Mortgage Q&A: “How much do mortgage brokers make?”

If you use a mortgage broker, you may be curious what they earn and how they’re paid.

In short, mortgage brokers work as middlemen between borrowers and banks/lenders, so they can be compensated by either party.

They are typically paid a percentage for each home loan they originate, as opposed to earning a salary.

So if we know what they make per loan, we’ll have a decent idea as to what they might take home each year as well depending on annual volume.

But you have to consider their costs to operate as well, which will vary based on how large their shop is, if they employ loan officers, how much they spend on advertising (if any), and so on.

How Does a Mortgage Broker Get Paid?

- They can choose to get paid by either the lender or the borrower

- They can charge an origination fee directly, which comes out of the borrower’s pocket

- Or elect to get paid by the lender, which is indirectly paid by the borrower

- The latter results in a slightly higher interest rate, meaning it’s paid over time via higher monthly mortgage payments

In the recent past (before April 1, 2011), mortgage brokers could make money on both the front and back end of a mortgage loan.

Simply put, they could charge a loan origination fee directly to the borrower and also get paid by the mortgage lender via a yield spread premium (YSP).

This YSP was the commission the bank or lender provided in exchange for a mortgage rate above market.

In short, the higher the interest rate, the more YSP the broker would receive from the lender.

YSP was also referred to as “par-plus pricing”, as the compensation pushed the interest rate above the par rate. Or “rate participation fee”, “service release fee,” and many other vague variations.

Mortgage Brokers Used to Get Paid Twice on the Same Loan!

Brokers had the ability to make several points on the back end of a loan, potentially earning thousands of dollars, sometimes without the borrower’s knowledge.

They could also collect money on the front end of a loan via out-of-pocket closing costs like loan origination fees and processing costs, which the borrower paid directly.

For example, back in the day it was possible for a broker to charge one (or more) mortgage points upfront for origination, receive another two points on the back from the lender, and also tack on things like loan processing fees.

All told, they could make three to five points on a mortgage, aka 3-5% of the loan amount. If we’re talking a $500,000 loan amount, that’s anywhere from $15,000 to $25,000 per loan!

And it could be even higher for jumbo loans. Prior to the housing crisis, it wasn’t unheard of for brokers to make massive commissions like this.

They Could Ask for the Max Rebate…

You’d hear about them asking for “max rebate” on the back end, which was the limit wholesale lenders would pay out, while still convincing the borrower to pony up an origination fee on the front end.

As a result, brokers could essentially be paid twice for the same transaction.

The beauty of it was the yield spread premium came in the form of a higher mortgage rate. So it didn’t even look like a fee or a cost to anyone – it just meant the borrower had a slightly higher mortgage payment for the entire loan term.

In other words, the borrower was saddled with a higher rate for the life of their loan and may have also paid a commission upfront, without realizing it.

Had the broker just charged the upfront fee and nothing else, the borrower may have received a mortgage rate of say 4% instead of 4.5%.

In hindsight, it probably didn’t matter because most of those loans didn’t last more than a few years (or months) before they were refinanced or foreclosed on. Eek.

How Mortgage Broker Compensation Works Today

- Brokers can no longer get paid twice on a single loan

- They must now choose how they want to be compensated, by the borrower OR lender

- But they may have a different compensation package with each lender they work with

- So their commission could vary from loan to loan depending on where it’s placed

As noted, the controversial practice outlined above was outlawed in 2011.

The Fed came in and changed all that by effectively banning yield spread premiums, and now mortgage brokers can only get paid by the borrower OR the lender, not both.

That doesn’t mean they can’t still make a lot of money per loan, it just means the way they can get paid via the wholesale mortgage channel has been limited.

In other words, they either charge you directly to close the loan or they get paid by the lender and you pay for that commission indirectly (not out-of-pocket at closing) via a higher interest rate.

If charging directly, the borrower pays for the broker fee or origination fee, loan processing, and so on. Compensation can also vary from loan to loan.

If being paid by the lender, it’s similar to YSP. But brokers must now choose a compensation plan upfront with each lender they work with, as opposed to charging different amounts on each loan as they see fit.

They Must Stick to One Compensation Plan for All Loans with a Given Lender

And they usually must stick with that compensation plan for three months before they can change it again.

For example, they may choose to earn 1% commission on every loan they close with Bank A. So if the loan amount is $500,000, they’d earn $5,000. If it’s $300,000, they’d only get $3,000. And so on.

But they may select a higher compensation structure with Bank B that gives them 1.5% on each closed loan.

Assuming the loan terms and cost are the same, they can send your loan to Bank B for a higher commission, as it won’t affect what you ultimately receive.

However, a different broker may decide to set all their compensation levels at 2%. And if you happen to work with them, your interest rates may be higher across the board to account for their larger commission.

So you kind of have to compare mortgage brokers too in order to find the one offering the lowest rate/costs.

In other words, you can still get a raw deal, or at least a not-as-good deal. The good news is they can no longer get paid on both the front and back end of the loan.

But you should continue to be vigilant and look over your loan documents to ensure you aren’t being overcharged.

In short, you’ll want your broker to send your loan to the bank that offers you the lowest interest rate, not the one that gives them the highest commission.

What Is the Mortgage Broker’s Commission? And How Do I Find It?

So you’re applying for a home loan and want to know the mortgage broker’s fee. I don’t blame you, it’s important stuff.

But if the interest rate and combination of closing costs are favorable relative to other banks/lenders/brokers, it doesn’t really matter what they make.

Still, you should know and you have a right to know. Here’s how to find out.

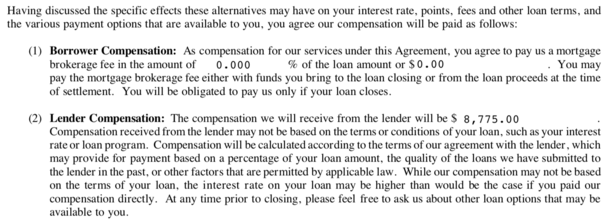

When signing loan disclosures early on in the process, look out for a “Loan Brokerage Agreement” form that spells out their commission, and whether it’s borrower- or lender-paid.

The screenshot above is an example where a broker earned $8,775 via the lender for facilitating the loan. Not bad for one loan, eh?

To figure out how much they’re making on a percentage basis, simply take the compensation amount and divide it by the loan amount.

The loan amount in this example is $780,000, making their compensation 1.125%. It’s reasonable as they could charge 2% or more depending on the wholesale lender they partner with.

You can also find the broker fee on the Closing Disclosure (CD) and the ALTA Settlement Statement when it’s time to sign docs and close your loan.

Okay great, so what do brokers make?

- A survey said they were paid 2.25 points per loan on average

- On a $300,000 loan amount that would be $6,750 in compensation

- While it sounds like a tidy sum, you have to consider their volume and operating costs as well

- It’s pretty close to what real estate agents make, usually 2.5% of the sales price

A press release from 360 Mortgage Group detailing the compensation changes said mortgage brokers generate an average revenue of 2.25 mortgage points on a home loan.

For example, on a $500,000 mortgage, they’d make roughly $11,250 in revenue. That sounds pretty good, doesn’t it?

But as mentioned, we have to subtract the costs of doing business, which are variable. From there, you’d have your profit per loan.

Not a bad take for helping people get mortgage financing, depending on how many loans are closed each month, and what expenses are involved.

Mortgage Broker Pay Will Vary by Location

As you can see, mortgage broker salary will definitely vary based on the size of the loans they typically close. In more expensive areas of town (or the country), brokers might make six-figures or much, much more.

While those in lower-priced metros could make significantly less if costs are still relatively similar.

Additionally, brokers who focus on mortgage refinances might have higher loan volume than those who help home buyers purchase real estate, as the latter can be harder to come by and slower to close.

Of course, if they partner with a local real estate office or two, they have the ability to generate a ton of purchase loan business too. So it’s hard to say either specialty would be more successful universally.

Their average income will also depend on the financial institutions they choose to partner with, as compensation structures and points per loan will vary across different mortgage lenders.

One aspect of a mortgage broker’s job is linking up with lending partners that are good at quickly closing loans, while also offering competitive pricing. As such, these partners can greatly affect a mortgage brokers salary.

[How to get a wholesale mortgage rate?]

Will mortgage brokers still make the same money?

- While it might be more difficult to make a ton of money on a single loan

- Brokers still have the ability to make a very good living even with limited volume

- A broker who closes just $2 million a month could earn over $500,000 annually

- Very few other occupations pay anywhere close to that much

The 360 Mortgage Group believes brokers will be able to adapt to the compensation changes. And if you know anything about the mortgage business, new rules are typically circumvented overnight.

Many mortgage lenders are now publishing multiple mortgage rate sheets, with one version lender-paid compensation and the other borrower-paid compensation.

So brokers can simply pick up a specific compensation-based rate sheet they’d like and be on their way.

For example, if they want to make 2.50 points, there’s a rate sheet for that. If they only want one point, there’s a rate sheet for that too.

But the rule change will probably reduce average incomes for loan brokers since they won’t be able to take a little from both the front and back of the loan.

Receiving compensation from just one entity, as opposed to two, means it’ll be more difficult to charge an excessive amount per loan, though not impossible.

This is good news for home buyers and existing homeowners looking for refinance who will hopefully enjoy lower mortgage payments. But bad news for mortgage brokers, who continue to lose market share. It could also dent their total pay.

It’s recommended that you shop for a mortgage by gathering rate quotes online, at your local bank/credit union, and also via a mortgage broker or two.

You’ll never know who might have the best rate/terms unless you actually take the time to shop around!

Read more: Why use a mortgage broker?

- Mortgage Rates Quietly Fall to Lows of 2025 - June 30, 2025

- Trump Wants Interest Rates Cut to 1%. What Would That Mean for Mortgage Rates? - June 30, 2025

- What the Fannie Mae and Freddie Mac Crypto Order Really Means - June 26, 2025

This was a very good read as I am currently in the beginning stages of opening my mortgage broker firm. This information conjured up more questions and curiosities for me. Thank you!

Kevin Rice

Realtor/Managing Broker

Koncierge Real Estate LLC

Is the broker allowed to charge a borrower a 1000 dollar underwriting fee, despite being paid compensation by the lender

Karan,

Some lenders permit a flat fee to be included in total broker compensation. Not all charge it.

Hi Colin,

I completed a refi (no cash out) about 4 months ago and with drops in rates, it makes sense to refi again. I tried to use the same lender but they say there is a 6 mo. seasoning requirement, otherwise as a Fannie/Freddie loan, they’re going to be on the hook to repay compensation and will end up losing money on the original deal because of how aggressively they price their loans. In fact, if I refi with any lender within that 6 month period, they state they will forfeit some compensation. How does this work? For loans recently refinanced within 6 months, what happens with lender compensation?

Lou,

It’s known as commission recapture, and basically protects investors from losing money if the loans they purchase last mere months. It’s a hotly debated topic because while brokers will say not to refinance, another might gladly take your business if it doesn’t affect them. There’s also the question of whether this should fall on the consumer. Why should they suffer (have to wait) if rates plummet right after a refi? Counterpoint is should you be refinancing that frequently? As you can see, complex issue…

It’s true please don’t do this to them just wait rates are going lower.

What are some mortgage broker franchises worth looking into?

As a mortgage loan officer for over 20 years and a mortgage broker since 2013, I would have to say that when you describe Lender Paid compensation stating that the consumer pays in the form of a higher interest rate is a little disingenuous. The whole truth is that the rates that are being sold even with a 2.25 Lender Paid comp in the wholesale space is still beating bank and retail lender rates, So why would you say in the form of higher rates? Most banks are selling at 2.5 to 5% yield spread but because they are lenders they dont have to disclose. No one sells at par rate.

Patrick,

It’s more the idea that the interest rate will be higher if they choose lender-paid vs. borrower-paid compensation (and pay cash at closing), not that wholesale rates are higher than retail. As you stated, the interest rate can still be lower than retail banks if they pay nothing out-of-pocket.

Hey i had a question? Do you have to become a mortgage loan officer before you can become a mortgage broker? Also do you need to have a storefront for the mortgage brokerage firm?

Thanks.

Jonathan,

I don’t think it’s compulsory to be a loan officer before becoming a broker, but it’s probably a common path. Someone who is very knowledgeable could probably jump straight into being a broker. And maybe hire some seasoned LOs to work with them. As far as a storefront, I’d say no because these days most things can be done electronically. You probably still need a business address though, which might have to be your own residence if that’s the case.

How much does a mortgage broker pay his/her loan officer (as a percentage of the commission) on a typical loan?