A friend of mine asked me over the weekend how mortgage interest works? His coworker had posed a similar question to him, and he was passing it on to me.

At first, I didn’t know how to answer the question as it was fairly broad. I said what do you mean by that?

He said, if you have a rate of 3% and a loan amount of $1 million, does that equate to $30,000 in interest?

Wishful thinking, right? I explained that mortgage rates should be viewed as annual interest rates.

Long story short, you pay a lot more than the interest rate on the loan because that rate of interest is paid annually for 30 years in most cases.

Look at Mortgage Rates as Annual Interest Charges

A better way to understand how mortgage interest works is to consider the mortgage rate on an annual basis.

So if your 30-year fixed mortgage rate is 5% and your loan amount is $500,000, you’d pay roughly $25,000 in interest the first year.

Note that I said the first year and roughly. The reason it’s a rough estimate is because the loan amount isn’t fixed.

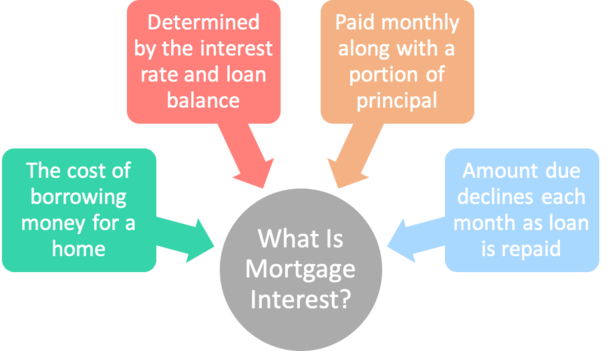

Each month, you pay a portion of interest and a portion of principal. As such, your outstanding loan balance falls with each payment.

This means less interest is due on subsequent monthly payments, and because mortgages are amortized (same payment amount each month), the composition of the payment changes.

As each payment is made, less interest is due (thanks to a smaller loan balance), and more of your payment goes toward the principal balance instead.

Using our example, you’d have a monthly principal and interest payment of $2,684.11.

The very first payment would consist of $2,083.33 in interest and $600.78 in principal.

If you multiple $2,083.33 times 12 (months), you’d get $25,000, which is that 5% interest rate applied to the $500,000 loan amount.

That’s the easy part, and perhaps how you can visualize mortgage interest at work.

Mortgage Interest Goes Down as Payments Are Made Each Month

But remember that the loan amount isn’t static, even though the monthly payment amount is.

Because $600.78 of that first mortgage payment was principal, the loan balance is no longer $500,000.

It’s now $499,399.22. This is a good thing. Your loan is being paid off, even though it’s still quite large.

For month two, the same 5% interest rate is charged, but now it’s based on an outstanding balance of $499,399.22.

If we do the math again, it’d be $2,080.83 in interest, slightly less than in month one.

It’s still a 5% rate of interest, but less is due thanks to the smaller balance.

And because your mortgage payment amount is fixed, that means the remainder of the $2,684.11 goes toward principal.

This works out to $603.28 in principal being paid down in month two. It’s not a big jump, but it is an additional $2.50 going toward the principal balance.

That also means it’s $2.50 less being paid in interest. However, the interest rate is still 5%.

For all of year one, you’d actually pay $24,832.48 in interest. Not the full $25,000 because the loan amount wasn’t $500,000 the entire year.

It dropped each month as principal payments were made.

Consider the Final Mortgage Payment to Visualize It Better

Hopefully my example that broke down the first year’s mortgage interest charges was helpful.

But why don’t we also look at the final mortgage payment too to see where things end up.

Remember, it’s the same monthly payment amount for the entire 30 years, or 360 months on a 30-year fixed mortgage.

This means payment #360 is still $2,684.11. And the interest rate is still, you guessed it, 5%!

However, the outstanding balance at the end of the loan term is only $2,671.65. So using our same 5% interest rate, we only owe $11.13 in interest for the final payment.

Remember, the 5% rate of interest is based on the outstanding balance. And because most of the loan has already been paid off for 29 years and 11 months, there’s not much left.

The final payment is that $2,672.97 in principal remaining, plus the $11.14 in interest, which again totals $2,684.11.

Total Mortgage Interest Paid During the Entire Loan Term

Now we know the 5% rate of interest is annual, and during year one alone it’s nearly $25,000.

So how much is it when we look at all 30 years of the loan term, assuming it’s a 30-year fixed kept until maturity?

Well, it’s a big number. We’re talking more than $466,000, which is nearly the same as the original loan amount.

That puts the total interest paid as a percentage of principal at about 93.25%. In other words, you would have paid about 93% of the original amount borrowed in interest alone.

In total, you would have paid about $966,000, nearly a million dollars, to repay a $500,000 mortgage.

This is where the anti-debt, anti-mortgage folks get fired up because they argue that the 5% mortgage rate isn’t genuine.

Instead, it’s a 93% interest rate, or something. But really, it’s just math, and how any loan works that you hold for a long period of time.

Mortgage interest is paid annually for decades, so the total amount of interest due will be very high.

If you don’t like it, you’re always free to pay off your mortgage early, if you have the capacity to do so.

But perhaps your money is better served elsewhere, especially if you’ve got a low 2-3% fixed interest rate for the next 20-odd years.