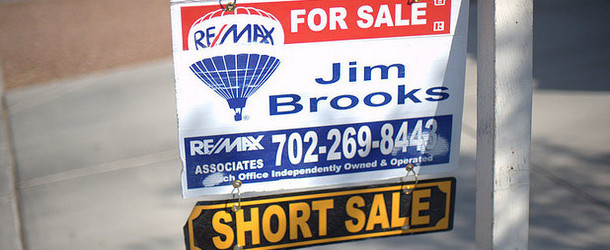

If you’re reading this, you’ve undoubtedly heard of a real estate short sale, which allows a distressed homeowner to unload their property for less than the current mortgage balance.

Short sales have surged in popularity over the years thanks to the precipitous drop in home prices and the overwhelming presence of zero down mortgages taken out during the boom.

This led to a huge negative equity problem, which is in part being dealt with via short sales.

And while these transactions can be a great alternative to foreclosure for the homeowner, they can also greatly benefit the home buyer in the transaction as well.

But like anything that saves you money, there are plenty of hoops to jump through, and patience is a requisite.

Short Sales Are 27 Percent Cheaper

Per the latest Campbell/Inside Mortgage Finance HousingPulse Tracking Survey, released this morning, the average short sale price was 27 percent lower than a non-distressed property.

This explains why they’ve been quite popular among first-time home buyers, despite waning somewhat recently.

Last month, first-time home buyers accounted for 39.7 percent of the short sale transactions completed.

While a sizable share, it’s down from the peak 54.1 percent share seen in November 2009, just before the original expiration of the homebuyer tax credit.

It also represents a third straight monthly decline, and the lowest share since the survey began.

Why Are Short Sales Becoming Less Popular?

Well, as mentioned earlier, short sales aren’t for the faint of heart. And they aren’t so, ahem, short – they require patience, as the bank needs to approve the deal. And homeowners must wait, often months, before getting word back.

In fact, the average time-on-market for a short sale is now 16.6 weeks, or about four months. Most of this time is simply waiting to get a decision.

Clearly the wait time can be daunting, especially if the mortgage lender comes back with a simple “no.”

Short sales also require a lot of cooperation from lenders, servicers, investors, appraisers, and so forth.

There’s also the worry of what happens during those months of waiting. Do mortgage rates rise and eclipse the savings associated with the short sale price?

Does the borrower still qualify several months in the future or does something unexpected come up? Or do they simply look at a different property that is a traditional sale and ready for purchase immediately?

[Home prices vs. mortgage rates]

Despite all the uncertainty, it’s clear you can save a pretty penny if you’ve got the time and are willing to wait for a short sale to get approved.

They’re also a safer alternative than buying an outright foreclosure, which may be riddled with unknown problems.

So if you’re a “would-be buyer,” you may want to consider a short sale. Just realign your expectations and remember not to get your hopes up. It’s still a bit of a lottery.

If you want to take advantage of a short sale without all the red tape, try to find one that is already approved, but recently fell through. That way you can jump right in and buy it like you would any other home. Just check to see why the previous buyer is no longer interested first.

Read more: How short sale fraud works.

- Rocket Mortgage Completes Redfin Takeover, Offers $6,000 Home Buyer Credit - July 1, 2025

- Mortgage Rates Quietly Fall to Lows of 2025 - June 30, 2025

- Trump Wants Interest Rates Cut to 1%. What Would That Mean for Mortgage Rates? - June 30, 2025