You’ve probably heard about the big NAR settlement that could completely change how real estate works going forward.

But if you haven’t, or are unsure of what’s changing, there are two new rules set to go into effect August 17th, 2024.

The first is that offers of compensation will be prohibited on Multiple Listing Services (MLSs).

In other words, listing agents won’t be able to say they’re offering 2% or 3% to the buyer’s agent on the MLS.

The logic is that this type of co-op commission leaves the buyer out of the conversation, which isn’t fair if the buyer ultimately pays for it.

While they may not pay it directly, a pre-determined commission might result in a higher sales price.

In addition, there’s also not much transparency about the fee, nor do consumers know such fees are negotiable.

Simply put, this move is intended to boost transparency and ideally lower fees for consumers by letting buyers negotiate with their agents separately ahead of time.

But there might be some unintended consequences as a result, which I’ll get to in a moment.

The other major change is that buyers must sign a written agreement before they can tour a property. At that time, compensation will also be discussed.

Real Estate Agent Fees May Drop, However…

Now about those unintended consequences I alluded to. While the standard commission might go down thanks to these new rules, from say 2.5% to 1.5% or even 1% on the buy-side, there’s still the question of who pays it.

As noted, the seller can continue to offer buyer agent compensation, it just can’t be included on the MLS.

So hypothetically this could be conveyed in other ways, such as on their own brokerage website listing, via phone call, text, etc. At least that is what some think for now.

That too could change if this evolves into a situation where co-op commission is completely banned and decoupled.

But as of now, many real estate agents assume they can still make offers of compensation via channels other than the MLS.

In theory, this means nothing might change in some transactions. For example, a seller could tell their listing agent to offer 2.5% to a buyer’s agent. And a buyer’s agent may ask for 2.5% from their buyer.

The logic here is that they want to move the property quickly, and being stingy could backfire.

If the seller only offers 1%, or offer nothing at all, a buyer’s agent may need to make up the shortfall with the home buyer.

At that point, the buyer may balk or simply be unable to come up with the out-of-pocket funds to pay it.

When all is said and done, the seller might lose a buyer and kick themselves for not just offering compensation and getting a decent sales price.

On the other side of the coin, a buyer might be OK with getting nothing from the seller and paying their agent themselves to sweeten their offer (assuming multiple bidders).

So there are a lot of scenarios here and still a lot of uncertainty about how this could evolve.

But some things I’ve seen thus far are a real estate sign that makes clear the seller will offer buyer agent compensation, buyers forgoing an agent and contacting the listing agent directly, and some even signing a form that says they won’t tour homes that don’t offer compensation to the buyer’s agent.

It’s going to be very interesting. And like I said, it’s still very fluid and there’s a lot we still don’t know.

How Will Home Buyers Pay for Buyer Agent Compensation?

Beginning August 17th, 2024, home buyers will have a few options to pay the buyer agent compensation.

They can maintain the status quo and hope the seller offers it, with the buyer’s agent fee coming out of the sales proceeds.

They can go direct to the listing agent and request a dual agency, where the listing agent represents both buyer and seller.

They can hire a real estate lawyer and have them guide them through the process for a flat fee, assuming such a setup is permitted.

Or they can foot the bill themselves by simply paying it out of pocket to an agent.

Some folks seem to think buyers are going to increasingly pay the buyer’s agent commission themselves as sellers and their agents offer zero compensation.

While I don’t fully agree, given the fact that most Americans can barely scrape together their down payment and closing costs funds, it’ll likely happen more frequently.

And if and when it does, it could burden some home buyers, especially the aforementioned who don’t have deep pockets.

That brings us to the original question in this post. If they’re unable to pay cash, can real estate commissions be financed instead?

Real Estate Commissions Can’t Be Financed

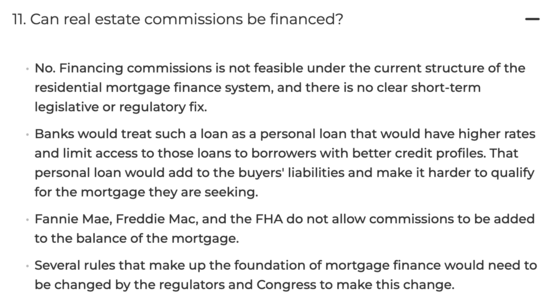

At the moment, real estate commissions can’t be rolled into the loan amount, aka financed, per NAR.

This goes for all major loan types, including conforming loans backed by Fannie Mae and Freddie Mac, along with FHA loans and VA loans.

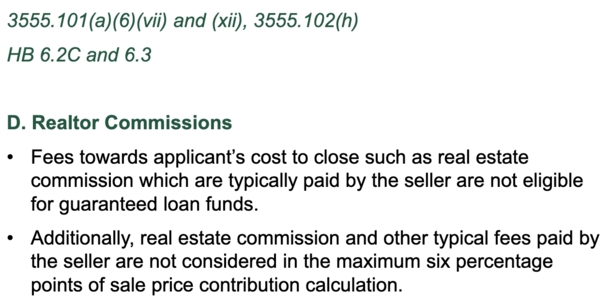

The same is true of USDA loans for that matter as well, as seen in the screenshot below.

However, it’s important to note that real estate commissions aren’t considered in the maximum interested party contribution (IPC) calculations.

So you can get the seller to pay your buyer’s agent and still get the full amount of seller concessions for other stuff like lender fees and third-party costs, including title insurance and home appraisal.

Both Fannie Mae and Freddie Mac issued letters to confirm that real estate agent commissions won’t count towards the IPC limits if they continue to be customarily paid by sellers.

And the VA released a circular because their regulations specify that a veteran cannot pay for real estate brokerage charges.

In light of the settlement, veterans will be permitted to pay it, assuming buyer-broker charges are not included in the loan amount. In addition, it won’t be considered a concession.

As for why real estate agent commissions can’t be financed, for one it never really came up since the seller would typically pay the buyer’s agent via sales proceeds.

This was essentially a non-issue prior to the landmark NAR settlement.

The other wrinkle is loan-to-value ratio (LTV) restrictions. If the borrower had to add an additional 2-3% of the purchase price in real estate agent commissions to their loan amount, they might no longer qualify.

This is especially true when putting down 0% to 3.5%, which is quite common these days. The homes simply won’t appraise and the max LTVs will be exceeded.

Could this change in the future? It’s possible but not necessarily probable for the issues mentioned above.

But Aren’t Concessions the Same as Financing Costs?

Not quite. When a seller agrees to offer concessions to the buyer, they typically raise the purchase price. So if you ask for $10,000, they will bump the price up by, you guessed it, $10,000.

As a result, your loan amount will be higher since you’ll likely keep your down payment percentage the same.

For example, if home was $325,000, and now becomes $335,000, and you’re putting 20% down, it’ll be a loan amount of $268,000 instead of $260,000.

In essence, you are financing the extra $10,000 via a higher purchase price and loan amount, but it’s indirect. And you need the property to appraise higher.

Conversely, if you were able to finance the real estate agent compensation, it would simply increase the loan amount without upping the purchase price.

So same example, loan amount becomes $270,000 and purchase price remains at $325,000. You’ve now got an LTV ratio of 83%, unless Fannie, Freddie, the FHA, etc. allow you to exclude real estate comp from the calculation.

They more than likely WILL NOT, as it would increase risk to them and allow real estate agents to continue to charge high commissions.

And because they use the lower of the purchase price and appraised value for LTV, it wouldn’t matter if the home appraised for more.

What About Using a Lender Credit to Pay Real Estate Commission?

Now let’s talk about a potential solution if the seller won’t offer buyer agent compensation and you don’t have cash to pay it out of pocket.

One viable option could be the use of a lender credit, which technically can’t be used for real estate agent commissions.

However, if the lender credit were used for other costs, such as lender fees and third-party fees, it would free up cash to be used elsewhere.

For example, say you’ve got a $500,000 loan amount and the buyer’s agent wants you to pay them 1%.

A 1% lender credit frees up $5,000 in cash to pay those other costs, allowing a buyer to compensate their agent with the freed up cash.

It’s still very early goings and unclear if such an arrangement will be permitted. After all, co-op commission might be on the chopping block next. But it’s something to consider.

Ultimately, it will likely be best for most home sellers to continue to pay the buyer’s agent via the sales proceeds.

This should maximize the number of eligible buyers/bidders and not shut out first-time home buyers, who are most at risk due to limited funds.

The good news is these real estate agent fees could come down as a result, saving both buyers and sellers some money along the way.

- UWM Launches Borrower-Paid Temporary Buydown for Refinances - July 17, 2025

- Firing Jerome Powell Won’t Benefit Mortgage Rates - July 16, 2025

- Here’s How Your Mortgage Payment Can Go Up Even If It’s Not an ARM - July 15, 2025

“Both Fannie Mae and Freddie Mac issued letters to confirm that real estate agent commissions won’t count towards the IPC limits if they continue to be customarily paid by sellers.”

This guidance is based on the general assumption that commissions are paid by sellers. This is no longer the case.

On Aug 17, buyer brokers will begin to execute agreements with buyers directly that will identify a “specific and conspicuous disclosure of the amount or rate of compensation” that buyer broker and the buyer will agree upon. Each broker representing a buyer must negotiate with their buyer client to agree on the amount the broker may earn in the transaction. The total cost of the buyer brokerage fee will become the full responsibility of the buyer alone.

Otherwise, a broker who knows the seller can include a 10% commission concession into the purchase price, and make make a higher offer on the property. For instance, DR Horton now offers 8% commission to buyer brokers, because it controls the price of the home and the offer amount. Leaving commissions without caps will not survive simply because it allows one to fund excessive closing costs with federally-related mortgages.

GSE caps is the only back-stop.

When listing broker was negotiating a “full 6% commission” they actually were getting it from the net proceeds of the seller – the seller had an incentive to control this cost as it was taken directly out their net. Broker would, in effect, give buyer broker half of thier earned commission.

A concession does something else – it allows some costs to be baked into the mortgage subject to an overall assumption that loan is used for something other than the tangible sales price of the property.

Obviously, this is something GSEs will have to clarify, otherwise, all sorts of 8% commission offers will start popping up.

Jane,

Concessions still come from the seller, though it’s true that concessions typically raise the purchase price, which results in a larger loan amount. To that end, it is quasi-financing since it’s paid by the borrower via a higher mortgage payment, interest, etc.

But one important thing limiting outrageous commissions is that buyers have to negotiate their buyer agent fee upfront and it should not increase after the fact. So if they agree to a 2% fee upfront, it doesn’t matter if a builder is offering 8%. They’d get 2%.

This is a important detail that should limit this type of thing. That being said, more changes are possible as this is still very fluid and new. They might clamp down on excessive offers of compensation next, or prevent seller/builders from even advertising them going forward, even if off-MLS.

Nice article on how buyer agent commissions can be financed. I am also an agent and have found that since this NAR change that the sellers have still continued to pay the “full” buyer agent commission. My experience has been that the buyer agent commission amount paid for by the seller has gone up, as in our offer I just ask for what I want to be paid, and then it gets negotiated in the offer. Thanks for the info!