If you already have a mortgage, there’s a good chance you receive junk mail on a regular basis urging you to refinance.

You may receive solicitations from both your current bank/loan servicer and from a competing lender or mortgage broker looking to acquire your business.

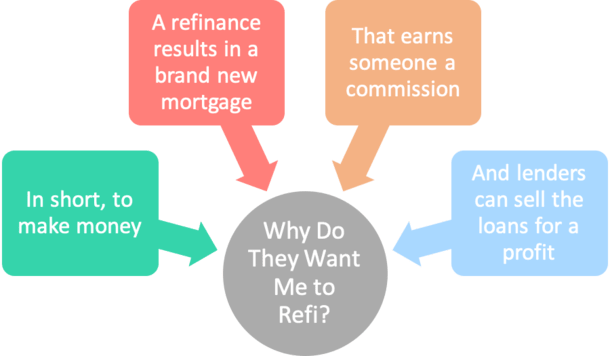

But why do they want you to refinance your mortgage so badly? What’s in it for them, especially if they already originated your mortgage and get paid interest each month?

Wouldn’t it be in their best interest (seriously, no pun intended) to hold onto your mortgage and continue to earn a decent rate of return, rather than give you a new low rate.

Why Would They Offer You a Lower Rate?

- Why would a mortgage lender offer you a lower interest rate than you currently have

- That would ostensibly earn them less money each month?

- Because they often sell the loans off to investors to make a profit

- Or they never owned your mortgage to begin with, so they earn a commission and proceeds from a sale

This might be easier to grasp if we look at it the other way around. Imagine you have a savings account that earns an APY of 0.95%.

Your same bank wouldn’t come to you and say hey, let’s get you into an account with a rate of 1.25% instead, you deserve more!

If they did, there would be a huge catch, such as locking up your money for five years at a fixed rate of return (CD).

On the other hand, competing banks might offer you that 1.25% APY with no strings attached (and even give you an opening bonus) because they don’t currently have your money.

That gives us one clue as to why a bank may want you to refinance with them. They don’t actually hold your mortgage.

You see, a lot of banks and lenders these days originate mortgages but then quickly sell them off to other investors. This is known as the originate-to-distribute model.

So while they may have made your loan, they don’t actually service it or make interest on it.

In other words, as the customer you are churnable to them. They can sell you another product over and over again without it affecting them negatively.

This means it makes perfect sense for them to want to refinance your home loan again, even if the new interest rate is a lot lower than it is on the existing loan.

Who Owns Your Home Loan?

- There’s a lot of confusion with regard to ownership here

- The bank that originally funded your mortgage may have nothing to do with it today

- It could have been sold off years ago to another company

- But if they still own/service it, they may not be keen to offer you a refinance

- In that case, just look elsewhere for a new lender who actually stands to benefit

Some of the confusion regarding “what’s in it for them” might come from the fact that ownership of the loan is unclear.

So even though say Bank of America closed your loan, it could have been sold to Wells Fargo or some other lesser-known loan servicer after the fact.

That would explain Bank of America’s willingness to refinance your mortgage. They can make money on closing costs (again) and make money by selling it off again or by servicing the loan.

If they actually hold onto the mortgage the second time around, they may not want to refinance it again in the future.

But if they sell it again, there’s a good chance you’ll get an offer to refinance down the road. They may even urge to you cash out to make the loan even bigger and more profitable.

If you consider a mortgage broker, who closes loans on behalf of a variety of lenders, they can refinance your mortgage over and over with different banks and always make a profit regardless of where the loan ends up.

They’ll still earn their commission even if your interest rate goes up, down, or sideways.

Sure, they may have to wait six months between each refinancing to avoid losing their commission from the prior loan, but if it makes sense, they can try to get you to refinance again.

Interestingly, Navy Federal Credit Union claims it services your mortgage for life.

While that could be a plus because you won’t have to keep track of who to pay if your loan is sold and the level of service might be superior because they keep you as a customer, they may not want to offer you an even lower rate.

Tip: Don’t be discouraged if your current lender isn’t interesting in refinancing your loan, shop around instead and you might find a better deal.

But The Bank Isn’t Charging Me Anything!

- Don’t be fooled into thinking you aren’t being charged if nothing comes directly out-of-pocket

- There is never, ever a free lunch, as cliché as it sounds

- If you aren’t required to pay lender fees or closing costs, you are receiving a higher interest rate than necessary

- This is the case even if you obtain a lower rate than your current rate

Here’s another myth. Just because you aren’t being charged a dime doesn’t mean you aren’t making the bank (or broker) any money.

If you haven’t already heard of a no cost refinance, mosey on over to that page and you’ll see how lenders are able to make new mortgages without charging you any money (out of pocket).

In short, they take advantage of lender credits to cover your closing costs. And these lender credits are generated by offering you a higher interest rate than what you might otherwise qualify for.

And they can choose lender-paid compensation, whereby the bank pays them instead of the borrower, again, for a slightly higher interest rate.

But if rates have fallen enough since you first got your mortgage, they still have the ability to offer you a lower rate with all those costs baked in.

So yes, they’re still making money, even if it sounds too good to be true. Never worry about whether the lender is making any money. Worry about whether it actually makes sense for you to refinance.

They’ll come up with a million different reasons to convince you to refinance, even if it’s not in your best interest.

How Money Is Made on a Home Loan

- Refinancing the loan (commissions and closing costs)

- Selling the loan to an investor (service release premium)

- Servicing the loan (collecting interest each month over time)

In summary, there’s a lot of money to be made on mortgages at different steps along the way.

First, loan officers and mortgage brokers can make commissions on a per loan basis when you refinance with them, regardless of whether they originated your prior loan.

As noted, lenders can pay these salespeople directly even if you don’t (directly).

Then when the loan is sold to an investor, the originating lender can earn what’s called a service release premium, which may be represented as a percentage of the balance, say 1-2% of the loan amount.

Finally, the company that services the loan can collect interest each month and make money as well.

This explains why mortgages are so profitable and why everyone wants you to refinance!

Read more: 17 Important Refinance Questions Answered!

What happens if you have just refinced and NESARA is enacted.

Our mortgage was recently sold to Rocket Mortgage, they currently do hold the mortgage as far as I can tell, and are relentlessly trying to get us to refinance.

Could it just be that they are worried we will refinance with someone else, and they don’t want to lose our loan? Or is it possible they resold it immediately after purchasing it, and are merely servicing it, without us knowing who actually owns it?

Jason,

I don’t think they’re worried about losing your loan. They likely scan their servicing portfolio to look for refinance candidates, and if they can find them, it’s possible to make more money by originating a new loan and selling it off to a new investor.

Great article about why they harass us so much.

I refinanced 8 months ago with my current servicer as far as I can tell. My original lender sold my loan immediately. I was ecstatic when I heard my new monthly payment. However, I could have sworn that I was told that my maturity date (and maybe even my principal?) would not change. Probably not in those exact words, but I’m sure that was discussed and that that was my understanding. I just spent an hour calculating my projected savings and, all things considered, I’m happy (12% is fair, right?) but I can’t shake the feeling of being tricked and I’m definitely bummed that I’m having to start over time wise. Am I justified in that?

Kimberly,

Are you saying they kept your loan term the same so you don’t push out the maturity date due to the refinance. For example, not refinancing into another 30-year loan and resetting the clock.

My current mortgage company is Rocket Mortgage, and I’m getting really tired of them trying to get me to refinance. I was going to before I realized that they were going to raise my interest rate and my payments were going up about $600 per month. I told them why will I refinance my mortgage with a higher interest rate and higher payments. They were including my finances into the equation. But my bills will not take me all those years to pay them off. So, no I don’t want to refinance because my interest rate is low at 3.2 percent. Also, they said that I’m still paying the PMI, they don’t realize I work for the Government and have access to lawyers and I was told that legally they have to remove the PMI when my house reaches 78% of the value, which it is. I’m so tired of Rocket Mortgage calling me, different people keep calling.