If you already own some real estate, perhaps a house or a condo, and are looking to move on, you might ask yourself if it’s better to sell it or rent it out.

This is an especially pertinent question when home prices appear to be peaking and are at/close to all-time highs. Similar to how they are now, maybe?

Like most things in life, the answer to this question isn’t universal – there are lots of different factors and scenarios to consider that will vary widely by individual situation.

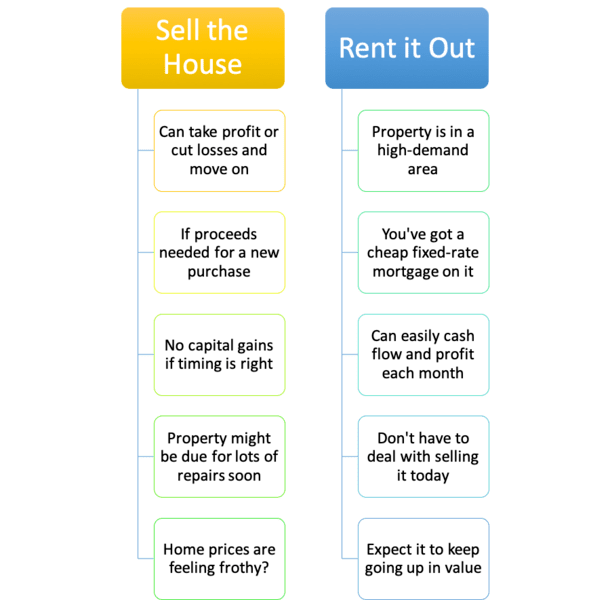

But we can at least discuss some of the pros and cons of keeping a property versus selling it.

Some of wealthiest folks out there got that way by investing in real estate, holding onto their properties, and building an empire. So there’s clearly a lot of potential upside. But there are risks as well.

Buy a Primary Residence Then Eventually Rent It Out

- Instead of buying a rental property outright

- It might be possible to buy a primary residence that you live in initially

- Then eventually rent out once you’re ready to move on

- This can result in better financing terms and greater knowledge of the property

Personally, I like the idea of purchasing real estate, living in it for a while, and then renting it out.

This way you get to know the property, the neighborhood, the neighbors, and so forth. You should also get the best financing terms available because mortgage rates are cheapest for primary residences.

Buying an investment property without having lived in it changes the picture a bit. Aside from not knowing all that lies beneath, you’ll also be stuck with a higher mortgage rate (all else being equal), and likely a larger down payment requirement.

From a mortgage standpoint alone, going primary first then renting is more attractive.

However, I understand that being a landlord isn’t for everyone, nor is maintaining a property, managing the finances, and so on.

But it can be a solid strategy to rent a former primary residence – you’ll just need some cash flow to do it.

After all, most non-first time home buyers use the proceeds from their former property as the down payment for the move-up property.

If you don’t have those proceeds, because you chose to hold onto your home, you’ll need to come up with assets elsewhere, assuming 100% financing isn’t in the cards.

It was actually this very practice that got us all in so much trouble, with mortgage lenders allowing 100% LTV financing on investment properties back in the early 2000s.

They’ve since wised up, so you’re probably going to need some cash in the bank to pull this off.

Moving Up Without Moving Out

- When homeowners are ready to move up to something bigger/better

- They often sell their existing property in the process

- And use the sales proceeds for their down payment

- So in order for this to work you’ll need other assets or perhaps a gift

If you purchased your first condo to live in when you were young, then decided to start a family, you could potentially rent out the condo and buy a house if you had the necessary funds.

Even if you don’t have the down payment money in your bank account, the use of gift funds could help you get around that hurdle.

Or you could look into a low-down payment mortgage if you felt renting out the unit made more sense than parting with it, even if the financing was a bit more expensive.

This could be a really sweet setup too if you’ve got a nice low fixed rate on the existing mortgage, perhaps something in the 3% range.

It gets even sweeter if you can cash flow the property by taking in more than you spend on the housing payment, HOA dues, maintenance, vacancy, and so forth.

And even better if inflation rears its ugly head and your fixed mortgage payment becomes a pittance over time while rents climb higher and higher.

Imagine a monthly mortgage payment that is fixed at $1,500, and being able to charge rent of $2,000 today, and perhaps $2,500 tomorrow, and $3,000 in the more distant future.

Renting Out a Condo vs. a House

- The house vs. condo argument runs deep

- And will vary based on your own preferences and comfort level

- I find condos/townhouses easier to rent out for a variety of reasons

- But there are drawbacks to both that should be considered

We also have to consider the type of property being rented out. In my opinion, it’s easier to rent out a condo or townhouse versus a single-family home.

The way I see it, a condo is a relatively small, empty box with limited fixtures that are pretty self-contained.

The exterior of the unit tends to be the responsibility of the HOA, so there’s a little less to worry about there.

For example, a roof leak might just require a call to the property manager, and not come directly out of your pocket (this is why you pay HOA dues every month).

Additionally, it might be quicker and easier to arrange help for any tenant-related issues, as most buildings usually have their people already lined up for all types of problems that might spring up.

If it’s a large building, there might even be maintenance staff on hand, available 24/7 for things that come up over time.

With a house, which will likely be larger, you’ve got your inside, outside, neighbors, and so on. A lot can go wrong, especially when you throw in a driveway, trees, fences, pools, spas, lights, and so on.

Houses in general are a lot of work, and if you’ve got a tenant living in one, you can expect to receive some phone calls over time as things naturally break down, or if the unexpected happens.

That being said, if you’re a handy person, renting out a house can be easy. And you may find that you have more control versus a condo where there’s shared ownership and lots of rules.

Either way, you’re going to hear from your tenants, so you’ve got to be prepared for that. Speaking of, vetting your prospective tenants is key to ensure you don’t wind up with a bad fit.

It’s probably more important than the structure itself, so always take the time to evaluate your tenants properly.

Selling a Property to Lock In a Profit and Move On

- It could make a lot of sense to just sell your property and take the profit

- This is especially true if there are tax-related benefits

- Perhaps because you’ve met ownership and use tests set forth by the IRS

- Then you can invest your money elsewhere with potentially less work/risk

While it’s possible to do quite well renting out a property, there may be instances where it just makes more sense to sell the thing and move on.

One example that comes to mind is if you can realize a nice profit by selling and you’re exempt from capital gains thanks to the ownership and use tests laid out by the IRS.

Being able to exclude $250,000 (or up to $500,000 if married) in capital gains is a pretty compelling reason to sell real estate for a tidy profit.

Another reason why you might sell is simply because it’s time to downsize and you’re getting close to retirement.

Or simply because you feel the property is beginning to show wear and tear and it might be better to move on before things really start to break down and require renovation.

Lastly, which I alluded to above, it simply might not be possible to float two mortgages, even with rent offsetting one of them.

Aside from the need for down payment funds, there are also DTI constraints that could make it impossible to keep your old property and purchase a new one.

This gets especially difficult the more properties you own that are financed with a home loan.

Pros to Keeping and Renting

- Don’t have to sell your property and deal with the typical aggravation/costs

- Can hold if it’s not a great time to sell and property still cash flows

- Can avoid capital gains if selling isn’t tax favorable

- Ability to profit every month for the foreseeable future

- If your mortgage payment is fixed and rents are rising it gets even better

- Someone else is paying off your mortgage for you

- Maybe you’ll move back in eventually if you like the place and your family dynamic changes

- Imagine buying a city condo when you’re young, renting it for years, then moving back in when you retire

Pros to Selling and Saying Goodbye

- You get your money and lock in your profit (hopefully)

- If capital gains aren’t assessed it’s even more compelling

- The proceeds can be used to purchase another property

- Or you can invest it elsewhere in something you feel is more attractive

- Don’t have to play landlord and deal with tenants

- Less to worry about if no/fewer rental properties are on your books

- Realize repairs are imminent and don’t want to renovate to stay current

- Believe the housing market is going south and it’s a good time to sell

- UWM Launches Borrower-Paid Temporary Buydown for Refinances - July 17, 2025

- Firing Jerome Powell Won’t Benefit Mortgage Rates - July 16, 2025

- Here’s How Your Mortgage Payment Can Go Up Even If It’s Not an ARM - July 15, 2025