In case you haven’t heard, there’s talk of a “refinance boom” as soon as 2025. Yes, you read that right.

While it seemed like high mortgage rates were going to spoil the party for a long time, things can change quickly.

Thanks to the millions who took out high-rate mortgages over the past couple years, even a slight improvement in rates could open the floodgates.

But now more than ever it’s going to be important to go with the right lender, the one who ultimately offers the lowest rate with the fewest fees.

This is especially true now that banks and lenders are working hard to improve recapture rates for past customers.

A Refinance Boom in 2025? What?

First let’s talk about that supposed refinance boom. This hopeful news comes courtesy of the latest Mortgage Lender Sentiment Survey® (MLSS) from Fannie Mae.

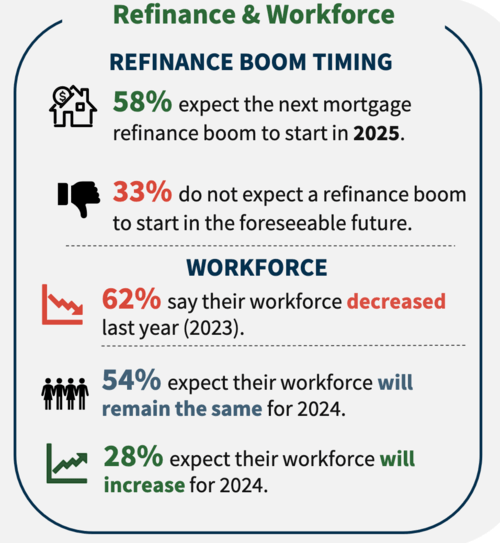

The GSE surveyed over 200 senior mortgage executives and found that almost three in five (58%) expect a refinance boom to start in 2025.

And some even believe it could kick off later this year, though that would take a pretty big move lower for mortgage rates in a hurry.

Either way, many are now anticipating that the Fed will cut their own rate in September as inflation continues to cool.

This expectation may lend itself to lower mortgage rates as bond yields drop and take the 30-year fixed down with it.

Assuming this all plays out according to plan, we could see a nice uptick in mortgage refinance applications.

After all, some four million mortgages originated since 2022 have interest rates above 6.5%, with about half (1.9M) having rates of 7%+.

If the 30-year fixed makes its way down closer to say 6%, or even lower, many recent home buyers will be clamoring for a rate and term refinance to save some money.

Loan Servicer Retention Has Surged Higher Recently

Now let’s talk about something called “servicer retention.” In short, once your home loan funds, it is typically sold off to an investor on the secondary market, such as Fannie Mae or Freddie Mac.

Along with the sale of the loan are the servicing rights, which can either be retained or released.

If they’re retained, the originating lender collects monthly payments and keeps in touch with the customer for the life of the loan (unless servicing is transferred at a later date).

If the servicing rights are released, payment collection is handed off to a third-party loan servicer.

Lately, banks and lenders have been opting to keep servicing in house to take advantage of a possible future transaction.

It allows them to keep an open line of communication with the homeowner, pitch them new products, such as a refi or home equity loan, cross-sell, and more.

In the meantime, they also make money via servicing fee income, which can supplement earnings when new loans are hard to come by (as they have been lately).

Anyway, what many mortgage companies are realizing is that with servicing retained, they can mine their book of business for refinance opportunities.

So instead of you calling a random lender when the thought crosses your mind, they might be calling you first.

Why Would My Mortgage Company Want Me to Refinance at a Lower Rate?

While it may sound counterintuitive for your existing mortgage company to offer you a lower rate, it’s a little more complicated than that.

As noted, some lenders sell the original loans and then either retain or release the loan servicing.

Some might sell both the loan and servicing rights to focus on bringing in new loans. It’s also entirely possible that your loan was transferred to a new company that didn’t originate it.

Either way, mortgage companies can still make more money by creating a new loan versus simply servicing the existing loan.

But their appetite and desire to do so may vary, which is why they may not offer the lowest rate out there relative to a third-party company.

You also need to consider independent mortgage brokers, who simply fund loans on behalf of wholesale lenders.

If rates drop, there’s a good chance they’ll be calling you to refinance your loan and they won’t care who currently holds the loan.

For them, they get paid on the origination of the new loan, not from servicing it or selling it.

In short, there are lots of reasons why mortgage companies and loan officers/mortgage brokers are incentivized to make new loans.

Instead of worrying about the why, worry about whether it’s a good deal for you. And that you’ve shopped around to ensure another company can’t do better!

[Is It Better to Refinance with Your Current Mortgage Lender?]

Will You Still Shop Around If They Call You First?

While it might sound nice to have a built-in reminder to refinance when rates drop, it might also deter shopping around.

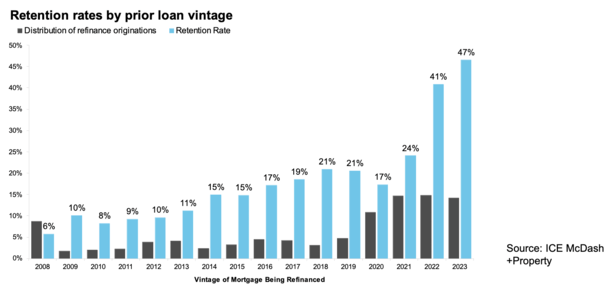

The latest Mortgage Monitor report from ICE found that retention rates on recent loan vintages have surged, as seen in the chart above.

Loan servicers retained a staggering 41% of borrowers who refinanced out of 2022 vintage loans and 47% of those who refinanced out of 2023 loans.

In other words, they’re snagging nearly half of the refinance business on loans they funded just a year or two ago.

And the retention rate among rate and term refis on FHA loans and VA loans tripled from around 15% in the fourth quarter of 2023 to 46% in the first quarter of 2024.

This means you’re more likely than ever to hear about refinance offers from the bank that currently services your mortgage.

That’s great for the mortgage companies, since they get to earn money on loan origination fees, lender fees, and possibly selling the loan and/or servicing rights again.

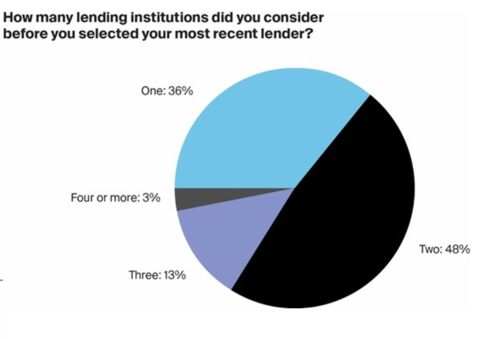

But it might not be great for you if you just go with the first quote you hear. Speaking of, ICE also noted that 36% of borrowers “considered” just one lender before making a selection.

And 48% considered just two. Did they consider two or actually speak to two? Remember, shopping around has been proven to save borrowers money. Actual studies by Freddie Mac prove this.

So if you just say sure, let’s work together again, you could possibly miss out on much better offers in the process, even if it is convenient.

Personally, I’d rather get a lower mortgage rate than save a tiny amount of time.

Read more: Why Do Mortgage Companies Want You to Refinance So Badly?