The current solution for those struggling to make mortgage payments due to COVID-19 is mortgage forbearance.

It allows homeowners to “pause” mortgage payments for anywhere from six to 12 months while their income is reduced or completely nonexistent.

Once it comes to an end, the homeowner must repay the missed payments, either by making a lump sum payment or getting on some kind of repayment plan.

But what about instead of forbearance, the borrower simply executed a cash out refinance and used the proceeds to cover expenses until they got back on track?

This is an interesting idea floated by Urban Institute VP Laurie Goodman and Brookings fellow Aaron Klein.

While taking on more debt doesn’t sound like the most sensible plan when you already can’t make ends meet, homeowners are currently sitting on a mountain of home equity.

During the previous housing crisis, a streamlined refinance program called the Home Affordable Refinance Program (HARP) was implemented to lower monthly mortgage payments for roughly 3.4 million Americans.

It allowed homeowners to refinance even if they didn’t have sufficient equity in their home, or in most cases, negative equity. And they could do so with limited documentation and no home appraisal.

The argument was that it didn’t increase risk to Fannie Mae and Freddie Mac because these homeowners wound up with lower monthly payments, even if they didn’t traditionally qualify for a mortgage refinance.

Homeowners Don’t Have Cash, But They’ve Got Equity

Today, we face a different challenge – homeowners don’t have cash on hand to make mortgage payments while their employment is disrupted by the coronavirus epidemic.

However, many homeowners have a ton of home equity, perhaps hundreds of thousands of dollars of it.

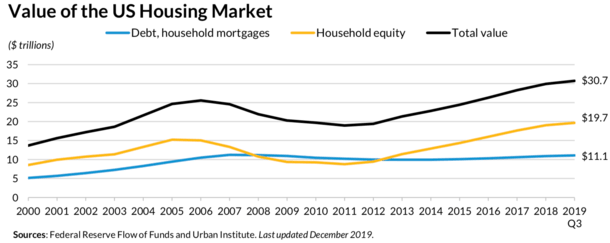

Collectively, there’s apparently $19.7 trillion in home equity and $11.1 trillion in household debt (mortgages).

Some $6.88 trillion of that is agency debt, backed by Fannie Mae, Freddie Mac, or Ginnie Mae, which covers FHA loans, VA loans, and USDA loans.

If homeowners could somehow tap into it, and obtain a near record low mortgage rate at the same time, it could be viewed as a win-win.

After all, borrowing cash with an interest rate around 3% on a 30-year term is a pretty good deal, and one that is hard to beat elsewhere.

Goodman and Klein say one of the best ways to stimulate the economy is via refinancing, but point out that there are roadblocks currently in place.

“What is the purpose of the Fed lowering short term rates to zero and buying hundreds of billions of mortgages to lower mortgage interest rates if people cannot functionally access a mortgage?”

A Streamlined Cash Out Refinance Program?

- Could Fannie and Freddie make it easier to get a cash out refinance

- By waiving appraisal requirements and reducing documentation requests

- Might be a better alternative to forbearance for borrowers and loan servicers

- Default risk would be mitigated if LTV is 80% or less

The researchers have floated the idea of a more lenient cash out mortgage environment, by applying some of the same benefits currently available to rate and term refinances.

This includes appraisal waivers, which are hugely important right now with many homeowners and appraisers told to shelter at home and maintain social distancing.

They do note that a cash out refinance increases risk to the GSEs, but call it “marginal” since the max loan-to-value (LTV) ratio is 80%.

That leaves a healthy cushion of at least 20% in home equity should the borrower default on the mortgage in the future, or be forced to sell the property.

The pair have also called for the expansion of these appraisal waivers to cover all GSE to GSE refinancings, including cross GSE (Fannie to Freddie and Freddie to Fannie) transactions.

“Allowing for more cash out refinancings will allow households to tap into the $19.7 trillion of existing home equity to better weather this economic maelstrom, thereby resulting in fewer people falling behind on their mortgage, and reducing forbearances.”

If they’re able to reduce forbearance requests, it will also help banks and perhaps more importantly, nonbanks, survive the crisis without needing some sort of liquidity backstop.

They also warn that it’s “important to act quickly” because once a borrower receives forbearance they’re no longer eligible for a mortgage refinance.

“Many borrowers may see a cash out refinance, with the opportunity to tap into wealth while locking in the lowest rates in several generations, as preferable to forbearance.”

- UWM Launches Borrower-Paid Temporary Buydown for Refinances - July 17, 2025

- Firing Jerome Powell Won’t Benefit Mortgage Rates - July 16, 2025

- Here’s How Your Mortgage Payment Can Go Up Even If It’s Not an ARM - July 15, 2025

It would be great if the government would allow retired individuals pay their mortgage off with their 401k without paying taxes on it, especially before their 401k is worth nothing. Then they wouldn’t have to worry about being homeless. I believe this would also stimulate the economy by putting more money in the lenders pockets so other could get loans to buy a house. Seems like a win win to me.