So, “what caused the mortgage crisis” anyway? In case you hadn’t heard, we went through one of the worst housing busts in our lifetimes, if not ever.

After home prices skyrocketed to all-time highs in the early 2000s, they began to take a dive around 2008. And didn’t start to recover until around 2012.

It was so bad that it set off the Great Recession, leading to countless real estate short sales and foreclosures. And though that much is clear, the reason behind it is much less so.

As you might suspect, there has been a lot of finger pointing.

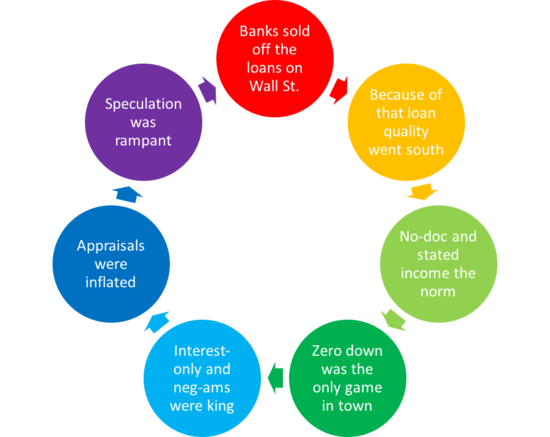

But in reality, there wasn’t just one cause, rather a combination of forces behind the housing crisis. I’ll attempt to list as many as I can think of here.

The Originate-to-Distribute Model

- Banks weren’t keeping the home loans they originated

- Instead they’re were quickly selling them to investors on the secondary market

- Who were then slicing and dicing them into high-risk securities for those thirsty for “yield”

- The transfer of risk allowed more risky loans to be made

In the old days, banks used to make mortgages in-house and keep them on their books.

Because they held onto the loans they made, stringent underwriting guidelines were put in place to ensure quality loans were made.

After all, if something went wrong with the loans, they’d be accountable. And they’d lose lots of money.

Recently, a new phenomenon came along where banks and mortgage lenders would originate home loans and quickly resell them to investors in the form of mortgage-backed securities (MBS) on the secondary market (Wall Street).

This method, known as the “originate to distribute model,” allowed banks and lenders to pass the risk onto investors, and thereby loosen guidelines.

The result was casual underwriting, less oversight, and more aggressive financing, which ultimately led to a lot of bad home loans being made.

Banks and lenders also relied on distribution channels outside their own roof, via mortgage brokers and correspondents.

They incentivized bulk originating, pushing those who worked for them to close as many loans as possible, while forgetting about quality standards that ensured loans would actually be repaid.

Because the loans were being sliced and diced into securities and sold in bulk, it didn’t matter if you had a few bad ones here and there, at least not initially…

Fannie Mae and Freddie Mac

- This pair that back the majority of conventional home loans wasn’t free from blame either

- They were quasi-public companies that were trying to keep private investors happy at the same time

- This muddled mission of promoting homeownership and increasing value for shareholders was problematic

- Their misstep was the easing of underwriting guidelines to stay relevant in a world dominated by private lenders

Banks and mortgage lenders modeled their loan programs on what Fannie Mae and Freddie Mac were buying.

So one could also argue that these two “government-sponsored enterprises” (GSEs) also did their fair share of harm.

In short, if the loan conformed to the high standards of Fannie and Freddie, it’d be easier to sell on the secondary market.

And it has been alleged that the pair eased guidelines to stay relevant in the mortgage market, largely because they were publicly-traded companies steadily losing market share to private-label securitizers.

At the same time, they also had lofty affordable housing goals, and were instructed to provide financing to more and more low- and moderate-income borrowers over time, which clearly came with more risk.

However, the private mortgage market took control during the lead up to the eventual crisis thanks to their bevy of high-risk mortgage products.

As a result, Fannie and Freddie had to ease their own underwriting guidelines to maintain market share.

Bad loans appeared as higher-quality loans because they conformed to Fannie and Freddie. And this is why quasi-public companies are bad news folks.

Bad to Non-Existent Mortgage Underwriting

- The underwriting, if you could even call it that, was atrocious at the time leading up to the mortgage crisis

- Basically anyone who applied for a home loan could get approved back then

- It didn’t matter what you did, how much you made, or if you had nothing in your bank account

- Once the well ran dry many of these homeowners simply stopping paying and walked away

That brings us to bad underwriting. Now it wasn’t that underwriters didn’t know what they were doing, it was more a matter of influence from upstairs.

They were often told to make loans work, even if they seemed a bit dodgy at best.

Remember, these lenders were trying to fund as many loans as possible, at any cost.

So a loan file that would normally be heavily scrutinized simply passed through underwriting and eventually funded.

The incentive to approve the loan was much, much greater than declining it. And if it wasn’t approved at one shop, another would be glad to come along and take the business.

After all, the loans weren’t being held for more than a month or so before they were the investors’ responsibility. So you could get away with it.

Faulty Home Appraisals Were Pervasive

- The appraisals and appraised values at the time were also highly suspect

- Emphasis on “high” valuation as opposed to low, pretty much every time

- The property values were often grossly inflated to make the shoddy loan work

- This further propped up home prices, allowing for even more bad loans with suspect collateral to be created

Going hand-in-hand with bad underwriting was faulty appraising, often by unscrupulous home appraisers who had the same incentive as lenders and originators to make sure the loans closed.

If the value wasn’t there, it only took a little bit of tinkering to find the right sales comparables to get it right.

If one appraiser didn’t like the value, you could always get a second opinion somewhere else or have them take another “look.”

Home prices were on the up and up, so a stretch in value could be concealed after a few months of appreciation anyway.

And don’t forget, appraisers who found the right value every time were ensured of another deal, while those who couldn’t, or wouldn’t make it happen, were passed up on that next deal.

Borrowers Had No Skin in the Game

- Lots of borrowers walked away from their homes because they weren’t at all invested financially

- When you put nothing down on a home purchase, it doesn’t take much to walk when prices go south

- The same was true of those who applied for a cash out refinance for 100% of their home’s value

- This lack of skin in the game led to scores of foreclosures and short sales because there was no reason to stick around

Another big issue was the lack of a down payment during the most recent boom.

Back when, it was common to put down 20 percent when you purchased a home. In the last few years, it was increasingly common to put down five percent or even nothing.

In fact, zero down home loan financing was all the rage because banks and borrowers could rely on home price appreciation to keep the notion of a home as an investment viable.

However, it wasn’t long before home prices began to peak and eventually fall, causing all types of problems for borrowers with little or no equity in their homes.

Those who purchased with zero down simply chose to walk away, as they really had no skin in the game, nothing to keep them there.

Sure, they’ll get a big ding on their credit report, but it beats losing a whole lot of money. Conversely, those with home equity would certainly put up more of a fight to keep their property.

Super Aggressive Mortgage Financing

- Zero down financing was prevalent at the time

- As were negative amortization loans like the now infamous pay option ARM

- These products allowed borrowers to pay less than the minimum amount of interest due

- With the expectation that rising home prices would make up the difference over time

Playing off the lack of a down payment, aggressive loan programs like the pay option arm and other interest-only options also contributed to the mortgage crisis.

As home prices marched higher and higher, lenders and home builders had to come up with more creative financing options to bring in buyers.

Because home prices weren’t going to come down, they had to make things more affordable.

One method was lowering monthly mortgage payments, either with interest-only payments or negative amortization programs where borrowers actually paid less than the note rate on the loan.

Some banks, like now-defunct Bear Stearns, actually offered a pay option arm at 100% LTV.

This meant you could come in with zero down payment and make a super low payment monthly, often as low as 1%, for several years before the loan adjusted to a more realistic interest rate.

The result was scores of underwater borrowers who owed more on their mortgages than their current property values.

As such, there is little to any incentive to stay in the home, so borrowers increasingly defaulted on their loans or walked away.

Some by choice, and others because they could never afford the true terms of the loan, only the introductory teaser rates that were offered to get them in the door.

It was so bad that some homeowners never ever made their first mortgage payment.

Limited Documentation Was the Norm

- It all started with stated income loans

- Which were only intended for select borrowers with complicated finances like the self-employed

- It proved to be a slippery slope as lenders moved on to SISA and no doc loans

- At the end all you needed was a credit score to get approved for a mortgage!

Home loans used to be underwritten full doc, meaning you would need to provide pay stubs or W-2’s, along with asset and employment information.

This would give the bank or lender plenty of reliable information to make an underwriting decision.

Then came limited documentation loans, such as stated loans, now known as “liar’s loans,” which were intended for people like doctors and the self-employed who had complicated tax structures.

Eventually, everyone seemed to be taking advantage of limited documentation underwriting, often because they couldn’t meet underwriting guidelines legitimately.

After all, your interest rate would only be another quarter-percent higher in many cases, so why provide real income if you can fudge the numbers a little and get approved?

More troubling were no-doc loans, where borrowers only provided a credit score.

No income, asset, or employment information was provided, allowing virtually anyone with a decent credit history to get their hands on a new home. Yikes!

Over Reliance on Credit Scores

- Some argue that we relied too much on borrowers’ credit scores

- Which are automated and easily manipulated if you know what you’re doing

- And by no means foolproof or a good standalone indicator of mortgage default

- Borrowers also didn’t care about destroying their credit if it meant losing less money

That brings us to the now infamous credit score, which became the bank’s go-to risk indicator in recent history.

Remember, if they didn’t verify income or assets, the FICO score became very important. In reality, it wound up carrying too much weight.

Instead of reading between the lines, lenders were happy enough to look at an automatically populated three-digit credit score to determine risk.

If the applicant’s credit score was above a certain threshold, they were approved.

Meanwhile, those with lower credit scores and perhaps more compelling borrower attributes like income and assets would be denied.

This led to a lot of first-time homebuyers getting their hands on shiny new houses, even if their largest loan prior had been something as simple as a revolving credit card.

Low Mortgage Interest Rates

- Cheap mortgage rates were a bit of a double-edged sword

- While they allowed borrowers to save money and keep borrowing costs low

- The low rates also fostered a refinance frenzy and encouraged individuals to buy overpriced homes

- It was common to serially refinance (over and over) and tap home equity along the way until it ran dry

And then there’s super low interest rates, which have been historically low for years now, and just recently hit their lowest point ever.

During the housing boom, these low mortgage rates encouraged people to buy homes and serially refinance, with many taking large amounts of cash-out in the process.

It wasn’t uncommon to tap equity every six months as home prices surged higher because it was so easy to do so.

Many of these borrowers had built up equity in their homes, but after pulling it out to pay everyday expenses and lavish purchases, had little left and nowhere to turn when financing dried up.

At the same time, those who pulled cash out did so using appraised values that could no longer be supported.

Many of these borrowers wound up with loan amounts that far exceeded the true value of their homes, and a much larger monthly mortgage payment to boot.

Real Estate Speculation Was Rampant

- Many of the homes lost during the mortgage crisis were actually investment properties

- Ironically, a lot of mortgage and real estate industry workers got in on the fun too and lost their hats

- But again it didn’t matter because they often purchased these properties with nothing down

- And when things went south, they simply walked away unscathed other than their damaged credit

It wasn’t just everyday families who lost their homes, despite the emotional headlines.

Tons of real estate investors defaulted on their properties, adding to the foreclosure epidemic and pushing home prices lower.

Many of these speculators purchased handfuls of properties with little to no money down.

Yes, there was a time when you could purchase four-unit non-owner occupied properties with no money down and no documentation! Amazing isn’t it?

Why mortgage lenders ever thought that was a good idea is beyond me, but it happened.

Of course, the minute home prices turned, most of these speculators out of the game, either by selling or simply walking away, creating a further drag on home prices.

Home Builders Created a Supply Glut

- There was definitely a supply and demand imbalance at the end

- Just too many homes out there and not enough willing and able buyers

- Especially once homes became too expensive and financing options ran dry

- Many of these properties were also built in the outskirts where no one lived

Everywhere you looked, at least in places like California, there are scores of new, sprawling housing developments.

It seemed every corner had a sign spinner or a billboard advertising new luxury condos or single-family homes.

Unfortunately, many were built in the outskirts of metropolitan areas, often in places where most people didn’t really want to reside.

And even in desirable areas, the pace at which new properties were built greatly exceeded the demand to purchase the homes, causing a glut of inventory.

The result was a ton of home builders going out of business or barely hanging on. And guess who wanted even lower interest rates? You guessed it, the home builders. Why?

So they could dump off more of their overpriced homes to unsuspecting families who thought they were getting a discount.

Of course, the builders didn’t actually want to lower home prices. They’d rather the government subsidize interest rates to keep their profit margins intact.

Unsustainable Home Price Appreciation

- Everything worked early on because home prices kept rising year after year

- But they couldn’t sustain forever without the support of creative financing

- And once home prices stalled and began to drop the party was over

- The flawed financing backing the properties was exposed in severe fashion

As a result of many of the forces mentioned above, home prices increased rapidly.

Everyone thought they could get rich in real estate, either by flipping a property or refinancing over and over and investing the money.

The promise of never-ending home price appreciation hid the risk and kept the critics at bay.

Even those who knew it would all end in tears were silenced because rising home prices were the absolute solution to any problem.

Heck, even if you couldn’t make your monthly mortgage payments, you’d be able to sell your home for more than the purchase price. Once that reality faded, big problems emerged.

Greedy Borrowers (Yes, You Too)

- No one was forced to buy a home or refinance their mortgage

- It was all entirely voluntary despite any pressure to do so

- What happened to all the money that was extracted from these homes?

- Ultimately everyone who took part has to take accountability for their actions

Finally, the homeowners themselves should take some accountability for what happened.

After all, no one was forced to buy a home, or forced to refinance and pull hundreds of thousands of dollars out of their home.

And where exactly did all this money go? When you tap your equity, you get cash backed by a home loan.

But what was all that money spent on? Were these equity-rich borrowers buying brand new cars, going on fancy vacations, and buying even more real estate?

The answer is YES, they were. Everyone got a little caught up in the excitement and forgot that you actually had to pay the money back.

These were loans, not free money, yet many borrowers never paid the money back. Good deal, eh?

While they walked away from their homes, they may have kept the many things they bought with the proceeds. You’ll never hear anyone admit that though.

Ultimately, each borrower was responsible for paying their own mortgage, though there were certainly some bad players out there that may have manipulated some of these folks.

Still, a home purchase is a major decision and one everyone should fully understand and be comfortable with before proceeding.

And while you can blame others for financial missteps, it’s your problem at the end of the day, so take it seriously.

There are likely many more reasons behind the mortgage crisis, and I’ll do my best to add more as they come to mind. But this gives us something to chew on.

Read more: When will the next housing crash take place?

- UWM Launches Borrower-Paid Temporary Buydown for Refinances - July 17, 2025

- Firing Jerome Powell Won’t Benefit Mortgage Rates - July 16, 2025

- Here’s How Your Mortgage Payment Can Go Up Even If It’s Not an ARM - July 15, 2025

Good Article. The only thing I would add is; Loan Officers were real Loan Officers prior to 2001. The Loan Officer worked for the bank and had a degree in business/ finance or years of banking experience. In 2004, I started to notice that anyone could be a Loan Officer,- the loans were being originated in such large volume anyone could be a Loan Officer especially if you were a good sales person. The moral, ethical and trust values were lost and it was all about making money not the consumer.

LP

self regulation is the problem, it was so with the IPO and the morgage failure

The crisis was brought on by credit expansion on a massive scale. Bankers got bad habits and these were re-enforced :(

You for got the root cause of all this. Who allowed all those people to originate these loans? It was the Clinton and Bush administration. The government wanted more home ownership so they instructed HUD to instruct Fannie Mae to process more loans. The only way to process more loans was to lower the lending standards. Lending standards are set by Fannie Mae and they were compelled by the government to lower there standards to increase home ownership. So it was the government that actually caused the housing crisis. If they never lowered the requirements then the crisis would have never happened.

Thank you Anthony! I kept waiting to read about govt influence. How could that not be mentioned? No bank would make these bad loans if there wasn’t an insurance company that would insure the loan. Hello Fannie and freddie and hello Barney Frank

Frank /Dobb, Clinton, and a liberal lowering of mortgage requirements had everything to do with banks, without scruples, to make easy money on mortgage origination. Don’t ever be fooled by anyones spin!

Actually this all started under Carter. The fair housing act, but it didn’t have big enough teeth. It was pushed heavily along under Clinton. Frank and Dodd gave it teeth and shoved it through. Bush actually tried to warn this was no good, but the Dem controlled house and congress got it done. Just about anyone with a paycheck from anywhere could buy a 300k home, gee wonder whats gonna happen. Get their Dem Pres elected and blame Bush, thats what. At the expense of the american people.

Blame the government BUT who was making all the money from these home loans? The builder, the mortgage broker, the appraiser, wall street, etc, not the homeowner. Nobody ever mentions that. The house price was set by the builder and they kept raising them beyond the worth of the home. SO who really got rich?

Regardless of the price, the value is what one is willing to pay.

I blame the home builders, who as you mentioned, created tons of fake neighborhoods throughout the country, especially in random areas where housing demand wasn’t at all strong. And they were selling homes with all types of crazy incentives like zero down with all sorts of tax credits. I don’t think they actually checked to see if anyone could actually afford the homes.

Letting Taco Bell employees who made minimum wage buy $500,000 homes didn’t help…

The sad part is it’s all happening again once more…

For most of his career, Barney Frank was the principal advocate in Congress for using the government’s authority to force lower underwriting standards in the business of housing finance. Although he claims to have tried to reverse course as early as 2003, that was the year he made the oft-quoted remark, “I want to roll the dice a little bit more in this situation toward subsidized housing.” Rather than reversing course, he was pressing on when others were beginning to have doubts.His most successful effort was to impose what were called “affordable housing” requirements on Fannie Mae and Freddie Mac in 1992. Before that time, these two government sponsored enterprises (GSEs) had been required to buy only mortgages that institutional investors would buy–in other words, prime mortgages–but Frank and others thought these standards made it too difficult for low income borrowers to buy homes. The affordable housing law required Fannie and Freddie to meet government quotas when they bought loans from banks and other mortgage originators.At first, this quota was 30%; that is, of all the loans they bought, 30% had to be made to people at or below the median income in their communities. HUD, however, was given authority to administer these quotas, and between 1992 and 2007, the quotas were raised from 30% to 50% under Clinton in 2000 and to 55% under Bush in 2007.

It’s also important to take into consideration that the homeowners themselves volunteered to purchase these homes with questionable mortgage loans. It’s no ones responsibility but your own to figure out what is best for your own personal finances. Nothing is set in stone until you sign on the dotted line and no one is forcing their hand to sign. The blame can be pointed at everyone and it seems the homeowners are the ones playing victim all to well when it was their choice and responsibility to know what in fact they were getting into. Financial institutions can offer whatever programs they want to and can definitely pressure people into certain loans. But just because you go to a car dealership and the salesman is pressuring a certain car doesn’t mean you just blindly take the first one that he says you should buy. Its being an adult and not biting off more then you can chew. Just my .02.

For whatever its worth, I was working in real estate sales around 2007.

Besides showing properties, I did broker price opinions.

My job was to determine asking prices….

On a regular basis, I would determine the correct ask price and present my data to the broker.

The broker immediately would tack on 30% or more to the ask price. It was weird And seemed wrong at the time,

I consider my self a value minded guy, but I remember thinking that something was wrong With this pricing.

Frequently I had to tell people “the house you are looking for does not exist at the price you are looking for today”

I also did maintenance and handy man jobs on foreclosures.

It was a big scam.

I would give an estimate to the bank for a job, maybe I thought a lawn mow every two weeks should cost $30, im not greedy, and I like work hard and do a good job, immediately the broker corrected it and had me charge hundreds. I was making hundreds of dollars per hour using a push mower.

It was ridiculous and seemed wrong.

$30 to $50 per hour to shovel snow. It seemed like too much.

And the banks actually paid it. How?

I didnt think it was right. I kept thinking im going to loose jobs if I charge too much.

It all fell apart. I was right.

It doesn’t pay to charge people too much for anything, its just not moral or sustainable and poor business practice.

I like a fair price because I believe what goes around comes around.

Don’t get greedy. Peace.

Here is a formula to determine the correct ask price…

Just to help keep things normal. Use it for buying and selling.

Its called the intrinsic value formula for stocks

It can work for real estate.

E (8.5+2(inflation 10 year average))(4.4/today’s 10 year bond yield)

E is earnings. Your earnings on a home are what you save by owning vs. Renting.

Comparable annual rent for similar property-property tax-maintenance cost annually.

So if rent is $12,000 and average inflation is 2% and you pay $4000 in tax and expect to pay $3000 in maintenance and a ten year bond yeils 2.5%

E= 12,000-(4000+3000)=5000 so you earned 5k by not renting.

5000 (8.5+2 (2))(4.4/2.5)= what you should be paying for that house. Or asking. Around 110k

Its a fair value formula compared to the risk free interest rate

And a good rule of thumb.

If your looking to buy a home, and the price seems to high, compare to the risk free rate…you may be better off buying a bond and waiting ten years.. if you need a mortgage buyer beware.

A value minded real estate investor might offer half and negotiate from there.

I will offer any random reader another tip.

If you want a mortgage look at the yield curve, the difference between the short term and long 30 year bond interest yield…

If the short term is higher than the long term …wait..

Corporate layoffs are around the corner…

Some of you blame Clinton for the crisis and many blame

Bush. The fact is that Clinton did start the mortgage market to climb and he DID deregulate the mortgage market…”A LITTLE”. But Bush took it to another much higher level. He saw what a great job Clinton did and how the market grew but Bush being Bush and having to prove himself to Daddy went hog wild and he thought well if Clinton deregulating it a little did that good then i will deregulate it even more and the market will go thru the roof,…and it did, but then it crashed. The mortgage market is supposed to move like rolling hills,…NOT HIGH PEAKS AND LOW VALLEYS. BUSH just had to prove himself to daddy in Iraq and with the economy and as usual he F***ED IT UP LIKE HE F***ED EVERYTHING UP. The difference being, Clinton listened to his advisors and he had damn good advisers!!!!

Dan,

Keep political opinions out of this. I’ll go with the well thought out backed up in facts of the previous comments.

Your Bush is F**k Up thesis, is very compelling but doesnt really hold water. When F**k Up is used as facts. It screams I am a Left Wing Liberal idiot

Well put. I agree with you 100%, Michael.p b.

To Dave Lava,

You said “Keep political opinions out of this” and then you went on to say “I am a Left Wing Liberal idiot”. I just wanted to point out your hypocrisy.

The main reason was government granted way too many people cash and incentives to people who had no way to make long term payments and thus people who had NO business buying a property were bidding up the prices on property when they were artificial unqualified buyers ! So then no flip no payment til bankruptcy.