The other day I wrote about how adjustable-rate mortgages might soon make a comeback, given how high fixed mortgage rates have become.

Now that the popular 30-year fixed is priced in the 7-8% range, some home buyers might be looking at alternative products.

This may include the 5-year or 7-year ARM, both of which provide a fixed interest rate for a lengthy period of time before becoming adjustable.

Given how much mortgage rates have increased in such a short time span, these could be viewed as short-term solutions until a refinance makes sense again in the future.

But if for whatever reason you keep your ARM once it becomes adjustable, it’s important to understand how it works.

Adjustable-Rate Mortgage Caps Limit Rate Movement

Today we’re going to talk about caps on adjustable-rate mortgages, which limit how much the rate can move once it becomes a variable rate loan.

As noted, many ARMs are hybrids, which means they offer a fixed-rate period initially before becoming adjustable.

Two of the most popular ARM option are the 5/1 (or 5/6 ARM) and the 7/1 (or 7/6 ARM).

They are fixed for 60 months and 84 months, respectively, before becoming adjustable for the remainder of the loan term.

That loan term is the usual 30 years, so there are still 23-25 years left once it becomes adjustable.

If there’s a 1 after the 5 or 7, it means the loan is annually adjustable. So it can adjust just once per year.

If there’s a 6 after the 5 or 7, it means it can adjust semi-annually. So two adjustments per year.

Once an adjustable-rate mortgage becomes variable, the initial rate is replaced by the fully-indexed rate, which is a combination of a fixed margin and variable mortgage index.

For example, an ARM might feature a margin of 2.25% and be tied to the SOFR, currently priced at say 5.25%. Combined, that would result in a rate of 7.50%.

While a rate adjustment is probably the most frightening aspect of an ARM, note that there are “caps” in place that restrict rate movement.

The purpose of these rate caps is to limit interest rate increases as a means of avoiding payment shock.

So even if the associated mortgage index tied to the ARM skyrockets, the homeowner won’t see their monthly payment become unsustainable.

Of course, these caps can still allow for a big payment increase, so they’re more a buffer than a full-on solution.

There Are Three Types of Caps on Adjustable-Rate Mortgages

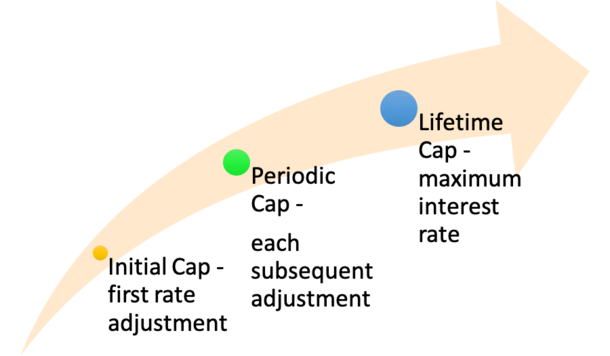

Now let’s discuss the different types of caps featured on ARMs, as there are three to take note of.

There is the initial cap, which limits how much the rate can go up (or down) at first adjustment.

There is the periodic cap, which limits how much the rate can go up (or down) at subsequent adjustments.

And there is the lifetime cap, which limits the total amount the rate can go up (or down) during the entire loan term.

For the record, the lifetime cap may also be referred to as the “maximum interest rate,” which is how high an adjustable-rate mortgage can go.

And the “minimum interest rate” is how low an adjustable-rate mortgage can go, which will often either be the margin or the start rate.

So an ARM loan with an initial rate of 4.5% might have a minimum rate of 4.5% as well, or it might have a minimum rate set to the margin, which could be as low as 2.25%.

As for the maximum, it might be 5% higher than the initial rate. So if the initial rate was 4.5%, it could go as high as 9.5%. Ouch!

But both the initial and periodic caps would apply as well, which could limit the speed at which the rate climbs to those levels.

For example, if the caps were 2/2/5, which is common, the rate could only go to 6.5% after the first 60 or 84 months.

And then it could adjust to 8.5% six months or a year later, depending on if its annually or semi-annually adjustable.

That could effectively slow down the rate increases if the associated mortgage index was surging, as they have been lately.

Of course, it can work against you too if the indexes are falling, limiting rate improvement by the same measure.

Check Your Disclosures to See What the Caps Are On Your ARM

If you elect to take out an ARM instead of a fixed-rate mortgage, it’s imperative to know what your interest rate caps are (and also what index the loan is tied to).

Fortunately, this information is readily available on both the Loan Estimate (LE) and the Closing Disclosure (CD).

It will tell you whether your interest rate can increase after closing, and if so, by how much.

You’ll see the maximum mortgage rate possible, along with the maximum principal and interest (P&I) payment listed.

The year in which the rate can adjust to those levels will also be displayed for your convenience.

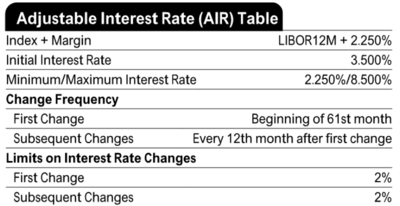

A more in-depth “Adjustable Interest Rate Table,” known as the AIR Table, can be found on page 2 of the LE and page 4 of the CD.

As seen in the image above, you’ll find the index, the margin, and the caps, including first change, subsequent change, and the change frequency.

All the details you need to determine how your ARM may adjust will be in that table. This way there are no surprises if and when your ARM becomes adjustable.

Remember, it’s also possible to refinance your mortgage before it becomes adjustable, given these ARMs are often fixed for five to seven years.

So you’ve got time to watch mortgage rates and jump on an opportunity if one comes along while the initial interest rate remains fixed.

This gives you options if you’re hoping for mortgage rates to come down. Just be aware that there’s no guarantee rates will improve and you’ll still need to qualify for a refinance in the future.

This is why the date the rate, marry the house strategy can backfire if the stars don’t quite align.

Still, with ARMs beginning to price a lot lower than the 30-year fixed, they could be worth looking into finally.

Just take the time to educate yourself first before you dive in as they are a bit more complicated than your plain old 30-year fixed mortgage.

Read more: Can you refinance an adjustable-rate mortgage?

(photo: Midnight Believer)