Most people don’t bother shopping around for their mortgage, despite the tremendous potential savings involved.

In fact, nearly half of consumers only bother obtaining a single mortgage rate quote.

It’s understandable since it’s certainly not any fun calling a bank to inquire about a mortgage refinance or to set up home purchase financing.

So expecting someone to call two or even three banks sounds completely intolerable.

But the studies are out there – and they prove you can save some real money if you do take the time to contact more than one mortgage lender.

While that’s totally your prerogative, it turns out some borrowers should put even more time into the process.

Got a Low Credit Score? You Better Shop a Lot

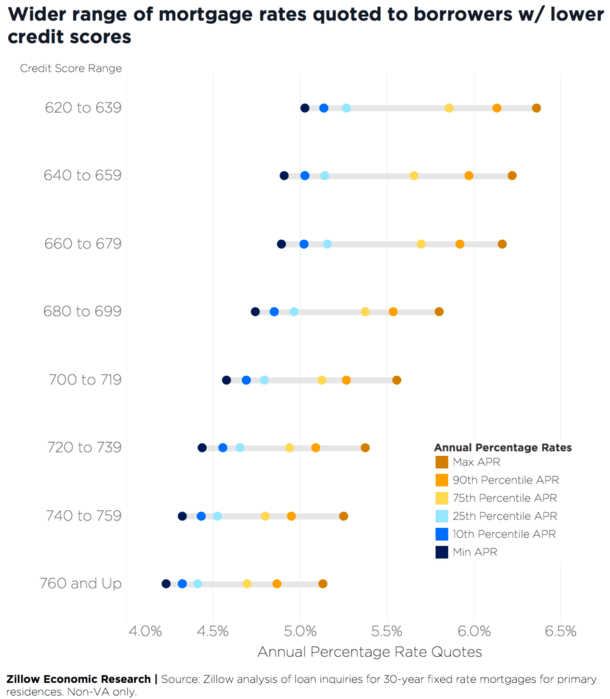

A new study from Zillow found that borrowers with the lowest credit scores are quoted the widest range of interest rates on their home loans, which means comparison shopping can be even more beneficial.

For those with credit scores between 620 and 639, generally considered right smack above subprime, there was a 133-basis point (1.33%) range between the lowest and highest APRs offered to borrowers seeking 30-year fixed-rate mortgages between September 2018 and mid-May 2019.

Meanwhile, those with excellent credit scores (760+) only saw a range of 92 basis points (0.92%) between the best and worst APRs.

In terms of median APR offered, the 620 to 639 credit score cohort received a quote of 5.48%, nearly a full percentage point (0.94%) above the 760 or higher credit score group’s 4.54%.

Aside from being more expensive, a higher rate can also present challenges when it comes to overall loan approval.

For example, if the interest rate creeps up too high, the monthly payment will also rise, putting pressure on a borrower’s debt-to-income ratio (DTI), which can lead to a declined loan application.

So the low-credit score borrower may miss out entirely if they don’t take the time to shop their rate, knowing the spread can be over 1.25% from lender to lender.

Better Yet, Take the Time to Improve Your Credit First!

Instead of merely shopping around more, why not address your credit score issues head on?

There’s no reason you can’t work on your credit, especially if you’re thinking about buying a home or refinancing your mortgage.

The return on investment for putting in a few hours could be invaluable, and potentially easier than shopping from lender to lender if it’s not your thing.

These days, it’s pretty easy to get your hands on a credit report for free and determine what’s holding your scores back.

Additionally, the credit bureaus have made it pretty simple to dispute things online, instead of having to rely on snail mail and fax machines for documentation requests.

So there’s really no excuse anymore.

Sure, you might still get approved for a mortgage with a marginal credit score, but why pay more month after month if you don’t have to?

Loan Type Also Affects Mortgage Rate Fluctuation

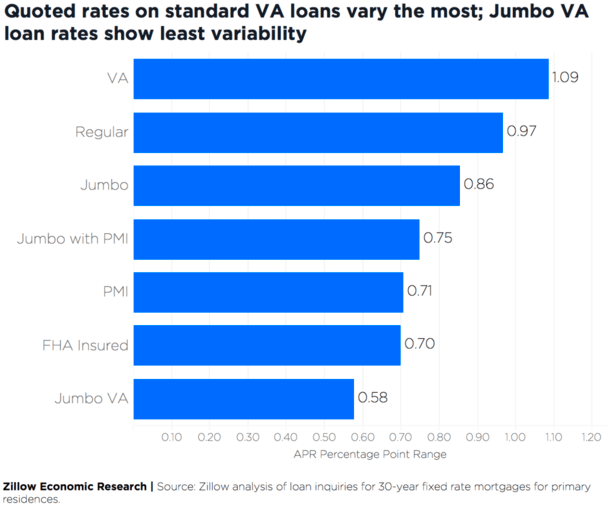

Credit scores aside, mortgage rates can also fluctuate more based on the underlying loan type, such as FHA vs. conventional.

The biggest range in APRs was seen on VA loans (non-jumbo), which exhibited a range of 1.09% from lender to lender.

The good news is VA loan rates had the lowest overall rates relative to other types of loans, with a median APR of 4.25%. The bad news is you might be quoted a rate a full point higher depending on the lender.

In other words, take the time to shop your rate if you’re eligible for VA financing, as not all lenders are created equal.

The so-called “regular” spread was a lower 0.97%, which Zillow defines as a conventional loan (non-gov) without private mortgage insurance (PMI).

Ironically, the lowest spread by loan type was seen on jumbo VA loans, which only ranged by 0.58%.

Still, more than a half point is nothing to scoff at, so really you should be shopping around regardless of loan type.

Lastly, they found that rates varied more in pricier metros in the country, with spreads wider in Los Angeles, San Francisco, and Seattle.

They attributed this to a greater share of jumbo loans with a wide range of credit scores.

The researchers also discovered high levels of rate variability in the metros of Boston, Charlotte, Houston, and Phoenix, even after controlling for loan type and credit score.

At the end of the day, put in the time if you want a low mortgage rate, regardless of your credit score, loan type, or location.

- UWM Launches Borrower-Paid Temporary Buydown for Refinances - July 17, 2025

- Firing Jerome Powell Won’t Benefit Mortgage Rates - July 16, 2025

- Here’s How Your Mortgage Payment Can Go Up Even If It’s Not an ARM - July 15, 2025