Mongoose vs. Cobra. Coyote vs. Roadrunner. Pirate vs. Ninja?

And finally, “fixed-rate mortgage vs. adjustable-rate mortgage.” Yes, we’re talking about the greatest rivalries of all time.

Okay, maybe this one isn’t as interesting as those others mentioned above, but it can be if you’re buying a home or refinancing an existing mortgage.

So what’s better, the boring old fixed-rate mortgage or the more provocative and often controversial adjustable-rate mortgage (ARM)?

Let’s discuss both and come up with some conclusions, which can vary based on individual preferences and circumstances.

Fixed-Rate Mortgage vs. Adjustable-Rate Mortgage

During the housing boom in the early 2000s, homeowners often chose adjustable-rate mortgages as a means to qualify for a home they probably wouldn’t be able to afford with a traditional fixed mortgage.

Back then, you could qualify a borrower at the ARM’s lower start rate, even though the loan would eventually adjust much higher.

Even if they could afford a fixed-rate loan, homeowners were happy to take the lowest interest rate possible, which typically came with the ARM.

But times have changed, and adjustable-rate mortgages have now fallen out of fashion with fixed-rate mortgage rates hitting all-time record lows. Rates have since risen quite a bit but the trend is the same.

In fact, fixed-rate mortgages account for more than 90% of the purchase money mortgages and refinance loans being originated nowadays.

Sure, fixed mortgages are definitely more popular, but that doesn’t mean they’re any better, or always the right choice.

It’s just a matter of preference for most. And as homes become less and less affordable, the popularity of ARMs will rise once more.

Fixed-Rate Mortgages Like the 30-Year Are the Default Option

- Most homeowners opt for fixed-rate mortgages when buying a home or refinancing an existing loan

- We’re talking 90% or more of all home loans are 30-year or 15-year fixed mortgages

- ARMs were very popular prior to the mortgage crisis because of their relative affordability

- But now have less than 5% market share (that could change as home prices continue to rise)

When taking out a mortgage, most people tend to choose a fixed-rate mortgage, making it the default option.

The most popular of the fixed mortgages is the 30-year fixed, seeing that the payment is fixed for the entire term of the loan, and the long amortization period keeps monthly payments low.

The 15-year fixed-rate mortgage is also pretty popular, but because the entire balance must be paid off in half the amount of time, monthly payments are much higher.

That means fewer borrowers are willing or able to choose one due to affordability concerns.

Start with a 30-Year Fixed, Refinance to a 15-Year Fixed?

Typically, a homeowner will start with a 30-year fixed, then when it comes time to refinance, they’ll go with a 15-year fixed to stay on track and avoid resetting the clock.

This allows a homeowner to save money and stay on track in terms of paying off their loan. If they take out another 30-year loan they’d delay their payoff.

There are also adjustable-rate mortgages, which most borrowers tend to avoid unless they are extremely savvy investor-types, ultra-rich, or instructed to do so by their mortgage broker or loan officer.

I say savvy because some folks will take a chance on the initial interest rate discount offered on ARMs despite the associated risk of a higher interest rate in the future.

So you need to know what you’re doing when selecting an ARM, and most importantly, have the capacity to absorb any interest rate adjustments in the future.

As mentioned, there were also those borrowers who had to take out an adjustable-rate mortgage to qualify because the interest rate was lower.

This was a routine practice before the mortgage crisis, with the ARM option typically floated by the real estate agent, broker, or loan officer whether it was in the borrower’s best interest or not.

This isn’t as common nowadays because it’s not necessarily easier to qualify for an ARM since you often need to qualify at the fully-indexed rate.

What Type of Adjustable-Rate Mortgage Are We Talking About?

- Today’s ARMs are usually hybrids with a fixed and adjustable period

- They feature a fixed interest rate at the beginning of the loan term for X number of years

- Followed by an adjustable-rate period for the remainder of the loan term

- This makes them a little bit safer, but not as cheap as they otherwise would be

The big question when debating the fixed vs. ARM decision is what type of adjustable-rate mortgage are we dealing with?

These days, it’s quite common to take out an ARM with an initial fixed-rate period, such as a 5/1 ARM or a 7/1 ARM.

The above examples are fixed for the first five and seven years, respectively, before becoming annually adjustable for the remainder of the term. They’re known as hybrid ARMs for that reason.

There’s even an option that is fixed for 10 years before its first adjustment, making it relatively low-risk.

This means you’ve got some breathing room before the interest rate adjusts up or down. That’s right, your mortgage interest rate can move up or down if it’s an ARM.

And all of these ARMs are amortized over a 30-year period, meaning they will take 30 years to pay off, assuming you hold them until maturity (which most borrowers don’t).

So they are the same as a fixed-rate mortgage in terms of length, and if you only keep them for five or seven years, they act no differently regarding how much principal and interest is paid.

Actually, you’d likely pay off more of your principal balance and pay less interest due to the lower interest rate on the ARM.

The major difference is that the 30-year fixed is, ahem, fixed, while the ARMs are, you guessed it, adjustable. By adjustable, I mean your mortgage rate can move up, down, or sideways.

This obviously presents some serious risk, assuming mortgage rates rocket higher during the few short years you hold the loan.

ARMs Can Go Up and Down (But Typically Only Rise)

- ARMs can adjust higher or lower over time depending on the associated mortgage index

- In that sense they don’t necessarily need to be refinanced

- Whereas if mortgage rates drop significantly after you obtain your loan

- You may need to refinance your fixed-rate mortgage to take advantage of lower market rates

While it’s possible that mortgage rates could move lower in the future, they’re no longer at record lows and may just stay put over the next few years in the 5-6% range.

And mortgage indexes tied to ARMs have risen with all other interest rates and likely won’t fall anytime soon.

So an ARM you obtain today will probably reset higher upon its first adjustment, meaning your monthly mortgage payment will go up.

If you can’t handle that hypothetical higher mortgage payment, you may want to stick with the 30-year fixed, even if it’s slightly higher today.

But will you stay in the home for 5-7 years, or will you move. And will you refinance before that time?

If there’s a good chance you will do either, an ARM could make more sense than a fixed-rate mortgage, assuming the interest rate is a lot lower.

Also note that both fixed-rate mortgages and ARMs require active participation. Just because your loan has a fixed rate doesn’t mean you don’t have to keep an eye on rates.

If rates move lower, you may lose out if you don’t refinance your fixed-rate mortgage. So it’s not as set-it-and-forget-it as it appears.

Keep the ARM for the Fixed-Rate Period Only

If you are buying your first home, but plan to move or upgrade to a better home as you start a family, an adjustable-rate mortgage might be the best option short-term.

And the money saved during those few years can be used for a down payment on the next home. Additionally, the lower interest rate increases affordability during the months it’s held.

At the same time, it hasn’t been uncommon lately for homeowners to choose a 30-year fixed, then refinance into another 30-year fixed shortly after once rates improved.

This is mainly because the initial discount on ARMs hasn’t been great relative to fixed-rate alternatives.

If the spread between the two isn’t wide, it may not be worth the risk.

And chances are someone who elects to go with an ARM will likely suffer long-term if they keep it.

Most will probably have to refinance or sell before the first rate adjustment.

This is why short-term ARMs are typically reserved for the very wealthy, who have the option to refinance or pay off the loan whenever they choose.

If you go with an ARM and don’t have the option to pay it off or refinance, you could be stuck with a rising payment, which could put your mortgage (and property) in jeopardy.

Tip: Never choose an adjustable-rate mortgage just to qualify for a loan. If you can’t qualify for a loan at the fixed mortgage rate, consider holding off and renting for a while or buying a cheaper property.

Does the Initial Discount of an ARM Justify the Risk?

- Make sure the ARM discount is worth the risk of a potentially higher rate later

- Also consider how long you’ll keep your home loan and the property

- You might not keep it long enough to ever worry about a rate reset

- It could be a much better deal than the more expensive fixed loan you won’t take full advantage of

Be sure you’re getting a good discount on the ARM in exchange for the uncertainty and risk of it rising in the future.

Currently, 30-year fixed mortgage rates are hovering around 6%, while the 5/1 ARM is pricing pretty similarly, depending on the lender.

The spread between products isn’t great at the moment, meaning ARMs aren’t too favorable right now.

At other times, the difference in pricing might be 1.5%, making an ARM a serious contender.

Risk appetite, age (retirement), job status, investment strategy, and downright stress will also come into play, so be sure to do plenty of math and compare different scenarios before deciding on anything!

Simply put, you’re taking a risk when choosing an ARM (hence the discount), so take a hard look at the numbers compared to fixed rate options.

While an adjustable-rate mortgage typically provides financing at a discount, it comes with much more uncertainty, especially in today’s market.

And if it’s a goal to pay off your mortgage, a fixed mortgage is generally the best option for most.

Tip: If you buy an owner-occupied property that you intend to later rent out for the long-term, a fixed-rate mortgage might be a good pick because you’ll probably keep the loan for a long period of time.

And chances are you won’t want to refinance the loan since financing is more expensive on investment properties.

When Is an Adjustable-Rate Mortgage Is a Good Idea?

- You are buying a starter home and plan to sell in a few years

- You expect mortgage rates to improve in the near future and will likely refinance

- You have marginal credit and expect to improve it, thereby opening the door to better financing

- You didn’t get great terms in general and think you can do better once those issues are resolved

- You’re wealthy and can pay off your loan in full whenever you wish

- There’s a large spread between ARMs and fixed interest rates

When a Fixed-Rate Mortgage Might Be the Better Call

- Rates are super low (or at/near record lows) and aren’t expected to get any better

- When interest rates are expected to rise substantially in the near future

- If you have trouble refinancing and don’t want to take any chances

- You bought a home you wish to rent out in the future and don’t want to have to refinance it as a non-owner occupied property

- You want to pay off your home loan in full by a certain date (e.g. retirement) and want that certainty

- If the spread between fixed and ARM rates is marginal

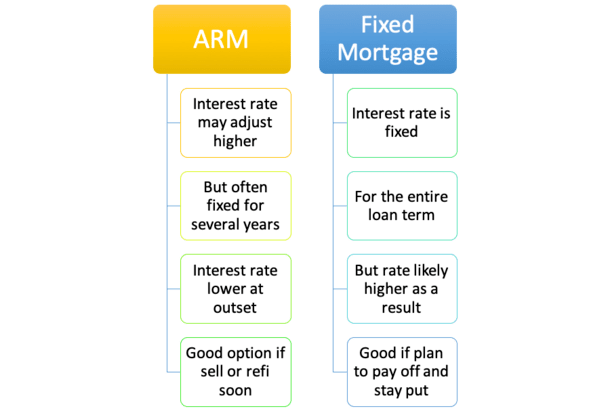

Pros of Fixed-Rate Mortgages

- The interest rate will NEVER change

- Your monthly payment won’t fluctuate

- Easier to manage your finances/budget

- Rates on fixed-rate mortgages are very low at the moment

- No stress about what rates are doing (you can sleep at night)

- No need to refinance unless rates drop dramatically (but you still can if need be)

- Easy to wrap your head around, no surprises

Cons of Fixed-Rate Mortgages

- Interest rates are typically more expensive

- Your monthly payment will be higher

- You’ll pay more interest over the loan term

- It could be harder to qualify for a mortgage with a higher rate

- You’ll pay your mortgage off more slowly

- You’ll build equity at a slower rate

- You may choose not refinance for fear of losing your low, fixed rate

Pros of Adjustable-Rate Mortgages

- Lower mortgage rate (at least initially)

- Lower monthly payment

- You’ll pay less interest in the early years

- Build equity faster while interest rate is lower

- Most ARMs are fixed for a certain amount of time

- Caps and ceilings limit interest rate movement

- You might sell/move before the interest rate even adjusts

- You can always refinance if rates rise and you qualify

- Interest rates can actually drop over time!

- You’ll have extra cash on hand for other expenses or investments

Cons of Adjustable-Rate Mortgages

- Interest rates can rise substantially in a short period of time

- You may not be able to afford the higher monthly payment post-adjustment

- You could lose your home to foreclosure if you can’t keep up with payments

- You may refinance over and over and never actually pay off your mortgage

- Refinancing can be quite costly versus holding your original fixed-rate loan

- You might be stuck with your high-rate loan if you don’t qualify for a refinance

- ARMs often feature floors that limit if you interest rate can actually drop

- You need to actively keep track of mortgage rates

- You will likely be a lot more stressed

- Your interest rate may dictate whether you move or stay put

- More difficult to budget accurately

- Time moves faster than you may think

(photo: eckes/bernd)

- Rocket Mortgage Completes Redfin Takeover, Offers $6,000 Home Buyer Credit - July 1, 2025

- Mortgage Rates Quietly Fall to Lows of 2025 - June 30, 2025

- Trump Wants Interest Rates Cut to 1%. What Would That Mean for Mortgage Rates? - June 30, 2025