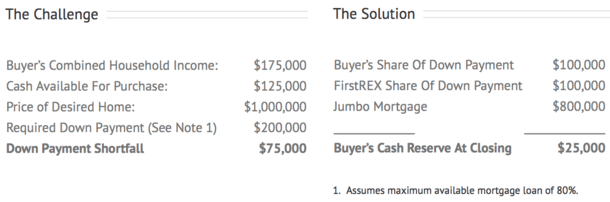

If you’re a little light on down payment funds, a company called FirstREX (now known as “Unison Home Ownership Investors”) might be able to help you out, for a cost.

Put simply, their “REX HomeBuyer” product (now called the “Unison HomeBuyer program”) will give you up to 50% of the down payment you make on a home in return for an “equity investment” on your property.

Unison Wants Shared Equity in Exchange for Down Payment Funds

- If you’re unable to come up with a 20% down payment

- Unison HomeBuyer can help you out in exchange for future home price appreciation

- And they don’t require any monthly payments for their investment

- This can reduce your mortgage payment and help you avoid PMI

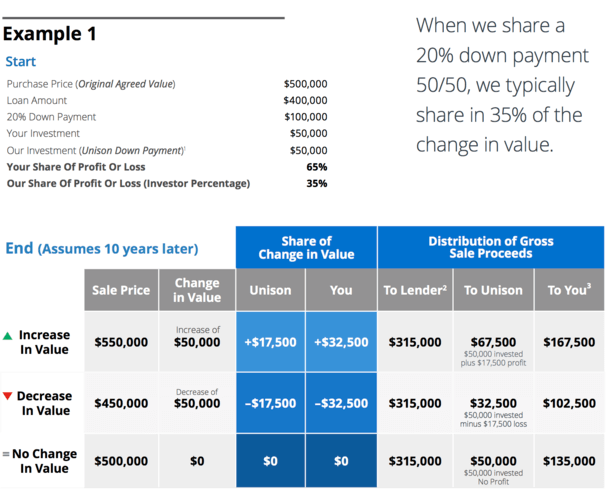

For example, if you’d like to purchase a home for $500,000 and want to put down 20% to avoid mortgage insurance and obtain a more desirable interest rate, but only have 10% available, they’ll give you the other 10%.

So you’ll only need $50,000 in down payment funds and they’ll provide the additional $50,000, pushing the loan amount down to $400,000 at 80% LTV.

When it comes time to sell your property, Unison will get a share of the change in value. If the home sells for $550,000 in the future, their stake would increase to $67,500. That’s a profit of $17,500 for Unison based on a 65/35 split in your favor.

For a 25% down payment, the company typically takes 43.75% of the change in value.

Additionally, Unison gets a transaction fee at the time of purchase, though they don’t collect any monthly payments on the down payment or charge any interest. They are also strictly co-investors in your property, not co-owners with any occupancy rights.

Unison HomeBuyer Benefits

- Aside from allowing you to buy more house

- You can enjoy a lower monthly housing payment

- Keep more cash on hand for your own needs and expenses

- And potentially make your offer stronger in a competitive housing market

The company lists a number of benefits to using their product, with the most prominent being the ability to purchase “just a little more house.”

They make the argument that you can get a more expensive home now while mortgage rates are still low, even if you haven’t saved up the necessary amount.

Or if you have the money saved, but simply don’t want to put all your eggs in one basket, you can use Unison HomeBuyer and keep the other half of your down payment funds in a different place, either in cash or some other investment like stocks, bonds, etc.

Double the down payment will also help you avoid private mortgage insurance because the maximum LTV is 80% with this product, so you can save three-fold on the monthly payment via a lower interest rate, no PMI, and a smaller loan amount.

Lastly, you may need some cash reserves to qualify for a mortgage and if they aren’t being used for the down payment, it could help with getting approved for a loan.

Unison HomeBuyer Guidelines

- They’ll boost your down payment to bring the LTV down to 80%

- So if you can put down 10% they’ll bring in another 10%

- If you can only muster 5% they might be able to bring in 15%

- Then they get a percentage share of the sales proceeds plus their original investment back

Unison will provide up to half of the required down payment, and as mentioned, the max LTV ratio is 80%. That means the minimum down payment is 20%, and Unison will provide up to 10% of the purchase price. You have to provide the other 10%.

If you wish you put down 25% on a home purchase, they’d provide 12.5%, and so on.

There is no minimum or maximum home purchase price, but the maximum amount Unison will provide is $500,000.

The property in question must be a single-family (some condos are permitted), and owner-occupied, though the company may consider some second homes under limited circumstances.

No rental properties are allowed and the subject property must be “typical” for the neighborhood. In other words, they don’t want anything unique or funky that could put their investment at risk.

Speaking of risk, they require a minimum FICO score of 680 from the primary wage earner (with some exceptions), and will typically approve you based on income as long as the corresponding lender does.

The Unison HomeBuyer down payment is meant to close concurrently with the home purchase, with the down payment provided directly to the escrow company at closing.

When it comes time to sell, they get their piece of the appreciation. There is a 30-year maximum term, so if you happen to still be in the home, you’ll need to pay the company out based on the value of your home at that time.

You can also buy out the homeownership investment in as early as three years by obtaining a third-party appraisal to assign a market value.

It’s important to note that if you happen to sell within three years of obtaining the down payment, “special provisions apply” that improve the company’s investment outcome. In other words, I think they charge you a higher rate of return.

Does Unison HomeBuyer Make Sense for You?

- The product is meant to extend your purchasing power

- But in doing so you will miss out on a potentially large amount of appreciation

- So you might want to consider buying a little less house

- Or exploring alternatives such as a low-down payment mortgage or gift funds from a relative instead

As noted, their investment return is higher if you don’t stay in the home for at least three years, so the product doesn’t make sense unless you plan on sticking around awhile.

Additionally, I believe the property needs to remain owner-occupied while their investment is in place, so that could be a limiting factor as well.

The transaction fee is something to consider – it is equal to 2% of the funding they provide in conjunction with a non-agency loan or 3% for an agency loan (it has since been lowered to 2.5%).

You also obviously forego some of your home price appreciation if and when you sell for a profit, though the upside is that you’re risking less of your own money. How much you forego depends on the size of the down payment.

If you wish to refinance your mortgage, you can do so at any time by subordinating the Unison HomeBuyer Agreement to your new mortgage but you must pay a small processing fee of $300 (they have eliminated the processing fee).

One bright spot is that if you remodel your home while their down payment is in place, you can get full credit for the renovation value so Unison doesn’t benefit from it too.

And if you can get your LTV down to 80% from 90%, you can ditch the PMI and the higher pricing adjustments associated with a higher LTV. That means a lower mortgage rate. A smaller loan amount also means the monthly payment will be less.

As with anything else, do the math to compare costs and benefits of both routes to determine if Unison HomeBuyer makes sense for you. Just be careful not to buy too much house just because you can.

Read more: Do you need down payment protection?

- Rocket Mortgage Completes Redfin Takeover, Offers $6,000 Home Buyer Credit - July 1, 2025

- Mortgage Rates Quietly Fall to Lows of 2025 - June 30, 2025

- Trump Wants Interest Rates Cut to 1%. What Would That Mean for Mortgage Rates? - June 30, 2025

I love to read their contract! .. You get transferred, and rent the house. Do they foreclose? Will FNMA allow it through their underwriting? Is the yield/payout higher than paying the PMI? Remodel the home? Will they subordinate to a line of credit for a remodel? Too many issues. I hear REX I’m thinking of a dog. Could apply here

dh,

Yeah, I could see things getting messy unless you kept things really simple…but things are never simple, are they? And it takes away some of the freedom/flexibility of homeownership if you can’t do what you want.