Mortgage Investors Group, or MIG for short, has a familiar story in that they were founded by a small group of loan officers before growing into a billion-dollar independent mortgage bank.

What makes them more special is the fact that they’ve been around since 1989, a testament to their staying power in the very unforgiving mortgage industry.

That means surviving a few housing booms and busts, yet carrying on and continuing to grow along the way.

A couple of their claims to fame include being the Tennessee Housing Development Agency’s (THDA) top lender annually since 2003.

And the number one USDA home loan lender in Tennessee every year since 2014. Let’s learn more about them.

Mortgage Investors Group Fast Facts

- Direct-to-consumer retail mortgage lender

- Offers home purchase loans, refinances, and reverse mortgages

- Founded in 1989, headquartered in Knoxville, TN

- Funded about $4 billion in home loans last year

- The 3rd largest mortgage lender in the state of Tennessee

- The Tennessee Housing Development Agency’s (THDA) top lender since 2003

- The #1 USDA home loan lender in TN since 2014

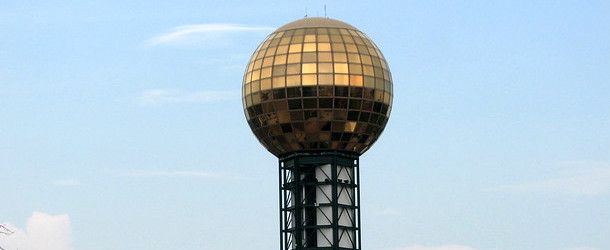

Mortgage Investors Group is a direct-to-consumer retail mortgage lender based out of Knoxville, Tennessee (pictured above is the Sunsphere from the 1982 World’s Fair there).

As noted, they got started all the way back in 1989 by co-founders Chuck Tonkin II and Chrissi Rhea, along with five colleagues.

Today, the company has grown to 26 branch locations and 450 employees, with more than $20 billion in closed loans since inception.

This means you can apply for a mortgage at a local branch or online via their website.

Last year, they mustered nearly $4 billion in total loan volume, despite only working in the Southeast.

They’re licensed in just nine states, including Alabama, Arkansas, Florida, Georgia, Kentucky, Mississippi, North Carolina, South Carolina, and Tennessee.

In their home state, they are the third largest lender, beaten out only by behemoth Rocket Mortgage and megabank Wells Fargo.

The company is also quite active in nearby Alabama and Georgia, the #1 USDA loan lender in Tennessee, and the top Tennessee Housing Development Agency (THDA) lender since 2003.

Roughly 60% of their volume consisted of home purchase loans, meaning they’re probably a good choice for a home buyer.

The rest was made up of mortgage refinances, home improvement loans, and reverse mortgages, all of which are geared toward existing homeowners.

How to Apply with Mortgage Investors Group

To get started, you can either visit their website or head over to a local branch if one happens to be situated nearby.

Their website offers a wealth of information, including how-to guides, mortgage calculators, a mortgage glossary, and a loan officer directory.

You can search for loan officers by location or name, then apply directly from their webpage once you find the individual you’d like to work with.

MIG offers a digital mortgage application that uses the latest technology to ensure a quick and pain-free loan process.

This includes the ability to fill out an app from a smartphone or computer, eSign disclosures, and scan and upload documents.

Additionally, their on-site underwriting, loan processing, closing, and appraisal services mean you can get to the finish line without delays.

This is especially handy in a competitive housing market where time is money and then some.

Available Loan Programs at Mortgage Investors Group

- Home purchase loans

- Refinance loans: rate and term, cash out, streamline

- Conforming loans backed by Fannie Mae and Freddie Mac

- Jumbo loans

- FHA loans

- VA loans

- USDA loans

- Reverse mortgages

- Reverse purchase mortgages

- Georgia Dream loans

- THDA loans

- Down payment assistance loans

- Fixed-rate and adjustable-rate options available in various loan terms

One standout area for Mortgage Investors Group is their selection of loan programs, which is seemingly endless.

Aside from all the usual stuff like loans backed by Fannie, Freddie, and the FHA/USDA/VA, they offer jumbo loans, reverse mortgages and even reverse purchase mortgages.

They also have several options for first-time home buyers and low-to-moderate income borrowers, including the Georgia Dream loan and THDA loans.

Their Home Court Advantage program offers up to 105% of the purchase price and includes a second mortgage that can cover down payment, closing costs, and other prepaid items.

Both fixed-rate and adjustable-rate mortgages are available in various loan terms, including 15-year fixed mortgages and 5/1 ARMs.

They lend on all major property types, including single-family homes, condos/townhomes, and multi-unit investment properties.

Mortgage Investors Group Rates

Mortgage Investors Group says they’re here to get you an affordable mortgage with award-winning service, but they don’t post their mortgage rates online.

In order to get pricing, you’ll either need to call up a loan officer on the phone or fill out a preliminary application online to get in touch with one.

At that point, you’ll you be able to receive a mortgage rate quote and determine what lender fees they charge, if any.

Because they don’t publicize mortgage rates, the only real hint we have is customer reviews, which are generally favorable.

But pricing will always depend on the loan scenario in question. And you should always obtain several mortgage rate quotes to ensure you don’t miss a lower-priced, quality option.

Be sure to compare Mortgage Investors Group’s quoted mortgage APR to other lenders, which factors in both lender fees and the interest rate.

Mortgage Investors Group Reviews

Over on Zillow, Mortgage Investors Group has an almost-perfect 4.97-star rating out of 5 from over 2,500 customer reviews.

Many of the recent reviews indicate that the interest rate and/or closing costs were lower than anticipated, a good sign if you want a low-cost mortgage.

They’ve also got a perfect 5.0-star rating from over 100 Google reviews, along with a 4.7-star rating on Facebook from roughly 130 reviews.

The company is an accredited business with the Better Business Bureau (BBB) and currently holds an ‘A+’ rating based on customer complaint history.

Speaking of, they’ve only had one complaint closed over the past three years.

To summarize, Mortgage Investors Group seems to be a particularly good choice for home buyers thanks to their wide range of first-time home buyers loan programs.

This is especially true for those short on down payment funds or income, as they work extensively with the Tennessee Housing Development Agency and USDA.

But they’re also quite active when it comes to mortgage refinancing as well, so they could also be a great choice for an existing homeowner too if their mortgage rates and fees are competitive.

Mortgage Investors Group Pros and Cons

The Good

- Offer a digital mortgage application and in-house processing/underwriting

- Can apply for a home loan from any device or in-branch with a human

- Tons of loan programs to choose from including first-time home buyer and reverse mortgages

- Excellent customer reviews across ratings websites

- A+ BBB rating

- Lots of free loan calculators and how-to guides on their website

- Website also available in Spanish

The Maybe Not

- Only licensed in a handful of states in the Southeast

- Do not publicize mortgage rates or lender fees online

(photo: bobistraveling)

Our experience with Mortgage Investors Group was marred by several issues, leading to a negative outcome that prompted us to choose another lender. Initially, agreeing to work with them resulted in a barrage of irrelevant sales and marketing spam inundating my email account, which, despite their apologies, was distracting and unprofessional during the already challenging process of home purchase. The most significant problem arose when we ordered the property appraisal, initially quoted at $200 and later increased to $250, citing the ‘size of the lot’ as a reason, though this was evident from the beginning. Unfortunately, the delivered appraisal had a major flaw, rendering it unusable as it only detailed a single building structure while our property had two separate structures. Despite our request, Andy Munsey, Director of Digital Lending, refused to refund our money for the flawed appraisal. In conclusion, I would caution against choosing Mortgage Investors Group due to their propensity for errors and their inadequate customer service in resolving such issues.