There are plenty of so-called experts and gurus out there with all types of advice on what you should do with your money, but perhaps the most celebrated is Warren Buffett, known affectionately as the “Oracle of Omaha.”

On Saturday, the 82-year old financial wizard held his annual shareholder meeting for Berkshire Hathaway in Nebraska’s largest city, which many refer to as “Woodstock for Capitalists.”

He talked about everything from politics to the economy to his personal life on Star Wars Day (May the fourth…), and every single word was taken as gospel by his loyal legion of followers.

Fox News also caught up with Buffett, who took the time to discuss the state of the economy with Liz Claman.

The most interesting tidbits (to me) were about housing and mortgages, something you may want to pay attention to if you’re thinking about buying a home or refinancing.

Buffett Says Get a Mortgage Today

One major takeaway from the interview was the line, “if you ever want to get a mortgage, today is the day to get a mortgage.”

If you’re wondering why he is so bullish on mortgages, it’s pretty simple. Mortgage rates are at or near all-time record lows, so you can borrow money on the cheap.

This low-rate environment explains why housing is so affordable at the moment, even though home price-to-income ratios are above historic norms.

Like anyone else with half a brain, he knows interest rates (including mortgage rates) will eventually rise, and so locking in a low fixed rate today is paramount.

He also said those who are borrowing money to finance a home should do so for a “long period of time,” meaning go with the 30-year fixed mortgage instead of the 15-year fixed.

Heck, one could even make an argument for a 40-year fixed mortgage if they’re comfortable investing elsewhere.

Why? Well, as I’ve discussed in other posts, most recently my mortgages vs. inflation post, the value of money erodes over time. And a fixed mortgage balance will be easier to pay off in the future with inflation-adjusted dollars.

For the record, Buffett expects inflation in the future thanks to the quantitative easing that has been keeping rates low for years now.

In other words, why pay off your mortgage as quickly as possible when rates have never been lower and money is expected to be worth less?

Why not take advantage of a low fixed mortgage rate for as long as you possibly can, seeing that we may never see them this low again.

Sure, this advice comes from a big-time investor who can easily beat the rate of return on a mortgage, but even amateurs can probably pull it off with rates so low.

Good Time to Invest in Single-Family Homes

Speaking of investing, Buffett also noted that today is a good time to invest in a single-family home, though he did say, “It’s not quite as attractive as it was a year ago.”

Yes, home prices have increased from levels seen a year ago, but they’re expected to keep flying higher thanks to limited inventory, low rates, and other market factors.

However, Buffett believes that those who buy today should expect to stay put for a long period of time to do well in housing. Of course, Buffett isn’t a day trader, so his trades are never seen as short-term.

He’s not going to tell you to buy a home to flip a year from now, even if you could make a huge profit doing so.

Finally, Buffett spoke out about the mortgage interest deduction, which he doesn’t think is going anywhere.

Despite ongoing pressure from certain groups to eliminate the favorable tax break, he thinks it’s unlikely to be dropped, and if it is, it will be part of a larger piece of legislation.

So that’s that. Even Warren Buffett thinks it makes sense for you to buy a house and finance it with a mortgage, as if you needed another reason.

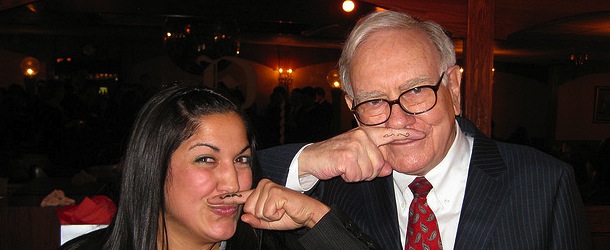

(photo: Aaron Friedman)

If Buffett says it, it must be true. Too bad interest rates have surged lately. I wonder if he still thinks it’s a great time to take out a mortgage. Sadly, once Buffett lets his opinion be known, the opportunity has already passed.