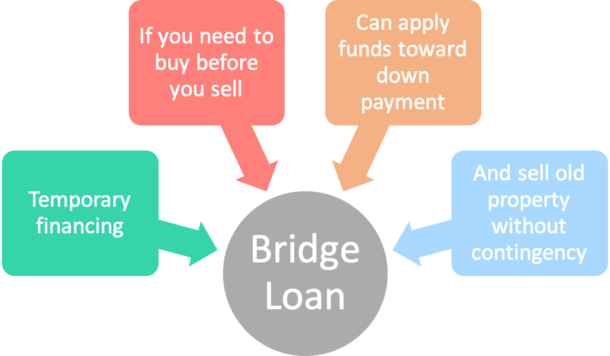

A “bridge loan” is essentially a short term loan taken out by a borrower against their current property to finance the purchase of a new property.

Also known as a swing loan, gap financing, or interim financing, a bridge loan is typically good for a six month period, but can extend up to 12 months.

Most bridge loans carry an interest rate roughly double the average fixed-rate product and come with equally high closing costs.

Bridge loans are generally taken out when a borrower is looking to upgrade to a bigger home, and haven’t yet sold their current home.

A bridge loan essentially “bridges the gap” between the time the old property is sold and the new property is purchased.

Bridge Loans Can Help You Drop Home Buying Contingencies

- If the home you want is in a competitive housing market

- Home sellers typically won’t agree to contingencies from the buyer

- To solve the buy before you sell quandary

- A bridge loan might be a good solution to fill the gap

Many purchase contracts have contingencies that allow the buyer to agree to the terms only if certain actions occur.

For example, a buyer may not have to go through with the purchase of the new home they are in contract for unless they’re able to sell their old home first.

This gives the home buyer protection in the event no one buys their old home, or if nobody is willing to buy the property at the terms they desire.

But when a home seller won’t accept the buyer’s contingency, a bridge loan might be the next best way to finance the new home.

In fact, some real estate companies have partnered with lenders to extend bridge loans at no cost, including large brokerage Compass.

How Do Bridge Loans Work?

- A bridge loan can be used to pay off the loan(s) on your existing property

- So you can buy a new property without selling your current one

- Or it can act as a second/third mortgage behind your existing loan to finance a new home purchase

- It may not require monthly payments, just payment in full once you sell

A bridge loan can be structured so it completely pays off the existing liens on the current property, or as a second loan on top of the existing lien(s).

In the first case, the bridge loan pays off all existing liens, and uses the excess as down payment for the new home.

In the latter example, the bridge loan is opened as a second or third mortgage, and is used solely as the down payment for the new property.

If you choose the first option, you likely won’t make monthly payments on your bridge loan, but instead you’ll make mortgage payments on your new home.

And once your old house sells, you’ll use the proceeds to pay off the bridge loan, including the associated interest and remaining balance.

If you choose the second option, you’ll still need to make payments on your old mortgage(s) and the new mortgage attached to your new property, which can stretch even the most well-off homeowner’s budget.

However, you likely won’t need to make monthly payments on the bridge loan, which can make qualifying for the new mortgage easier.

Either way, make sure you’re able to take on such payments for up to a year if necessary.

Most consumers don’t use bridge loans because they generally aren’t needed during housing booms and hot markets.

For example, if your home goes on the market and sells within a month, it’s typically not necessary to take out a bridge loan.

But if the housing market cools off, they might be more common as sellers experience more difficulty in unloading their homes.

They may also come into play if the new property is highly sought-after and you need a stronger offer (e.g. larger down payment) for acceptance.

Bridge Loan Rates Are Typically Quite High

- One downside to bridge loans are the high interest rates

- Relative to longer-term, traditional financing options

- But because the loans are only intended to be kept for a short period of time

- The interest rate may not matter all much that

As noted, interest rates on bridge loans can be costly, typically double or higher than what you’d receive on a traditional home loan.

Like a standard mortgage, the interest rate can vary widely depending on all the attributes of the loan and the borrower.

Simply put, the more risk you present to the bridge lender, the higher your rate will be.

For example, if you need a very high-LTV loan and you’ve got marginal credit, expect an even higher rate.

But if you’ve got excellent credit and plenty of home equity, and just need a small loan to bridge the gap, the interest rate may not be all that bad.

And remember, these loans come with short terms, so the high cost of interest will only affect your pocketbook for a few months to a year or so.

Just be mindful of the closing costs associated, which are often also inflated because lenders know you’ll be fairly desperate to obtain financing.

Bridge Loans Can Be Risky

- Be careful when you take out a bridge loan

- As there’s no guarantee your existing home will sell in a timely manner

- Pay attention to all the terms of the loan and watch out for hefty fees prepayment penalties!

- Consider alternatives like HELOCs or home equity loans

Many critics find bridge loans to be risky, as the borrower essentially takes on a new loan with a higher interest rate and no guarantee the old property will sell within the allotted life of the bridge loan. Or at all.

However, borrowers usually doesn’t need to pay interest in remaining months if their home is sold before the term of the bridge loan is complete.

But watch out for prepayment penalties that hit you if you pay the loan off too early!

Make sure you do plenty of research before selling your home to see what asking prices are and how long homes are generally listed before they’re ultimately sold.

The market may be strong enough that you don’t need a bridge loan.

But if you do need one, be aware that a home could go unsold for six months or longer, so negotiate terms that allow for an extension to the bridge loan if necessary.

If you think a bridge loan is right for you, try to work out a deal with a single lender that provides both your bridge loan and long-term mortgage.

Usually they’ll give you a better deal, and a safety net as opposed to going with two different banks or lenders.

Also keep in mind that there are other alternatives to a bridge loan such as financing down payments with your 401k, stocks, and other assets.

It may also be possible to use funds from a HELOC for down payment, which may prove to be the cheaper option.

The downside to a HELOC or home equity loan is that you might have trouble qualifying if your DTI ratio includes your existing mortgage payment, future mortgage payment, and the home equity line/loan payment.

There are also iBuyers that will buy your old home almost instantly, allowing you to purchase a replacement property with ease, but they may not pay top dollar. And again, fees are a concern.

When all is said and done, a contingency may provide the best value, even if it takes some convincing and additional legwork.

Whatever you decide, take the time to consider the pros and cons of each scenario before moving forward.

- Rocket Mortgage Completes Redfin Takeover, Offers $6,000 Home Buyer Credit - July 1, 2025

- Mortgage Rates Quietly Fall to Lows of 2025 - June 30, 2025

- Trump Wants Interest Rates Cut to 1%. What Would That Mean for Mortgage Rates? - June 30, 2025

Which lenders provide bridge loans for residential? I asked a couple of big lenders such as BoFA, they don’t any longer.

Pascale,

Not sure that the big banks offer bridge loans…kind of a specialty product that you might find with smaller niche lenders. A broker might be able to help you in your search.

I have already sold & closed on my home in Miami, but am looking for a job ( I am a PreK teacher hoping to find a PreK teaching in Orlando). What kind of loan could I get with a willingness to put at least 33% down payment?

a lender just told me there was a 3 day right of redemption to our bridge loan. I don’t understand what that means. I know it means funds won’t be exchanged until the 3 days after closing, but why is this nececessary?

Cindi,

Do you mean rescission? It’s a cooling off period in case borrowers have a change of heart.

Colin My mother is taking a bridge loan (in PA) because she has not sold her house and wants to move into her a new home. She is being told she has to take her Home off the Market for Two Months. Is this a regulation or the preference of the Lender?

Keith,

Probably a lender-based rule, but maybe an issue many different lenders have.

Try to convince publishers of your articles to put the date at the top. Some information is very time sensitive. Relying on info that is several years old is not very useful.

I know this article is recent but still it should have a date.

Thanks.

David Marquardt

David,

This is a WordPress issue, posts have dates and timeless pages do not, as far as I can tell.

I’m curious where in Pa your mom was able to get abridge loan. I am trying now but having a hard time finding any lenders who do bridge loans. Any help would be appreciated

Louise, send me an email at andrew.collette@phmloans.com I would be happy to connect you with someone who can help.

I’d also like the name in PA – Philadelphia area. Our newly constructed house settlement is mid-September with no buyers for our existing house. House is for sale at $549K, appraised at $575k and we only owe $240K on it…New mortgage is in place so that is good — just need $ for settlement of new house or we lose major $ there.

My mother and niece bought a house together using a bridge loan using her paid-for home which she has owned since 1975. My mother passed away last September and in probate, I received the old house and my niece got the new house. I have been paying on the loan every month on time. My niece has let the other house go into foreclosure. This bridge loan was in my mother’s and my niece’s name but attached to the property I inherited. So basically I’m stuck paying off a $60k loan for a house that my niece has abandoned? Is there any way around this? The loan is not in my name at all.

Leslie,

While the loan may not be in your name and not affect your personal credit, if not paid it could wind up in default and the property lost. Sounds complicated, may want to consult a professional and/or see if there’s a way to refinance or get the loan current again if you want to keep the properties. Good luck.

We own our home free and clear, but are still interested in a bridge loan. How would that work?

Jo,

Assuming you are buying a new home while keeping the existing one, a bridge loan could tap into your existing equity to provide for the down payment on the new home, assuming you don’t have the cash on hand.

can a bridge loan work with a 1031 exchange?

JB,

I believe bridge loans are used frequently in 1031 exchanges to provide for short-term capital while selling the old property.

Great article. Considering a move out of state. Do lenders have any issues with a bridge loan to sell a property in PA while moving states away? What about trying to use one to enter into a 203k loan on the new property? Thanks

We lost our home to foreclosure several years ago, but are still paying off the bridge loan. We used the same bank. We were new homeowners and really didn’t understand a bridge loan. Do we still owe on it?

Lori,

If you’re saying you had two loans including a bridge tied to the home you lost, it may depend on what you worked out with the lender. It could be that you’re paying a deficiency judgment based on the difference between what you owed and what the bank sold your home for, or on some sort of payment plan. If you’re not sure, you may want to contact the bank/servicer to better understand what you’re paying and why.

My mortgage has been paid off on my house in Chicago. I am interested in moving to Florida ( I have money set aside for a down deposit ) Which method would be easier and more reliable: 1) take out a bridge loan or an adjustable loan (pay it off quickly) on the new house then sell? or 2) sell my house first then purchase a new house?

Mellody,

It depends on a lot of things, like if you have temporary housing and/or a place for all your stuff, if it’s a good time to sell, if you’ve found a new house already, etc. I suppose its preference since your home is paid off and probably won’t affect your ability to get another mortgage. However, you will have to explain that you’re actually moving to Florida and occupying that new home as a primary residence, and that you’ll be making money in the state to support the new mortgage.

We own a home in Florida with no mortgage. looking to buy a new home but because our income is not all documented can not get a loan. Have some stocks and savings but they want to see income deposited in a bank account. What can we do?

Sue,

There are asset depletion loans that take into account significant assets in lieu of income for those who are income-light, asset-rich.

I believe it’s because on most loans or purchases you have three days to change your mind. So it’s protection for both you and the bank

We want to build and would like to possibly do a bridge loan. How can we get the best estimate for our home’s value so we can determine if a bridge loan will get us what we need for the new house down payment? is it worth getting an appraisal on our own so we can know almost for sure if it’ll work? Even if that means likely having to pay for two appraisals since the bank will inevitably want their own appraisal later?

Amanda,

It could make sense to order a “subject to” appraisal to get your ducks in a row if you need bridge financing, and may not set you back very much in the grand scheme. Good luck!

Has anyone taken out a bridge loan to move to new location, then sold their own home later with closing very close together? Did it work out and what would you say the bridge loan cost if you paid it off relatively quickly?

Rhonda,

This is actually a common tool some real estate companies are offering to clients nowadays so they can get their offer accepted during a seller’s market.