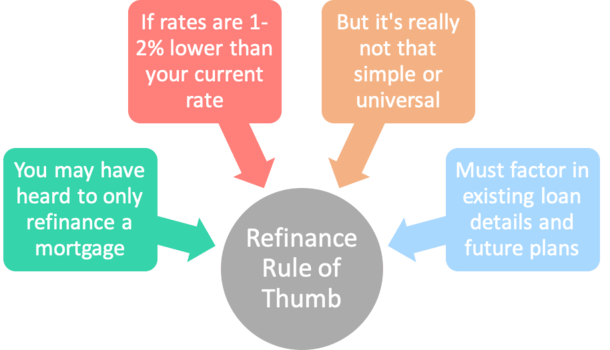

If you’ve considered refinancing your mortgage, you may have searched for the “refinance rule of thumb” to help you make your decision.

Funnily enough, there isn’t just a single refinance rule of thumb. There are numerous ones that exist.

And before we dive into them, it should be noted that rules don’t tend to work universally because there is a laundry list of reasons to refinance a mortgage.

What works for one person might not work for another, and if you’re relying on some sort of shortcut to make a decision, you might wind up shortchanging yourself in the process.

That being said, let’s look at some of these “refinance rules” to see if there are any takeaways we can use to our advantage.

Only Refinance If the New Mortgage Rate Is 2% Lower

- Some say to only refinance if you can get a rate 2%+ lower

- This is definitely not a rule to live by and ultimately very conservative

- It’s possible to save lots of money with a rate that is less than 1% lower

- There are also other reasons to refinance that aren’t always interest rate-dependent

One popular refinance rule says you should only refinance if your new interest rate will be two percentage points lower than your current mortgage interest rate.

For example, if your current mortgage rate is 6%, this rule would tell you to refinance only if you could obtain a rate of 4% or lower.

But clearly this rule is much too broad, just like any other rule out there. When it comes down to it, a refinance decision will be unique to you and your situation, not anyone else’s.

This old rule assumes most mortgage loan amounts are pretty small, unlike the jumbo loans we see nowadays.

The thought might be that the closing costs associated with the refinance could eclipse any potential savings. Chances are this is false.

[How to lower your mortgage rate without refinancing.]

Is It Worth Refinancing Your Mortgage for a 1% Lower Rate?

Let’s take a look at some basic math to illustrate why the 2% refinance rule falls short, and how even a rate just 1% lower (or less) can be quite beneficial:

Loan amount: $500,000

Loan type: 30-year fixed-rate mortgage

Current mortgage rate: 7% ($3,326.51 per month)

Refinance mortgage rate: 6% ($2,997.75 per month)

Cost to refinance: $4,000

In this hypothetical scenario, the existing mortgage payment on a $500,000 loan set at 7% is $3,326.51.

If refinanced to 6%, the monthly mortgage payment falls to $2,997.75. Sounds like it could be worth refinancing…

That’s a difference of roughly $330 a month, which will certainly make it easier to meet your mortgage obligation. Or simply to allocate the savings elsewhere.

However, there is a $4,000 cost to refinance that must be accounted for (let’s not ignore the closing costs).

Still, it would only take just over 12 months to recoup the cost of the refinance ($4000/$330). It’s actually even less time if you factor in increased equity accumulation thanks to the lower interest rate.

That said, the refinance “breakeven period” (time to recoup your upfront closing costs) is very short here. So we don’t need to follow that “2% lower rate” refinance rule.

In fact, even a drop in rate of just 0.50% (from 3.5% to 3%) would result in monthly savings of about $140 and take less than two years to recoup.

[See all the top refinance questions in one place.]

Pay Attention to Refinance Fees, Especially with Small Loan Amounts

But what if the loan amount were only $200,000? The game changes in a hurry. Your mortgage payment would drop from $1,330.60 to $1,199.10.

That’s roughly $130 in monthly savings, not very significant, especially if it still costs you thousands to refinance.

Assuming the cost of the mortgage was still somewhere around $3,000, it would take about 23 months, or roughly two years, to recoup the costs associated with the refinance.

If you were thinking about selling your home in the short term, it probably wouldn’t make sense to throw money toward a refinance.

That is likely why this old refinance rule exists. But home prices (and loan amounts) are much higher these days, so it’s not a good rule to follow for everyone.

The same goes for any other mortgage rate rule that says your rate should be 1% lower, or 0.5% lower.

Whether it’s favorable or not really depends on a number of factors, such as the loan amount, closing costs, and expected tenure in the home.

If we don’t know the answer to all those questions, we can’t just throw out some blanket rule for everyone to follow. Again, don’t cut corners or you could find yourself in worse financial shape.

[Check out these mortgage payment tables to quickly eyeball differences in rate, or use my refinance calculator to run your own simulation.]

Tip: Pay close attention to the closing costs associated with the loan. Simply looking at the rate and payment isn’t good enough.

Only Refinance If You’ll Save “X” Dollars Each Month

- This blanket refinance rule fails to consider the interest savings

- The decision might have nothing to do with your monthly payment

- There are other benefits to a refinance aside from paying less each month

- Such as the faster accrual of home equity and a shorter loan term (perhaps due to retirement)

Another common refinance rule of thumb says only to do it if you’ll save “X” dollars each month, or only if you plan to live in your home for “X” amount of years.

Again, as seen in our example above, you can’t just rely on a blanket rule to determine if refinancing is a good idea or not.

Some borrowers may need to stay in their home for five years to save money, while others may only need to stick around for just over a year.

But plans change, and you may find yourself living in your home much longer (or shorter) than anticipated.

And if you look at the refinance savings in dollar amounts, it will really depend on the cost of the refinance and how long you make the new payment.

If it’s a no cost refinance, which is always a popular option, you won’t even have to worry about the break-even period.

There are also homeowners who simply want payment relief, even if it means paying more interest long-term.

Others may want to refinance into a shorter-term mortgage, perhaps to pay off their loan before retirement, even if it increases their payment in the process.

So it’d be foolish to get caught up on this rule unless you have a bulletproof plan in place. Let’s face it, nobody does.

[Does refinancing hurt your credit score?]

Forget the Rules, Consider the Loan Term and Type

- The mortgage term (and type) can be a big part of the decision to refinance

- Consider your remaining loan term and what type of mortgage you’ll be refinancing into

- Along with how long you plan to keep the new loan post-refinance

- Also factor in your future plans (moving, staying put, or keeping the property to rent out?)

Finally, consider the mortgage term when refinancing, and the total amount of interest you can avoid paying over the life of the loan.

If you’re currently five years into a 30-year fixed mortgage, and refinance into a 15-year fixed mortgage, you’ll shave 10 years off your aggregate mortgage term.

Assuming mortgage rates are low enough at the time of refinance, you could even wind up with a lower monthly payment despite the shorter term.

You will also build equity faster and greatly reduce total interest paid, which will shorten your break-even period and maximize your savings.

[30-year mortgage vs. 15-year mortgage]

If you simply refinance into another 30-year loan, you must consider the five years in which you already paid interest when calculating the benefits of the refinance.

Those who have had their mortgage for a decade or longer may won’t want to restart the clock at 360 months, even if mortgage rates look too good to pass up.

Also factor in your current loan type versus what you plan to refinance into.

If you currently hold an adjustable-rate mortgage that will reset higher soon, the decision to refinance may be even more compelling.

Put in the Time and Do the Math Before You Decide

At the end of the day, you shouldn’t use any general rule to determine whether or not you should refinance.

Doing so is lazy, especially when it’s not that difficult to run a few numbers to see what will make sense for your particular situation.

If you feel overwhelmed by all the math, ask a friendly loan officer or mortgage broker to run some scenarios for you to illustrate the potential savings and break-even periods.

They have the tools at their fingertips to quickly generate various outcomes simply by plugging in some numbers.

Just be sure they’re giving you an accurate and complete picture and aren’t simply motivated by a paycheck. Data can be manipulated in many ways.

As noted, you can also check out my mortgage refinance calculator on this very website to run the numbers yourself.

Either way, take your time – you’re not shopping for a big screen TV, you’re making one of the biggest financial decisions of your life.

The return on investment can be huge if you get it right.

Tip: When to refinance a home loan.

(photo: angermann)