Freddie Mac has just launched a new renovation loan product known as the “Freddie Mac CHOICERenovation Mortgage.”

While the name is a bit of a mouthful, the offering is expected to be more liberal than their existing plainly named Renovation Mortgage.

The new loan program will go head-to-head with similar offerings from Fannie Mae (HomeStyle Renovation) and the FHA (203k loan).

Let’s learn more about the CHOICERenovation Mortgage and what makes it different from their old product.

What Is the CHOICERenovation Mortgage?

- An all-in-one single close home loan

- That includes renovation costs and permanent financing

- Similar to Fannie Mae’s Homestyle Renovation and FHA’s 203k

- Can be used by first-time home buyers and existing homeowners via refinance

In light of the aging housing stock out there, Freddie Mac is stepping up their renovation loan offering to help more homeowners and home buyers fix up properties that need some TLC.

Since the Great Recession ended in 2009, the renovation market has grown by more than 50% to more than $400 billion annually, per the Harvard Joint Center for Housing Studies.

Perhaps more shockingly, 40% of the nation’s 137 million homes are at least 50 years old, while 80% are at least 20 years old.

This might explain all those dumpsters you see lining the neighborhoods, and the incessant noise of table saws throughout the day.

Anyway, like the FHA 203k and HomeStyle Renovation loans, the CHOICERenovation Mortgage features a single-close home loan that combines purchase and renovation costs into one.

It can also be utilized by existing homeowners looking to make repairs via a no cash out refinance.

The product is geared toward all types of homeowners, including first-time home buyers, those looking to age in place, and multigenerational families who may need to make customizations to their existing living space.

Additionally, Freddie Mac says it’s unique in that the loan proceeds can be used to renovate or repair a property damaged by a natural disaster.

Or to prevent damage from a future natural disaster by installing retaining walls, storm surge barriers, or retrofitting the foundation.

CHOICERenovation Mortgage Guidelines

Now let’s discuss some program specifics to see if this loan option will work for your needs.

As mentioned, it can be used by a borrower purchasing a new home as well as an existing homeowner looking to refinance and make improvements.

It’s also possible to borrow at very high loan-to-value ratios, as follows:

- 1-unit primary: 95% (FRM/ARM), FTHB if >95% HomeOne only; 97% Home Possible® only

- 2-unit primary: 85% (FRM/ARM)

- 3- and 4-unit primary: 80% (FRM/ARM)

- 1-unit second home: 90% (FRM/ARM)

- 1-unit investment properties: 85% (FRM, 7/1 and 10/1 ARMs)

- Manufactured home 95%/95%

*TLTV to 105% with eligible Affordable Seconds (via Home Possible and HomeOne only)

To determine value on a purchase transaction, they use the lesser of the purchase price with renovation costs, or the appraised value as completed.

If it’s a refinance, they use the appraised value as completed.

In terms of loan type, they offer both fixed and adjustable-rate mortgage options, including the usual 30- and 15-year fixed loans, along with popular ARMs like the 5/1 and 7/1.

With regard to property type, you can finance 1-4 unit primary residences, 1-unit second homes, 1-unit investment properties, and even manufactured homes.

The obvious exclusions here are non-owned duplexes, triplexes, and fourplexes.

Because the CHOICERenovation Mortgage allows for super conforming mortgages (those between conforming and jumbo), the max loan amount can be quite high depending on the county in question.

For example, in Los Angeles County you can get a loan amount as high as $822,375 via the program.

CHOICERenovation Eligible Renovation Costs

The proceeds of the loan must be used to finance renovations on an existing dwelling. They may not be used to raze an existing structure and build a new home.

Additionally, the proceeds may not be used for items not permanently affixed to the property unless they’re new appliances.

The funds can be used to cover permits, title updates, appraisals, plan fees, and up to six months of PITI payments.

And as noted, proceeds may be used to renovate or repair properties damaged by natural disasters, or to bolster them for future weather-related events.

Borrowers also have the option to use loan proceeds to pay off any short-term financing for prior renovations of an existing home.

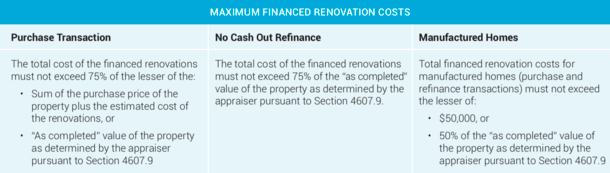

In terms of maximum financed renovation costs, see the table above by transaction type.

Borrowers have the ability to draw up to 50% of the material costs at loan closing.

If you choose to work with a home improvement store, 100% of the cost of materials and renovation costs (including labor) can be advanced if paid directly to a home improvement store.

All the renovations associated with the loan must be completed within 365 days of the note rate of the mortgage.

One other nice feature is that a borrower doesn’t need to occupy the property while renovations are ongoing, yet it can still be a primary residence if you move in within 60 days of the last disbursement date.

Regarding the differences between their older Renovation Mortgage offering and the new CHOICERenovation loan, the latter doesn’t require borrowers to obtain Interim Construction Financing prior to securing permanent financing.

And approved sellers can deliver the mortgages to Freddie Mac prior to completion of the renovations.

CHOICEReno eXPress Mortgage

Freddie Mac recently released a lightweight version of this product known as “CHOICEReno eXPress Mortgage.”

It’s basically a streamlined renovation program for homeowners who want to finance small-scale improvements.

For example, window or door replacement, roof repairs, interior/exterior painting, and other minor remodeling work.

They see it as an alternative to credit cards or other forms of unsecured financing when homeowners simply need to make cosmetic changes to their properties.

The main difference is the total cost of the financed renovations can only be up to 10% of the home’s as-completed value (or 15% in rural regions with high needs classification).

And any Freddie Mac Seller can deliver CHOICEReno eXPress mortgages before the completion of renovations without recourse.

You can see all the differences between the two programs here, along with FAQ.

Read more: How to Pay for Home Renovations: Pros and Cons to Different Methods

- Will Mortgage Rates Be Higher or Lower by the End of 2025? I Asked AI. - July 2, 2025

- Rocket Mortgage Completes Redfin Takeover, Offers $6,000 Home Buyer Credit - July 1, 2025

- Mortgage Rates Quietly Fall to Lows of 2025 - June 30, 2025