I wrote a while back that more than half of consumers switched mortgage companies when obtaining a subsequent home loan.

The message was pretty clear – there’s not much loyalty in the mortgage business.

Ultimately, it’s hard to be loyal if there’s a better deal to be had elsewhere, or if someone else is offering to treat you better.

In an effort to combat that, and improve customer retention in the homes loans business, lenders are beginning to take things a lot more seriously.

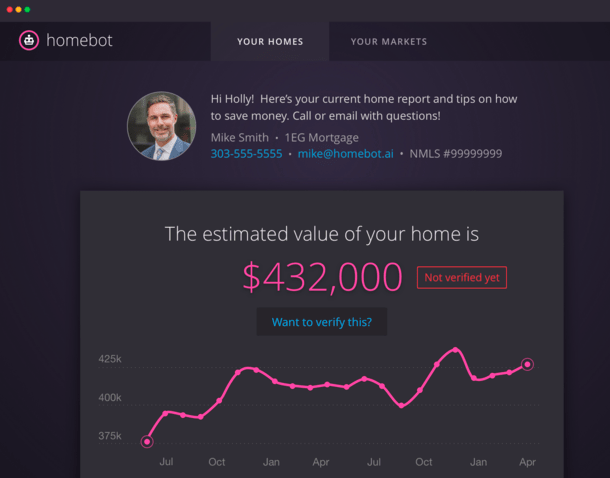

Homebot Engages Past Customers with Real Data

For example, last year Guild Mortgage partnered with Homebot to deliver regular, customized home financing digests to its existing customers.

Their automated marketing platform allows loan officers to present past customers with relevant data, economic insights, and other market intelligence.

Most importantly, it helps them stay connected with homeowners long after the mortgage has funded.

As part of that agreement, Guild Mortgage’s 1,100+ loan officers have access to Homebot’s “Lender Base” software to serve its ongoing customer retention initiative.

Many other mortgage lenders have also partnered up, including Planet Home Lending, Citywide Home Loans, and Cherry Creek Mortgage.

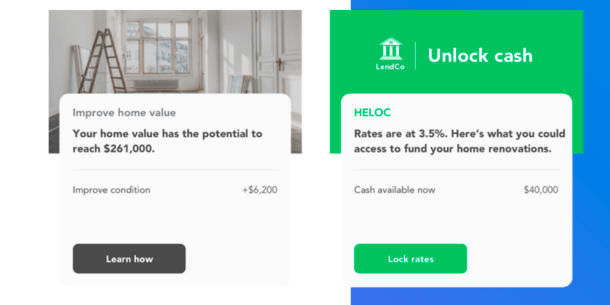

HouseCanary’s ComeHome Wants Your Customers to Come Back

In late 2019, HouseCanary launched ComeHome, a proprietary platform used to attract, retain and even convert customers.

It creates an ongoing relationship with the homeowner that focuses on what’s probably their largest asset.

The ComeHome solution allows lenders to inform homeowners of “opportunities,” such as the ability to refinance, or tap home equity via a line of credit (HELOC).

Most importantly, it makes it easier for mortgage lenders and their originators to engage their customers more frequently using technology as opposed to cold calls and direct mail.

And it’s not just ballpark estimates or generic copy, but rather real data backed by HouseCanary’s automated valuation model.

For example, customers can be informed that certain home improvements may increase their home value by X, using cash from known available equity in the property.

Customers also get a direct path to the loan officer when they’re ready to take action, another important consideration.

Ultimately, the software is in place to ensure you are the homeowner’s first choice for refinancing a mortgage, taking out a home equity loan, or even financing a next home purchase.

Because sometimes simply being first is good enough. The path of least resistance is usually the path taken.

Clearly that’s better than sending your client a notepad with your name on it, or a postcard in the mail with a joke on it.

Quicken Loans’ Cyclops Sees You

Then we have “Cyclops,” a mortgage servicing customer relationship management (CRM) software built by none other than Quicken Loans, the nation’s largest retail home loan lender.

The company developed the Cyclops software in 2016 at its Detroit headquarters, and recently sold the source code to Black Knight.

Like the aforementioned solutions, it provides “highly personalized information about loans, homes and neighborhoods” to existing customers.

For example, a loan originator can use the property’s current value to present refinance and home equity opportunities to borrowers.

It provides an omni-channel customer experience where the borrower can interact with the lender or loan servicer however and whenever they please, which may also increase customer retention.

But Still…Shop Around and Be Prudent

While all this new technology sounds awesome, and is awesome compared to a flyer that winds up in your recycle bin, a few words of caution.

First, don’t take these cool data visualizations as an invitation to refinance your mortgage every six months.

While there’s a good chance you’ve got some equity in your home, it doesn’t necessarily need to be tapped. There are other ways to pay for home renovations.

It may also not be in your best interest to fiddle with your mortgage, even if presented with a really compelling case using artificial intelligence.

Additionally, just because a lender contacts you first doesn’t mean you should use them, or feel any obligation to do so.

While they might have put the idea in your head, still do your due diligence and take the time to shop around with other lenders to see what they have to offer.

It’s pretty shocking that just 2% of consumers choose a mortgage lender for the best interest rate. And that’s exactly why these keeping-in-touch products will work.