When the mortgage crisis struck in the early 2000s, missed monthly payments and notices of defaults increased dramatically, leading to the rise of the “short sale.”

A combination of plummeting property values and a lack of home equity forced many homeowners to look for a way out, hoping to avoid foreclosure along the way.

What Is a Real Estate Short Sale?

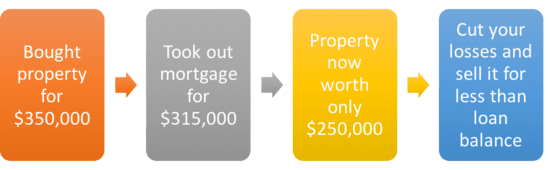

In short, it’s the sale of a property for less than its associated mortgage balance, which allows both the homeowner and mortgage lender to cut their losses if a traditional sale isn’t possible.

Simply put, if what you owe on your mortgage exceeds the current value of your property, a traditional home sale will be difficult.

After all, you’ll need to make the lender whole, and if you can’t sell for what you owe, that won’t be possible.

Typically, a home seller will use the proceeds of their sale to pay off the loan amount in full, with the excess going into their pocket.

The short sale is essentially a loss mitigation option for a struggling homeowner who wants to sell, but can’t. And doesn’t want the black-eye of a foreclosure on their credit report.

Real Estate Short Sale Example

Original purchase price: $500,000

Current appraised value: $350,000

Outstanding mortgage balance: $450,000

In this example, the homeowner wouldn’t be able to sell their home and satisfy their outstanding loan balance.

Not only do they owe $100,000 more than the home is worth, but there would also be transactional costs related to the sale.

This individual would be a good candidate for a short sale, though the lender holding the mortgage would need to approve.

Short Sales Became Increasingly Common in the 2010s

- Many home buyers purchased properties at the height of the market in the early 2000s

- Often with zero down financing and interest-only mortgages (or pay option ARMs)

- When home prices declined rapidly many of these homeowners held underwater mortgages they couldn’t afford

- And because they had no home equity, a traditional home sale wasn’t possible

Although not normally a common practice, real estate short sales surged in popularity as a result of the most recent housing downturn.

It was the perfect storm of inflated home values and exotic mortgage financing, the latter of which was designed to make a home affordable at the time.

Typically, short sales are reserved for extreme cases when the bank or lender decides that it is in their best interest to take an early loss instead of enduring costly foreclosure proceedings. Yes, foreclosures cost banks and mortgage lenders money too.

If you’ve missed a few mortgage payments and recently received an NOD, or Notice of Default, you may be seeking out foreclosure alternatives. Even if you’re still making on-time payments, you might want to sell and on move on for whatever reason.

But if your existing mortgage balance is greater than the value of your property (referred to as an underwater mortgage), and you don’t have the ability to make your mortgage payments in full, you could have few places to turn aside from foreclosure.

The reason foreclosures weren’t a problem in preceding years was due to appreciating home prices and more prudent financing options. Even if homeowners fell behind on payments, their homes would often be worth more than what they bought them for.

So a standard market sale would still be possible because these borrowers had equity in their homes beyond the outstanding mortgage balance.

Once home prices began to move sideways or drop, many homeowners weren’t so lucky.

This was especially true for borrowers who got into negative amortization loans or even high loan-to-value loans, who found themselves with a mortgage balance that exceeded the value of their home.

Even those who put 20% down and made all their payments on time may have just purchased a home at exactly the wrong time, namely the height of the market, which eventually pushed their home underwater too.

Let’s look at an example where a short sale isn’t necessary:

2003 purchase price: $500,000

Existing mortgage balance: $490,000

2012 property value: $600,000

In the above situation, even though the outstanding mortgage balance is just below the original purchase price, there is still $110,000 in home equity.

So a short sale is not necessary, as the owner could sell the home and cover the cost of the mortgage and closing costs with plenty of room to spare.

The homeowner in this example may have pulled cash out or opened a home equity line of credit after home prices increased.

But because they didn’t fully tap out their equity, they’ve still got breathing room to avoid a short sale if they’re unable to continue making payments.

If we consider that listing agents take 3% of the sales price and give another 3% to the buyer’s agent, then we add another 2% in transaction fees, that’s roughly $48,000.

The home seller could still walk away with roughly $62,000 via a traditional home sale.

Here’s an example when a short sale may make sense:

2006 property value: $650,000

Existing mortgage balance: $675,000

2012 property value: $655,000

In this example, though the home appreciated ever so slightly over six years, the borrower was making 1% minimum payments each month via a pay option arm, thus tacking additional interest on top of the existing loan balance.

The result was a mortgage balance greater than the current value of the home, making the situation ideal for a short sale if the borrower fell behind on payments or simply wanted to walk away.

Of course, even those who made fully-amortized mortgage payments each month found themselves upside down on their mortgages thanks to the precipitous drop in home prices during that time.

This was mainly due to the existence of zero down mortgages that were so pervasive at the peak of the housing boom.

Clearly this was a deadly combination for even the most responsible of homeowners, which explains why short sales and foreclosures became so prevalent.

Note that even those with some equity (near-negative equity borrowers) might not be able to sell their homes because of the transaction costs involved.

As illustrated above, if you use a real estate agent you’re looking at 5-6% of the purchase price.

Factor in transfer taxes and other closing costs and you might have to pursue a short sale, even if the remaining loan amount is less than the home’s value.

Short Sales Are Complicated and Time Consuming

- Short sales can take a very long time to complete

- And may be riddled with paperwork along the way

- Lender approval isn’t a guarantee (they need to sign off on it)

- And you still need to find a buyer for the property like a standard home sale

So are short sales the answer? Before you think you’ve found the magic bullet, think again.

Short sales are complicated, just like the foreclosure process, and also require lender approval.

They take a lot of time and work, as well as cooperation from a number of interested parties, including the bank or lender, loan servicer, investor on the loan, home buyer, real estate agents, and the homeowner.

If you’ve missed multiple mortgage payments and are facing foreclosure, the bank or lender won’t automatically offer a short sale.

You need to prove that your situation merits a short sale, which typically involves providing documentation that proves you are indeed in dire straits (not the band) with no other viable options.

Even if your situation fits, the bank or lender must still decide if your particular situation works for them financially.

They aren’t offering this option out of the kindness of their heart. So it can be a fight and take a lot of time to get a short sale approved.

And as the ailing homeowner, you’ll still need to find a prospective buyer for your home.

As you probably already know, selling a home takes time, even if it’s a short sale property.

In fact, it can take even more time than a traditional sale because both the bank and the buyer have to agree on the sales price.

This will also make the home buying process more cumbersome, and could lead to a lot of fallout if a first-time home buyer gets spooked or impatient.

Couple that with the complicated process of assessing comparable sales in the area and the fact that the lender must decide if the price is right, and you’ll quickly realize that things could take a while.

Short Sales Are Often a Last Resort Before Foreclosure

- Like a foreclosure, you lose your home via a short sale (not good if you like your home)

- They should still be treated as a last resort once you have exhausted all other options to keep your home

- The benefit is slightly less credit score damage and a shorter wait to qualify for a mortgage again

- The downside is you have to find a buyer for your home and it can take a while

Ultimately, there are pros and cons to short sales, like anything else.

Though short sales can be a blessing to some homeowners, as they may not do as much credit score damage as a foreclosure (assuming you do them right), they should still be treated as a serious and final option before foreclosure.

After all, do you really want to lose your home and experience difficulty buying another one in the future? Sure, the short sale will result in a shorter waiting period to buy a home again, but it’s a wait nonetheless.

Freddie Mac and Fannie Mae require at least a two-year wait, possibly four years without extenuating circumstances, compared to three or seven years for a foreclosure.

Another plus to a short sale is that you might be able to avoid a deficiency judgment, where the lender can come after you for the shortfall between the sales price and loan balance. But tax implications may still persist.

There are other loss mitigation options out there to stop loan foreclosure, such as a short refinance or a loan modification program, and if you speak with the bank or loan servicer, they’ll likely point out other alternatives first.

Ultimately, banks and mortgage lenders want to cut their losses, and they’ll do whatever is in their financial interest, first and foremost.

So if you do decide to pursue a short sale, you’ll need to make a strong case for yourself or you’ll likely be denied. Though the volume of short sales picked up quite a bit post-crisis, it won’t always be an option.

Make sure you consider all of your alternatives before making the huge decision to sell your home.

Those Who Stuck Around Are Now in Good Shape

- Many who sold their homes short during the crisis would actually be in pretty good shape today

- Had they held onto their properties and rode out the storm they’d like be very equity rich today

- Thanks to massive home price appreciation and the availability of low mortgage rates

- But that’s the benefit of hindsight and it often wasn’t a viable option for most

Many of those who were able to endure the housing crisis and hold onto their homes are actually in great shape nowadays.

I know folks who were underwater by more than a $100,000 during the dark times a few years ago, but are now up several hundred thousand dollars from the time they purchased the property.

Often, if you’re able to ride out a bad cycle in real estate, you can come out way ahead, even if you’ve got a huge paper loss on your hands temporarily.

And that’s the takeaway. It’s not actually a loss until you decide to part with the property for less than what you bought it for.

Of course, many couldn’t afford their homes, or were unwilling to keep paying large mortgage payments because they didn’t believe home prices would rebound.

With the benefit of hindsight, we now know this may have been a huge mistake.

Imagine selling Apple stock back in 2009 because you got spooked, only to watch it rise tenfold five short years later.

The same concept can be applied to a home, granted you have to continue paying a mortgage to reside in it each month.

The point is that real estate isn’t a short term investment, nor is it something you should take lightly.

Always make sure you can afford to stay in the home through good times and bad.

And pay close attention to the type of financing you use to purchase your property to ensure you can afford it regardless of what happens.

Hopefully you won’t find yourself in a situation where you need to sell your home short, but it can be a useful solution for some who no longer have the means to keep their property.

Buying a Short Sale for a Discount

- It might be possible to buy a short sale for a huge discount

- But the process can be very time consuming and uncertain

- The transaction may fall through if the lender/investor doesn’t approve the sale

- Try to find a pre-approved short sale that fell through to save time and increase chances of success

If you find yourself on the other side of the fence, as the prospective buyer of a short sale property, it can be a great deal.

You’re essentially getting a discount on a home that the existing owner can no longer afford. And it may be in perfectly good shape, in a desirable part of town, unlike a foreclosure, which may need considerable work.

However, as noted, expect the short sale process to be quite time-consuming, perhaps taking several months for the transaction to be completed.

Remember, the mortgage company needs to agree to let the borrower sell short and establish an acceptable sales price, and banks aren’t always as motivated as homeowners might be.

The trade-off is that you should be able to purchase a home below market value, so patience can be rewarded.

While short sale discounts will vary by city, state, and time period, you could save anywhere from five percent to 20% or more.

One of the quickest and easiest ways to buy a short sale is to make an offer on a property that already has bank approval for a certain sales price.

If the lender has already agreed to accept the listed price, a short sale can move rather quickly, potentially as fast as a traditional sale.

For example, if a buyer backs out after successfully negotiating a short sale price, you can move in and make an offer without delay.

In this case, you might be able to close in as little as 30 days and ideally save some big bucks.

Read more: Short sale waiting periods.

Colin, we had a short sale go through in July 2013. We only had 1 late payment due to the closing date moving from June 29th to July 2 right at the end. What I was wanting to know is, can I get a mortgage 18 months later with an average credit score of 753, 180k income and less than 10k in credit card debt. I know the big-box lenders wouldn’t do it probably but could a local lender? Thanks for your thoughts.

Jerald,

There are definitely programs for borrowers who have had a recent short sale, though the interest rate will likely be higher and the loan restrictions more plentiful. Probably best to speak with a broker who can take a closer look at your credit and then shop all their available loan programs (with local and national lenders) at once to find a home for your loan.

I applied and was approved for a 24 month modification of my mortgage loan. The modification expired April 2016, my remaining balance owed is only $9200. I ask my mortgage if they would consider taking $7200.00 as payment in full. While my request is being reviewed the mortgage co ask that someone come by take pictures of my house inside & out? Why…

Thanks

Sam,

It sounds like they’re doing an appraisal of some kind to assess the value of the property.

Hello. I have a question regarding foreclosure in CT. My wife and I can’t afford to keep our house and it is in my step son in laws name. It has been 3 months since the foreclosure process started and is in short sale mode. The lender canceled the insurance. We found a small apartment and the first months rent and security has been paid. It is only a 9 month rental but it’s only 700 a month and it’s a cabin at a 4-h camp. If we leave is the bank responsible? Thanks

Ernie,

Depends on the foreclosure laws in your state, the deficiency balance, etc. May want to consult a professional to determine course of action.

Hi Colin, I’m reaching out to all with hope that you or anyone can help Me. I just got served with foreclosure papers! After 6+ yrs of torment and circus acts of trying to repair my mortgage. I qualified and was given a “stimulus” package in 2010 paying 2% for 5yrs etc. only to have it taken away 6 months later for missing paperwork(which I was never told what papers were missing!). so I was made to start the process all over again now paying a rate of 11.5% YES! 11.5% after 1 yr of sending paystubs/Bank statements and many more hoops! I got no where, I had a professional work on it as she went through the same. then another and another. I hired a law firm in 2014 to address the issue! which cost me $5000.00. they promised I was being bamboozled by Citibank and would handle it! They too did absolutely nothing to help but waste more precious time! and I’m in the process of reporting them to the bar/better business etc. I DONT KNOW WHERE TO TURN ANYMORE…PLEASE HELP OR ADVISE ME BEFORE I LOSE MY HOME FOR OVER 20YRS!..

If you read this entirely, I thank you from the bottom of my heart!!

J Roschbach

SI NY 10314