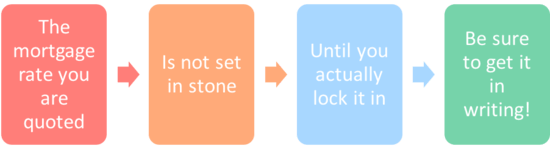

A “mortgage rate lock” is essential to ensure you actually receive the interest rate you are quoted by a bank or mortgage broker.

When you purchase real estate or refinance an existing mortgage, you’ll need to lock in a mortgage interest rate at some point during the loan process. You can do this early on or later in the process, depending on your preference.

While comparing lenders, you’ll you be presented with a mortgage rate quote, but it will mean very little until it’s actually secured, or “locked” by a bank or lender.

It’s kind of like a car dealer telling you a price over the phone, then you show up at the dealership and the price is a lot different for whatever reason. Until you have it in writing, it doesn’t carry much weight.

What Is a Mortgage Rate Lock?

When you lock in a mortgage rate, you are guaranteed that interest rate, assuming your loan actually qualifies under said lender or bank’s guidelines. And as long as you close by the lock expiration date.

By locking your home loan, you secure a specific interest rate for a given loan program based on the day it is locked.

For example, you may be told that the 30-year fixed is being offered at 3.5% today for your desired loan amount and loan-to-value ratio (LTV).

Once you formally apply, you’ll be given the opportunity to lock in that quoted rate so it doesn’t change if market conditions worsen.

Just know that mortgage rates change daily, so a quote from yesterday might mean nothing today.

The rate lock will also include any associated costs, known as discount points, or lender credits, which offset any closing costs you’d otherwise have to pay out-of-pocket.

So the lock actually cements your interest rate and the costs associated, both of which can fluctuate until you’ve formally locked.

It will also detail the loan amount, loan term, and the mortgage index and margin if it’s an adjustable-rate mortgage (ARM).

If any of these things change before you close (e.g. you need a larger loan amount), your lock is also subject to change. But it will still be based on the pricing from the day you originally locked.

Most lenders don’t charge a rate lock fee, but they’ll often ask for a deposit at the time you lock for the home appraisal as an indirect means of making sure you’re committed to the loan application.

For example, if you lock with them but then decide to use a different lender, it could cost them, so they want some assurances.

Choosing a Mortgage Rate Lock Period

- 15 days

- 30 days (most common)

- 45 days

- 60 days

- 90 days

When you lock your loan, you must also choose a rate lock period, which is how long the rate is actually good for.

Once this period ends, your lock will expire and you’ll lose that price unless you pay an extension fee.

In other words, you need to fund your loan before the lock expires.

Locks can range from 7 days to 90 days or even longer. In fact, loanDepot recently introduced a 150-day rate lock.

But the most common lock period is anywhere from 15-45 calendar days, which is the average time it takes for a home loan to close.

For example, if you agree to a 15-day lock on December 6th, your lock will expire on December 21st. If you do a 30-day lock, it will expire on January 5th.

The longer the lock period, the worse the pricing will be, all else being equal, because it’s risky for a lender to offer a guaranteed rate over time.

While the mortgage rate may not be different based on the lock period, the closing costs will most likely vary. So you might find yourself paying more in closing costs for a 45-day lock vs. a 15-day lock.

It’s important to pick the appropriate length of time to ensure you get the loan closed (funded) before the lock expires, without subjecting yourself to additional fees.

Either way, you will always have the opportunity to extend your rate lock at a relatively small cost if the process gets delayed, which it often will!

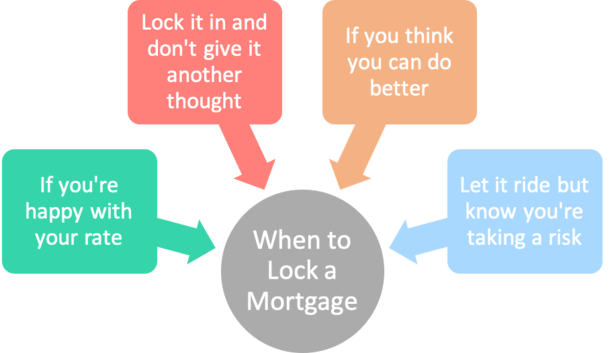

When to Lock Your Mortgage

- There is no universal right or wrong answer here

- It’s always going to be a moving target (like timing the stock market)

- Base your decision on the current interest rate environment (trending up or down)

- And the amount of time you have until your closing date

Some borrowers may choose to lock in a mortgage rate at the initial time of the loan application, before the loan is even submitted to the underwriting department.

This is known as a “pre-lock,” and ensures the interest rate is set before the loan is even underwritten.

It can be helpful to pre-lock your mortgage rate if the debt-to-income ratio is close to the maximum, so if there are any interest rate fluctuations, the DTI won’t be exceeded.

It could also be a smart move if mortgage rates are rock-bottom and there is little expectation for rates to improve further.

However, this option is typically only available on a refinance or for a purchase loan that has has a fully executed purchase contract.

If you’re simply shopping for a home, a pre-lock probably won’t be an option.

Others may float their mortgage rate and lock their mortgage at the last minute, effectively gambling on the hopes of mortgage rates improving later in the loan process.

If you feel mortgage rates have more room to fall, this could be the way to go. But as mentioned, it’s a gamble and there’s no guarantee.

You can typically lock your loan Monday through Friday during normal business hours, which tend to mirror market hours.

Some lenders may allow a lock on a weekend, but the pricing will likely factor in the uncertainty of the week ahead.

Can Mortgage Rates Change Once Locked?

- Once you’re locked, your interest rate won’t change

- So even if rates rise after the fact your low rate will still be honored

- However, if rates fall after you lock, you won’t get to take advantage of them

- Unless the lender provides a float-down option for a small fee

Nope. Once you lock in your rate, your rate cannot change as long as your loan funds before the lock’s expiration date.

For example, if you lock in a rate of 3.75% on a 30-year fixed mortgage and rates shoot up to 4.5% over the next week, you can give yourself a pat on the back.

Those who didn’t lock will have to contend with the higher rates, but you can rest assured that your rate won’t change.

However, it’s also possible for mortgage rates to drop after you locked. In this case, you might be perturbed, but again, your rate won’t change, or improve in this case, either.

In that sense, you’re taking a risk by locking on a certain day. For the record, there is no special day to lock, or a better day to lock than others.

It’s like asking someone what the best day to buy stocks is. Plenty of opinions I’m sure, but no one really knows.

“Should I lock my mortgage today?”

If you’re asking this very cliché question, consider the following:

- Are you happy with the rate and fees being charged today?

- How much do you stand to gain if rates improve?

- How much time do you have before you must lock in order to comply with all lender timelines?

- Could a rate spike jeopardize your loan entirely?

- What’s the current rate trend? Is it your friend?

- Is any big economic or geopolitical news on the horizon?

- Do you like to take risks?

As a rule of thumb, the longer you have until the close of escrow, the more chances you have of mortgage rates improving.

Conversely, if you only have a couple weeks before you close, you’re taking more of a risk by floating your rate.

Put simply, mortgage rates tend to rise and fall all the time, and if you have a longer period of time to float, there’s a better chance you’ll see a favorable day or two to lock in a great rate.

This is why it may not make sense to lock well in advance.

For example, if you have a 45- or 60-day escrow, you’ve got a lot of time to watch rates and see how things go.

It might be prudent to just take a wait and see approach, especially if mortgage rates jumped higher in recent days or weeks.

The ebb and flow might benefit you if a long period of rising rates suddenly reverses course.

It’s kind of like buying airline tickets. Imagine you’ve got three months before you trip. You have time to sit and watch fares to see if they come down. And even if they go up, they might come back down again.

If your flight is in two weeks, you don’t have that luxury, and could wind up with an even higher fare if you push it to the last minute.

Ultimately, it’s your choice and will be dictated on your risk appetite and/or if you’re satisfied with where rates are on a given day.

Think it through and try not to be too impulsive. No one know with certainty if rates will go up or down tomorrow, next week, or next month.

What If My Rate Lock Expires Before Closing?

- You generally have several options here

- Including a lender courtesy to extend the lock a few days for free

- Or you can pay a lock extension fee if you need even more time

- This will increase your closing costs, but ensures your original rate is honored

As mentioned, mortgage locks don’t last forever, they come with a set time period.

Assuming you lock your rate early on, there’s a chance the rate lock period could be exhausted, at which point the lock could expire.

If the rate expires before loan closing, you’ll need to get it re-locked. This could entail worst-case pricing (assuming mortgage rates have risen) AND a re-lock fee.

For example, if rates went down, you’d be stuck with your old, higher rate and a re-lock fee to boot.

And if rates went up, you’d be subject to a higher rate, which is even worse. In other words, don’t let your lock expire.

Ask for a Rate Lock Extension

- Don’t stress if time is running out on your rate lock

- Just be sure to discuss an extension before the lock actually expires

- This will keep your original pricing intact for an extended period of time

- If you’re lucky the lender will extend it a few days for free if that’s all you need

Typically the lender will keep an eye on the rate lock period and issue a “rate lock extension” before the lock actually expires. Doing so will ensure you get to keep the rate you originally signed up for.

However, rate lock extensions don’t come for free either. If it wasn’t the lender’s fault, the cost of the rate lock extension could run you several hundred dollars or more, depending on the associated loan amount.

It is calculated as a percentage of the loan amount. So you might be charged .125% for a 7-day lock extension, or .25% for a 15-day extension. These fees will vary from lender to lender and could be more or less.

The higher your loan amount, the higher the cost. On a $200,000 loan amount, you’d be looking at a cost of $250 or $500 to extend the lock period, respectively.

While that fee sounds like a raw deal, holding onto a rate that is an .125% or more lower could save you a lot of money over the term of the loan.

In other words, it’s better to get the extension than let the lock expire for fear the rate could rise.

If the delay happens to be the lender’s fault, they will generally offer a free rate lock extension for seven days out of good faith.

This should be enough to get the loan closed without any cost to you. Even if it is your fault, you might be able to get a few free days to ensure the loan closes before the lock expires.

In any case, you can try to negotiate a lock extension in your favor, and ask them to extend it for free if you feel it was out of your hands. They may work with you to retain your business and avoid you going elsewhere.

Rate Lock Break Option

- You might be offered a rate lock break

- Assuming mortgage rates fall substantially from the time you locked

- This could give you the opportunity to snag an even lower rate

- But there is usually a cost involved so make sure you plan to keep the loan for a while

Some lenders may give you the option to “break your lock” if rates substantially improve after you lock.

However, this option will come at a cost. For example, say you lock in a rate of 4.625% and rates all of a sudden fall to 4%.

The lender may let you execute a rate lock break whereby you get a rate of 4.125% (an eighth over the prevailing market rate) at an additional cost in the way of discount points.

In other words, you’ll wind up with a lower rate than what you originally locked, but you won’t get quite the lowest rate currently available, nor will you get it for free.

You’ll pay some fraction of a point to get it, perhaps a quarter or half a point.

Then once you break even on that initial upfront cost, you can save money via lower monthly mortgage payments year in and year out.

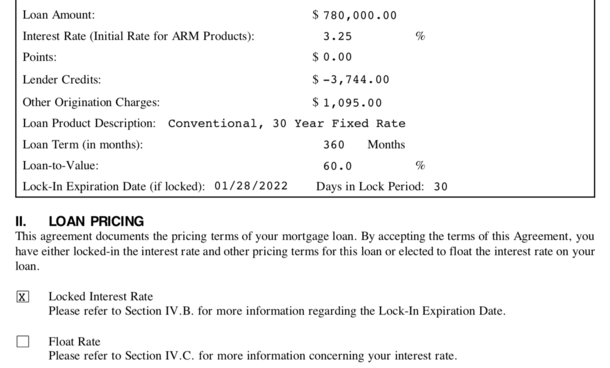

Get the Mortgage Lock in Writing!

- Always get your mortgage lock confirmation in writing!

- Ask for it when making your verbal rate lock request

- And keep the paperwork in a safe place in case anything comes up along the way

- It’ll be your story against theirs if you were simply told your rate was locked

It’s important to stay on top of your mortgage rate lock, and also to make sure you have the rate and terms in writing.

Never just assume a mortgage broker or bank has locked your interest rate.

As you can see from the Loan Terms Agreement form pictured above, the interest rate for this particular loan has been locked.

It details the interest rate, lender fees, and the lock expiration date. Most importantly, the “Locked Interest Rate” box is checked.

If the loan isn’t locked, the “Float Rate” box will be checked, meaning it’s subject to change until locked.

You should receive this form or something similar with your original disclosure package. Pay close attention to it.

They may say your rate is this or that, or that it’s locked, but in actuality they may be floating your rate in the hopes of getting a better commission.

Or perhaps you’ve been misquoted, and they’re praying the mortgage rate will come down to what they originally quoted you.

I’ve seen that happen a million times. They’ll go into panic mode if they failed to lock a rate initially, often after quoting their borrower a guaranteed low rate.

They’ll call the mortgage lender each day to see how mortgage rates have moved, and nervously push on day after day, waiting for the moment rates fall to the level they were initially quoted.

Sometimes they will settle for a lower rate with less commission to them, but often they’ll simply tell the borrower the rate is higher for some reason.

And the borrower will just have to accept it because they’ve spent so much time working on the loan that they’ll just want to get it done.

Watch Out for Changes to Your Mortgage Rate

- Always beware of a possible bait-and-switch

- Where you’re quoted a low mortgage rate initially

- Then told something entirely different later on

- Also pay attention to the closing costs and terms to ensure everything is correct

Some unscrupulous loan officers and brokers may even change the original terms they quoted you to produce a lower rate.

Such as raising the margin, adding a prepayment penalty, or changing indexes, caps, or even loan programs.

They may also tell you that mortgage rates increased since you were first quoted. This might be true, but it could also be baloney.

Keep an eye on rates yourself to see what’s going on in the market to avoid getting taken for a ride.

In summary, make sure you know exactly what you’re getting when it comes to the interest rate and terms associated with your mortgage rate lock.

Any mistakes here will lead to higher monthly mortgage payments for years to come, or a major headache if you fail to jump on a good rate early on.

Sure, you can hold out for better, but if you’re happy with a certain interest rate, might as well not take chances.

And again, always get your lock confirmation in writing from the bank or broker before you proceed with the deal! This cannot be stressed enough!

- UWM Launches Borrower-Paid Temporary Buydown for Refinances - July 17, 2025

- Firing Jerome Powell Won’t Benefit Mortgage Rates - July 16, 2025

- Here’s How Your Mortgage Payment Can Go Up Even If It’s Not an ARM - July 15, 2025

USAA quoted me a mortgage rate of 3.625% with .625 points. I called the next day and they locked me in for a different rate of 3.625% with 1.125 points. This was not disclosed, and I would not have asked them to move forward with the credit check and loan process for that rate. I asked that they pull the phone record of our call. Now, I’m not able to even use USAA to see if they have lower interest options at this point and now my credit score will show that it was checked. Is there anything I can do?

Hannah,

Sounds like a company you won’t want to do business with if the cost jumped that much and they didn’t tell you. You can shop around and not worry about credit inquiries because FICO knows when you’re shopping for a mortgage by grouping together credit hits from multiple lenders into one single hit.

MAKE SURE YOU ARE NOT PAYING-OUT ANYTHING BEFORE YOU LOCK-IN YOUR INTEREST RATE AND RECEIVE YOUR FULL DISCLOSURES.

Fannie Mae, Freddie Mac does not regulate or require any financing institution, including Banks or Credit Unions, to purchase an appraisal prior to locking-in a clients mortgage interest rate.

I am approaching closing and my rate was locked for 30 days. I spoke to the banker on September 28th, my loan application was generated on September 29th and I signed the loan application on September 30th. My lender is saying that the interest rate was locked and if the closing does not occur by September 28th I would have to pay a fee to extend the lock. I signed on the 30th and docs were generated on Sept 29th. They want to charge me $150 for 1 day extenion. It seems suspect.

I’m doing a refinance and want to cash out as much equity as possible without incurring PMI. The house appraised higher than expected but our rate lock was based upon a lower refinance amount (the house appraised 12% higher). Our lock is expired (but we’re being given a free two day lock extension)… I’d like to increase the amount of the loan to maximize the cash out… The bank is telling us that we’d need to pay for a new lock if we wanted to change the loan amount… This doesn’t sound logical to me, because our going in position was based upon wanting to get the maximum amount of equity out of the home (e.g. we really didn’t make a specific loan amount request – we stated a goal to which the loan originator assigned a value)

What are the reasons that the bank doesn’t want to allow us to change the loan amount at this point?

Christine,

Lock extension fees are common and normal – if it was their fault ask for them to cover the fee in good faith.

John,

Check their rate lock policy. They may not allow loan amount changes once the rate is locked. Of course, you can always try to work something out with them if they were aware of your intention to see what the value came in at.

I applied for a 10 year refinance and I got approved for the amount requested. I then locked the interest at a great rate (2.75%). The lock is good if the loan amount does not change by more than $10,000 below or above the original amount approved. Unfortunately my house did not appraise for the amount I expected and I have to reduce the amount of the loan by $20,000 to stay at 80% loan to value to avoid paying PMI. Now, the interest rate is higher. Will I be able to relock the interest rate if it goes down again?

Borrower,

Check the bank’s lock policy to determine if you can relock at market price or if it’s worse-case pricing. Or try to negotiate with them to honor your rate.

Hi, I called my Loan officer and told to lock the rate verbally. They sent me the Disclosure document to sign but I haven’t signed anything yet. I have to sign them until 11/26. Can I still shop around and re-negotiate with them in case I find a lower rate? Would they be ready to negotiate again and give me a new rate since I have not signed anything yet. Also, in case they are ready, would they charge me anything?

Jains,

Sounds like you told them to lock your loan, meaning it should be locked on the day you agreed to lock. You can still shop around with other lenders, but your original lender may charge you a non-refundable fee for appraisal or other costs (check your paperwork to see if anything is charged upfront). And negotiating once locked could prove difficult unless you have a compelling reason.

Hi Colin,

Appreciate your time. I am just wondering if there is any possibilities that either loan officer or lender try to kill time, for any reasons, to make the rate lock expires intentionally. Would there be any benefits for either of them?

Mitra,

If they’re the ones delaying it, they’d be the ones that should pay for any lock extensions while maintaining your original rate/price, so I wouldn’t think so.

Hello Colin,

Could a lender change mortgage rate after they bought my loan from another lender, in this case B of A? I had a great rate of 30yrs fixed at 2% after going through a trial period. Now Fay Servicing, the new lender, says it is still a trial period and wants to increase my interest rate. Please help. I do have B of A papers that state that it was fixed at 2% for 30years. Could B of A sold it to Fay under pretense that it was still in modification period? Do I have any power to tell Fay that with B of A, I had fixed 30yrs at 2%? Please advise.

Thank you so much for your advice.

Annie,

You may want to read your paperwork closely to determine if that 2% rate is truly fixed for the life of the loan. If so, you may want to inquire with BofA/Fay to get to the bottom of why they’re trying to increase it. If they shouldn’t be you should be able to argue accordingly.

Hi, I locked in a rate with USAA over the phone. It went down .10% the next day. I got the paperwork and it looks like I am agreeing to it when I sign. Can I still call and ask to lock in a new rate and for new papers to sign? Or is there something else I am missing? Thanks!

Joe,

Until you lock you can ask for a price update if you believe rates have fallen.

I am a Vet and currently in a VA loan.

I just started the process to refi.

The originator stated she locked me into a 3.25% in which we signed for.

The next day the lender sent us a 3% rate lock, we were happy to sign.

The originator states it a mistake.

Can the lender rescind?

If he truly made a mistake, the opening page came from SVP of Marketing.

Please advise.

Joe,

If it was truly a mistake they’ll likely stick to their guns. You could ask to meet in the middle, at 3.125%, out of good faith if you feel you’ve been wronged. Not sure if fighting for 3% will get you anywhere, but that’s between you and the lender.

Hey Colin… Think your site is great. My wife and I are first time home buyers. We won the bid on our house (agreed that we’d close by April 15th). Our mortgage lender asked if we wanted to lock and because rates were so low (3.25) and potentially going up, we agreed believing we’d finish the process by that time. The seller suddenly hit us with wanting to close late in June. We’re trying to negotiate an earlier closing but they’re not budging much… Perhaps only a few weeks under a U&O as they apparently want to stay in their house until their daughter graduates high school. (Something not mentioned earlier.) Our lender said they could extend the lock to April 25 and after which, it would be $85 a day. Over the course of two months, that’s pretty sizeable. I’m not quite sure what to do at this point. Do we allow the rate to lapse and then start the process again in April to entirely to stay within a 60 rate lock hoping for a better number even though rates are going up? (As we predicted.) We feel pretty screwed by the sellers at this point but, knowing they had other offers on the home, aren’t sure what recourse we have.

Greg,

That’s unfortunate. If you do decide to let the lock expire and relock with the same lender make sure their lock agreement allows for new market pricing and not worse-case based on the original day you locked. Most do if enough time has passed. Rates can also drift lower over time…you have several months to eyeball rates so there’s a potential advantage there as well if you look on the bright side. There’s always the option to look at other lenders during this time as well.

Thanks for your help Colon. I appreciate it! Will keep you posted on how it all turns out.

Hi Colin

Applying for a 30yr fixed with NYMCU

Disclosures quoted a 3.669 apr on 3/14 I signed on 3/16 but they do not lock the rate. Was called today and informed that the rate went up to 3.75! Don’t know the apr yet. There paperwork states the rate is not guaranteed so does this mean that the rates could keep going up until I close. I’m so disappointed because for the past few weeks while shopping for a loan the credit union was consistent in offering 3.66 until now that I’m actually near the end of the process then I’m hit with the increase.

Any suggestions.

Lydia,

If you want to lock your rate you need to tell them and ask for paperwork to ensure it’s locked at the rate you desire. Unfortunately, rates do fluctuate if they aren’t locked, though they can move both up and down. If you’re totally unhappy you can try to negotiate with them or get new quotes from other lenders that may offer lower rates.

Hi Colin,

I’m in the process of trying to lock a rate from my builder’s lender. They’re offering 3.875% and $1295 credit. Is that good? Another lender offered me 3.625%, but if I go with them, I will have to pay an extra $3500 in closing costs since the builder won’t pay the entire $7K if I go with another lender. Thoughts?

Capree,

Depends what you do with the mortgage…if you keep it for a long time eventually the lower rate will pay off because you’ll have covered the closing costs and will be enjoying a lower rate (payment) each month for years to come. But if you don’t keep it for very long it could make sense to limit out-of-pocket costs. There’s always a third or fourth lender to compare to as well…

Dear Colin,

My lender quoted me 3.5% for a 30 yr fixed rate and when I asked him several times to lock in the rate, he either says he will lock it in later or he simply doesn’t reply my email. Our appraisal has already came back, the price is 12% higher than our buying price. And he has already submitted our application to the underwriter. We are 20 days away from the settlement date, given the fed announcement few days ago, I really want to lock in the rate as it will very likely to go up in june. Any thoughts why our lender doesn’t want to lock the rate for us now? I actually told him that even it’s slightly higher than 3.5% we can also stomach. Any way to get him lock the rate for us or shall I change to other lender at this point? I feel it’s a bit late to change lenders as we are only 20 days away from settlement. Thanks a lot!

Thanks,

Alice

Alice,

That’s frustrating but not unheard of. I’m sure he will have some excuse for not getting back to you, but it’s always good to get a lock in writing so there aren’t any surprises at the 11th hour. Good luck!

Hi, We are a first time home buyer and have signed up for a new construction condo that will be ready around July-August 2017. Is there a way that we can get a guaranteed fixed rate mortgage commitment. We have an excellent FICO score and will paying down 20-25% of the price.

Thnx

– SAM

Sam,

It’s possible to lock rates in ahead of time via pre-lock, though it depends on the lender. Many lenders also have very long lock periods, such as 90-120 days, but the longer the lock period, the less favorable the pricing because they are guaranteeing a rate for a lot more time and that is clearly more risky.

Hi Colin,

I am awaiting closing on loan which has passed the 60 day lock period and is now in an extension period due to lender and underwriters and no fault of my own. With todays market, the rates had dropped significantly enough to warrant re-consideration. Can I ask this lender to re-lock at a lower rate and can they do this without additional costs to me or what would be my best option?

Thanks,

Mel,

You can certainly ask for a float down at no cost in light of market improvements, but there’s no guarantee they’ll oblige. Typically, you kind of have to state your case to get some kind of benefit.

Hi Colin R.

I am buying a home soon, got a disclosure from a lender on my locked interest rate at 4.25% for 30 Year Fixed Rate Conventional with all closing costs taken care by the Lender (around 3500$ paid by lender and around 3600$ for escrow etc.) The agent locked it for 15 day I believe. House around 235K, for 10% down by me, credit score around 750. Is 4.25% a good rate to be locked at? When I googled the current interest rate, it shows around 3.7% as of July 4th on multiple websites. Please suggest. Thank You. Syed Rah

Syed,

Hard to say – it looks like you’re getting a pretty big lender credit to pay all closing costs and a good chunk of escrow and you’re only putting 10% down. The rates you see advertised might be for 20%+ down at par (no closing costs paid for by lender). The rate may also be higher if mortgage insurance is built in, or lower if paid separately.

Hi Colin R,

We have recently purchased a new construction house. We locked the rates in a while ago and now it looks like we’re going to just go over our rate lock in period. We have been told that if we don’t take the rate lock extension (we don’t want to do this as interest rates have dropped a bit) that we will have to wait 31 days before anyone else can get us a mortgage. Is this true?

Thanks, Stephen.

Stephen,

Sometimes the bank you originally went with will subject you to worse-case pricing for a period of 30 days once the lock expires, but other lenders may have no problem re-locking your loan at current pricing.

Hi Colin R,

I am trying to refinance a 30yr fixed, as a single guy with over 770 credit score. I have 20% down and have had a recent appraisal to confirm.

I’m in Illinois, and the rate I am getting is around 4.125. The bank is requiring I pay an $1800 relock fee at that rate (long story), which i’m not sure is a good idea. My loan officer can knock it down to $1200.

Is the loan APR rate too high? Would it be wise to relock or what can I do to get a current rate if they are better? Bankrate lists < 3.5% for Illinois.

Charles,

It’s hard to say whether that rate is good/bad without knowing all the details, but paying a coupe grand to relock doesn’t sound very favorable. Options might include waiting for X days until the relock fee no longer applies or taking the loan to a different lender that ideally has a lower rate and no relock fee to worry about. Might want to shop around first to see what kind of rate you can get elsewhere.

My bank is offering me a 90 day rate lock today 10/5/16. Do you think I should lock or float to a 45 day or shorter lock? I realize this is an educated guess.

Justin,

The general way to look at it is if you’re happy with the rate and don’t see rates getting any better before you close, lock. If you aren’t fully sold on the rate and think there’s room for improvement (enough to justify waiting), you can float. But then you’re guessing, like you said, unless you’re an expert on the matter.

I’m about to close on a VA refinance 30 yr fix but was expecting $3200-3500 lender credit when I did the 90 day rate lock at 3,25% back in late July. This was agreed upon over the phone after I shopped around for a few days and they came with an additional ~$1000 lender credit and that’s when I decided to lock it in. But now my lender is giving me only $2200 credit due to the lower loan amount from the estimated $331000 to the final total of $327400. I was never told that it can fluctuate during our initial conversation plus that now he doesn’t remember giving me the extra ~$1000 amount even though that was the main reason I decided to go with this lender. Is there any possible recourse?

Peter,

The credit is dictated by the loan amount because it’s a percentage of the loan amount, so it can move lower with the loan amount. As for the $1000 you verbally discussed, I don’t know, that’s between you and the lender.

I am purchasing a new home and it will not be done until January 2017. The loan officer wanted me to lock 90 days interest rate until January with 0.125% higher interest rate then the current rate. Should I lock or wait until 30 days before closing?

Jean,

That’s up to you…essentially if you think rates will rise from now until then locking now might make sense and vice versa.

I’m in the process of purchasing a new home. I closed on my last home on Sept 9. My new home is scheduled to close on Dec 14. In mid-October I noticed a credit check was done. I contacted the lender and asked if it was them that pulled the credit. It was, and was told that all is good and they sent it to underwriting. They had qualified me in June at 4.25 but was told to pay down some debt and I should be able to get a lower rate. Was also told that once the old mortgage had been removed the rate should increase as my credit score would get a jump. They came back with a 4.125 rate. I questioned this since I had been told on a couple of occasions that I could expect about 3.70-3.90. They pulled up my credit report and told me it was because my old mortgage hadn’t dropped off. I was furious at that point since that is exactly what they were waiting for but only gave it three-weeks since closing (they did the pull on Oct 4). My understanding is they should have waited at least 30-days to insure the mortgage dropped. Because they didn’t wait my rate was higher due to not making it to the next level in my credit score. I was told they could run it through again but wouldn’t do it until the week of November 14. They also mentioned that the rates would most likely increase after the election. A week or so passed and I saw a jump in my scores on two free credit score sites. I called them and told them what I saw. I wanted them to run the credit right then to get the rate but they said we already agreed on week of November 14. The manager called and persuaded me to wait until the week of November 14th since she didn’t think the rates would go up until December. So I wait and now the rates have bumped up. The credit check was done yesterday but I haven’t heard back from them yet (I probably will have to call them). Having pulled my credit too soon after selling the old house makes me feel as though they are incompetent. I also can’t believe they didn’t see that my old mortgage hadn’t been removed before sending to underwriting. I feel I’m dealing with an incompetent lender or a dishonest one. Do I have any repercussions on their incompetence/dishonesty if they come back with a higher rate? I’d even accept the 4.125 now but it really should have been lower had they done their job correctly. Why do I have to police everything they do?

Hi Colin:

I was told my someone I trust who has purchased 7 homes over the years as B&B that she got taken advantage of a mortgage lender who gave her a low rate and then three days before the closing he upped her rate by 2%. She told me that mortgage lender do this all of the time and suggested I go with a credit Union. The problem is I am new to the state and took early retirement (I’m 56) it seems I don’t qualify. One exception is one credit union will agree to do my loan if I have good credit (I do) and worship in the area. So are these mortgage lenders nothing but a scam like she said? I already signed papers with the seller for a condo but have yet to meet with the lender. No assessment has been done and it won’t happen for at least two weeks. I checked with other banks and their interest rates seem to be ridiculous.

I started escrow November 1st Ann’s signed loan documents shortly after via esign. The rate said 4.0%. I was pushing to lock rate before election and she told me it can’t happen until after appraisal. Appraisal was completed on the 14th. By dragging her feet and through many phone calls from me she then changed her answer to can not lock rate until after I’m 100% qualified. She now called me and said that I’m 100% qualified but now a month and a half later I can lock my rate at 4.5%. What is this all about? It seems like a racket.

Betsy,

Like any other business there are bad players and irresponsible people who can overcharge and/or mess up your loan, thereby causing fees to go up if they don’t lock in time, etc. You just have to vet them like you would any other business, and get everything in writing to ensure you aren’t bait and switched. Good luck!

Hi colin. I currently have a 5/1 arm with 3 years left on it @ 3.125%. I have some equity and want to eliminate my PMI so I am in the process of a refi to conventional. Lender offering 4.5% or a buy down to 4.375% for conventional loan. This will reduce my monthly mortgage by about $150 – $175 (including taxes and insc). While not a lot of savings, I have concerns rates will rise dramatically so want to lock now? Do you think it’s worth it?

Kem,

$150-175 per month is nothing to sneeze at for most people. Have you shopped around elsewhere to see if you can get a better rate or that same 4.375% without having to pay for it? Not sure rates will rise dramatically…again, seeing that they’ve already jumped a lot, in fact, it’s possible they could improve at some point.

Colin,

August 4, 2016 I applied to refinance my 3 properties. The process was delayed because they made a mistake on the type of appraisal to get for one property. Finally, Oct 4 we went ahead with the closing of the other two.

It took them months to order another appraisal and get the refi in order. Now they have increased the fees x7 and increased the rate.

They have declined to honor the original rate or quoted fees.

This company is so very dysfunctional. I have had to deal with at least a dozen different people.

What can I do about this?

In addition, though it is a FM loan, no other company was able to qualify me. Did they fudge my numbers?

Ruth,

Hard to say without knowing all the details. Some lenders may deny a loan another will accept, even if Fannie is okay with it due to things like overlays and lender risk appetite, etc. As for the fees and rate, again hard to say without knowing what increased and why. The rate probably went up because rates have surged in the past month or two.

What is the rule on a 12 day lock expiration letter?

Do you send an additional one even though the rate has been extended?

This might just be a New York rule but I could use clarification.

Thanks!

I locked in a rate that is to expired 12/29/16 when my contract is to close. There was a problem with the septic tank on the house that didn’t let it pass an inspection. So no fault on my part. The new closing date is two months from now due to having to have a new septic being installed. The lender said I would have to pay a fee to break the lock. I was not aware of this and this was not communicated to me during

The process. Can I change lender and if so, am I obligated to Pay the lender any fees?

Kim,

Is it the seller’s fault, or is it just one of those unexpected events? Unfortunately, lenders can’t keep your rate locked forever, especially when they’ve increased since you locked. But they should make it very clear upfront that there’s a fee if you break your lock. Might want to review the rate lock form and/or see if you can work things out with all parties to avoid any unnecessary fees. It could just be a non-refundable application fee that you lose, perhaps in the form of an appraisal you paid for. But if a new lender can get you a lower rate it might be beneficial to move on and eat the cost.

The seller knew the septic tank is old and needed repairs. They had it repaired but it didn’t pass.

We received an initial LE for a VA Refi/Cashout and gave our intent to proceed. One week later, they fired the original loan officer after noticing that he charged us .5% instead of 3.3% on the VA funding fee. The next LO (Senior Vice President) stated that we had to pay the difference, which was over $10,000. After a few weeks of discussion, the lending institution agreed to honor the error with a credit, however, they upped our unlocked interest rate from 3.75% to 4.75%, even though the rates have dropped below 3.75% in the last two weeks. Can they just up the interest rate to whatever they want in order to cover their zero tolerance mistake?

Glenn,

Sounds like a mess. Are they really paying the difference if it’s being absorbed by you via a higher mortgage rate, especially if rates didn’t increase and in fact dropped?

Just working on buying a new house but am torn between the 180 day lock and 90 days. Looking at the current market trend what would u recommend. Thanks

Ike,

It depends on how much time you need – will it takes 180 days to close or just 90? Also compare pricing on both locks and upside/downside. Generally, rates are expected to hover in their current range this year, but you never know.

Hi Colin,

I made a contract with a builder and my house is being built now. My estimated closing is on June 27th.

One lender offered me 4.125% rate and 3 month free lock which will end on June 10th. After that date , they will charge 60 $ per day lock extension fee.

The main reason to apply this lender is , he told me I can pay PMI as low as 107 but after application , PMI shown 188.5 .

He said it is because of my 2nd lien .(car) , my CLTV is passing 100%.

I hope my explanation is clear.

Should I accept his offer or wait for FED`s decision ?

If I pay my cars loan by half , do you think I can decrease my PMI.

FHA or Conventional or 10/1 ARM is more logical?

Thank you very much.

Nuri,

You have a lot of questions but paying $60 per day for 17 days is over $1,000. There might be a lender out there with similar pricing willing to offer a 90-day lock that won’t require additional extensions. Maybe paying off your car could lower the LTV to the point where PMI isn’t necessary, but make sure it’s enough to do so. Loan choice is entirely up to you and your risk appetite, plan with the property (how long you’ll keep it), if you like today’s rates, etc. Good luck.

Colin,

Under contract with a close on May 15th. To lock in today 3/23/17 is about $620. If I wait another 12 days, i’m on a different locking rate and price to lock would be $350.

In your opinion, and taking into account the current market, would you lock now or wait the 12 days.

Thank you!

Lendee,

The million-dollar question…no one knows with any certainty what will happen tomorrow. We’ve had a good week or so in terms of rates, but that might change suddenly. If you’re happy with your rate, you need to ask yourself if $270 is worth stressing over for the next 12 days. That’s if it stresses you out, it might not. And you might save by waiting…either way it’s your call. Good luck!

Hi Colin, would love your two cents. I’m purchasing through a HomePlus program and I was told a week ago that my rate was “locked” which I have in writing. Then I get a surprise in the Loan Estimate with a higher interest rate. The Lender is now taking responsibility for their mistake – they never did lock the loan – but because it’s a govt program, they say the rate “is what it is.” I close in 2 weeks and will lose the property if I went with another lender so late in the game (market is tight where I am). What is an appropriate concession for this .25% rate hike/mistake that the lender made? They’re offering to pay the mortgage insurance. Is that a good concession? It serves as a disincentive for me to pay off the balance earlier (which I thought I might do). They say MI will drop off in 10 years.

Thank you!

Dee,

You’ll have to do the math to see if the higher rate is being offset enough by the mortgage insurance concession. You can always push for more (maybe an .125% better in rate to meet in the middle) and try to negotiate, depending on what the mistake was and how accountable they should be for it.

Hello Collin!

We are offered an interest rate of 4.375 for a conventional 30 years fixed loan. Our house would be finished August 31/2017… The lender told us that we need to pay for extension to lock the mortgage rate. I want to know your prediction … will that rate go up or down significantly?

Lyne,

In my 2017 prediction post I said rates would pull back, then rise and close 2017 higher.

However, it could be a bumpy 2017, with rates seesawing up and down all along the way. The question is could you get caught out in a bad month, or luck out and get a low rate in a particularly good month if you just wait to lock. Or will rates just do very little and remain unchanged, thereby making it cheaper to wait and do a shorter-term lock? No one knows for sure but locking way in advance is likely locking in a higher cost to lock.

Hello Colin,

I locked in a 4.375% rate yesterday with a signed Float/Lock Agreement document. Can i tell my loan officer i want to unlock the already locked rate since rates are lower today and my closing is in 30 days?

Basil,

If you locked you can’t unlock if rates go down, otherwise it wouldn’t make any sense to lock in the first place.

Hello Colin – I’ll try to make this short. I applied for a jumbo cash out refinance, 30 year fixed. The interest rate provided by the lender is 4.125. Both the loan application and the loan estimate, both populated by the lender quote 4.125. A couple of days ago, I received an email from the lender asking if I wanted to lock this rate and if so, I need to respond by 3pm. I did reply and said, “Yes, please lock the rate.” I received a follow up email from my lender stating he made a huge error and the rate is 4.5. Can I hold him to the 4.125?

Colin,

My 30 day rate lock expired and my broker Relocked my loan for 30 days because it was cheaper than getting a 30 day extension. My Relock is about to expire. What are my options? Can I get an extension to the Relock? How does pricing work with that scenario? If not, do I have to get a new mortgage.

Thanks for your time.

Ron

Ron,

It depends what their re-lock policy is and what rates are like now vs. when you originally locked…it sounds like they took care of you once, not sure they’ll be able to do that again, at least not on the house. But you’ll have to ask why it’s being extended, because of you or because of the lender. If it’s the lender’s fault for the delay, they should try to accommodate you, if it’s you, well, you may have to pay a bit or face worse-case pricing. Generally it’s an .125% of the loan amount cost to extend for a week longer. The good news is if rates haven’t changed or worsened since you locked, they might be able to extend it for free.

Hi,

we are in the process of buying a house. The homeowner/seller is a real estate agent. She and her sister inherited the house from their Mother. The Seller bought out her sister but never had a quick claim deed. She is currently trying to find her estranged sister, this is causing a delay in the closing rate beyond our locked in rate. Would it be unreasonable to ask the seller to pay the additional cost of a 15 day extension?

She is a licensed agent and should have disclosed that she did not have a quick claim deed to provide to the title company.

Louise,

It’s perhaps reasonable, but whether they agree and will compensate you is another story. Ideally, your real estate agent can work out a deal where you aren’t on the hook for any extra costs as a result of their delay.

Hi Colin,

So my bank is now doing a promotion for no origination fee for any new mortgages with a rate-lock occurring between 1/1/18 and 3/31/18. However, they are trying to charge me the origination fee because they claim that I locked the rate as of 12/18/17, over the phone, even though they have only just now sent me a document to sign confirming the locked rate, dated 1/4/18, which I have not yet signed. Nonetheless, they are still claiming that my rate was locked as of 12/18, and as such I do not qualify for the promotion. Thoughts?

Chris,

Sounds like they locked on your behalf or perhaps you don’t recall agreeing to lock verbally on the phone at that time. Another hitch is what the rate was locked at and what rates are like now…either way, you can argue and try to get your way.

selling house to my son, he locked in at 4.75, now 3 days before closing they say they miscalculated settlement fees, and have to change interest rate to 5.25, they had him sign change order to keep closing date, what recourse do we have?

Mike,

Depends why the rate went up – if they raised it to cover those additional closing costs, an alternative might be to pay those costs out of pocket to keep the original rate of 4.75%.

Hi Colin,

I am currently refinancing a loan amount of about $600,000 and my rate lock has expired. My lender extended the rate without asking for my consent on any fees and now wants to charge me an extra 1.1 point for a 30 day extension. This seems pretty high to me. Is this normal?

Christina,

Ask for a breakdown of that extension cost – it sounds steep, as if the lock was broken and re-locked at worse-case pricing since rates increased lately. But the only way to find out is to ask. Typically an extension may only cost .125% or .25%.

Hi,

My rate was locked a week ago and I went ahead and signed my mortgage contract making sure that the rate lock field was checked. Today, after over a week from that, the lender came back to me and said that they made a mistake from their side and assumed that the property was a townhouse but they discovered today that it is a condo. When I created my loan application, I specified that the property was a condo but he is saying the the website listing was mentioning that it was a townhouse and that was led him to the mistake. Now they are proposing me a rate much higher and wanted me to sign it asap to avoid delays in my closing date. Is this legal??

Hi Seyf,

Not sure how much higher they’re proposing, but there is a pricing adjustment for attached condos on conforming loans (you can check Fannie Mae LLPAs if applicable). For example, the condo hit is 0.125% for LTVs up to 75%. And 0.75% for LTVs of 75%+. These are adjustments to fee, not rate. That 0.125% works out to $125 per $100,000 borrowed, while 0.75% is $750 per $100,000 borrowed. Sometimes the interest rate can be increased to absorb that extra cost instead of borrowers paying it out-of-pocket.

That makes sense but is it legal to hide that fee from the mortgage contract and ask for it right before closing? A week ago, I had better rates with other lenders than this new proposed one and they all mentioned the fact that my house was a condo not a townhouse so rates were higher. Now this lender already made me pay for the appraisal fee and even if I decide to lose more on that and choose another lender, I am sure that they will provide me a higher readjusted rates since the 30-yr conv. mortgage rate went up these last days.

It sounds like the other lenders knew it was a condo and priced accordingly, and the other one made a mistake that is now being disclosed. So not sure it was hidden to begin with, but could explain why they had the more competitive rate. If you feel wronged, you could ask for them to split the difference or negotiate in some way. Maybe they can waive one of their lender fees for their mistake?