Mortgage Q&A: “What mortgage term is best?”

Before you set out to snag the lowest rate on your home purchase loan or mortgage refinance, you’ll need to decide on (or at least narrow down) a mortgage term.

I’m referring to the amount of time it will take to pay off your home loan in full.

The “mortgage term” is essentially the duration of your mortgage, whether you actually keep it for that length of time or not.

Let’s talk about why it matters and what factors may sway your decision in this department.

Choosing an Appropriate Mortgage Term

- One thing you’ll need to decide on when taking out a mortgage is the “loan term”

- This is the duration of the home loan, which can generally range from 10 to 30 years

- It’s how long it will take to pay off the mortgage in full based on regular monthly principal and interest payments

- Your choice can greatly impact how much interest is paid to the bank over time

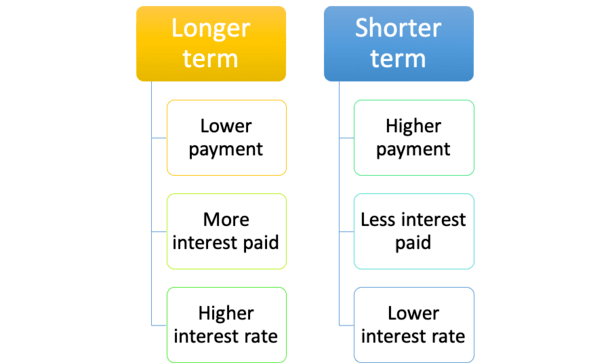

First off, your mortgage payments and the amount of interest you pay will be determined, in large part, by the term of your mortgage.

For example, a 15-year mortgage is paid off in half the amount of time as a 30-year mortgage, so the monthly mortgage payment will be much higher.

It won’t be double the amount of the 30-year because you’ll pay less interest over a shorter period of time, but it’ll be significantly higher.

Generally, you’re looking at a mortgage payment that is 1.5X that of the 30-year term mortgage.

This can obviously stretch a budget thin, so it’s important to decide on term before shopping to ensure you wind up with the right loan program to fit your unique financial profile.

Tip: One advantage to a shorter loan term is a lower interest rate, which keeps monthly payments somewhat in check.

The 30-Year Mortgage Term Is Standard

- The 30-year fixed mortgage is the most popular loan program available

- It features a 30-year loan term and a fixed rate for the entire duration

- Most ARMs also have a 30-year term despite coming with adjustable interest rates

- However there are plenty of other terms available too so be sure to explore all of them!

Most mortgages are based on a 30-year amortization, meaning they are paid off in full after 30 years.

For example, if you take out a 30-year fixed mortgage this year, it’ll be paid off in the year 2052. Ouch.

At the same time, not all 30-year mortgages are fixed for 30-years. The interest rate can actually change during the loan term.

That’s right, there are a ton of mortgages based on a 30-year payoff schedule that can adjust monthly or annually for much of that time.

A common example would be the 5/1 adjustable-rate mortgage, which is amortized over and due in 30 years, but adjustable after just five years.

It’s fixed for the first 60 months, and adjustable for the remaining 25 years, but still considered a 30-year term loan.

Same goes for a 7/1 or a 10/1 ARM, except their fixed period is seven or 10 years, respectively, before going adjustable.

15-Year Mortgage Terms Are Also Very Common

- Aside from 30-year terms, 15-year terms are the next most common choice for homeowners

- They require much higher monthly mortgage payments as a result of the shorter amortization period

- But can result in big savings because the loan is paid off in half the time

- They also feature lower interest rates (about .50% lower than the 30-year fixed)

Then there are 15-year term mortgages, which are amortized and paid off in 15 years.

They too are fixed for the entire duration, so you don’t have to worry about your mortgage rate adjusting higher (or lower, not that you’d be concerned about that).

These are a great choice if you want to pay off your mortgage early, assuming your money isn’t better served elsewhere. Or it you’re close to retirement.

With a 15-year mortgage, you’ll enjoy a lower mortgage rate than a 30-year loan, and pay much less interest. A win-win really.

Let’s look at an example, assuming the loan amount is $200,000.

30-year payment: $870.41 (3.25% rate)

Total interest paid: $113,347.60

15-year payment: $1,333.58 (2.50% rate)

Total interest paid: $40,044.40

As you can see, the interest rate is 0.75% lower on the 15-year term loan.

This isn’t unusual because lenders are willing to offer a discount to homeowners who pay off their mortgages faster.

If you need three decades to pay off your mortgage, and want a fixed interest rate for that entire time period, you’re going to pay a premium for it via a higher mortgage rate.

Anyway, the 15-year mortgage would save you roughly $73,000 in interest over the full loan term, but your monthly mortgage payment would be about 50 percent higher.

If you could handle it, and actually want to pay down your mortgage, it’d be a worthwhile move, especially if you happened to be refinancing from a higher rate.

For example, if your rate was 3.75% on a 30-year term, refinancing to a rate of 2.5% on a 15-year term today would only be an additional $400 a month.

That’s a pretty good tradeoff for a relatively small bump in monthly payment.

Someone looking to retire who wanted to own a home free and clear could be a candidate for a shorter-term mortgage.

Same goes for someone living in an area of the country where home prices aren’t too high. The difference in monthly payment might be relatively negligible.

[30-year fixed vs. 15-year fixed]

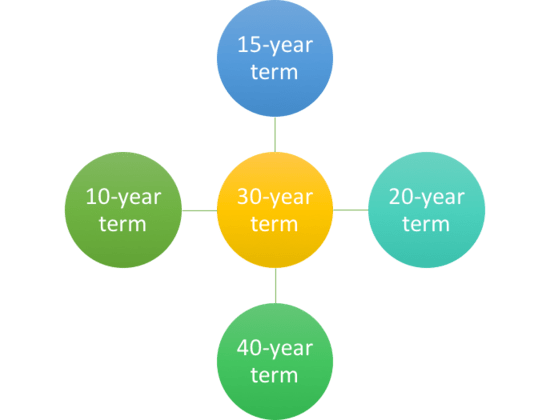

What Other Mortgage Terms Are Available?

- Other mortgage terms include 10-, 20-, 25-, and 40-year terms

- But not all banks and lenders offer all these options

- You may also be able to choose your own home loan term

- Where you can pick any loan term you like between a certain range

Mortgage terms don’t stop at 30 and 15. There are plenty of other options, including 10-year, 20-year, 25-year, 40-year, and even five-year terms.

Yep, you can pay your mortgage off in just 10 years or stretch it out to 40 years if you need a little more time.

The longest mortgage term I’ve seen was 50 years, but that was gimmicky and short lived, for good reason.

If 15 years is too quick, but 30 is too long, there’s always the 20-year mortgage.

There are even mortgages amortized over 40 years that are due in 30, so the options are endless really.

The five-year loan term that was popular in the 2000s referred to balloon mortgages where the loan was due in full after just five years.

Of course, borrowers were expected to refinance/sell at that time, and they’re amortized over 30-years, making them affordable on a monthly basis.

The shortest mortgage term where the loan is actually paid off in full would likely be the 10-year fixed mortgage.

As the name indicates, it has an interest rate that doesn’t change and is paid off in just a decade.

While it might be offered by certain lenders, it could well be out of reach for most homeowners because mortgage payments will be roughly double that of a 30-year loan.

Note: Mortgages with terms longer than 30 years and balloon mortgages have essentially become fringe products because they fall out of the so-called Qualified Mortgage (QM) definition that affords lenders extra protections.

Average Mortgage Term Is Much Shorter

- Most homeowners don’t keep their mortgages for the full term

- Instead they’re often kept for less than a decade before a refinance or home sale

- So consider your intermediate plans if you want to save some money

- You might be able to go with a cheaper ARM instead of paying a premium for a fixed-rate product

Keep in mind that most homeowners only hold onto their mortgages for about seven to 10 years.

This is a result of either selling the property and moving on, or refinancing the existing mortgage to take advantage of lower mortgage rates, or to get cash out.

So whatever mortgage term you choose, be sure it makes sense for your particular situation, and also from both a mortgage rate and monthly payment perspective.

Take the time to map out an intermediate plan so you can choose a mortgage appropriately.

How Long Should Your Mortgage Term Be?

- Consider how long you plan to keep the property in question

- Affordability may also dictate loan term choice and leave you with only one option

- Those moving relatively soon may benefit from an ARM with a 30-year term

- While those purchasing forever homes who can afford it may want a 15-year fixed

Ultimately, most homeowners are going to go with a 30-year term, and in all likelihood, a 30-year fixed.

It commands something like a 90% market share for purchase mortgages and 75% share for refinances.

But that doesn’t necessarily mean it’s the right loan choice for all these borrowers.

If you think you may move in just a few years, perhaps because you bought a starter home, the 30-year fixed may actually be a bad choice.

After all, the interest rate will be higher and the benefit (of the fixed interest rate) not fully realized if only kept a few years.

Conversely, don’t go after a 15-year term if you think you’ll have a tough time making the larger payments.

For many, this might not even be an option due to DTI constraints, which limit how much you can borrow.

Similarly, you may not want to pick a 20-year term or 25-year term over a 30-year loan if the rate isn’t significantly better (or at all different) and affordability is a concern.

Tip: You can always pay extra on your mortgage later to save money on interest and whittle down the loan term. Check out my extra mortgage payment calculator to determine potential savings.

How to Change Your Mortgage Term

- There are options if you want to decrease or increase your loan term

- A standard refinance will likely be your best option here

- Many homeowners switch from 30-year to 15-year term loans when refinancing

- This allows them to stay on track payoff-wise and obtain lower interest rates in the process

So we know the typical mortgage term is 30 years, but what if you want to change the length of your mortgage?

Let’s say you were a first time buyer, and like 90% of other home buyers, went with a 30-year fixed.

One day you tinker around with a mortgage calculator and realize you’re going to pay hundreds of thousands dollars in interest and not pay off your loan until you’re 70.

Now what? Panic, bury your head in the sand? No. Do something about it, assuming you want to.

The easiest and most straightforward method is to execute a rate and term refinance. Notice it says term right in the phrase…

While refinancing to a lower interest rate can result in monthly payment savings, going from one 30-year loan to another means you’re resetting the clock.

By this, I mean getting even further away from paying off your mortgage in full.

What some savvy homeowners do is refinance from a 30-year term to a 15-year term. That way they don’t extend their loan term, and in some cases actually shorten it.

As noted, mortgage rates are also cheaper on 15-year mortgages, so the savings can be two-fold.

It’s Also Possible to Pay Extra to Reduce Your Loan Term

- There’s another option if your loan term is longer than you’d like and you don’t want to refinance

- You can simply pay extra each month toward principal to shorten your loan term

- Aside from shedding years off your loan, you’ll also save by way of less interest

- And it gives you payment flexibility versus a shorter-term mortgage

If you can’t or don’t want to refinance, you can also just pay extra each month to effectively shorten the loan term.

To summarize, the longer the loan term, the lower the mortgage payment, but the more interest you’ll pay, and the longer it will take to build home equity.

Further complicating matters is the fact that some folks don’t want to pay off their mortgages, and would rather invest their money elsewhere.

This is especially true with interest rates so low and returns in the stock market and elsewhere so high.

Either way, make a plan and think about what your short-term and long-term goals are before diving in.

Tip: If you aren’t sure what loan term to pick, you can always make larger payments on a longer-term loan (biweekly mortgage payments).

If you go with a shorter term, you’re stuck with a larger monthly payment no matter what.

To err on the side of caution, you can go with the standard 30-year term and make extra principal payments if and when you desire.