Mortgage Q&A: “How to get a wholesale mortgage rate?”

Wholesale mortgage rates tend to be considerably cheaper than their retail counterparts, though it’s never a guarantee with so many lenders out there these days.

To get your hands on one, you need to shop for your home loan with a mortgage broker, who has access to wholesale mortgage rates via their lender partners.

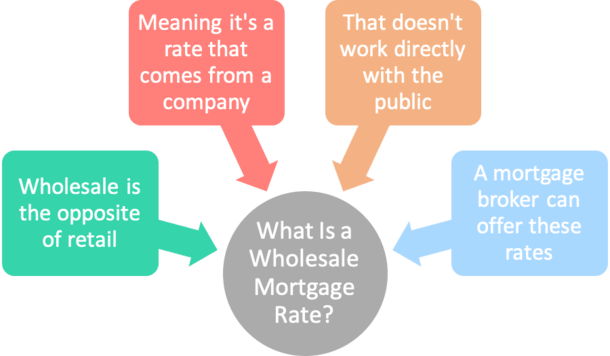

What Is a Wholesale Mortgage Rate?

- It’s an interest rate offered by a mortgage broker to a homeowner

- Via a wholesale lender partner (B2B lending channel)

- They differ from retail mortgage rates that are obtained by consumers directly from a bank/lender

- Can be higher, lower, or the same depending on the lenders in question

Mortgage brokers work as middlemen (and women) between homeowners and mortgage lenders.

That means they’re both client-facing (with you) and directly in contact with wholesale lenders.

They receive pricing from Account Executives, who are basically like loan officers, except they only deal with brokers, not the public.

In other words, you can only get your wholesale rate by working with a broker, who acts as an intermediary between you and the Account Executive (AE).

Typically, brokers have a handful of wholesale banks they work with directly, all with different rate sheets and loan programs. And perhaps most importantly, pricing!

Once you begin working with a broker, they can compare rates among these lenders and ideally provide you with the lowest rate (and closing costs) available.

Instead of shopping with a single retail bank or credit union for a mortgage rate, a broker can shop your loan application around with a number of different wholesale lenders all at once to find you the most competitive rate.

So the advantage can be two-fold, as you can benefit from both access to wholesale rates and a greater number of different lender options to compare. And you don’t have to do the legwork!

This can be especially helpful if you’re not one to shop around, which is apparently a lot of people out there.

Wholesale Mortgage Rates Come with Associated Rebates or Costs

- Your wholesale rate might have a commission baked in

- Meaning you won’t have to pay for it out-of-pocket

- But the trade-off is a higher interest rate

- Unless you’re willing to pay those costs yourself at closing

In the past, brokers could earn a commission for offering a rate above market, known as the yield spread premium, while also getting an upfront commission from the borrower.

This has since been outlawed to prevent steering borrowers into high-cost loans. It was also absurdly expensive for the homeowner to be charged twice.

Today, a broker has the option to get paid a certain percentage of the loan amount directly by the lender, or they can charge you on the front-end via mortgage points (loan origination fee).

They aren’t allowed to do both, so they must choose between borrower-paid or lender-paid compensation.

In most, cases, borrowers opt for lender-paid because it means they pay less (or nothing) out of their own pocket, which tends to be the preference.

The broker’s commission aside, you might still be on the hook for closing costs and/or mortgage points if you wish to buy down your rate, or obtain a slightly lower rate than what was initially offered.

If there is a cost associated with the interest rate, you will have to pay mortgage discount points to obtain that rate.

So all those amazing rates you hear about, which might be in the 1-2% range, often require that you pay multiple points upfront out-of-pocket.

That can equate to thousands of dollars at closing, which might save you money if you keep your loan long enough to recoup the costs. Just tread carefully.

While they aren’t deceiving per se, you should know what you’re getting if you’re offered a below-market rate and/or a rate that is nowhere close to the competition.

This is yet another reason why it’s key to look at both the interest rate offered and the closing costs, which collectively make up the mortgage APR.

Those who only take the time to consider the rate might be missing the full picture.

Now, if there is neither a cost or a rebate, it is considered the par rate, meaning you receive the exact rate you qualified for. However, certain third-party closing costs may still apply.

If there’s a rebate, it goes to the borrower via a lender credit, meaning it can cover some or all of your closing costs so you don’t have to pay them out-of-pocket.

This can be quite beneficial if you’re light on cash or simply don’t want to pay for a given interest rate.

Take the time to compare all the options to determine if it’s worth paying anything, or if it’s better to just settle for a slightly higher rate in lieu of paying closing costs.

Often, the difference might only be an eighth of a percent (0.125%), which could be negligible monthly payment-wise.

Wholesale Channel Might Not Offer the Best Pricing

- Wholesale mortgage rates may not actually be lower

- Despite brokers often vehemently claiming they are

- There are a lot of different lenders out there with competitive pricing

- So it’s wise to shop both the retail and wholesale channels

As with anything else you shop for, it’s important to keep in mind that a wholesale rate may not always be the best deal for you.

Retail banks can compete with wholesale lenders by charging lower fees and/or using existing relationships to knock down the mortgage rate.

So while a broker may tell you they’ve got access to the lowest rates available, they may not be able to compete with certain banks or credit unions you have a prior relationship with.

Or it could be that a retail bank (or online mortgage lender) has a pricing special for a given loan product that the wholesale guys simply can’t match.

Additionally, not all brokers work with the same wholesale lenders, nor do they set their compensation levels at the same rate.

This means rates can vary from broker to broker, so it could be wise to shop your broker too, instead of just assuming one broker will shop on your behalf.

Like retail lenders, it might be worthwhile to speak to one or two (or more) to see if pricing differs among them. Yes, it’s more work, but the return on investment could be huge.

In summary, it’s best to compare both routes (mortgage brokers vs banks) to determine which is best for your unique situation and home loan needs.

You should certainly put in the time to compare different rates at a variety of banks to ensure you don’t miss anything better that might be out there.

Tip: If your loan scenario is particularly tricky, you may be best served by going with a mortgage broker, as they’ll be able to find potential solutions in a shorter period of time.

- UWM Launches Borrower-Paid Temporary Buydown for Refinances - July 17, 2025

- Firing Jerome Powell Won’t Benefit Mortgage Rates - July 16, 2025

- Here’s How Your Mortgage Payment Can Go Up Even If It’s Not an ARM - July 15, 2025