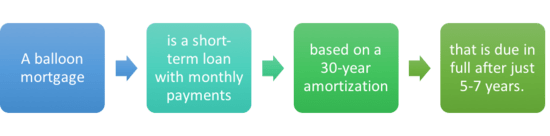

A “balloon mortgage” is a home loan that does not fully amortize over the life of the loan, leaving a large balance at the end of the shortened term.

What Is a Balloon Mortgage?

- It’s like a standard home loan

- In that you make principal and interest payments each month

- Based on a 30-year amortization (or similar)

- But differs in that the loan is due in full in just a fraction of the time

Put simply, monthly mortgage payments are based on a typical 30-year loan term, but the loan itself is due in full after just five or seven years, instead of 30.

As a result, the final payment on a balloon mortgage will be significantly larger than the regular monthly mortgage payments.

Of course, most borrowers expect to either refinance before the balloon mortgage term ends, or sell the associated property. So the final payment likely won’t even come into play in the real world.

Let’s look at an example of a balloon mortgage:

7-Year Balloon Mortgage

Interest Rate: 5.00%

Amortization: 30 Years

Loan Amount: $250,000

In the above scenario, the monthly mortgage payment would be $1,342.05 per month, which is the same exact amount as a standard 30-year fully-amortizing payment.

This monthly payment would remain in effect for the first 84 months, leaving a remaining balance of $221,204.98 left over at the end of the seven-year term.

This outstanding balance is the balloon mortgage payment that is due in full after seven years. It probably sounds like a lot of money to pay (it is!), but as mentioned earlier, most borrowers tend to either refinance or sell before it gets to that point. They usually have no other choice unless they are extremely wealthy.

The ING Easy Orange Mortgage was an example of a balloon payment first mortgage that was freely available to homeowners nationwide. It’s no longer around.

Seconds mortgages may also be balloon mortgages, a common one being the “30 due in 15.” It amortizes like a 30-year mortgage, but full repayment of the loan is due in just 15 years. Again, most borrowers either pay it off, refinance, or sell before the term ends.

Advantages of Balloon Mortgages

- The main advantage of a balloon mortgage

- Is a lower interest rate

- Because action is required on your part

- Once the term expires

- At that point you need to find a new loan (refinance), sell your home, or pay off the mortgage in full

You may be wondering why a homeowner would choose a balloon mortgage as a opposed to say an adjustable-rate mortgage or a fixed-rate mortgage.

Well, balloon mortgages rates should come at a discount to both fixed-rate loans and ARMs, making them a cheaper alternative.

And if you don’t plan on staying in the home or with the loan for more than a few years, it could prove to be the right choice for you.

Of course, the big trade-off is the associated risk if you get stuck holding the bag. A balloon mortgage essentially requires action on your part, so a reduced rate should be offered in exchange.

Disadvantages of Balloon Mortgages

- Uncertainty at the end of the loan term

- Which can be a very short period of time

- Some balloon mortgages only last five years

- If you don’t qualify for another home loan

- You could be in trouble and/or forced to sell your home

The clear disadvantage to a balloon mortgage is the uncertainty at the end of the loan term.

Using our example from above, after seven years, the entire loan balance is due. No ifs, ands, or buts about it. So if you don’t have $221k cash on hand, you’ll need to figure out an alternative.

This means selling or refinancing, or perhaps getting a new balloon mortgage that extends the loan term.

Imagine if your home falls in value during that time and you owe more than the final balloon payment – you’d have a major problem assuming you couldn’t execute a short sale or a short refinance.

This isn’t the case with a fixed-rate loan or an ARM.

Fixed-rate mortgages have the same payment throughout the life of the loan, while ARMs may adjust higher or lower, as determined by their caps.

Those caps will limit the amount the mortgage payment can rise, providing some level of protection and an early warning system, so to speak.

Sure you could be underwater on your loan (owe more on mortgage than home is worth), but the payments would likely stay manageable thanks to the caps.

You also won’t be on the hook for the remaining loan balance at any point unless you go into foreclosure.

Balloon Mortgages vs. Adjustable-Rate Mortgages

- They are very different loan products that may both feature lower interest rates

- A balloon mortgage requires full payment at the end of a shortened loan term

- An ARM can simply adjust higher (or lower) after the fixed-rate period ends

- But is still likely based on a 30-year loan term

A balloon mortgage differs from an adjustable-rate mortgage because full payment is required at the end of the shortened loan term.

With ARMs, the interest rate simply becomes adjustable after the initial fixed-rate period ends, but the loan isn’t due in full immediately (or any earlier than a 30-year fixed).

It continues to get paid down on a 30-year schedule, though mortgage payments can fluctuate up and down based on the variable interest rate.

In conclusion, be sure to compare all your options – you may be surprised to find that a fixed-rate loan prices better (or similarly) to an ARM or a balloon mortgage, without all that risk!

Update: When the Qualified Mortgage (QM) rule was introduced by the Consumer Financial Protection Bureau (CFPB), balloon mortgages were largely outlawed. That should give you an idea about what consumer advocates think about these types of loans.