How Mortgage Amortization Works

- While your mortgage payment stays the same each month

- The composition changes over time as the outstanding balance falls

- Early on in the loan term most of the payment is interest

- And late in the term it’s mostly principal that you’re paying back

Ever wonder how your home loan goes from a pain in your neck to real estate free and clear?

Well, it all has to do with a magical little thing called “mortgage amortization,” which is defined as the reduction of debt by regular payments of interest and principal sufficient to pay off a loan by maturity.

In simple terms, it’s the way your mortgage payments are distributed on a monthly basis, dictating how much interest and principal will be paid off each month for the duration of the loan term.

Jump to amortization topics:

– Principal vs. Interest

– Fully Amortized vs. Interest-Only

– Mortgage Amortization Example

– How to Shorten the Amortization Period

– How to Pay Off My Mortgage in 10 Years or Less

Understanding the way your mortgage amortizes is a great way to understand how different loan programs work.

And an amortization calculator will show you how your balance is paid off on a monthly or yearly basis.

It will also show you how much interest you’ll pay over the life of your loan, assuming you hold it to maturity.

Trust me, you’ll be surprised at how much of your payment goes toward interest as opposed to the principal balance.

Of course, there’s not much you can do about it if you don’t buy your home in cash, or choose a shorter loan term, such as the 15-year fixed mortgage.

Unfortunately, with home prices so high and home affordability so low, most home buyers (and especially first-time home buyers) tend to go with 30-year mortgages.

These are the default choice, whether we’re talking about conventional loans or FHA loans.

There’s nothing inherently wrong with that, but it does mean you’ll pay a lot of interest for a very long time.

Still, if you can get a better return for your money elsewhere, or if you have higher-APR debt like credit cards, auto loans, student loans, and so forth, it can still be a great choice.

How Mortgage Payments Work: Early Payments Go Toward Interest

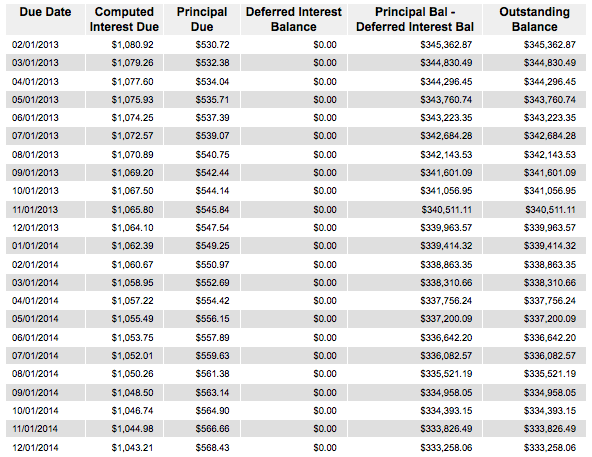

- This is a real amortization schedule for a 30-year fixed-rate home loan

- You’ll notice that the bulk of the monthly payment is interest

- Over time the interest portion will go down and the principal portion will rise

- Thanks to a smaller outstanding loan balance

Pictured above is an actual “amortization schedule” from an active mortgage about five months into a 30-year fixed-rate mortgage. That means it’s got another 355 months to go. Almost there!

Your mortgage lender or loan servicer may provide an amortization schedule calculator that you can use to see how your loan will be paid off.

Or you can use any number of free loan amortization calculators found online. It can be helpful to make decisions about your mortgage going forward.

As you can see in the table above, the principal and interest payment is $1611.64 per month. It doesn’t change because the loan is fixed, but the ratio of interest to principal does.

Early on, more than $1,000 of that $1,611.64 is going toward interest each month, with just over $500 going toward the principal balance.

You want those principal payments to go up because they actually pay down your loan balance. The rest just makes your lender (and loan servicer) rich.

The good news is as you pay down your mortgage, the total amount of interest due will decrease with each payment because it’s computed based on the remaining balance, which goes down as principal is paid back.

And as that happens, the amount of principal rises because a fixed mortgage has a fixed payment too. So it’s a win win. Sadly, it doesn’t happen all that quickly.

During the first half of a 30-year fixed-rate loan, most of the monthly payment goes to paying down interest, with very little principal actually paid off.

Toward the last 15 years of the loan, you will begin to pay off a greater amount of principal, until the monthly payment is largely principal and very little interest.

This is important to note because homeowners who continuously refinance their mortgages will find themselves back in the interest-paying portion of the loan every time they start anew, meaning they’ll pay a lot more interest over the years.

Each time you refinance, assuming you refinance into the same type of loan, you’re essentially extending the loan amortization period of the mortgage.

And the longer the term, the more you’ll pay in interest. If you don’t believe me, grab a mortgage amortization calculator and you’ll see.

Tip: If you have already paid down your mortgage for several years, but want to refinance to take advantage of low mortgage rates, consider refinancing to a shorter-term mortgage, such as a 15-year or 10-year fixed mortgage.

This is one simple way to avoid “resetting the clock” and stay on track if your goal is to pay off your mortgage. Use a refinance calculator to determine the best approach when doing your loan comparison analysis.

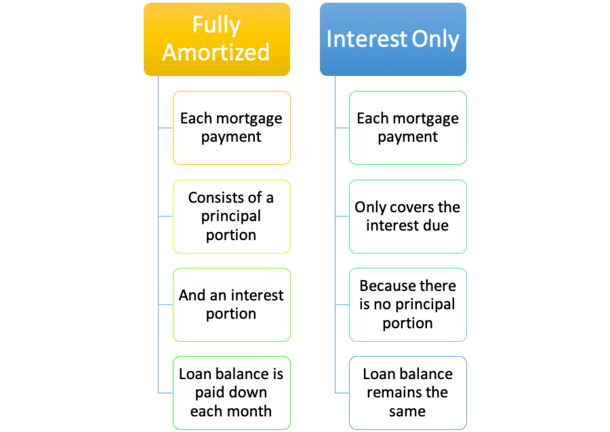

Fully Amortized vs. Interest-Only

If you’ve come across the term “fully-amortized,” you might be wondering what it means.

Simply put, if a borrower makes regular monthly payments that will pay off the loan in full by the end of the loan term, they are considered fully-amortizing payments.

Often, you’ll hear that a mortgage is amortized over 30 years, meaning the lender expects payments for 360 months to pay off the loan by maturity.

This relates to the fact that most mortgages have 30-year terms, such as the popular 30-year fixed.

To better illustrate, let’s consider interest-only mortgage payments, which are often an option on home loans.

If your lender gives you the choice to pay just the interest portion of the mortgage payment each month, it would not be considered a fully-amortized payment.

Why? Because if you continued to make those payments each month, they wouldn’t pay off the loan.

In fact, an interest-only payment would do absolutely nothing to pay off the principal balance of the loan. It would only tackle the monthly interest expense.

If you had a loan with an outstanding balance of $300,000 and solely made interest-only payments for five years, you would still owe $300,000 after those 60 months were up.

So for a loan to be fully amortized, you need to make both a principal and interest payment each month.

Let’s look at a mortgage amortization example:

Loan amount: $100,000

Interest rate: 6.5%

Monthly mortgage payment: $632.07

Say you’ve got a $100,000 loan amount set at 6.5% on a 30-year fixed mortgage. The total principal and interest payment is $632.07 per month.

As noted, this amount will not change from the start date of your mortgage to the very end.

If you break down the very first monthly mortgage payment, $541.67 goes toward interest and $90.40 goes toward principal.

The outstanding balance is reduced by $90.40, so next month you’ll only owe interest on a balance of $99,909.60.

When it comes time to make your second monthly mortgage payment, interest is calculated on the new, lower balance.

The payment would remain the same, but $541.18 would go toward interest and $90.89 would go to principal. This interest reduction would continue until your monthly payments were going primarily to principal.

In fact, the 360th payment in our example contributes just $3.41 to interest and a whopping $628.66 to principal. A payoff calculator will illustrate this.

Consider Larger Mortgage Payments to Shorten Amortization Period

- If you want to pay your loan off faster and reduce your interest expense

- You can make larger payments each month to accomplish both those things

- The excess amount will go toward the outstanding loan balance

- Reducing the amount of interest due on subsequent payments

Okay, so now you have a better idea of how your mortgage amortizes or gets paid off. Your next move will be to determine if paying your mortgage down faster is a good idea.

In the example above, you’ll pay a total of $227,545.20 over the 30-year term, with $127,545.20 going toward interest. Ouch!

If you make slightly larger payments, say $700 each month instead (consistently), your mortgage term will be cut by roughly seven years (23 years total) and you’ll only pay $76,448.10 in interest.

That will save you about $50,000 over the life of the loan…not bad.

If saving money is your goal, you can also make an extra payment here and there if you so choose, which can make a major dent in your loan balance.

It’s actually pretty incredible how far a little extra goes in the mortgage world.

Conversely, you might be happy as a clam to pay your mortgage down slowly, seeing that mortgage rates are so low relative to other types of loans and/or investment options.

For example, if you can pay a rate of 4% on your home loan for 30 years and get a double-digit return in the stock market, what’s the rush?

This is why some home buyers opt for adjustable-rate mortgages with no intention of ever paying off their loans, knowing they can do better elsewhere.

How Do I Pay Off My Mortgage in 10 Years?

- If you want to pay off your home loan faster

- Say in 10-15 years as opposed to 30

- You simply need to figure out what the monthly payment would be

- Based on the number of months in which you want it paid off

Now let’s look at some specific ways to greatly speed up the loan amortization process, assuming you don’t have other credit card debt, auto loans, personal loans, and the like.

I’m providing ballpark estimates here, so do your diligence with a mortgage calculator to determine what works for your particular loan amount and mortgage rate. Results may vary.

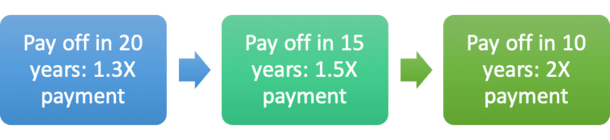

How to pay off your 30-year mortgage in 20 years:

Depending on your mortgage rate, a monthly payment of around 1.2X to maybe 1.3X should whittle your loan term down from 360 months to around 240 months, and save a ton of interest in the process.

Just find out what the 20-year payment would be and you could make 240 monthly payments instead of 360. Then plug it into a extra mortgage payment calculator to see the savings.

How to pay off a 30-year mortgage in 15 years:

If you want to cut your mortgage term in half, simply figure out what the 15-year payment would be, then make that payment each month until the mortgage is paid in full. In general, this is about 1.5X the 30-year payment.

For example, a $350,000 mortgage set at 5% would require a monthly payment of $1878.88 in order to be paid off in 30 years.

If you made the 15-year payment of $2767.78 instead, the mortgage would be paid off in 180 months, or 15 years.

How to pay off a 30-year mortgage in 10 years:

If you want to pay off the mortgage in just 10 years, the rule of thumb is to double your monthly mortgage payment. It’s not exact, but it’s very close.

Using our example from above, you’d need a monthly payment of $3712.29 to extinguish the loan in 120 months. Those with relatively small loan amounts might have no trouble doing this.

At the same time, it might be a big ask for someone with a jumbo mortgage who is struggling with affordability as it is.

How to pay off a 30-year mortgage in 5 years:

If you’re really impatient and want to pay off the mortgage in five years, you basically have to make anywhere from 3.5-4X the monthly payment. That’s $6,604.93 in our example to pay it all off in 60 months.

How to pay off a 15-year mortgage in 10 years:

If you have a 15-year fixed, but want to pay it down in 10 years, you can generally make a monthly payment about 1.5X and it’ll be paid off in 120 months instead of 180.

How to pay off a 15-year mortgage in 7 years:

To cut your 15-year mortgage term in half (or a bit more), doubling mortgage payments would pretty much lower the term to seven years or less, perhaps closer to 6.5 years.

How to pay off a 15-year mortgage in 5 years:

For those with a 15-year mortgage who want to triple the payoff speed, a monthly payment roughly 2.5X will get the job done.

You can do this same formula for basically any mortgage term and desired payoff duration.

So if you have a certain payoff date in mind, figure out the number of months first, then plug in that monthly payment into a loan calculator to get the length of the mortgage down.

I should mention that mortgage rates are lower on shorter-duration home loans, so you may actually save more money by choosing a shorter loan term to begin with.

However, you do get the added bonus of flexibility if you have a longer-term mortgage and making extra principal payments is simply voluntary.

This is why a mortgage refinance from a 30-year mortgage to a 15-year fixed mortgage can be so powerful.

Not only is the term shorter, but the interest rate is lower too. Sure, the payment amount will rise, but you’ll own your home a lot sooner and pay way less interest.

Take the time to learn about biweekly mortgage payments as well if you’re into saving money.

These are payments made every two weeks, which equates to 26 total payments a year, or 13 monthly mortgage payments.

That extra payment each year goes toward principal, lowering the total amount of interest paid and decreasing the term of the loan.

Every prospective homeowner should also take a look at an amortization schedule and/or a mortgage calculator to determine exactly how payments apply in their particular situation.

Simply knowing your interest rate is not enough to make an educated decision on a loan product, let alone buying real estate.

You’ll see how much impact even an eighth of a percentage point can make, which illustrates the importance of having an excellent credit score so you can obtain the lowest interest rate possible.

Read more: 30-year vs. 15-year mortgages.

- UWM Launches Borrower-Paid Temporary Buydown for Refinances - July 17, 2025

- Firing Jerome Powell Won’t Benefit Mortgage Rates - July 16, 2025

- Here’s How Your Mortgage Payment Can Go Up Even If It’s Not an ARM - July 15, 2025

I’m 10 yrs into a 30 yrs fixed mortgage at 5.75% with impounds fees included in the mortgage payment of $924.00. I have come to my senses to try and pay down my mortgage at the age of 66 yrs. I still have $108,000 left to pay. I have investigated on getting a refi – for a lower rate but if I pay a monthly amount toward the Principal that technically is lowering my APR I have read.

My question is this– how many years will a $200.00/month to the Principal decrease my 20 years mortgage?

Thank you,

Lynda

Lynda,

Yes, you can reduce your interest expense (and thus lower the APR) by paying extra early. To figure out what $200 extra would do per month you can plug in the numbers into an early payoff calculator. It will tell you how much you’ll save and how quickly the loan will be paid in full. Make sure you specify when those extra payments are actually starting to get accurate figures.

Colin,

I am planning to buy a home and say it is worth $35000. If I chose 5 year arm, the monthly mortgage is almost $1500. If I chose 20 year FHA, the monthly mortgage is almost $2000.

If I chose 5 year arm and pay an extra $500 towards principal, does that going to be better than 20 year FHA? At the end of 5 year arm, if I refinance to 15 year fixed.. is that going to make it better?

Thanks,

RAM

RAM,

You need to do the math with an early payoff calculator to see the difference in loan balance after say five years and also lifetime. Going with the ARM and the extra $500 a month might leave you with a slightly lower balance than the 20-year term with no extra payment. But also consider that with the ARM, you’ll need to refinance if rates rise in five years and rates may not be as low in the future.

I have 10 years left on my 15 yr mortgage. I can save about 2% by refinancing to a 10/30 yr ARM. How can I calculate the monthly payment easily to have the ARM paid in full at the end of the 10 yr period so the adjustable rate never is relevant. 115K on 10 yr ARM at 2.9% vs. my current 4.8%… this appears to provide for a better rate than a 10 yr fixed.

Stop trying to get financially fit messing with interest rates or term years. If you are thinking in 15-30 year terms you are financially screwed. Quite literally.

Just take a 30 year and pay it like a 15 year at the minimum. The goal is not to play with 1 or 2 %… the goal is to be filthy rich! Total “cost weight”, is the thing to look at(my own term which means, how much an investment costs you verses how much you can gain off it.)

I bought a super steal of a house 3 years ago put it on a 30year because of the rate, but have paid it down to 1/4 of current market value.(in 3.84 YEARS!) If you think about things in 15 or 30 year terms you are totally screwed! 5 years, 10 years at the max. I said I would sell that house within 5 years the day I bought it (and everyone looked at me like I was a moron) but, it is one of my equity leverages now and is probably too good to get rid of. It has gained 66% value in 3 years(because I bought it in 2012 at the bottom of the market, AND below market value at that time) and has gained 39% from principle reduction. So basically a “God-like” investment. Thank God for wisdom! Stop trying to manipulate a few percentage points. Think bigger. Money is made at “the buy”.

The only rule is: Buy smart! Don’t try to save 10k$ over 30 years! Make 105% on your investment in 3 years… that is the goal IMO. It is totally possible. The banks foreclose on someone, pay 20K$ to remodel the kitchen and bathrooms and then sell the properties at 30-40% markup in a few months.

If you think in small numbers, that is what you will get.

IMO.

T Shane,

You’d basically need to double your 30-year payment to pay it off in around 10.

Hello Colin-

I am thinking of refinancing my home.

I wanted to know if it’s wise to refinance (or just take out a loan) to fix up my home?

I am 4 yrs in on 30 yr…

I have been doing my research, but (honestly) I am still lost and undecided on the right steps to make.

Please advise

Thanks

Y Henry,

Read around this site to get a better idea of your options and potential strategies. It depends what your goal is for the loan/home…do you plan to stay a long time or is there a possibility you’ll sell? Lower rates make more sense for those planning to hunker down for a while. Conversely, you don’t want to pay for a lower rate (closing costs and so forth with a refi) if you aren’t going to keep the loan for a good amount of time. You also reset the clock on your 30-year loan if you get another 30-year loan, though you’re only 4 years into it. But if the rate is way lower it’s a much easier decision. Could also explore second mortgages (home equity loans/lines) as you alluded to.

I have 14 years left on a 30 year loan at 7%, I have finally got my credit score up to where I could refinance. Should I refinance to a 15 or 10 year loan or just keep the loan I have.

Vern,

You’re likely an ideal candidate for a refinance because your rate is so high relative to today’s rates. In order to stay on track (toward payoff) you’d probably want to switch to a 15-year fixed or 10-year fixed as you mentioned. Rates are closer to 3% today and you probably have a low LTV, another plus to getting a new loan rate.

Thank you for your quick response to my question on refinancing my home even though I only have 14 years left at 7%. Would I have a better chance of getting refinance if I apply with my same mortgage company(wells fargo) or should I go with another one.Thanks. Vern.

Vern,

Generally you should shop around to see the many options and pricing available to you. Wells may not have the best rate and fees. And sometimes existing lenders can talk you out of a refinance.

We have two mortgages on the one property as we upgraded to a bigger forever family home 8 years ago and the “extra” went on an 02 mortgage rather than face penalties on breaking the 01. Now both mortgages are due for a refix or float decision. One mortgage has only 97 months to go and is at $51,000. The other is at $40,000 and has 206 months to go . Both were initially 25 year terms. We want to fix one at 4.85% for three years and FLOAT the other at 6.24% but pay it off aggressively in the three years, then focus on getting rid of the other one. Which one should we float and super charge our payments on, leaving the other one ticking along on minimum payment? All the calculators I can find don’t take into account the amortization and how much further along the interest/principal curve each one is…I can’t pay the fixed one very aggressively as there is a limit of only being able to pay 5% of the remaining balance extra per year or we face tough financial penalties. Please help us make the right decision, thanks so much from New Zealand.

Kim,

You’ll probably find that the one with just 97 months has a larger percentage of principal in each payment. But perhaps both could be refinanced to lower rates and shorter/similar terms based on what remains on each. If you use a calculator to see total interest outlay on each (subtracting what has already been paid) it may help your decision.

I am looking into refinancing and I’m thinking of doing a 25-year mortgage which would still have lower payments than the 28 years remaining on my 30 year. However, is there any advantage to doing that versus just taking the 30 year mortgage at the same rate and making the 25-year payments? That way I would still pay it off in 25 years, but have the flexibility to make lower payments if my future finances require that.

Would the amortization look the same if I took the 30-year and made the payments like a 25-year, or would I somehow still be paying more interest upfront, such that I will have less equity in 5 years than if I took the 25-year option?

Mr Dioji,

Your logic is sound. The only potential downside to the 30-year is it gives you an excuse not to stick to the 25-year plan. But that can also be a good thing if you get stretched too thin with the 25-year loan. And seeing that there’s no rate discount on the 25-fixed, the 30-year with extra payments could be a sensible play. Your call.

Mr Robertson,

We made a huge mistake and are now trying to figure out what to do. We started off 29 years ago with a ARM and after about 15 years went to a fixed 30 year at 5.5%. On top of that we took out a home equity loan 10 years ago at 3% and put an addition onto our home and just yesterday we received notification that a huge increase in our monthly payment will begin this coming November. I’m 60 years old and my wife and I now realize we essentially have paid monies for 29 years and still almost have the same debt. Should we try to pay down our 5.5% loan asap or just except the situation and keep saving money in a 401K to maintain liquid assets or maybe a combination of the two? Any advice would be most appreciated.

Steve,

Most folks recommend paying off the mortgage before retirement, but this isn’t a reality for everyone. It’s a recommendation and something that’s not always easy to do. If the rate is due to increase, maybe you can refinance it into a low fixed rate or combine the two loans into one loan at a lower combined rate, or just refinance the first to a lower rate and use the savings to tackle the second if the rate is rising. You can probably do a lot better than 5.5% these days. As for how much to allocate to the mortgage(s) it depends on your personal financial goals. If you feel you’ll get a better return with the 401k vs. paying off the mortgage then that might dictate your decision. I’m not sure if you’re more concerned with monthly payments or paying off the mortgage, or both. Probably best to sit down and go through all your options and discuss with wife best direction. Good luck!

Hello – I was looking over my fathers loan documents and I am confused. He refinanced in 2007 to get my mother off the mortgage. Original loan amount is 175000 @ 7.95% interest (He needs to refinance again I know) – its a conventional loan without PMI.

When I looked at his amortization schedule, it shows that he will still have a balance of over 130,000 when his loan matures. Am I missing something?

Cathy,

Could be a balloon payment? Maybe check the term of the loan to figure that out, regardless, as you noted, his rate is super high relative to today’s rates.

I still own $78000 of my mortgage from 22 more years to go and 8.99 interest. what is the best way to go non counting refinance. now i have a good job a good income which can allow me to pay extra $5,000 a year or pay right now $28000 to the principal. is it going to help me or just don’t make any sense?

Edgardo,

It depends what your goal is…if you want to pay off the mortgage as fast as possible and you have extra cash that can be used to do that, you’ll save money on that 9% mortgage. The faster you pay the more you’ll save, but then that money is tied up in your home until your sell or cash out. You can also look into refinancing if it’s possible to lower the rate while also choosing a shorter loan term such as a 15-year fixed to pay it down even faster.

Colin,

Thank you for the clear explanation. I have a question about a payoff statement I received. My listing agent asked for me to get her the final payoff amount, and I got this over the phone from my lender. The lender then sent me a payoff statement which breaks down the number and gives me the date which that amount is valid up to. However, the statement then says, “Funds received after this date will require additional interest of $X per Month. The above calculations are invalid after month-end.” Why would the interest go up each month? Shouldn’t my total amount due to pay off the loan in full go down each month? Are they assuming I’m going to stop making my mortgage payments?

It is an FHA 30-yr loan. I have been paying biweekly for over 4 years.

We are 9yrs into a 15yr mortgage. Around year 3 I was making $100 extra principal each month through my bank. This lasted for about a year. The bank sold to another bank and the payment stopped.

Upset when that happened I did not continue. Can I resume the extra payments and still save or am I nearing the large-principle/small interest part of my loan?

Matt,

Yes, it’s probably based on the assumption that interest will accrue as time goes on sans payments of said interest.

Angela,

Try to find your amortization schedule on the lender’s website or simply plug in the numbers to see where you’re at and if it will benefit you.

We refinanced our mortgage in May of 2004 for $115,000 at 5.85 interest rate for 30 years. We have 89,904.00 left on the balance. I have been trying to pay extra just the last few months as my husband and I would like to retire but unfortunately cant because of the mortgage. What would be the best way to pay it off early. If I continue to pay $200.00 extra a month any idea how many years that would knock off? Or would it be best to refinance for 30 years at a better interest rate so our payment is smaller and then my kids will have to have whats left of the balance after we are gone? Not sure what to do.

Colin, is it possible to be making payments according to a 30 year amortization table on a loan but show a maturity date 15 years from the first payment date on my Note? I have a loan of $48,200 and have been paying $376.04 per month according to the contract thinking my loan would be paid off at the maturity date. I am 9 years into the loan and am only down to $42000 or so. Come to find out that the 15 year payment should be more like $477 and some change per month. At the end of my maturity date I’m still going to owe around $37,000. How is this possible? Is this a bank screw up? What do I do?

Kathy,

Rates are certainly a lot lower than they were in 2004 – potentially a couple points lower than what you have…in fact, you could possibly refinance to a 15-year fixed and enjoy a monthly payment that is comparable to your existing 30-year payment, and pay it off in half the time…well around 2031 vs. the currently scheduled 2034. And you could even make extra payments on top of the new 15-year payment or look at a 10-year fixed as well if you were really in a hurry to pay it off. Of course, you have to qualify for these options based on your income. Good luck.

Richard,

Is it a balloon payment maybe?

Hi Colin, I am 3 months into my 30 Yr Fixed at 3.5%. I recently got a job and realized that I can pay an additional amount every month. My lender has offered me two refi options: 15 Yr Fixed at 2.875, with no closing cost(lender credit) and a 2.625 with $3k closing cost. Should I refi to one of these? If yes, which one? or Should I stay on my current loan and pay extra every month? My goal is to pay off the loan in 5 years.

Sam,

If your goal is pay the loan as quickly as possible, paying to lower the rate to 2.625% might not make sense because there’s a breakeven horizon for those upfront costs that is only realized after X years of enjoying the lower rate. Check out an amortization calculator to compare both options with a 5-year payoff. It’s also possible to shop around with other lenders and banks to see if they have better deals.

I have a question. I have a 30 year loan at 4.0% that I have acquired in 09/14. I am thinking of refinancing and have an offer on the table for a 30 year at 3.25% and origination would be around $1700. I started the initial 30 year with 166 600 and now the payoff would be around 160100.

If I refi, I can lower the payment, but I would restart at 30 years. When I take into account all the interest I have already paid on top of restarting at 30 years again, is the 3.25 loan for $1700 worth it? How long before I truly am in the black? my current payment is around 795 I think and the 3.25 would push it down to around 710 or so.

Eldin,

You say you’ve only had the existing loan for two years…so it doesn’t stretch out the amortization too long, 32 years versus 30. A breakeven calculator will allow you to determine when the savings would kick in…shouldn’t take too long if monthly payment is around $85 less and out-of-pocket cost is $1700.

Hi Colin,

Great blog, and thank you for the information. My husband and I just sold our home, and we did well. Now the question is should we refi our current loan we have for our new home, or put the amount we gain from the sale of the home without refinancing the current loan? it is going to be a very large amount, so we are not sure which way to proceed. Also, the new home was purchased only 3 months ago, so we are in a very stages of the repayment. We would like to make a wise decision with our loan with the new home, since we very fortunate and were able to pay off our last house in 16 yrs, after purchasing it on 30 yrs fixed loan. Would love to pay this one off too as soon as possible. Thank you!

Sonia,

It depends on your financial goals – if it’s to pay the mortgage off as soon as possible then the more you pay toward it the better. But you may want to put money into other investments as well. You may also want to consider shorter-term mortgages if your goal is fast payoff and you have available cash.

I live in MN and 12 years ago I was desperate as my well and septic system quit and I could not get a loan as I lived in a 100-year old house on 10 acres of land. I found a manufactured home dealer who said he could get me a loan and so I went with them. It was a negative amoritization loan which I did not know of. They did not want me to get a lawyer on my behalf so I did not. Now my original loan amount was paid off they said quite a while ago and I owe them interest. They indicated they felt they were to get $200,000 in interest off of me. Now I’m trying to get a loan to pay off the $120,000 they want and I’m having trouble. I believe these people because of their bullying and 11% interest rates and high projected monthly payments are predatory lenders. What can I do? Someone told me if I went to the attorney general in MN I might not have to pay off anything. What is your opinion in this matter. Thank you.

KarenJean,

It sounds like a very serious situation and if you feel you’re being wronged it might make sense to contact a housing counselor, the Consumer Financial Protection Bureau (CFPB), or potentially an attorney.

Here is my situation and question. I am about to buy a house. Getting a 30 yr fixed at 3.375 and I am about to have 3 children in college. Therefore I am not paying for college yet but will be in about 3 years. My plan is to get my amortization schedule from my lender as soon as I close. Then for payment 1 I will make the full payment plus the principal of payment #2. Therefore my next payment would essentially be payment number 3(right?) Then for the next payment I would do the same thing. Full payment plus the principal of payment #4. Then I would do this until I need to start making college loan payment and save a lot of interest in the beginning of the loan. Good Idea and your thoughts?

Thanks

Paul,

The larger payments won’t change the amount due on the future payments, but it will save on interest. If your payment is $1,000 a month, it’ll still be $1,000 a month for subsequent months, but the loan will be paid off earlier with extra payments.

Hi Colin-

Do you have (or know of) a calculator that doubles the *amount of principal* paid each month in addition to the regular payment? I’d like to pay the regular payment PLUS whatever amount is going toward principal that month, and see how quickly the payment schedule shortens.

Great stuff here, btw. Thanks for taking the time to write thoughtful answers for people with genuine questions.

If extra payments are made shortening the loan but no immediate reduction is visible on the statements, Are the bank keeping a separate record of this? Sounds like more work for them which they’d want to charge for. Do they?

Dan,

You should see a lower outstanding principal balance that reflects the extra payments, but not necessarily an early payoff.

Hi Colin,

we are about to purchase our first home in NYC. If we plan on refinancing within the next 3 years to make some home improvement, do you suggest a 10 year ARM vs a 30 year fixed?

Pros & Cons?

Thank you.

Carolina,

If you know for sure you’ll refinance without question in three years you could technically go with an even shorter-term ARM like the 3/1 or 5/1 ARM and get an even lower rate. The big question is where rates will be in three years when it’s time for your refi, but if you’re 100% going to refi at that time it’s not really part of the debate…

In all types of mortgages, are you (must you?) actually repay the entire amount borrowed? For example, I borrowed $30,000 to purchase my house. I have made a LOT of extra principal payments, (and never refinanced), which, other than the first year or so, I marked on my check what the amount of the extra principal paid, was.

If I add up the amount I have paid for principal, according to MY good record-keeping, must it come to $30,000 before my loan can possibly be paid off? I would think the answer is yes, but I’m wondering about it.

If you have already explained this, I apologize for having you repeat the answer, but please do, in an email to me, if possible. I have a 30-year fixed rate loan at 6% with no penalty for paying it off early.

If it turns out that I have been cheated (by the bank?), will I be able to get the extra money I have paid, back? and without having to sue the bank?

Thank you very much for your help.

A Kirmkman,

Yes, a loan needs to be paid in full, including interest and principal, before the bank considers it repaid. If it turns out you overpaid they should be able to cut you check for the difference.

Perhaps people aren’t as ignorant as some might think, and I’m not saying that any of you here are saying that!

Perhaps people are aware and are in a 30 yr. fixed because that’s the only way they can afford to pay their mortgage payments,or perhaps,like in my case their income is Seasonal,and therefore making it much more difficult putting the money together, especially if you have a Tractor loan, & a business loan, farming is expensive and crops are seasonal, so I think a lot of people understand, but they due what they have to do .

We got a 30 year mortgage in 2007 that started as a 5/1 and since the rates have been low (based on LIBOR), it still adjusts every year and has stayed fairly low. Unfortunately, the first 10 years are “interest only” payments. It is not a negative amortization loan. Once we hit that 10 year point, does all that interest we’ve been paying count when we start paying principle? How can we find out how much of an impact the additional principle will be on our current payment? The amortization schedule provided on the loan is based on a much higher interest rate (aka 2007) then we have today. Thanks!

Rob,

If you’ve been making interest-only payments this entire time, your original loan balance should be unchanged. So if it started at $200,000, it would still be $200,000, because no principal was paid. That means you’ll have 20 years to pay the original balance, with payments amortized over the 20-year period. That means they’ll have to rise to pay off the loan in a shorter period unless you refinance into a new 30-year loan.

My amortization schedule shows:

Due Date

01/01/2017

Computed Interest Due

$218.69

Principal Due

$132.47

Deferred Interest

Balance

$0.00

Principal Bal

Deferred Interest

Bal

$50,334.75

Outstanding

Balance

$50,334.75

I called and ask to explain why the Pay Off Amount and the Outstanding balance is the same with the deferred interest in it. She really didn’t make it clear. I thought my payoff balance would be lower than the $50,334.75. The Amortization Schedule shows as the payments are made the balance is less and less. Could you please explain this to me. Thanks so much!

Ladi,

Those two numbers are the same (I assume) because your deferred interest balance is $0, so any number plus zero will not change that number. If you think your balance should be lower, put your original loan amount into an amortization calculator and scroll down to the month you’re currently in to see what the balance is (assuming you didn’t make any extra or miss payments).

Colin,

Thank you so much! I will try that. I did called my mortgage company to explain it to me and I ask to speak to the payoff department but she tried to explain it to me but I don’t think she knows anymore than I do! LOL

Sounds about right…good luck!

I’m 12 years 6 months into a 30 year 6.75 interest mortage.$1227.41 monthly payments. Loan was 178.000 balance owed is 125.000. I was offered 4.90 % for 30 years to refinance @ $917. Per month and was told if I pay $1200. A month I could pay off in 15 years or $1600 in less both payment by weekly. PLEASE I DONT QUITE UNDERSTAND. How do I find out about Amortization of my loan and should I take the offer?

Rose,

If you’re already halfway through a 30-year loan, it might not make sense to get another 30-year loan, unless you can’t afford the payments of a new 15-year fixed loan. You may want to see what 15-year fixed costs, could be cheaper (lower rate), but you’ll have no choice but to make the larger, 15-year payment every month if you go with it. So the new 30-year term would give you more flexibility to make the standard payment, or pay $1,200 or so as they suggested to pay it off in half the time. Use a mortgage amortization calculator to try out different loan scenarios with your loan amount and 30-yr terms and 15-yr terms and different interest rates.

I have a question. I understand the info above, I was in the mortgage business for 16 years on the processing and closing end.

My husband got a 5/1 arm in 2005 when the rates were low and it’s been pretty good. I’ve been watching the market in case we should Refi. I pay extra every month on the principal.

My question is…

The rate just adjusted up. I noticed that the old amount going to principal was 254.83 and with the new payment only 229.17 to principal.

…so, the amortization resets every time a new rate is introduced? Can you tell me what is happening? I tried googling but nothing specific comes up.

K,

Probably best to just call the servicer and get the info from the horse’s mouth, but theoretically, yes, a new interest rate means a new amortization schedule to accurately estimate the payoff. And the principal amount would change each month anyway as the loan is paid down, though a dramatic drop in principal signifies a new, higher interest rate.

I have 7 years left on my mortgage, the interest rate is 9%. I have cleaned up my credit and have a good score now. Should i refinance? I really need to do some home repairs and want to lower my monthly payments. What are my options?

Sherrij,

If you have a rate of 9%, you could potentially save a lot of money with rates being a lot lower these days. However, you do need to look at your remaining loan balance and the total interest that will paid if you don’t refinance versus the savings if you do decide to refinance. Also you may not want a long mortgage, and instead a 10-year fixed or shorter to avoid resetting the clock.

Hi! I have a question. If a yearly on the new 30-year,$75,000 mortgage is $7,300 and the payment is made at the end of each of the next 30 years. Suppose that the payment is made at the end of each month. Would 12 of these monthly payments be equal to one of the yearly payments?

Liz,

I don’t understand your question.

Hi,

I have a 30 year fixed mortgage. The original loan amount is $100,000. I am on year 10. Due to a loan modification, the bank change the maturity date from 08/2037 to 10/2037. All the modification did was lower my interest rate. I do not understand why my amortization schedule shows that I will have a balance of about $55,000 on the maturity date.

Hope you can help me since the the rep from the mortgage servicing was not able to explain this as well. He submitted it for further research.

Thank you.

Maria,

Hard to say without knowing all the details, but it might be something to do with the lower modified monthly payments resulting in deferred principal and a balloon payment. Basically the payments you’re making now might not be sufficient to pay off the entire balance by maturation.

Hi Colin, This is such a helpful article. My husband and I are considering purchasing a property for $610K using a 30year VA loan at 3.635% interest rate. We can get 0% down (with no funding fee, and no PMI, with no penalty for early payoff). We will have a chunk of cash that we had saved for a down payment $30-50K in the bank afterwards. Would you recommend putting that towards the principal in the first year vs using it as a downpayment to lower the loan amount?

Kate,

If used for down payment it’s locked up in the house, if you keep it and go zero down you can decide what you’re comfortable putting into the home after the fact. But the interest rates might differ for zero down vs. putting up a large down payment. It also depends on how liquid you want to be vs. potentially cash poor. There’s also a potential middle ground I suppose. Good luck!

Hi,

Not sure if it is to our best interest to refinance. I have been trying to research a break even point and I just can’t get my head around it. We bought a house in 2005 on an interest only 5/1 ARM. I looked up historical data on the interest for the month of 10/2005 and it was 5.817%. The original loan was 450,000. We have been paying off both interest and principal since we bought the house. It is now down to 338,000. Do you think you can help us figure out if the quote for a 15 year fixed rate at 3.6% is worth it to refinance? Our current monthly is 2783.05 and I always pay 300 over. Our current rate is 3.5%. Sometimes when we have extra money, I pay more. We have a 2nd mortgage that will be paid off in 2 years and it will free $1750 to go towards this bigger loan.

I think everyone is making a big mistake here; all the old school businessmen would tell you that never pay a money today that you can pay tomorrow. Of course in a 15 years period you pay less interest as compared to 30 but the fact is you are poorer every month by half the amount of your monthly payment, meaning that extra money could go towards your life style, better food, school, trips etc etc. The extra interest you pay over 30 years is easily compensated by inflation or your house added value over the years. You just have lived all these years with less monthly income with a 15 year mortgage.

Jonathan,

Good point about inflation, though not everyone looks at things that way. There are generally two camps – the people who want to be mortgage-free ASAP and those who believe there are better uses for their cash.

Hello Colin,

I am being a bit lazy doing the actual calculation myself. My question is if you were to make monthly payments equivalent to 15 yr fixed even though you have a 30 yr fixed, would the total amount of interest payment be about the same, aside from the difference that comes from the interest rate difference? My interest rate for 30 fixed was 3.875. Upon current rate lookup, 15 fixed is about 3.5 and 10 fixed at 3.25. But with additional fees involved with refinancing, I am not sure if refinancing is still a much better option with lesser cash availability for other savings, eg. second property purchase down payment. I would appreciate your advice. Thanks.

Jay,

Yes, if you have the same balance and make the same monthly payment over the same time period (15 years), the same amount of interest would be paid if the rates were the same. But like you said, you could potentially save with a lower interest rate on a 15-yr or 10-yr. To offset that rate improvement, you’d have to make an even larger payment each month on the 30-yr fixed to extinguish the loan in 180 months. Note that the refinance would also lock you into making that larger payment, whereas the 30-year provides choice each month.

I have been in my home for 20 yrs. I paid $96000 and my principal payment is $520.00 a month. How much interest am I still paying a month? The rate I am at is 7.5%.

I don’t even know what I owe on the house, but guessing about $34000… ?

Okay, my friend just told me that my terminology was wrong on saying ” principal ” payment. The $520.00 a month is is my house payment before all the insurance and other garbage is tacked on. Hope that clarifies my question. Please help

Peach,

Assuming you’ve never refinanced, and you just made the regular principal and interest payment every month, just plug in the original loan amount and interest rate into an amortization calculator and scroll down to the month you’re currently in to get an idea of what your current balance is. If it has been 20 years, you might be around month 240.

Hi Colin,

I currently have a house loan of $300,000 on a 30-year fixed payment plan.

Lets say I start making payments (large lump sums or small steady payments) specifically towards to principle (none to interest). If I get to the 10-year mark of my 30-year loan and my all principle is paid off, do I still have to pay the remaining interest associated with my next 20-years worth of payments? In other words do I still have to pay the remaining interest on the loan or do I still have to pay off the entire amount of the loan including principle and interest?

The reason why I am asking is because I called the company which I make my mortgage payment to and they stated I would have to pay off the remaining amount of interest on the loan in this scenario…. I believe they gave me false information but I wanted to make sure.

Shawn,

If you paid the entire principal balance the mortgage would be paid off in full. This is how mortgages wind up getting paid before maturity. If they made you pay all the interest somehow it would defeat the purpose of making early/extra payments. They might be referring to some nominal amount of leftover interest for the last month.

How do you break monthly payment into a portion going toward interest and a portion going toward principal.

Thanks.

Sam,

Your question isn’t totally clear to me, but any basic mortgage calculator will break down the total amount of principal and interest due in each monthly payment. From there, you can decide if you want to pay even more toward your principal balance each month.

Hi Colin –

I bought my house last year, 328K @ 3.375 7-1 ARM. I want to pay the house off before the ARM kicks in. my question is what the best approach ? how do I pay the home off in 5 years?

so far I send the bank $3,500 a month which is roughly:

$900 interest

$540 principal

$920 extra principal payment

balance is taxes

additionally I save $2,000 per month in a savings account to be used to pay off the mortgage. I thought it would be best to hold funds in savings account as a safety net not knowing what the future could bring me.

starting January I will add another $500 to the savings per month and plan to add $10,000 to savings annually.

so two questions, is this a smart approach to aggressively paying off my mortgage or should I send the bank more per month now ? and perhaps more importantly, when would this plan pay off my mortgage? I really would not want to refinance at year 7 and I wouldn’t want to see the rate adjust up either. I am divorced and restarting and looking at retirement once this house is paid off so a 5-7 year plan. thank you !!

John,

I outlined ways to pay off a mortgage in five years below. How/why you pay it off is preference and completely up to you, but the earlier you pay extra, the more you save because it means less interest is accrued. But as you mentioned, having a safety net is important too. So finding a balance you’re comfortable with might be key.

For the last 18 years we have paid on a mortgage of $105,000. Today we still owe $79,585 on said mortgage. How do we get 18 years of continuous payment and still owe 79k? Is there a way to get out of this or at least get this paid off soon?

Sherry,

Unfortunately, mortgage interest is front-loaded, so payments in the early years are mostly interest before becoming mostly principal later on. Check out the composition of your monthly payments with your loan servicer to see where the money goes each month now versus the early years. It could be that your interest rate is very high, and a refinance to a lower rate (such as what’s offered on a 10-year fixed) could be beneficial and shave years off the remaining term.

I have a $70000 balance on a 15 year loan. I have been paying at least $130.00 extra each month since March of 2013. At this rate when should I have my loan paid?

David,

You’d just need to find out the regular monthly payment amount, then add $130, plug that combined payment into a mortgage calculator, and see when it would be paid off.

Hello Colin,

I’ve read lots of your articles but still couldn’t find an answer to my question so I’m gonna ask you here. My wife and I are 34 years old with no kids living in Ohio and would like to buy a house around $250,000. We finished grad school and did some extra years of research and finally started working and making real money at 33. We don’t have any assets. Just some savings but for now we are saving half of our salaries (around 50,000 last year). We can basically make any mortgage monthly payments. So my question is what kind of mortgage is best for us? A 15 year with higher monthly payments? wait another year and save some more for down payment and get even a 10 year loan?

Or a 30 year mortgage and put our extra money in stock or other investments or in savings for unexpected future financial changes, instead of locking it in a house?

Thank you for your amazing blog.

Moe,

It really depends on what your preference is for your money – for example, invest or set aside as you said, or pay down debt. If you can make any monthly payment you want, you could pick a 30-year fixed then make larger payments on it as you see fit to pay it down sooner. The downside is the interest rate is higher relative to the 15-year fixed. One other thing to consider is if you are light on down payment funds, your mortgage rate might be higher as a result, so you could argue to take whatever loan is cheapest now and refinance into a lower-rate, shorter-term mortgage once you have more cash (and hopefully more equity) to lower the LTV on the subsequent refinance. But that too assumes rates stay low or ideally move even lower. One last point is rates are super low so it is generally more attractive to carry cheap mortgage debt. Good luck!

Mr. Colin:

I have researched a few articles about refinancing, but still haven’t come with an answer to my questions. We are in our 6th year into our 30 year mortgage where we close the deal on a 2.25% rate. Original loan was for $134,924 where the balance now is $116,000. We are wondering if it would be wise to refinance if we could find a lower rate for a 15 year mortgage or if it would be better if we just make extra payments to the principal and reduce years and interests on the long run. We also took an equity loan on 2019 for $25,000 with a different bank to make home improvements. Thank you for your response.

Maria,

If your goal is to pay down the loan as quickly as possible, a refinance to a 15-year could make sense if you receive a lower rate in the process and have no problem making the larger 15-year payment each month. It might be hard to beat that 2.25% right now though. As you mentioned, you can also make larger payments each month on your existing mortgage to accomplish the same thing.

I am 5 years into a 20 year loan at 3.5% with a HELOC at 5%. Considering a cash-out refi to a 10 or 15 year loan to pay off the HELOC and take advantage of lower rates. My original rate of 3.5% is already very low and not sure at which rate I’d benefit from the refi. Consolidating the debt and paying off early are my main goals. Thanks!

Katherine,

Rates on 10/15 year loans are in the low 2% range at the moment, so that’s still a significant drop from 3.5%, plus getting rid of the 5% second mortgage in the process. Do the math taking into account the interest you’ve already paid on the original loan and the proposed new loan’s total interest to compare.

Have a 15 year jumbo loan at 3.5%. One of the big loan companies offered a 2.75% thirty year loan but would not offer a 15 year loan on a jumbo, $500 closing costs. Any downside in paying a 30 year over 15? Meeting the payments is not anticipated to be a problem.

Stephen,

The most obvious issue would be a higher interest rate tied to the 30-year vs. a 15-year, even if you pay it down at 15-year speed (or faster). May want to shop around more to find a lender that offers 15-year jumbos at an even lower rate if possible.

I am one year into a 15 year mortgage and have come into some money. I know how interest is frontloaded. If I were to pay half of my remaining principal, would that move me to the corresponding payment breakdown (P vs I) on the existing amortization schedule, thus avoiding most of the frontloaded interest?

Mark,

Yes, depending on the lump sum paid at the beginning of year two, it could substantially reduce total interest paid. And the monthly payment, while the same, would shift heavily to principal instead of interest as a result (again, assuming a large sum is paid upfront). This would also shorten your loan term. Try my early payoff calculator to see the impact.

Hi Colin,

I am currently researching on behalf of my Mother. I have been living with her for over a decade with my kids due to my divorce. My father has passed away 3 years ago and the family (I have 4 siblings) is okay with me looking into lowering the mortgage payments for her. I pay a lot of rent and I am also in agreement to lower the mortgage payments!

The dilemma is she still has 300,000 balance at 3.99% 30-year fixed rate and I think they refinanced years ago. Her house is valued around $600,000. The monthly payment is actually $1,700 total so it’s actually pretty good for L.A. Due to historically low rates now because of the pandemic, we are thinking we can lower the monthly payments even further by refinancing. My Mother is thinking about taking some equity out to do some backyard improvements as we let it go downhill after my Father passed away.

We do plan on staying in this house and keeping it in the family. Just want to see if this is possible to lower one’s monthly payments AND take out some equity, say $50,000 to our advantage. I read about refinancing at 15 years but it may be too high for us, I guess a refinance calculator would be a necessary tool. I’d appreciate your thoughts!

Hi Janice,

It might be possible to pull cash out and get a lower rate than your current 3.99% rate, though rates have increased a bit lately and cash out refis are typically more expensive than standard refinances. To find out if you can beat that 3.99% rate, simply shop around with some lenders and/or brokers to see what they can offer. It might be a nominal improvement like 3.625% or similar but could still be worth it if you want the cash.

Hi Colin,

I am on year four of a 30 year mortgage. I have a $322,000 mortgage balance with 4% interest rate. I was thinking of either refinancing and taking out a $300,000 loan (paying down an additional 22,000) Or since interest rates are starting to climb, should I make the $30,000 chunk payment (22,000+ closing costs) to pay off the loan sooner? I don’t know anything about the amortization table. Will that lessen my interest? I don’t plan on leaving anytime soon the house but I also don’t know if a refinancing would cost $15-17,000 whether it makes sense to refinance for a .75 rate difference?

I have a principal balance of $246,000 on a 30 year fixed loan of 4.125%. Maturity date is 07/2045. My principal is $493.58 per month. If I pay an additional $700 on the principal each month…how soon can I pay my loan off?

What do I need to pay to be paid in full in 3 years?

Sheila,

You can put those numbers into an early payoff calculator to find out – I have one on this site under the Calc tab. To pay off in three years, you’d have to pay around $7,300 per month.