Mortgage Q&A: “What is a conventional mortgage loan?”

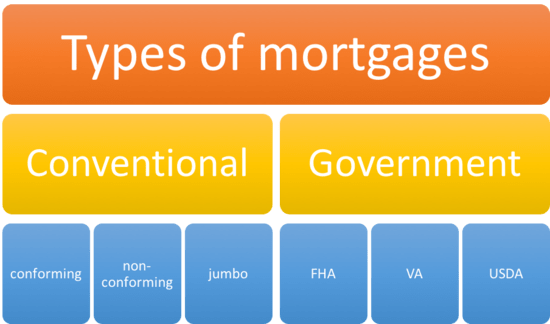

A “conventional loan” simply refers to any residential mortgage loan that is not insured or guaranteed by the federal government.

The word conventional means standard, regular, or normal, which is basically saying that these types of loans are typical and common.

And that makes a lot of sense because conventional home loans make up the largest share of mortgages issued in the United States.

Their counterpart, government mortgages, account for the rest, albeit a smaller slice of the pie.

Conventional loans account for about 85% of the residential mortgage market, with government loans the remaining 15%.

What Makes a Loan Conventional?

- Conventional just means anything that is non-government

- By that definition it can include many different types of home loans

- The most common are conforming loans backed by Fannie Mae and Freddie Mac

- Along with jumbo loans and non-conforming loans that don’t meet agency guidelines

What makes a loan conventional? Simply put, not being backed by the government. That’s it.

This means conventional mortgage loans can be both fixed mortgages or adjustable-rate mortgages, including the 30-year fixed, 15-year fixed, hybrid ARMs.

They can also be used to purchase a home or refinance an existing mortgage.

Additionally, these types of loans may be conforming or non-conforming loans, with the former meeting the standards set forth by government-sponsored enterprises (GSEs) Fannie Mae and Freddie Mac.

Same goes for interest-only loans, non-QM loans, 40-year loans, and so on. Basically anything under the sun.

The key is that they are not considered government loans, despite the fact that Fannie and Freddie are technically under government control via the FHFA.

Conventional Loan Examples

- Conforming loans backed by Fannie Mae or Freddie Mac

- Jumbo loans (that exceed the conforming limit)

- Portfolio loans (proprietary loan programs offered by banks and credit unions)

- Non-QM loans (interest-only loans, DSCR loans, bank statement loans, etc.)

Conventional Loan Requirements

There is only requirement: the loan must not be issued or insured by the government.

This means FHA loans, USDA loans, and VA loans do not meet this definition.

They are all backed by government agencies, whether it’s HUD, the U.S. Dept. of Veteran Affairs, or the U.S. Department of Agriculture.

So these three types of loans are non-conventional. Simple as that.

Conventional Loan Is Not Synonymous with Conforming Loan

Be careful not to confuse conventional with conforming, as the two terms can actually be very different, despite being lumped together constantly by lenders and reporters.

Let’s talk about the difference between conventional and conforming for a moment to really let it sink in.

I’ll start by saying all conforming mortgages are conventional, but not all conventional home loans are conforming. Confused yet? Bear with me here.

To answer the first part of that statement, consider that conforming loans are those backed by Fannie Mae and Freddie Mac, which aren’t the government, as noted above.

As for the second statement, there are non-government mortgages that exceed the loan limits allowed by conforming mortgages, making them conventional loans that are non-conforming.

Case in point, the jumbo loan, which is conventional but not conforming due to loan amount.

Jumbo Loans Are Conventional, But Not Conforming

- Jumbo loans are considered conventional loans because they aren’t government-backed

- They are distinct due to their large loan amounts that exceed conforming loan limits

- As a result they don’t meet agency (Fannie/Freddie) or government (FHA/VA) underwriting guidelines

- They often have their own unique underwriting criteria you must meet to get approved

Home loans over the conforming loan limit are considered jumbo mortgages and aren’t eligible for delivery to Fannie Mae or Freddie Mac as a result.

There are no jumbo loan limits (maximum loan amounts) because they aren’t governed by any particular entity.

So any private sector (non-government) mortgage lender can lend as much as they want to a borrower, as much as $10 million or more.

And there is no set loan eligibility standard they must abide by either, so underwriting criteria can vary widely.

But if the loans don’t meet the guidelines of Fannie and Freddie, they will often come with a higher mortgage rate as a result.

This has to do with liquidity. It’s easy to sell loans that adhere to Fannie/Freddie underwriting standards because investors know what to expect from the underlying mortgage securities.

Conventional loans can be all over the map in terms of loan amount, down payment, credit score, and general risk. Still, both types of loans are considered conventional because they aren’t government loans.

Additionally, conforming loans have a minimum credit score requirement of 620 and tend to have a max loan-to-value ratio (LTV) of 97%.

Meanwhile, non-conforming conventional loans may allow lower credit scores and even higher LTVs.

Do You Have to Put 20% Down on a Conventional Loan?

Absolutely not. Although there are benefits to putting 20% down on a home purchase.

Fannie Mae’s HomeReady is a very popular conforming loan program that allows down payments as low as 3%. And Freddie Mac Home Possible offers the same.

However, if the LTV exceeds 80 percent on a conventional loan, private mortgage insurance is usually required by the mortgage lender.

Either way, conventional mortgages may provide more flexibility because banks can set their own mortgage underwriting guidelines and risk appetite.

Instead of being at the mercy of rigid government or quasi-government guidelines, loan requirements will vary from bank to lender.

For example, if a conventional lender such as a credit union wants to approve mortgages with 500 credit scores, or with zero down, they can.

This assumes they’re willing to take such risks, because they are private entities that answer to nobody other than having to meet ATR rules.

Government Loans Are Not Conventional Loans

- A government home loan is NOT conventional

- This includes FHA mortgages, VA mortgages, and USDA loans

- These three major loan types are all insured by the federal government

- Conversely, loans backed by private entities Fannie Mae and Freddie Mac are considered non-gov

Now let’s turn our attention to mortgage loans that are backed by the federal government, referred to as “government loans,” or “govie loans” for short.

These are considered non-conventional because they’re government-backed. End of story.

So if your mortgage is insured by the government, it’s non-conventional.

Note that I said insured and backed, not actually funded by the government. The government doesn’t make these loans directly, but rather relies on private companies to perform that piece.

The most popular of the government loans is the FHA loan. It is a mortgage backed by the Federal Housing Administration (FHA), a division of the Department of Housing and Urban Development’s (HUD) Office of Housing.

FHA loans allow for down payments as low as 3.5 percent. But mortgage insurance is required, even if the LTV is below 80%.

Additionally, there are FHA loan limits that dictate how much a homeowner can borrow based on the county in which they reside (or plan to reside).

Another common and widely used government home loan is the VA loan. It doesn’t require a down payment or minimum credit score.

It is reserved for military and their families, unlike the FHA, which any individual can use.

Lastly, there is the USDA home loan program. It also provides 100 percent financing (no minimum down payments) to home buyers in rural neighborhoods throughout the country.

In that sense, it has a limited reach as well, making FHA loans the king of the govie loans.

Most Lenders Originate Both Conventional Loans and Government Home Loans

For the record, most mortgage lenders and mortgage brokers originate both conventional mortgage loans and government loans.

After they collect your information, they may recommend you go with a loan backed by Fannie/Freddie, or a loan backed by the government such as an FHA loan.

Or they may say you have no choice but to go in one direction, thanks to a low credit score or a large loan amount.

FHA loans were quite popular after the housing market took a hit a decade ago, thanks to the low credit score requirement and limited down payment.

But Fannie and Freddie have taken back market share thanks to their 3% down offering and cancelable PMI, coupled with the FHA’s stricter mortgage insurance policy.

If you’re shopping for a mortgage, be sure you know the distinction between these key loan types.

One may be better suited for you for one reason or another, and it’s always good to know all your loan options.

If a lender recommends one over the other, be sure they thoroughly explain how they came to that conclusion.

Assuming you live in a more expensive region of the country (or are simply buying an expensive home for your area), you may no choice but to go the conventional route due to home value alone.

Read more: FHA vs. conventional loan