The latest weekly Forbearance and Call Volume Survey from the Mortgage Bankers Association (MBA) revealed that 7.80% of outstanding home loans were in forbearance.

That number was up slightly from 7.74% a week earlier, putting roughly 3.9 million homeowners in forbearance plans.

Much of these are COVID-19-related, thanks in part to a very liberal CARES Act that allows just about anyone to apply for relief with no documentation.

Ginnie Mae Loans Continue to Perform the Worst

- More than 10% of FHA/USDA/VA loans are in forbearance plans

- This compares to roughly 5.5% of Fannie Mae and Freddie Mac loans

- While the forbearance numbers have leveled off in recent weeks

- There’s a good chance the numbers may spike again if COVID worsens and the economy slows

In the latest week, the share of Ginnie Mae loans in forbearance increased from 10.26% to 10.27%, while the share of Fannie Mae and Freddie Mac loans in forbearance fell from 5.64% to 5.49%.

Mortgages backed by Ginnie Mae include FHA loans, USDA loans, and VA loans, all of which have relatively easy qualifying criteria relative to conforming loans backed by Fannie/Freddie.

While the numbers seemed to have leveled off lately across all loan types, things could get worse if the COVID-19 flare ups across the country continue. And who knows what the fall and winter hold.

In the meantime, we’ve got some data that sheds light on what types of homeowners are entering into mortgage forbearance plans, courtesy of the Urban Institute.

They used forbearance data provided by Ginnie Mae, which ends with mortgages having a first payment date in May 2020, to illustrate the differences between loans not in forbearance and those in COVID-related forbearance.

Is Credit Score a Driver of Mortgage Forbearance?

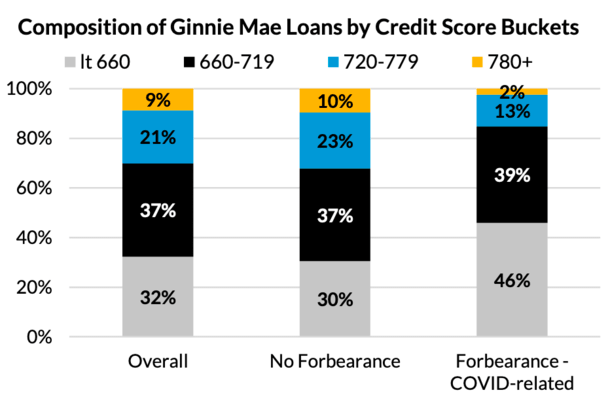

As you can see from the graph above, credit scores were lower across the board for those in forbearance plans compared to those who weren’t.

For example, 46% of those in forbearance plans had FICO scores below 660, compared to just 30% of those not in forbearance.

And just 13% of those in forbearance had credit scores from 720-779, a full 10 percentage points less than the non-forbearance cohort.

So-called excellent credit was basically unheard of in the forbearance group, with just two percent of borrowers having scores of 780+.

This compared to 10% of those who weren’t in forbearance plans when the data was collected.

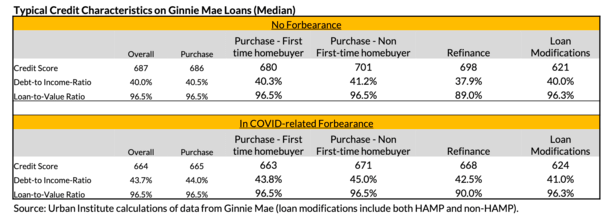

Additionally, debt-to-income ratios (DTIs) were higher for those who took advantage of COVID-19 forbearance.

As seen in the chart above, the median DTI was 40% for borrowers not in forbearance plans, and 43.7% for those in COVID-related forbearance.

If we break it down to purchase loans, it’s 40.5% versus 44%. If we only consider mortgage refinances, it’s a wider 37.9% versus 42.5%.

So it’s clear that both credit score and DTI are drivers of mortgage forbearance.

Conversely, loan-to-value ratio (LTV) doesn’t seem to make any impact, though these types of loans all feature very-low or no-down payment requirement.

The Urban Institute’s take is that those with the weakest credit profiles are the most likely to be impacted by COVID.

Assuming this is correct, “it would indicate that institutionalized forbearance has kept the most vulnerable homeowners from losing their homes.”

Fear of Forbearance Hurts New Loan Applicants

- Lenders are afforded some protections if borrowers go into forbearance shortly after loan funding

- But the financial penalties are still pretty steep and unattractive

- This has caused lenders to implement overlays above traditional qualifying criteria

- And reduce the time they hold a loan between closing and sale for securitization

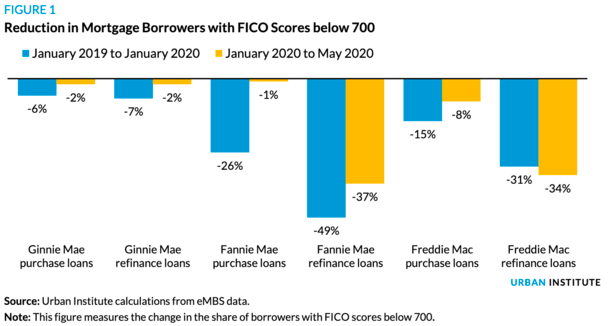

Unfortunately, mortgage lenders seem to already be aware of this, and have since tightened the credit box by imposing overlays on top of minimum requirements.

As a result, otherwise qualified homeowners have been shut out of the mortgage market, whether it’s for a new home purchase or a refinance, at a time when mortgage rates are at record lows and home equity at all-time highs.

They estimate that forbearance-related “penalties,” like the requirement for FHA lenders to sign a two-year partial indemnification agreement for 20% of the original loan amount, will result in 1% fewer home purchase loans and 5% fewer refinance loans in 2020.

That will affect approximately 255,000 creditworthy borrowers who may have no intention or desire to go into forbearance. But this is collateral damage.

Their argument is that very few loans actually go into forbearance before being sold, so it’s essentially creating an unnecessary roadblock with little upside to the housing agencies.

Of course, it’s not likely to change, so those looking to buy a home or refi this year or next really need to pay attention to their credit scores and debt load to ensure they qualify.