The term “Alt-A mortgage” gets thrown around a lot, and for good reason. It’s kind of the generic term for any loan that isn’t prime (A-paper) or subprime. In other words, it falls somewhere in between, but that can result in quite a range in loan quality.

Ultimately, its definition is really dependent on the investor who sets the guidelines and how it’s packaged and sold on the secondary market.

As such, it’s one of those mortgage terms that isn’t easily defined. It means different things to different banks and lenders, and many characteristics that make up an Alt-A loan are often gray. But I’ll do my best to give you the general idea.

Alt-A Loans Typically Feature Limited Documentation

- Most Alt-A loans aren’t full doc (verified tax returns and assets)

- This means income is either stated r it’s some kind of asset-based loan

- A popular option these days relies on bank statements instead of tax returns

- While it’s an acceptable measure of a borrower’s ability to repay the loan, it’s perhaps not as sound as traditional underwriting methods

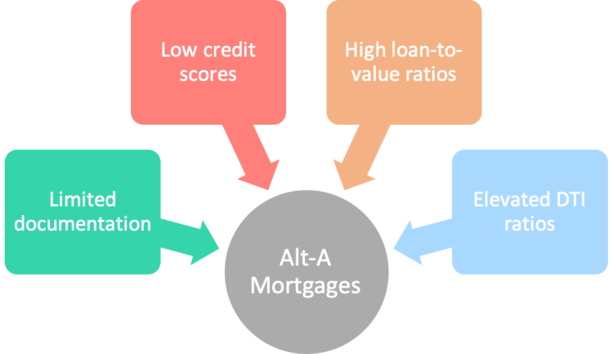

Perhaps one of the most overwhelming characteristics of Alt-A mortgages is their tendency to be limited documentation loans.

Most so-called Alt-A loans are not full doc, meaning income is not verified, but rather stated or thrown out altogether.

The same goes for asset or employment documentation. If a borrower prefers not to verify asset reserves or disclose employment history, the loan may also be referred to as an Alt-A loan.

These factors alone can lead to Alt-A categorization, even if the associated credit score is excellent and down payment ample.

Credit Score Can Be Excellent or Marginal

- This is where things get a little less clear

- An Alt-A borrower may have excellent or perfect credit

- Or a marginal or even bad credit score

- Because credit score doesn’t necessarily drive the definition of Alt-A

This is a fuzzy aspect of Alt-A lending, because Alt-A loans can yield credit scores from 620 all the way up to 800+.

I suppose the general rule you can count on is that Alt-A loans will not fall below a credit score of 620, which is typically reserved for subprime loans.

In the credit realm, you can also reasonably assume that Alt-A borrowers may have some permissible blemishes or shortcomings on their credit reports, but nothing too harrowing.

If they do have a bankruptcy filing or major derogatory accounts, this could be grounds for a subprime loan.

But typically that will be reflected in the credit score, and would likely disqualify the borrower from obtaining an Alt-A loan because of score alone.

If the borrower does have an excellent credit score, they may have a limited credit history, which could prevent them from obtaining a prime loan. Remember, a credit score means very little without solid history behind it.

High Loan-to-Value Common on Alt-A

- Alt-A home loans are typically low down payment loans

- 100% financing was common during the early 2000s

- Today they might feature a larger down payment

- If they are lacking something else like clean credit or the ability to fully document income/assets

Another typical quality of an Alt-A loan is its relatively low down payment. Most mortgages that fall into this category are characterized by minimal down payments, if any at all.

Often times this can be the driving factor behind a loan falling into Alt-A status.

The borrower may have great credit and the ability to document their income and assets, but no down payment to speak of.

For example, on an investment property, where loan-to-values are often limited, Alt-A lenders may allow 100% financing, certainly classifying the loan as Alt-A.

With a prime mortgage lender, the max loan to value (LTV) would likely be 80% or less. Most 100% or zero-down mortgages are also classified as Alt-A.

This makes the loan a greater risk to the investor, because limited or no equity in the home means a greater likelihood that the borrower could walk away or foreclose on the property if things turn south.

Alt-A Lenders May Allow Flexible Debt-to-Income Ratio

- You might find more flexible DTI maximums beyond what is typically allowed

- This allows borrowers to boost purchasing power if it’s a home purchase

- Or to more easily qualify for a refinance if in need of a lower rate and/or cash out

- Either way it will make the underlying loan more risky because the borrower is using a greater percentage of their income to pay back the loan

Typically, the debt-to-income ratio is a bit more flexible with an Alt-A loan as well. Instead of a DTI ratio of 30/40, the ratio may be more forgiving, such as 35/45.

This is important because it allows the borrower to qualify for a loan much more easily, essentially letting the borrower buy more “house” or put less money down.

That could ultimately stretch a borrower too thin, leading to a higher frequency of payment default. For that reason, Alt-A loans are typically priced higher because of the perceived risk.

Finally, some may classify a mortgage as Alt-A simply because of a mix of risk factors. This is known as layered risk, whereby the borrower presents risk to the lender in a few different ways, all at once.

An example would include a marginal credit score, say 660, a limited down payment, say 5% down, and a borderline DTI. Together, the attributes push the loan into Alt-A territory. Alone, maybe not.

Interest Rates on Alt-A Loans

- Mortgage rates on Alt-A loans will be higher than A-paper home loans

- Because there is added flexibility to account for additional borrower risk

- And simply because lenders can charge more if such loans aren’t available everywhere

- Always strive to be the best borrower possible so you can get financing from any mortgage lender

Because Alt-A loans come with more flexible mortgage underwriting guidelines, the interest rate may suffer. And by suffer, I mean go higher than you want it to.

This isn’t an absolute, but generally the mortgage interest rate on an Alt-A loan will be more expensive than the rate tied to an A-paper loan, all else being equal.

Again, this can be murky, but as a general rule, expect a higher rate if your loan is deemed Alt-A.

This might have to do with the fact that you can’t get these types of mortgages everywhere. As such, less competition and fewer mortgage lenders vying for your business means higher rates.

Additionally, the greater the combination of weaknesses you have in the above categories, the higher your rate will be because pricing adjustments will apply in each department.

For this reason, you should always strive to be the best borrower you can be to open yourself up to the most financing options and secure the lowest rate.