If you have ever purchased a home and applied for a mortgage, you’ve likely come across the term “escrow.”

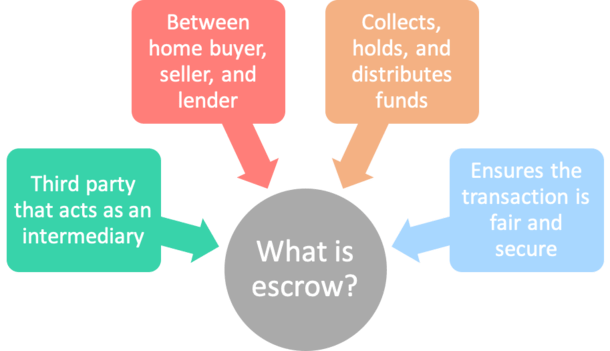

Contrary to Portlandia’s definition, the “the Egyptian god of waiting 30 days,” escrow refers to a third party that holds and distributes funds on behalf of two parties in a transaction.

In the case of a home purchase, an escrow company may hold the earnest money deposit and distribute sales proceeds on behalf of a buyer and seller.

The escrow company is deemed a safe and trusted intermediary, and also a neutral one, which facilities the flow of monies and documents during the home buying process.

At loan closing, an escrow officer will also prepare a closing statement that itemizes all the costs and credits associated with the transaction.

How Escrow Works When Buying a Home

Once you agree to purchase a property from a seller and sign the required documents, you (likely your real estate agent) will select an escrow company to handle the transaction.

When all parties agree to the terms of the transaction, you will be “in escrow.”

This typically involves ironing out details of the sale, such as purchase price and any contingencies (financing, appraisal, inspection), and providing an earnest money deposit as a sign of good faith.

The earnest money deposit is often 3% of the purchase price, which should be sent to escrow within three days of offer acceptance.

It shows the home seller you’re serious about buying their property and that you’ve got some skin in the game if there any issues along the way.

The important detail here is that the monies are sent to the escrow company as opposed to the home seller directly.

And only when certain conditions are fulfilled, as outlined in the purchase contract, are those funds released to the seller.

Simply put, the escrow company acts as the intermediary, or middleman, in the transaction so there aren’t unresolved disputes directly between buyer and seller.

This company will hold the funds on your behalf while collecting information from the buyer, seller, and property itself.

Typically, the escrow process takes 30-60 days, depending on the terms of the purchase agreement.

During this time, the escrow company will oversee the transaction and work with all parties to ensure a smooth closing by the desired closing date.

In the case of a mortgage refinance, an escrow/title company will still be involved, but to a lesser agree since it only involves the lender and the homeowner, no seller.

Escrow Instructions Serve as a Roadmap to Closing

The escrow process may involve the preparation of “escrow instructions,” which clearly outline what needs to be carried out before the release of funds.

Remember, the escrow company acts as the intermediary in the transaction and will only send any funds once both parties have satisfied their end of the agreement.

This may include title searches and vesting, various home inspections, obtaining a home loan, conducting an appraisal, receiving payoff demands, and setting a closing date.

Here is detailed list for the real estate escrow process in the state of California.

It basically lays out the many tasks that need to be completed in order for the transaction to close, and for all interested parties to receive their funds.

If you are the home buyer, you’ll likely work with an escrow officer throughout the home loan process.

Note that this individual could also be a title officer, settlement agent, or a real estate attorney depending on the state where you’re located.

They may send you occasional updates, such as an estimated closing statement, or an escrow holdback, which is an amendment to the original instructions.

One example might be a repair that must be completed, which requires escrow to debit the home seller’s account and hold the funds until satisfactory completion.

If there is an added seller credit or reduced purchase price, you may also receive a revised estimate from your settlement officer.

Once both the buyer and seller satisfy the conditions of the purchase agreement, it will come time to close escrow and release funds.

Closing Escrow: The Finish Line

The “close of escrow” occurs when both parties have satisfied all requirements associated with the home sale agreement and funds are released.

This requires the buyer to send the necessary cash to close to the escrow company’s bank, at which time the seller will vacate the property and provide the keys.

At the end of the loan process, the escrow officer will deliver wiring instructions to the home buyer and set up a loan signing with a notary.

The loan documents will need to be notarized and the escrow company will schedule a time and date that works best to sign.

Accompanied by a closing statement that indicates how much the buyer owes, the wiring instructions will outline where to send the necessary funds to close.

It’s super important to ensure the funds are wired to the correct bank and associated account in a timely fashion.

Always good to double-check with the escrow company directly by phone or in-person as wire fraud isn’t uncommon.

You can also take this time to speak with the escrow officer directly to go over all the fees outlined on the closing statement.

They can be very helpful in providing clarity to an often complex transaction in which credits and debits are going here and there and everywhere.

In fact, they might be a lot better at explaining all the transaction costs than the loan officer or mortgage broker themselves.

So don’t be afraid to speak with them directly if you have questions or concerns.

The Closing Statement: Double-Check Those Fees

The escrow company will provide the home buyer with a closing statement that lists all the details of the transaction.

This includes the escrow number, loan number, borrower name(s), funding date, settlement/distribution date, property address, and sales price.

You’ll see the loan amount, closing costs, and prorated items like homeowners insurance, HOA dues, partial property taxes due, and so on.

Additionally, there might be prepaid interest depending on when your close your loan during the month.

An itemized list of title/escrow fees will also be listed, along with any credits from the lender, seller, or real estate agent.

Note that any escrow overages will be refunded if there are excess funds. Typically, there is an “escrow pad” of say $500 that is included in case of an unexpected shortfall.

It is better to have a little extra money in case any estimates are slightly off, then simply refund the surplus after escrow closes.

As noted, if you have questions, this is a good time to ask your settlement agent before sending the wire.

If an escrow account is established, they will also determine the amount of reserves (months of taxes and insurance) required to fund the account.

What About Escrows on a Mortgage?

If you hear the term “escrows,” it has to do with an escrow account, which some mortgage companies require once your loan funds.

This account collects and distributes borrower funds for things like homeowners insurance and property taxes.

So instead of paying for these items yourself when they are due, the lender manages these payments on your behalf.

Also known as mortgage impounds, think of it like an autopay that ensures these important bills are paid on time.

Instead of paying a large sum twice a year, a smaller amount is included in your mortgage payment each month.

An easy way to remember it is PITI, which stands for principal, interest, taxes, and insurance.

On top of your regular principal and interest payment, you’ll pay a prorated portion of your insurance bill and your property taxes.

Then when it comes time to pay these items, your loan servicer will remit these payments on your behalf. They will also issue an escrow statement annually.

It can actually be beneficial for those who aren’t good at saving or setting aside funds for large bills.

You may not notice the smaller amounts leave your account and it could help you budget more effectively.

Others might like to control their money and make the payments themselves and earn interest on their money in the process.

Just note that if you’re able to waive escrows (not always an option), it might result in an additional cost at closing from the mortgage lender.

So it’s not always worth it. You may also receive interest on your escrow account anyway, meaning you might not miss out on any benefit of self-management.

To sum things up, escrow is very important and ensures a fair and organized process between buyer, seller, real estate agent, lender, and any other parties involved.