I’m sure most prospective homeowners like the idea of putting little to nothing down when purchasing real estate, but doing so isn’t without its drawbacks.

In fact, it can cost you quite a bit of money if you don’t come to the closing table with a sizable down payment, not to mention a higher loan balance.

Aside from having a larger mortgage payment, and a higher mortgage rate, you might also be hit with an extra form of insurance to offset the risk you present to the lender.

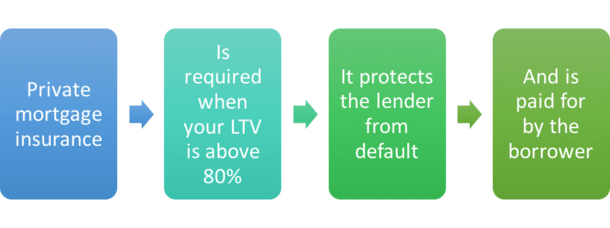

It’s known as “private mortgage insurance,” or PMI for short. Let’s talk about what it is, and more importantly, how you can avoid PMI!

What is private mortgage insurance?

- PMI is coverage that protects the bank/lender from borrower default

- It is NOT protection for the homeowner (but you have to pay for it!)

- Safeguards the lender in the event you’re unable to pay your home loan

- Allows them to offer low-down payment mortgages that are historically more risky

In short, mortgage insurance is all about risk and protection. Simply put, a mortgage with no down payment is more likely to default than one with a large down payment.

And even if a borrower with a huge down payment misses their payments, the lender can probably still sell the home for a profit if it falls into foreclosure.

If it’s a no-down payment mortgage and home prices take a dive, it could turn into an underwater mortgage, which would equate to a big loss for the lender when they attempt to offload it.

That’s where private mortgage insurance comes in. Lenders are willing to dole out low- or no-down payment loans, but they want assurances they won’t lose their shirt in the process.

PMI solves this dilemma by protecting the originating bank or lender when a borrower with a very high loan-to-value mortgage defaults. By protects, I mean insures. Lenders aren’t taking their chances here.

That’s right, PMI is for the lender’s protection, not yours. And YOU pay for it, not them.

If you default on a loan with PMI in-force, the lender will receive a payout from the private mortgage insurance company to cover the associated losses.

However, it is also said to benefit borrowers by giving them the opportunity to finance a property with very little down in one single loan, which I suppose is true. But it does come at a cost.

For example, homeowners these days can obtain 97% LTV financing (3% down) or higher if they agree to pay private mortgage insurance, thereby avoiding the need for a large down payment.

The trade-off is they get the house they want now, even if they don’t have the traditional 20% down payment.

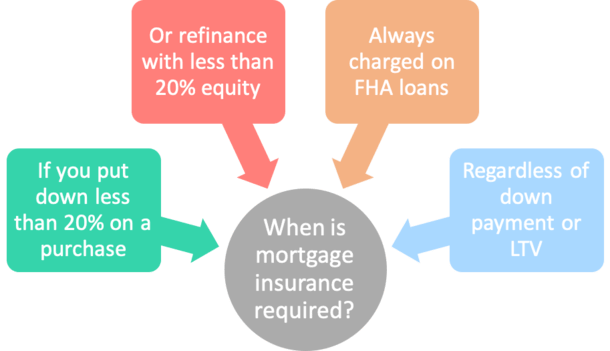

When is mortgage insurance required?

- Generally required if you put down less than 20% on a home purchase

- Or if you lack 20% home equity for a mortgage refinance

- Not all banks and mortgage lenders explicitly charge it (some waive it or build it into your interest rate)

- It is required for all FHA loans regardless of down payment or LTV

Borrowers who take out conventional loans (those not guaranteed by the government) and are unable or unwilling to come up with a 20% down payment must pay private mortgage insurance to obtain a mortgage.

This is similar to the mortgage insurance premium (MIP) paid by borrowers on FHA loans, though PMI is referred to as private because it doesn’t involve a government loan.

Rather, it tends to involve loans backed by Fannie Mae and Freddie Mac (conventional mortgages) and a private mortgage insurance company.

It is required by the bank or lender providing financing if the loan-to-value, or LTV, is greater than 80%. So those who fail to come up with a 20% down payment are stuck paying PMI.

Like other forms of insurance, you pay a premium for PMI coverage. It is often bundled into your mortgage payment (this is in addition to homeowners insurance).

For the record, some lenders may tell you that mortgage insurance isn’t required even if your LTV is above 80%, or that they don’t charge it.

But it’s likely just factored into the (higher) interest rate you receive. So you’re still paying for private mortgage insurance in these cases, just not directly.

To give you an example, if your mortgage rate were 4%, and you’re told you can avoid PMI at a rate of 4.25%, it’s still being paid for by you. But via higher monthly mortgage payments instead.

What mortgages don’t require PMI?

- VA loans (but they have an upfront funding fee)

- FHA loans (but they have their own monthly mortgage insurance premiums known as MIP)

- Conventional loans with at least 20% down payment (truly avoid PMI)

- Conforming loans backed by Fannie/Freddie with at least 20% down payment (truly avoid PMI)

- Portfolio loans where the lender doesn’t charge it (but could result in higher mortgage rate)

- Loans with lender-paid mortgage insurance (results in higher mortgage rate or closing costs)

How much does private mortgage insurance cost?

- Just like mortgage interest rates it depends on your particular loan scenario

- More risk (higher LTV, lower credit score) results in a higher premium

- A combination of high risk factors will lead to the highest price

- Work with your bank or broker to shop PMI and/or run different scenarios to drive down the cost

The cost of private mortgage insurance can vary greatly and carries its own pricing adjustments, just as the associated home loan does.

In other words, your LTV, credit score, loan balance, the amount of coverage, transaction type (cash-out refinance , rate and term refinance, purchase), loan type , loan-to-value ratio, and premium type can all come into play.

The greater the combined risk factors, the higher the cost of PMI, similar to how a mortgage rate increases as the associated loan becomes more high-risk.

So if the home is an investment property with a low FICO score, the cost will be higher than a primary residence with an excellent credit score.

The type of mortgage insurance also matters, such as borrower-paid versus lender-paid, along with annual premiums vs. single premiums, refundable vs. non-refundable, and so on.

Per the Insurance Information Institute (III), mortgage insurance premiums can range from $250 to $1,200 per year, though it’s not uncommon to pay several hundred a month for coverage if you’ve got a large loan amount and very little down payment.

Let’s look at a quick PMI cost example:

Purchase price: $200,000

Loan amount: $190,000

Loan-to-value ratio (LTV): 95%

Mortgage insurance premium: 0.70% of loan amount (paid monthly)

In the scenario above, you’d be looking at a cost of $110.83 per month for PMI coverage, which is lumped on top of your monthly housing payment.

If the mortgage is above 95% LTV, the annual mortgage insurance premium might increase to something like 0.90%.

In general, a higher LTV equates to higher risk and premium. So if you want to buy real estate with little to nothing down, expect a higher PMI rate.

Keep in mind that PMI can also be paid upfront or by the lender instead, with the latter resulting in a higher mortgage rate as a result.

The Homeowners Protection Act of 1998 (How to Get Rid of Mortgage Insurance)

- HOPA offers three options to remove PMI

- Automatic termination at 78% LTV

- Borrower-requested removal at 80% LTV

- Final termination at midpoint of loan term

I’m assuming the most popular question with regard to private mortgage insurance is how to cancel it? Fortunately, there are many ways to get rid of PMI.

In the past, homeowners continued to pay PMI even after their LTV fell below 80% because the banks and mortgage lenders were not required to notify borrowers.

It used to be the responsibility of the borrower to cancel PMI once they reached the 80% LTV mark, but recent laws have forced the banks and lenders to take responsibility as well.

Automatic Termination of PMI

All the confusion led to the Homeowners Protection Act of 1998, which established rules regarding termination of private mortgage insurance on principal residences.

The law requires home mortgages signed on or after July 29, 1999 to automatically terminate PMI once the homeowner reaches 78% LTV, or gains 22% equity in their home, based on the original property value (lesser of purchase price/appraised value).

This is the case regardless of whether the property declined in value since the time of purchase.

Just note that you must be current on your mortgage when you hit 78% LTV to get PMI removed. If you aren’t, it will be automatically terminated on the first day of the first month following the date that you become current.

Borrower Requested Termination of PMI

The law also allows homeowners to request the termination of PMI once they gain 20% home equity, or 80% LTV of the original value.

So at that time you can contact your lender and ask for the PMI payments to cease. But they won’t contact you, so you’ve got to keep an eye on your loan amortization schedule to figure out when you’ll hit that key level.

If you happen to make extra mortgage payments and/or your property has increased in value (or if you made documented improvements to your property), you might be able to submit a request for cancellation even faster.

In the case of borrower requested removal, you may be required to pay for a home appraisal, especially if home prices have gone down since purchase, so bear that in mind.

Additionally, you may have to prove that the property isn’t encumbered with any subordinate liens, aka second mortgages, which lower the amount of available equity in the home.

Lastly, you must have a good payment history (no 30-day late payments in the past year or 60-day late payments in the past two years), be current on your loan, and submit a written cancellation request.

Final Termination of PMI

The Homeowners Protection Act has one final option to remove PMI. If for some reason PMI was not canceled by request or automatic termination, the loan servicer must cancel mortgage insurance by the first day of the month immediately following the midpoint of the loan’s amortization period.

Again, the borrower must be current on their mortgage on this date for this rule to go into effect.

Mortgage servicing companies must provide a telephone number for all their mortgagors to call for information about termination and cancellation of PMI.

And new borrowers covered by the law must be told – at closing and once a year – about private mortgage insurance termination and cancellation.

The Homeowners Protection Act of 1998 does come with some exceptions though.

If your loan is considered “high risk”, if your property has additional liens, or if you were not current on your mortgage within the year prior to termination or cancellation, you could be stuck with PMI until those issued are resolved.

Additionally, it does not cover FHA loans or VA loans, or loans with lender-paid MI.

Though the law does not cover loans that were signed before July 29, 1999, or loans with lender-paid MI, lenders or mortgage servicers must tell borrowers about the termination or cancellation rights they may otherwise have with such loans (including rights established by the contract or state law).

If you signed loan documents before July 29, 1999 you will have to manually terminate your private mortgage insurance once you reach 20% equity in your home, or 80% LTV or less.

Be careful to pay special attention to this as the lender or bank is not required to notify you, and you will continue paying PMI if you fail to act.

There are many other specific statewide rules and rules for Fannie Mae and Freddie Mac loans, so always do your own due diligence, and contact your bank or lender to get all the facts for your specific loan in your particular state.

Canceling Mortgage Insurance on a Fannie Mae or Freddie Mac Loan

- Must pay MI for at least 2 years before requesting removal at 75% LTV or lower

- Must pay MI for at least 5 years before requesting removal at 80% LTV

- Exception if you made home improvements

- Must be borrower-initiated

- Must order an appraisal or BPO to assess current value

- Borrower must be current on mortgage payments

As mentioned, Fannie Mae and Freddie Mac have their own guidelines regarding mortgage insurance cancellation.

The biggie is that at least two years must have gone by since the origination date to execute a borrower-requested cancellation using the current value of the property (supported by an appraisal).

In other words, even if your property doubled in price over the course of 12 months, Fannie and Freddie wouldn’t let you cancel your MI. You’d have to wait until at least two years had passed.

Additionally, they’ll only cancel it if the LTV falls to 75% or less based on the current appraised value.

If you think your current LTV is at or just below 80%, there is a longer five-year seasoning requirement.

This means you must pay MI for a full five years, unless an appraisal proves your home appreciated enough to push the LTV down to 75% or less.

The one exception to these timelines is if you made improvements to the property.

In this case, Fannie will allow you to drop MI with no minimum seasoning requirement if the LTV is 80% or less.

For Freddie, the same LTV threshold of 80% or less applies.

In either case, you’ll need to prove you made some significant improvements to support the home’s value versus the original value.

This should entail something like a major kitchen or bathroom renovation, not just basic repairs or a fresh coat of paint. So be prepared to make your case.

Keep in mind that these guidelines apply to one-unit primary residences and second homes. There are different thresholds for 2-4 unit primary residences as well as 1-4 unit investment properties.

Lastly, you need to be current on the mortgage, which generally means no late payments whatsoever in the past 12 months, and no payment 60 days or more past due in the prior 24-month period.

How can I avoid mortgage insurance altogether?

- It’s actually very simple to avoid PMI

- Don’t take out an FHA loan (go conventional/conforming instead)

- And put down at least 20% when purchasing a property

- Or have 20%+ equity when refinancing an existing home loan

Yes! It’s pretty simple, really. Just put down 20% or more when you buy a home, or don’t borrow more than 80% of your home’s value when you refinance (20% equity position).

There’s nothing more to it. You won’t have to pay PMI!

But if that’s not an option for you, as it isn’t for most, it’s still possible to avoid paying private mortgage insurance altogether while putting no money down thanks to a combo loan.

Here’s how it works. If you keep your first mortgage at 80% LTV, and add a second mortgage of 20%, you can still obtain 100% financing without paying PMI.

The first lender doesn’t care as long as their loan stays at or below the key 80% LTV threshold.

Along with that, you’ll likely snag a lower blended mortgage rate by splitting the loan up. Learn more about mortgage combos and blended rates.

Or you can look into certain loan products like the Bank of America No Fee Mortgage, a so-called no cost loan that doesn’t require mortgage insurance, presumably even if the loan exceeds 80% loan-to-value.

The TD Right Step mortgage also allows a three percent down payment with no mortgage insurance required.

Is the mortgage insurance built into the rate? What about a second mortgage?

As mentioned, these programs sound good on the surface, but a word of caution.

They typically just have the mortgage insurance built into the interest rate. So it’s not really free. It’s just not directly paid out of pocket.

And worse, that means it stays with you for as long as you hold the mortgage.

It used to be common for homeowners to opt for a second mortgage instead of taking out one loan to avoid high interest rates and private mortgage insurance.

The only real downsides were the associated closing costs with a second mortgage, and the two separate payments you had to keep track of.

Nowadays, more borrowers seem to be going with one loan at a higher LTV, which is fine too as long as the mortgage insurance rate is reasonable, and doesn’t make your home loan unaffordable.

Either way, you should always explore the possibility of two loans to determine which will be a cheaper alternative. There are loan calculators out there (including my own) that will do the math for you.

Tip: If you do happen to have a loan with mortgage insurance, you can always refinance out of it and drop the mortgage insurance if the new loan amount has an LTV of 80% or less.

It’s not always advisable to refinance just to get rid of mortgage insurance, but if you can snag a lower interest rate in the process, it could be a really smart move if you’re into saving money.

In fact, an FHA-to-conventional refinance is a common tactic FHA borrowers employ to get rid of the mortgage insurance most of them would otherwise have to pay for the life of the loan.

Is there a rule that says an Insurance company won’t provide PMI if the builder and the homeowner are the same person? In other words I built my own home and the lender is saying that the insurance company will not provide PMI.

Hi Colin,

We are looking at purchasing a home for $250,000 that the owners have no mortgage on. If the owners take back a note for 30,000 (@4%) and we put down $20,000 will this let us avoid pmi? Thanks for providing this site and info.

Mario,

It might depend on the PMI company, though many if not all may have a similar exclusion. I don’t know for sure.

Ron,

The key would be taking out a loan from the lender at or below 80% LTV to avoid PMI so long as they accept seller carrybacks. Also consider the costs involved for both scenarios if the non-PMI route come with higher interest rates.

Should the mortgage insurance i had to carry, cover the Heloc i took out on a now foreclosed home?

I closed on my loan 22 November 2010. Fixed conventional with 85%LTV. My PMI disclosure states Automatic Termination on November 1 2014. RoundPoint Mortgage has had my loan the last few years and they will not drop the PMI and refund me my money. They are insisting that I have to pay for an appraisal. What can I do?

Nedalie,

Review your documentation to see if there’s a clause relating to a drop in value…I assume lenders are wary of home price declines in the past several years as grounds to block PMI from being dropped.

James,

Mortgage insurance is for the lender’s protection and tied to the loan you take out that exceeds 80% LTV at time of origination, so it shouldn’t apply to subsequent loans.

Colin

We are adding 1000 sf upstairs during a home improvement and plan to pay part cash and a 2nd lien loan for the improvement

We are close to the 80% at the moment but have turned a 4 bedroom into a 2 bedroom by opening up the home and removing walls – amazing outcome.

The additional 1000 sf and 2 more bedrooms, with high end materials will easily place our LTV under 80%

The question is what will be the effect of the 2nd lien?

Ive read LTV 70%

what is your observation of using a 2nd lien home improvements and a new appraisal to remove PMI?

Hi Colin,

PMI question for you. I was reluctantly paying $299/mo for PMI and recently made an additional principal payment to get my mortgage down below 80% of original value. Bank removed PMI, all good. Except, I made the additional principal payment end of March and they just recently charged me the “normal” April 5th PMI payment of $299 AND an additional final PMI on April 11th of $220. Bank says it’s a standard PMI closeout fee, 1.5 months of PMI, can’t be waived, part of contract, etc. (I don’t even think I ever saw a PMI contract btw…)

Anyway, am I getting ripped off? Normal payment in April when loan value reduced in March? And then another final PMI payment too?

John,

Sounds like your home will be completely different when all is said and done…probably a good idea to ask your PMI company because the presence of subordinate liens can stop you in your tracks. Alternatively, there may be the option of taking out a second mortgage to do the improvements, then refinancing both loans into one new loan at an LTV of 80% or less (if the value will be that much higher) that drops the PMI and ideally comes with a new low rate. But you may not want to do that for one reason or another.

hi, have a question. I’ve been trying to get my pmi removed plus interest at 6.7% did my try’s at refin. didn’t qualify with appraisal then reach 80% last year and still didn’t qualify. well now at 78% a year ahead of scheduled date. called and spoke to company holding loan their stated have to do another appraisal. but my paper’s state automatic termination when LTV reaches 78% on date 6/1/2017. I’ve reached that 78% last month and don’t believe i have to do another appraisal home purchased in 2007. feel it should automatic terminate i know that they changed the real estate law again in 2013. but going by my contract from 2007 . please advice, thanks

Marlene,

If your paperwork says it’s set to reach 78% in June 2017 that’s probably when they would automatically remove it. If sooner probably need an appraisal to justify. Depending on the cost of PMI each month the appraisal fee could make sense to pay if you’re confident the home is at value.

Hi Colin, Great information and thank you for helping so many folks out. My question revolves around the cost of PMI. Normal homeowners insurance to replace an entire house is no where near the annual cost of PMI. And PMI just covers the 20%. Why is there such a large disparity between the two? Are there any governing bodies limiting the amount they can charge? I feel like the insurance companies and the lenders are in this together as another product (although necessary and I get it) to gouge American consumers. The cost of PMI does not justify its intended purpose and the cost could easily be less. Am I missing something other than its my choice to take it or leave it? Many thanks for your response.

Hector,

Good question Hector and I’m glad you realize it’s necessary. I guess the main difference is that PMI is entirely avoidable (unlike homeowners insurance) if you actually put down 20% and get some skin in the game. As for the price, they may have to charge X amount for some capital buffer or something. I’m not quite sure why the rates are what they are.

We just refinanced out of FHA and into conventional loan with PMI. Our first payment is due with nearly twice the amount of PMI disclosed at closing. Can PMI be increased after closing like this?

Lindsey,

Might be a misunderstanding about the cost – should probably contact the lender/servicer/PMI company ASAP to determine what the payment is and why the paperwork deviated.

I don’t even know where to begin… In 2007 my mother purchased a home for 278K, put down 16K. Fast forward today…after a bankruptcy, near foreclosure, and modification she currently owes 280K. The current value is 238K (extremely upside down) I decided to help my mom get her payments under control to realize that she has been paying a PMI of approximately $700/mo. Yes, you read correctly, $700! My mother was not aware that she signed such a high PMI. No one I have spoken to in the mortgage arena or realty arena can believe the amount she has paid to date in PMI. Countrywide was the lender and then it was sold to BOA and now another Servicer with Fannie Mae as the investor. Is there anything we can do. She is at the point of walking away. This is $8,400/year. What can we do?

Re: FHA loans with MIP, not PMI. I wish I could just read one person who put in writing an easy to understand truth about removing FHA MIP. HUD FHA loans, where the borrower puts down the minimum, will continue to pay MIP for approximately 10-14 years, based on normal payment amounts (ie. no extra principal). Why is everyone under the impression that MIP will “go away” after 5 years. That is so misleading and hard for people to get. PEOPLE, your MIP will continue for a lot longer than 5 years and depending on when you got your loan, it could continue for the term of the loan. Today’s “estimated” market value has NO BEARING on the removal of MIP. If you doubt me, call HUD. Regards, John Public.

Viv,

That’s pretty brutal…tougher if the loan is already modified, but perhaps speak with a few knowledgeable lenders/brokers to see if anyone can either refinance the loan and get the PMI way down or seek another, more favorable loan modification. That seems absurd.

Is it possible to contact my PMI servicer (Essent) to buy out the mortgage insurance? I was told I might be able to do this by my lender. We planned on paying for it in closing, but the mortgage cops said it would make the total fees in the loan too high.

Kyle,

I suppose you can give them a call…always the chance of refinancing again with a higher value or getting upfront PMI or LPMI and still getting a lower interest rate with little/no cash out of pocket.

Mom and Dad’s name on loan. Dad loses job and got a low income contractor job, then mom passed away. It’s just been 15 months since home was purchased. Dad may not be able to make payments on his own, but is trying to keep house. Home value (Zillow, Redfin, Trulia) says it’s up from $225k to $270k.

1 – Can Dad request PMI to be removed?

2 – Will it require credit and income check again? It’s an issue since dad doesn’t have proof of stable income yet.

3 – Will the Dad be forced to refinance if they know mom passed away?

Hello! We financed our current home through VA 2 years ago. The bank told us VA required mortgage insurance. They charged us over 4600.00 dollars. I’m now reading that VA does NOT require mortgage insurance! I looked at our VA loan disbursement and no where on there does it mention the 4600.00. I think we’ve been cheated by the bank and they pocketed the money!! I’m not sure how to proceed. We of course want that money back!! Should I call VA and see if they have received the money or go to the bank and request the money back or just see a lawyer. That’s a lot of money!! They stick you enough as it is!! We have excellent credit, as a note. Please help!! Thank you!

Paula,

There might be a 2-year wait to remove PMI without refinancing regardless of current value.

Debra,

It might be a case of semantics…perhaps it was the VA funding fee?

What exactly is the bank being paid for by the PMI company? What is the reason for foreclosures at higher costs recently? Banks make enough money from the higher interest rates, repayment schedules and fees. Why do they feel the need to make more money from house. I think all PMI should go away. If you don’t have 20% then your interest goes up a little. Banks are in the business to make money but they should take some risk, they do each day with our money. If you can’t tell, I don’t like banks. I am trying to get into flipping and the banks are running me around and discouraging me.

Brian,

You can take a higher interest rate in exchange for not paying PMI directly.

Colin, we lost our home to foreclosure. I still think our lender, Wells Fargo, did us wrong, but we walked away. We rented homes a few years. We finally were able to purchase a home, borrowing down payment and started to breathe again. Less than two months later, we got notice that PMI was suing us for $90k. That’s the difference from what we owed and it sold. We are still paying PMI for this shortage. Is there any legal recourse for us? It’s straining us terribly.

Sandy,

I’ve heard of this happening but I don’t know the best route/solution unfortunately.

Colin,

I have read a few articles that have stated that you can pay PMI upfront. Is that still true in today’s market, and what would the percentage rate on that be?

Eric,

Yes, it’s usually an option that is covered via a lender credit or out-of-pocket. Hard to say the exact cost…typically it raises your interest rate by some percentage…whether it’s .25% or .50% or more is difficult to determine without knowing all details such as loan amount and getting the lender’s pricing, etc.

I am in the process of Refinancing (FHA) and my LTV is 70%. Is it required to pay for mortgage insurance?

new loan is 117,000 but the appraisal value is 165,000.

Tammie,

If the loan is another FHA then MI is required, if moving to a conventional loan you can avoid it with an LTV at or below 80%..

ok thanks for the information.

When a loan is sold will the PMI payment change. When the home was originally purchased it was a “conventional” loan. The loan was later sold and we were notified that the PMI payment was well over $400 monthly. there had not previously been PMI

Lisa,

I’m assuming the new loan had mortgage insurance…if a loan is refinanced into a new loan it’s possible the new loan could have PMI if the LTV warrants it.

I am trying to get my PMI removed. I owe $116,783 and they say my home was worth $159,700 back in 2010. My home is valued at $234,000 by their company I used to get an AVM. My house was damaged last year by a hail storm. They know that because they got the insurance check for $30,000 for repairs. New roof, new siding, new windows, and I purchased stone that never was on the house. Basically adding value to the home. They want an appraisal. I think that is ridiculous since I already met the LTV. What is my recourse other than putting out this appraisal money?

Wanda,

Not sure there is any alternative…generally an appraisal is required to remove PMI early. Annoying sure, but just because “they know what it’s worth” doesn’t cut it when large insurance companies are involved. Paperwork is a necessity sadly.

We own one acre of ground and currently live in a mobile home on it. We are looking to build soon. We had been told we could use our land as our 20% down payment. My question is are we still going to be required to have PMI insurance?

Hello,

I was wondering when requesting PMI if a credit report is pulled? I got the information from my mortgage company and it does not indicate one would be but I like to know in advance if it will so I know how many hard inquiries I have.

Thank you

Laura,

It’s possible to ensure are there are no subordinate liens (second mortgages) on the property. Probably best to ask them directly.

Hi,

question plz..

Mortgage company gave me a particular value for PMI, rate was locked BUT 2 days before closing they increased the PMI.

Is that allowed?

They are saying that the insurer for the PMI is charging higher premium now.

Is that legal?

Thanks

Pankaj,

Hmm…not sure, I thought rate quotes for good for X days but maybe they originally calculated incorrectly or some loan detail changed?

My original loan was a 30 year with less than 20% down. That loan started in 2007. I am refinancing now for a 15 year loan with no pmi. Do I understand correctly that as long as I haven’t gone below the 78% of original LTV that I should not expect any type of pmi refund? Thank you.

Kent,

Might depend on the PMI product you went with…check your paperwork and/or contact your PMI company to see if it was a refundable product.

Colin – I purchased my home in 2007 originally and put 20% down. I refinanced 3 1/2 years ago to get a lower rate. At that time they re-appraised my house and said I had less than 20 equity. This was during a down market.

For the past year I’ve been requesting they drop my PMI. I filled out an application and paid a fee for another appraisal. The market has fully recovered and surpassed where it was in 2007.

The mortgage company has been stalling on the appraisal for 4 months. Each time I call them they set a new date in 2 weeks, which they then fail to meet. They will not tell me which appraisers are on their approved list, or who they have contacted. They have given me conflicting explanations for why an appraisal hasn’t been scheduled.

Is there a way I can find what “cut” they get of my PMI as a kickback? And what is my recourse since they won’t schedule an appraisal and won’t accept any that I provide? I’ve read your links above and can’t find a similar situation. Thanks

Eric,

If they’re giving you the runaround you may want to start mentioning things like the CFPB to give them motivation. Seems pretty unfair to make you wait months and continue paying PMI month after month. Not sure about a “cut,” but PMI protects the lender from default…

You guys are lucky, Citi mortgage is self insuring my PMI and charging me 612.00 per month for PMI. Yikes!

My original paperwork and the 78% says my PMI should auto-terminate 6/1/17. I asked Chase about early termination was very surprised when they said I had another 3 years. Is there anything that can change automatic termination if I am current, have met 78% and loan was post 1999?

Michael,

You may want to get in touch with the PMI company directly to see what went wrong, or where the confusion lies.

Thank you for being so responsive to everyone’s questions Colin. I looked through and I didn’t see my question answered so here it is. I refinanced my 3-family investment property in 2007 and PMI was required with HSBC. I made an extra mortgage payment and a half every year. The market value dropped significantly and I may be around 85% LTV if re-appraised, however, my payments reflect that I am at the midpoint of my amortization schedule. Even though I haven’t made 180 payments on my 30 yr fixed rate loan, am I technically at the midpoint so, should my lender allow me to terminate my PMI? Does it matter if it is or isn’t a fannie/freddie backed loan? I’ve never missed a payment.

Bryan,

I believe the midpoint removal of PMI is an HPA thing, not anything to do with Fannie/Freddie. But my assumption is the midpoint of the loan’s amortization period is based on the original payment schedule, not the “new midpoint” based on extra payments you may have made. But it might not hurt to inquire directly with the MI company and/or your loan servicer to be sure. Please follow up if you do.

Thanks Colin! I called HSBC but apparently I’ll have to talk to a specialist who’s hours are from 8:30 to 4:30. They don’t make it easy. I’ll follow up with you later.

Colin,

Is there anything in the HPA-98 that allows banks to require evidence that the LTV be even lower than the 78% threshold to cancel early?

My loan is stating that to cancel the PMI prior to a 5-yr ownership, I have to prove that I have a LTV of 75% or better. I am confident that I meet the 80% threshold with a new appraisal, but I could be borderline on the 75% requirement. I don’t want to spend $500 to find out I am at 77% and they won’t cancel my PMI.

Thanks in advance for the advice.

Paul,

Fannie and Freddie loans have a rule for borrower-initiated cancellations that requires an LTV ratio of 75% or less based on the current value of the property if 2 or more years have passed, but less than 5 years have gone by since loan was taken out. That might be the issue you’re facing.

I have a conventional loan with lender with a opt-out pmi option once LTV reaches 20%. I purchased my home for 410K. The home was appraised at 430k at closing. After total rentiovation ( new tile floors, new kitchen, impact doors & windows ect..) I knew my home would be worth more for sure based on the fantastic comps. I decided to ask my lender to drop my PMI since my mtg balance is only 362K. My home was just appraised (by lenders appraiser) to 460K. Question is why was I declined the removal of the PMI?? My calculations puts me at a 78% LTV. Is the lender still using the oringal purchase price or appraisal? Why didn’t they use the new appraisal (460k) to determine the new LTV? And of course all mtg payment made on time! PLEASE HELP!

We were given the option to pay our PMI in full at closing. A Fannie Mae home renovation for an old home with lots of problems but worth the fix up. When you are eligible to take the PMI off are we able to get any of what we paid back? I have been getting mixed reviews. I am asking because the bank notified me I could have it taken off and even noted that it was paid all in the same email.

Thanks in advance.

Patricia,

Hmm…you may want to check with the mortgage insurance company to determine if the PMI is refundable or non-refundable, and then ask them to go over their refund schedule if applicable.

I am purchasing a family home. Sale price is 180,000. I am purchasing the home for 140,000. I am being given a Gift of Equity of 40,000. I am using 10,000 of my gift to pay closing costs and my 3.5% due for the FHA. My question is doesn’t my 3.5% and my gift of equity equal more than the 20% required to avoid PMI?

Thanks in Advance

Kelly,

If it’s FHA you have to pay mortgage insurance regardless of the 20% down…if it were conventional you could avoid it.

For at minimum 2 years correct? That’s what I thought it was, just making sure.

Thank you

Kelly,

No it can range from 11 years to the full term of the mortgage. For most people who don’t actually keep their mortgage longer than a decade, it’s still effectively the life of the loan.

Hi Natalie any luck with Roundpoint? I have enough equity in my home to terminate and they denied me and I can’t get an intelligent person on the phone to explain why. They are using the amount I paid for my home and not my appraised amount which is why they are denying termination.

I just sold my home, not really paying attention to my pmi insurance sold the house and it was at 53%. My original loan papers had my pmi insurance mature in 2018. I had the mortgage set up for 2 times a month payment so I reached 78% way before the maturity date, the bank is saying that the original maturity date is what they are going by, not that I had reached 78% way before that. The loan originated in 2005. Shouldn’t they have automatically terminated pmi at 78%? What is my recourse from this?

Bill,

The 78% automatic termination of PMI is based on original value and amortization of the loan. It sounds like you paid extra over time to lower the LTV but didn’t make a request for it to be removed. Unfortunately, it’s not automatic if you pay early or use current value, it must be initiated by the borrower, and typically an appraisal is required.

Why would my PMI have increased by more than double the amount (from $2500 per year to this year we are being billed $5400) from 2017 to 2018? House was purchased for $215k and was valued as such. We have an FHA loan, and understand the difference between MIP and PMI, but we just received an escrow shortage notice of over $3k and now our mortgage payments are increasing almost $500 per month. Why would the PMI change so dramatically from one year to the next? My wife and I had to go the FHA route due to not having 20% down and our middle of the road incomes and we can scrape the new payment together somehow, but this seems egregious. Did the new tax laws force this increase or are there other circumstances that would cause our PMI to more than double in cost?

Matt,

If you have an FHA loan, it’s not PMI, which stands for private mortgage insurance. It’s your annual MIP, which stands for mortgage insurance premium, and is paid monthly.

Anyway, ask your loan servicer if they miscalculated it (underestimated the cost) and if you now have to play catch up…and assuming that’s the case, ask how long the higher payments must be paid to get back on course.

I bought a condo with 15% down in 2006 for $130,000. At the time, it appraised for $144,000. Within 3 years, identical condos in the neighborhood were selling for $95,000. The values have not recovered at all since then, identical units are still selling for about $95,000. I have paid on time every month for more than 11 years, but I’m still not particularly close to 78% LTV. My loan servicer is one of the too-big-to-fail institutions that played a major role in the financial collapse in 2008, so I am basically paying extra each month in perpetuity because they lost $35,000 of my money. Is there any recourse? Or any way to cancel PMI without getting to 78% LTV on the current appraised value if you’ve been making every payment for X years?

It works off of your original appraisal…at least for Wells Fargo. Double check the “rules” for your bank…good luck!

I had my mortgage company, Caliber Homes, reach out about 8months after closing on my $200k house, and say that since I got the loan thru and bank and broker that I had to have PMI. He said if I had gone directly thru a mortgage company like them instead, I would not have had to have PMI, and he was trying to have me refinance the property to drop the PMI…also said I did not have to have 20% ownership for this to take place. Am I being lied to???

Rebbecca,

If less than 20% equity, chances are a lack of PMI is the result of it being built into the interest rate. Where someone gets a home loan shouldn’t affect whether PMI is required or not, though there are some companies don’t charge it. But like I said, they build in the cost elsewhere, typically via a higher interest rate or closing costs, all else being equal. So you have to consider the total monthly payment AND closing costs associated with the loan to determine if you’re actually saving money with or without PMI.

What happens with the money that is is paid to PMI? IF it is insurance, for “just in case,” do we get it back? Or are we throwing money away?

Noel,

Like other forms of insurance, PMI is paid to cover a potential risk that may or may not materialize. However, it is possible to get a refund for the unearned premium if the policy is cancelled ahead of schedule and it’s a refundable policy. In terms of throwing away money, home buyers can avoid it altogether by putting 20% down.

I have a Fannie Mae backed mortgage. I got a BPO Opinion done which valued my home at $440,000. My mortgage balance is at 76.7% of this new value. Will my PMI auto terminate once my mortgage hits the 75% ($330,000)? If not, can I call to have removed or will I need to have another BPO Opinion done once I hit 75% to remove the PMI? Any insights would be helpful on next steps I can take.

Ryan,

I believe it must still be borrower-initiated since you need to supply a BPO. The only time it’s “automatic” is when it’s based on the original amortization as opposed to a new appraised value. May want to ask the loan servicer first before you pay for another BPO.