At first glance, I’m wondering why he didn’t list it for $10,999,999, but shoot, he probably has a reason.

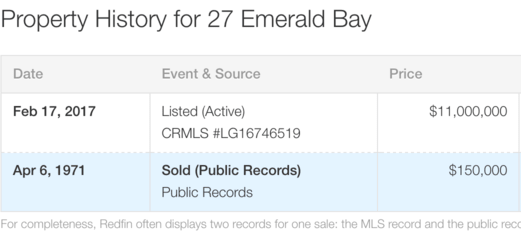

Legendary investor Warren Buffett has finally listed his vacation home located at 27 Emerald Bay in Laguna Beach, CA for $11 million.

It seems he’s finally ready to take some profits after breaking even – oh wait, he’s up $10,850,000. Never mind.

Yep, he bought the beach house back on April 6th, 1971 for $150,000. If we adjust for inflation the price would be $900,000 today, still a massive bargain to the astronomical listing price.

Buffett Put Just 20% Down and Took Out a 30-Year Mortgage

If you’re wondering how he financed the property way back then, he said he “probably only had $30,000 of equity in it,” meaning 20% down payment and 80% loan-to-value, which was common at the time.

He took out a 30-year fixed mortgage from Great Western Savings and Loans, which was later acquired by Washington Mutual and then JPMorgan Chase.

Per Freddie Mac, 30-yr fixed mortgage rates were around 7.31% at the time – incidentally, it was the first month they began tracking 30-year fixed mortgage rates.

Buffett apparently still holds the loan, remarking that “it’s the only mortgage I’ve had for fifty years,” meaning he must have refinanced once or twice to take advantage of either a lower rate or perhaps tapped some equity.

Why would one of the world’s richest men still have a mortgage, let alone a tiny one? Wouldn’t he have just paid it off with his billions of dollars? Well, no, because he’s a huge fan of the 30-year fixed.

Buffett Loves Mortgages

I’ve written about this in the past. Back in 2013, Buffett was urging homeowners to take out mortgages, at a time when they were close to record lows. He added that a long-term mortgage, such as the 30-year fixed, would be the most beneficial.

In short, his argument is that you get to lock-in a very low interest rate for three decades, something you can’t really do with any other type of loan.

And if rates go down, you still win because you can simply execute a rate and term refinance and enjoy the new, lower rate.

If rates happen to increase, your low rate stays the same and you’re still in good shape.

Buffett refers to it as a “one-way renegotiation,” in that you can’t really lose.

“If you get a 30-year mortgage it’s the best instrument in the world, because if you’re wrong and rates go to 2 percent, which I don’t think they will, you pay it off.”

No, rates won’t go to 2%, but even if they do, you’re free to refinance to that lower rate as long as you qualify.

Why Buffett Took Out a Mortgage

The reason Buffett took out a mortgage on the beach house back in 1971 was simply because he felt he could do better with his hard-earned money.

If the rate was indeed in the 7% range back then, he had the confidence to beat that rate of return by purchasing Berkshire stock.

He said with the $110k-$120k he borrowed (he doesn’t remember exactly how much), he was scooping up shares when the stock was around $40 a share.

Guess where it is today? It’s $262,270 per share…give or take, so it was probably a good call to take out a mortgage on the vacation home and put the money elsewhere.

As I’ve said before, stories of people paying down their mortgage in a couple years sound cool, but is doing so the best use of your money? Should you invest your money instead?

There’s nothing wrong with paying a mortgage off early, but there are alternatives out there to think about. If anything, it’s nice to diversify a bit. Putting all your eggs in one basket, whether it’s a home, stocks, a business, etc. can be quite risky.

And you just might miss out on something much bigger.

(photo: thetaxhaven)

Just happened on your website. It’s wonderful!

The thought of being able to purchase a beach house for 900,000 is a nice thought, needless to say the profit from what he paid for that house is nothing short of spectacular.

Thanks for the article, always fun seeing the super wealthy and how they handle their day to day lives, especially with mortgages.