It’s time for yet another mortgage match-up, so without further ado, here’s a biggie: “Renting vs. buying a home.” Or a townhouse for that matter…

This is certainly an intimidating question, and one that’s difficult to sum up in one post, but I’ll do my best to cover as many pros and cons for each as possible (feel free to add more in the comments section!).

First and foremost, there is no universal yes or no answer to this question seeing that real estate is constantly in flux and extremely local (more so than ever).

It’s also about so much more than money. There are many reasons to buy a home beyond the investment itself.

But financials are often a big driver of the decision, so that will be top of mind in this post.

Key Takeaways to Consider When Weighing the Rent vs. Buy Decision

- No One-Size-Fits-All Answer: Renting vs. buying depends on your unique finances, emotions, goals, and local real estate trends — there’s no universal “yes” or “no” answer

- More than Money: It’s not just about the monthly cost — homeownership builds wealth and offers freedom, while renting provides flexibility with fewer responsibilities

- Tough Market Today: High home prices and elevated mortgage rates (~7% vs. 3% pre-2022) make buying less affordable; Zillow recently said it takes over a decade to turn a profit

- Rent vs. Buy Math: Tools like the “rule of 15” (annual rent x 15 = good price) or price-to-rent ratios (1-15 favors buying, 16+ favors renting) can assist, but aren’t the full story

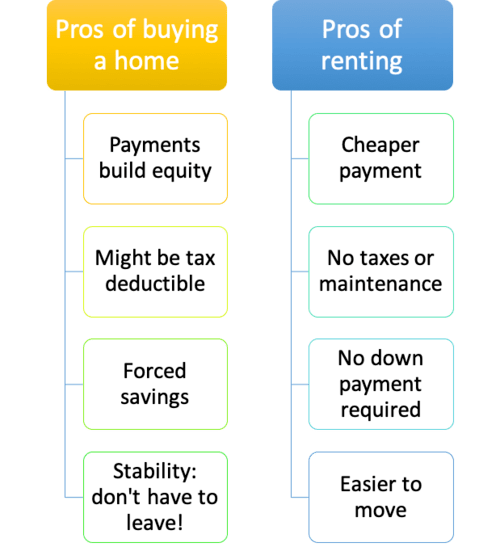

- Renting Pros: Cheaper upfront, no maintenance, easy to move, freedom to invest elsewhere

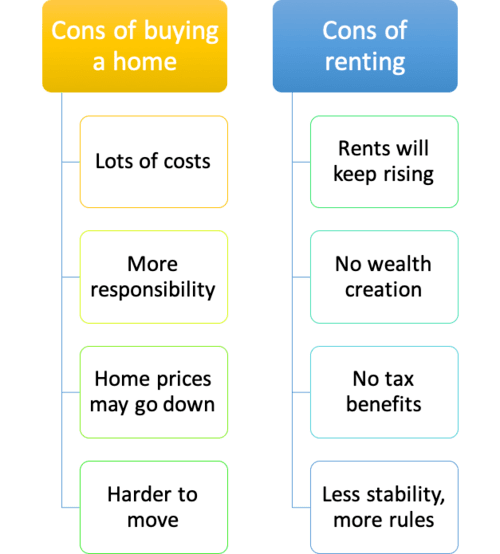

- Renting Cons: No equity, rent keeps rising, less control, at the landlord’s mercy

- Buying Pros: Builds wealth, tax breaks, control, potential cost savings if cheaper than rent

- Buying Cons: Big down payment, hidden costs (taxes, repairs), more stress, less mobility

- Timing Matters: No rush — buy when you’re financially and emotionally ready, and have a plan

- Trust Your Gut: After you’ve done your research, go for it if it feels right; if not, waiting’s fine too —there’s no right choice for everyone

Renting vs. Buying Is More Than Just the Monthly Payment

These days, home prices are well off their lows, and in fact at record highs (on a nominal and real basis) in much of the country. Simply put, homes aren’t on sale anymore, and haven’t been for some time.

In addition, mortgage rates are much higher than they were just a couple years after hitting all-time record lows.

These days, one should expect an interest rate closer to 7% rather than 4%, though they have drifted a bit lower over the past couple months.

This combination of high home prices and elevated mortgage rates has made it more and more difficult for prospective home buyers to make the move to homeownership.

In fact, Zillow reported in late 2023 that it now takes more than a decade to profit from a home purchase, factoring in all the costs.

This may have gotten a little better because mortgage rates seemed to peak at that time, and have since fallen. And prices may have eased somewhat as well.

However, contrast that to those who bought a home before 2021 with a really cheap mortgage (think sub-3%) that is locked in for the next 30 years. It’s just not as favorable these days.

And even though there is still an expectation home prices will continue to rise for the foreseeable future, it’s harder to make a deal pencil.

But prices are just one piece of the pie. With homeownership comes responsibility, while renting may be relatively carefree.

Rent vs. Buy Ratio

- There are several rent vs. buy ratios out there to consider

- You can use them to determine if a specific property is a good buy or not

- But purchasing real estate isn’t always just about the money

- People buy for many reasons so you don’t necessarily need to adhere to these stringent rules

Before we talk about the pros and cons of renting vs. buying, I wanted to touch on the many ways pundits determine if it’s more economical to buy than rent, and vice versa.

There are plenty of different rent vs. buy calculators out there, but most compare annual rents to asking prices to determine if it’s a good or bad time to buy.

For example, there is the “rent vs. buy rule of 15,” which says to multiply the annual rent of a comparable property by 15.

So if rent is $1,000 a month, it’s $12,000 annually. Multiple that number by 15 and you’ve got a suitable purchase price of $180,000. Last I checked, not many homes are going for $180k or less.

Trulia uses a “price-to-rent ratio” that follow the same formula, whereby you take the list price and divide it by one year’s rent.

Using our prior example, $180,000 divided by $12,000 would be 15. Trulia considers ratios of 1-15 as more favorable to buy than rent, whereas numbers of 16+ favor renting.

Of course, hot cities like New York City and Los Angeles will typically have much higher ratios, but they can also appreciate a lot faster.

Both Renting and Buying Have Their Downsides

Is That Rental Property a Good Buy?

- There are also rules geared toward real estate investors

- Such as the 1% rule and the 2% rule

- These determine if a property is a good investment

- They are based on projected rents for the underlying properties

There are other rules used for purchasing a rental property, including the 1% rule, the 2% rule, and a home’s gross yield, all of which are pretty simple formulas.

The 1% rule basically says to purchase a rental property only if each month’s rent covers 1% of the purchase price. So if a home is listed at $200,000, you need to bring in at least $2,000 in monthly rent for it to make sense. This is easier said than done.

The 2% rule is a lot less forgiving, doubly less in fact. In our preceding example, you’d need to get $4,000 a month in rent, which is probably next to impossible in most situations today.

Unless you buy a very cheap foreclosure or snag some other fire sale, or perhaps use it as a short-term rental on Airbnb or a similar platform.

These types of properties will most likely need a lot of TLC to get into the shape necessary to rent for such a premium.

Finally, there’s a home’s gross yield, which is calculated by taking the property’s annual rent and dividing it by the purchase price.

So if the annual rent is $24,000 and the purchase price is $300,000, you’d have a gross yield of 8%.

A yield of 8% or higher is generally pretty good and anything in the double-digits is pretty spectacular.

However, you can’t rely on a blanket rule to make your home buying decision.

You need to factor in the true cost by using real-time mortgage rates, expected home price appreciation, cost of maintenance, the desire to own vs. rent, and much more.

So bust out a calculator as opposed to going with a rent vs. buy rule of thumb if you want a truly accurate picture.

Even if a property doesn’t meet these rules, it could still be a very worthwhile purchase. Heck, “overpaying” for a property can make sense in certain situations.

Pros of Renting a Property

- The freedom to move whenever you want with one month’s notice

- The lack of responsibility and no need to foot the bill for maintenance

- Fewer expenses that might be paid by the landlord (including utilities)

- The ability to put your money into other investments that may yield better returns

Let’s start with the beauty of renting an apartment or a home. When you rent, you pay a landlord a certain dollar amount each month.

Simply put, this dollar amount is typically less than the going cost of a mortgage, assuming you factor in the insurance and taxes. Oh, and the ongoing maintenance, both seen and unforeseen.

Sure, a home loan may appear cheaper, but guess what happens when your toilet breaks? You can’t call your helpful resident plumber and get a free fix.

You’ll either have to get down with some DIY or open your checkbook. So renting, while seemingly the same price or even more expensive than owning, might still wind up cheaper.

There’s also a huge psychological freedom to renting. You aren’t locked in for 30 years. At most, you probably have a 12-month lease agreement. And there’s even a good chance you’ve got a month-to-month deal in place.

In short, you won’t feel trapped, and you can freely move on if you want/need to for any reason, such as job relocation, downsizing, upsizing, annoying neighbor, etc.

This should make it a lot easier to sleep at night, which can be invaluable in itself.

Cons of Renting a Property

- You walk away with nothing after paying tons of money in rent

- You’re often still stuck in a lease for 12 months or longer

- Could be forced to move on fairly short notice if the owner wants to sell

- Might be lots of restrictions in place like no pets, no remodeling, and so on

On the other side of the coin, renting seems to be synonymous with temporary.

If you want to establish a household or start a family, renting an apartment or a home might not be the best way of going about it. You might even be stressed out because of the lack of foundation.

You could also be limited to what you can do to the unit. Pets aren’t allowed? You can’t paint the place? You can’t do X, Y, or Z?

Oh, and those rent payments never stop – sure, 30 years is a long, long time, but your lifetime will probably be longer.

There won’t be any relief in retirement when you rent – you’ll keep paying your landlord for “as long as it takes.”

And at the end, you won’t have anything to say for it, no home equity or ownership, despite all those payments. Nothing to hand off to your kids/spouse or to sell for cash proceeds.

Additionally, your rent can and will most likely rise, even if some level of rent control is in place.

So you might be paying less than your neighbor with the mortgage today, but if your neighbor’s mortgage is fixed, they’ll still be paying the same amount in the future while your rent climbs higher.

Pros of Buying a Home

- A place of your own with few if any rules to follow barring an HOA

- You are in charge and can do what you want (remodel, move, rent out, stay forever, etc.)

- You can build a ton of wealth in the process without lifting a finger

- Might actually be cheaper than renting and tax deductible

Okay, so we’ve discussed some pros and cons of renting, but what about buying?

Well, the obvious advantage is that you actually gain home equity, or ownership in your home.

In other words, over time the home or condo becomes your property, as opposed to renting, where you never own anything aside from the measly contents.

Additionally, owning might be a cheaper alternative than renting in some markets, though this is becoming a lot less common thanks to higher rates and prices.

If you are able to find a place where it’s “better to buy than rent” where your mortgage payment, even when factoring in taxes and insurance, is less than what a landlord charges for rent, it could be a win.

After all, why pay $2,500 in rent if you can make a $2,200 mortgage payment, especially if you can write off the interest and the taxes?

That’s right, with homeownership comes tax benefits. Of course, the future of the mortgage interest deduction always hangs in the balance, but real estate taxes are still fully deductible.

Factor in the tax savings and your mortgage payment gets even cheaper compared to a rental payment.

An owner of property also has fewer restrictions, and can add or modify to their heart’s content, less any government bureaucracy or HOA rules.

This means you can make your property worth even more over the years, or simply make it more useful/attractive for you and your family.

For example, you could add an ADU in the backyard and give yourself more living space or a home office.

[2025 home buying tips to get the job done!]

Cons of Buying a Home

- Lots of hidden costs you never realize until you become a homeowner

- Greater responsibility, higher stress, and potential liability

- Could be more expensive than renting (and you might need to come up with a large down payment)

- Harder to pick up and go if you want to move for whatever reason (might be stuck or have to seel for a loss)

There are plenty of disadvantages to owning property as well. First off, you must come up with a sizable amount of money, either for down payment and closing costs, or to buy outright with cash.

With rent, typically you just need the first and last month’s payment. When buying, you’ll need at least 3% (Fannie/Freddie) or 3.5% of the purchase price in most cases (FHA loans), which can be a hefty amount in higher-priced areas of the nation.

Sure, there are still some zero down home loan options available, but the less you put down, the higher your monthly housing payment, which could also be subject to costly mortgage insurance.

These days, there’s a good chance your mortgage payment will exceed the rents in your area. This can certainly vary, but don’t be surprised if buying comes at a premium today.

You also have to pay real estate taxes and homeowners insurance, which don’t stop once the mortgage is paid off. You may even need to pay costly HOA dues and mortgage insurance premiums.

Factor that all in and you could still be paying thousands each month to live “rent-free.” That doesn’t sound very free, does it?

You also become the landlord when you own. Remember that helpful handyman at your old apartment complex that fixed your leaky faucet with a smile? That’s your responsibility now Bob Vila.

Oh, and you better believe that every little thing that’s wrong with YOUR property will give you stress, each and every day.

You can’t just pack up and move on with ease. It takes time (and money) to unload a property.

And you might not make out as much as you think once you factor in real estate commissions, closing costs, moving costs, taxes, and less-than-anticipated home price gains.

Heck, your house might even lose value and you could be foreclosed on if you don’t hold up your end of the bargain.

So it’s certainly not a foregone conclusion that buying is better than renting, though most wealthy people will be owners of real estate…

The Best Time to Buy Was Yesterday, the Second Best Time Is Today

Nope. I don’t buy into this cringe line you’ll often hear uttered by real estate agents. Sure, I get the point they’re trying to make.

That real estate tends to increase in value over time and instead of hesitating and continuing to “throw money away on rent,” you should just take the plunge.

As time goes on, you’ll gain equity with each payment and your home will rise in value. Okay, fine.

But this is more a sales pitch than it is a well-thought-out plan, especially if we’re talking about a very important financial decision like buying a home.

Ultimately, the best time to buy a home is when you are financially and emotionally ready, have done your homework, have a long-term plan, and have found a property that checks all your boxes.

Rushing into it just because time’s a wastin’ isn’t necessarily the best strategy. Being thoughtful and getting to know the market where you’re considering buying is a better move.

You might even do the math and determine waiting to buy is better, for now. And that’s just fine. There is no right or wrong answer for everyone.

Lastly, trust your gut. If it feels right, and you’ve put in the time and taken all the right steps, go for it. If not, don’t feel bad about holding off. You can always change your mind.

In Summary

- There are countless good/bad reasons to both buy or rent

- And no single answer to satisfy everyone all of the time

- Some individuals despise real estate investment and the headaches that come with it

- While others think you’re throwing away money when your rent

As you can see, there are plenty of pros and cons to buying vs. renting, and vice versa.

When you rent, you pretty much know what you’re getting into. You’re not going to make any money, but you’re not going to explicitly lose any either. And it’s mostly a hands-off type of deal.

With a home, you’re making a bit of a gamble on your future, and the future of the economy. Policy and the economy now matter to you, a lot.

After all, you need to put a certain amount down, and you need to ensure you keep making money so you can keep up with your mortgage payments.

You’ve also got to set aside an emergency fund so you’re able to pay for repairs if and when necessary.

But ideally, the tradeoff is that you’ll be rewarded for making that homeownership leap of faith.

Below, I’ve added a fairly exhaustive list of pros and cons for those pondering the rent vs. buy question. Hopefully it makes your decision that little bit easier.

Benefits of Renting

- May be cheaper than a mortgage payment

- Fewer (if any) maintenance costs

- No down payment required (less deposit)

- No real estate taxes (renters insurance optional)

- Less stress (who cares, it’s not yours!)

- Freedom to move or downsize when necessary

- No risk of home price depreciation

- Some utility bills may be included

- “Free” amenities such as pool, gym, security

- Money can be used for other, more profitable investments

- Can’t be foreclosed on

Rent Disadvantages

- Rental payment may exceed monthly cost of mortgage

- No ownership or wealth creation

- Payments never stop when renting

- Rent will rise over time

- Must deal with a landlord or management company

- No tax benefits

- Rules, regulations, and limitations

- More temporary, less stability

- Always at the mercy of the property owner

Benefits of Owning a Home

- You can build home equity and wealth

- Sizable tax deductions possible

- Your space, your rules (pets welcome)

- Ability to remodel, expand, tear down

- Pride of ownership (social status, accomplishment)

- Potentially better for children, family structure

- Mortgage can improve your credit history/score

- Ability to borrow against your home (HELOC or cash-out)

- No more monthly payments once mortgage paid off

- Fixed payments (if you choose a fixed mortgage)

- Mortgages are the cheapest loans available

- No landlord

- Can exclude capital gains when you sell (partially)

- Inflation hedge (houses become worth more as dollar loses value)

- Forced savings

- Leveraged investment

- Can rent out to others

- Can sell and use proceeds for bigger/better home

- Retirement nest egg

- It’s the American Dream!

Homeownership Disadvantages

- Home prices may go down

- Could overpay for your property

- Obtaining a mortgage (and finding a home) is a hassle

- Not everyone qualifies for a mortgage

- You must pay taxes and homeowners insurance

- Total housing payment can be more expensive

- Mortgage payment can rise (if an ARM)

- Sizable down payment necessary

- Maintenance costs can be excessive

- Pricey HOA dues (if applicable)

- You’re “stuck” in a home (long-term commitment)

- Increased liability and responsibility

- Transactional costs of buying and selling

- Ownership is stressful!

- Taxes and insurance generally rise

- Your home can be damaged or destroyed (and not fully insured)

- Can be foreclosed on and lose your home

Read more: When to start looking for a house to buy.

- Rocket Mortgage Completes Redfin Takeover, Offers $6,000 Home Buyer Credit - July 1, 2025

- Mortgage Rates Quietly Fall to Lows of 2025 - June 30, 2025

- Trump Wants Interest Rates Cut to 1%. What Would That Mean for Mortgage Rates? - June 30, 2025

I would say that owning a home is much better as compared to renting. First of all you are in-charge of your property you can do whatever you want whether you want to add a new room, a patio or rent out a room. Moreover, you will be able to build equity, and have your own living security, while at the same time you will have much more control over the costs.

I want to rent because it’s easier to move and cheaper.

Renting has a ton of advantages, including freedom of movement and freedom from paying for major repairs. It can also be cheaper.

I think renting is better if you move a lot which I do unfortunately as in the last 10 years have lived in 6 states. Was following my grandkids for 8 of those years and bought a house/condo in 4. Invested $70k in updating the 1938 first home. Was there 2 1/2 years. Did not realize my son had many opportunities career wise and relocated because of them. Did not realize that or would have held still and visited instead of relocating. I unfortunately want everything updated and spent quite a bit in my retirement age. Now am renting with the itch to buy, however, after reading the truth about mortgage com realized have no idea where I will live in the future so will rent.

In last 10 years following my daughter and grandkids, lived in 5 states bought in all of them. Updated every single place. My child said that I broke even on all of them. Not so sure of that with all the repairs and improvements made. Renting would of been better as did not hold still. Believed owning was better. Know better now. That said, if you will live in the same state and own a home for at least 10 years, it may be worth the investment. I am renting and itching to own but do not know for sure will live in this area. The website is very helpful in making my decision to keep renting.