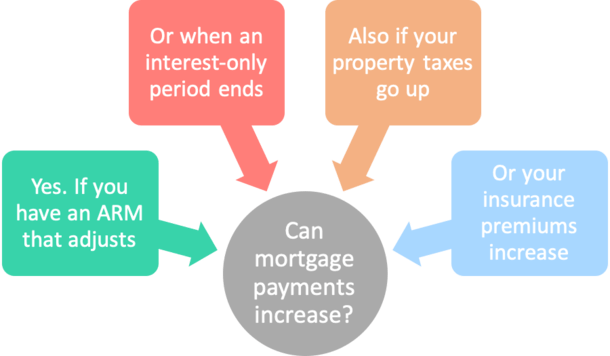

Mortgage Q&A: “Do mortgage payments increase?”

Wondering why your mortgage keeps going up? While this sounds like a no-brainer question, it’s actually a little more complicated than it appears.

You see, there a number of different reasons why a mortgage payment can increase, aside from the obvious interest rate change. But let’s start with that one and go from there.

And yes, even if you have a fixed-rate mortgage your monthly payment can increase! You’re not out of the woods.

While that might sound like bad news, it’s good to know what’s coming so you can prepare accordingly.

Why Did My Mortgage Go Up?

- Your property tax bill increased (and your loan has impounds)

- Your homeowners insurance bill increased (and your loan has impounds)

- You have an adjustable-rate mortgage (ARM) and it adjusted higher

- You had a temporary rate buydown that ended

- Your interest-only period came to an end

Mortgage Payments Can Increase with Interest Rate Adjustments

- If you have an ARM your monthly payment can go up or down

- This is possible each time it adjusts, whether every six months or annually

- To avoid this payment surprise, simply choose a fixed-rate mortgage instead

- FRMs are actually pricing very close to ARMs anyway so it could be in your best interest just to stick with a 15- or 30-year fixed

Here’s the easy one. If you happen to have an adjustable-rate mortgage, your mortgage rate has the ability to adjust both up or down, as determined by the interest rate caps.

It can move up or down once it becomes adjustable, which takes place after the initial teaser rate period comes to an end.

This rate change can also happen periodically (every year or two times a year), and throughout the life of the loan (by a certain maximum number, such as 5% up or down).

For example, if you take out a 5/1 ARM, it’s very first adjustment will take place after 60 months.

At that time, it could rise fairly significantly depending on the caps in place, which might be 1-2% higher than the start rate.

So if your ARM started at 3%, it might jump to 5% at its first adjustment. Or even higher!

On a $300,000 loan amount, we’re talking about a monthly payment increase of nearly $350. Ouch!

Simply put, when the interest rate on your mortgage goes up, your monthly mortgage payments increase. Pretty standard stuff here.

To avoid this potential pitfall, simply go with a fixed-rate mortgage instead of an ARM and you won’t ever have to worry about it.

You can also refinance your home loan before your first interest rate adjustment to another ARM. Or go with a fixed-rate mortgage instead.

Or simply sell your home before the adjustable period begins. Plenty of options really.

I had a 5/1 ARM in 2017 that I refinanced into a 30-year fixed before its first adjustment. In hindsight I’m very glad I made the switch.

Mortgage Payments Increase When the Interest-Only Period Ends

- Your payment can also surge higher if you have an interest-only loan

- At that time it becomes fully-amortizing, meaning both principal and interest payments must be made

- It’s doubly-expensive because you’ve been deferring interest for years prior to that

- This explains why these loans are a lot less popular today and considered non-QM loans

Another common reason for mortgage payments increasing is when the interest-only period ends. This was a common issue during the housing crisis in the early 2000s.

Typically, an interest-only home loan becomes fully amortized after 10 years.

In other words, after a decade you won’t be able to make just the interest-only payment.

You will have to make principal and interest payments to ensure the loan balance is actually paid down.

And guess what – the fully amortized payment will be significantly higher than the interest-only payment, especially if you deferred principal payments for a full 10 years.

Simply put, you pay the entire beginning loan balance in 20 years instead of 30 since nothing was paid down during the IO period.

This assumes the loan term was 30 years, because making interest-only payments means the original loan amount remains untouched.

It can result in a big monthly mortgage payment increase, forcing many borrowers to refinance their mortgages.

For example, a 3.5% IO mortgage with a $300,000 loan amount would be $875 per month. After 10 years of making just that payment, your monthly would jump to about $1,740. About double!

Just hope interest rates are favorable when this time comes or you could be in for a rude awakening.

Tip: This is the common setup for HELOCs, which offer an interest-only draw period followed by a fully-amortized payback period.

Mortgage Payments Increase When Taxes or Insurance Go Up

- If your mortgage has an impound account your total housing payment could go up

- An impound account requires homeowners insurance and property taxes to be paid monthly

- If those costs rise from year to year your total payment due could also increase

- You’ll receive an escrow analysis annually letting you know if/when this may happen

Then there’s the issue of property taxes and homeowners insurance, assuming you have an impound account.

Lately, both have surged thanks to rapidly rising property values and inflation. In California, many have even lost their insurance coverage, leading to massive price increases for state FAIR Plans.

Even if you’ve got a fixed-rate mortgage, your mortgage payment can increase if the cost of property taxes and insurance rise, and they’re included in your monthly housing payment.

And guess what, these costs do tend to go up year after year, just like everything else.

A mortgage payment is often expressed using the acronym PITI, which stands for principal, interest, taxes, and insurance.

With a fixed-rate mortgage, the principal and interest amounts won’t change throughout the life of the loan. That’s the good news.

However, there are cases when both the homeowners insurance and property taxes can increase, though this only affects your mortgage payments if they are escrowed in an impound account.

Keep an eye out for an annual escrow analysis which breaks down how much money you’ve got in your account, along with the projected cost of your taxes and insurance for the upcoming year.

It may say something like “escrow account has a shortage,” and as such, your new payment will be X to cover that deficit.

Tip: You can typically elect to begin making the higher mortgage payment to cover the shortfall, or pay a lump sum to boost your escrow account reserves so your monthly payment won’t change.

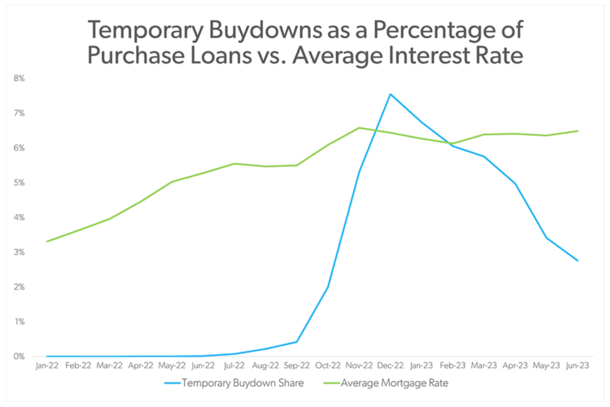

Your Mortgage Can Go Up Once a Buydown Period Ends

Here’s a bonus (and topical) reason your mortgage can go up; the temporary buydown. These have grown a lot in popularity lately.

In fact, they peaked at a 7.6% share in December 2022, per Freddie Mac, meaning many borrowers will be facing higher mortgage payments soon.

How it works is you get a discounted mortgage rate for the first one, two, or three years. Then your interest rate reverts to the actual note rate, which will be higher.

The discount can be 3% off the first year, then 2% off in year two, and 1% off in year three. So if your rate was 6%, it’d be 3%, 4%, 5%, and finally 6%.

For the remaining 27 years of your loan term, the non-discounted rate of 6% kicks in. This would obviously lead to a higher mortgage payment for those years.

Of course, this is well telegraphed and isn’t a surprise, so you should know exactly what you’re getting into, unlike an ARM where adjustments are based on the uncertainty of the market.

Still, if you don’t earmark the funds necessary for the higher payment, it could result in some unwanted payment shock.

Be Prepared for a Higher Mortgage Payment

The takeaway here is to consider all housing costs before determining if you should buy a home. And make sure you know how much you can afford well before beginning your property search.

You’d be surprised at how the costs can pile up once you factor in the insurance, taxes, and everyday maintenance, along with the unexpected.

Fortunately, annual payment fluctuations related to escrows will probably be minor relative to an ARM’s interest rate resetting or an interest-only period ending.

It’s typically nominal because the difference is spread out over 12 months and not all that large to begin with.

Though recently there have been reports of big increases in property taxes and homeowners insurance premiums thanks to surging inflation.

So it’s still key to be prepared and budget accordingly as your housing payments will likely rise over time.

At the same time, mortgage payments have the ability to go down for a number of reasons as well, so it’s not all bad news.

And remember, thanks to our friend inflation, your monthly mortgage payment might seem like a drop in the bucket a decade from now, while renters may not experience such payment relief.

Read more: When do mortgage payments start?

- UWM Launches Borrower-Paid Temporary Buydown for Refinances - July 17, 2025

- Firing Jerome Powell Won’t Benefit Mortgage Rates - July 16, 2025

- Here’s How Your Mortgage Payment Can Go Up Even If It’s Not an ARM - July 15, 2025