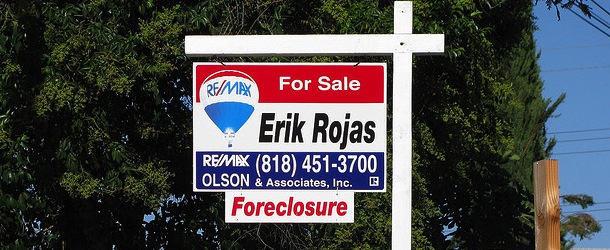

In a bid to perhaps stay relevant, though in the FHA’s own words, to continue “its commitment to fully evaluate borrowers who have experienced periods of financial difficulty due to extenuating circumstances,” borrowers may now be eligible for an FHA loan just one year after experiencing a short sale, foreclosure, or even a bankruptcy.

The news came via a new mortgagee letter (13-26) posted on HUD’s website Friday.

While it sounds completely irresponsible and crazy, especially seeing that we’re just a year or two out of the worst mortgage crisis in recent history, they do have some standards in place to ensure not just anyone can get a mortgage again.

Did You Experience an “Economic Event?”

In order to get approved for an FHA loan just one year after experiencing such a massive credit hit, you must prove it was due to an “Economic Event,” otherwise known as unemployment or a “severe” reduction in income.

Of course, by severe reduction they’re only talking about a minimum 20% reduction in household income for a period of at least six months.

The last time I checked, it’s pretty common for individuals to see their income fluctuate like that. And the FHA is even allowing those with seasonal or part-time employment to qualify under these new rules.

However, there are a few more checks and balances. The lender must analyze the borrower’s credit to determine that they were a sound borrower before the Economic Event took place, and that their credit only went downhill after the incident.

Additionally, borrowers must re-establish “Satisfactory Credit” for a minimum of 12 months prior to receiving their FHA loan.

In other words, your credit report should be clear of any late housing or installment payments during the past 12 months, or any major derogatory events on revolving lines of credit.

Additionally, a year must have passed since the date of the foreclosure, deed-in-lieu, short sale, or bankruptcy.

[Getting a mortgage after a short sale with no waiting period.]

Lastly, participants in this initiative must receive homeownership counseling or a combination of homeownership education and counseling.

The minimum requirement is a single hour of one-on-one counseling from a HUD-approved housing counseling agency, and they must address the cause of the Economic Event and steps taken to overcome and avoid reoccurrence.

It must be completed at least 30 days before submitting a loan application, but no more than six months prior. Counseling can be conducted in person, over the phone, or even online.

To sum it up, in order to qualify you must:

[checklist]

- Prove the negative credit event was the result of a loss of employment or significant loss of income

- Prove that you have recovered and re-established satisfactory credit

- Apply at least 12 months after the negative event took place

- Complete housing counseling to avoid similar missteps in the future

[/checklist]

The loan must also meet all other applicable FHA eligibility and policy criteria.

So all in all it appears to be a pretty darn accommodating new rule to help former homeowners qualify for a mortgage.

Interestingly, the FHA has seen its market share take a hit thanks to new rules aimed at shoring up its reserves, such as requiring mortgage insurance for the life of the loan and increasing annual insurance premiums.

But I suppose the FHA’s original mission is to serve the underserved, so it makes sense that they would be the ones to allow this type of loan program.

The rule change applies to FHA loans with case numbers assigned on or after August 15, 2013 through September 30, 2016. It works for purchase money mortgages in all FHA programs aside from Home Equity Conversion Mortgages (reverse mortgages).

If you’re interested to see if you qualify, find a lender that specializes in FHA loans so they can guide you through the process and increase your odds of approval. You’ll want to submit an airtight application to avoid any hiccups.

- Mortgage Rates Quietly Fall to Lows of 2025 - June 30, 2025

- Trump Wants Interest Rates Cut to 1%. What Would That Mean for Mortgage Rates? - June 30, 2025

- What the Fannie Mae and Freddie Mac Crypto Order Really Means - June 26, 2025

What next? No waiting period after foreclosure. How will people ever learn their lesson with stuff like this available?!?!?

Hi – Question for you. I am 2 years from a discharged foreclosure. I quit my job because I was moving and had a verbal employment contract. Unfortunately a hiring freeze occurred after my resignation and I did not get a contract. Would this be considered an “Economic Event” if I voluntarily quit a position and then was unable to secure a position for 1 year?

Susanna,

If that’s what caused the foreclosure maybe…you’d have to speak with some lenders to see if it’ll fly.

Why should a person be made to wait years for a property to be foreclosed on and ( RED FLAGGED BY FHA) in the process, to get another FHA mortgage? Meanwhile their credit has improved and scores in the 700’s. Is there any justice in this? Holding a person who had an unforeseen illness and a divorce which wrecked their credit for a while.