If you’re not satisfied with the selection of mortgage programs offered by your bank or local lender, you might want to consider the new 15/15 Adjustable-Rate Mortgage now being offered by PenFed for a limited time.

Yes, you heard that right. The Pentagon Federal Credit Union just launched, or in their own words, “invented,” an adjustable-rate mortgage that doesn’t make its first adjustment for 15 years.

And once it does adjust for the very first time, it never adjusts again. Talk about a gamble, assuming you still have your mortgage in the year 2033.

The 15-Year ARM Starts at 4.625%

- This is a first of its kind home loan program

- An adjustable-rate mortgage with just one rate adjustment

- During the entire life of the loan

- Which is a full 30 years despite what the name may indicate

PenFed’s new promotional loan program has a start rate (teaser rate) of 4.625%, which is fixed for the first 15 years of the 30-year loan.

Then the rate adjusts to whatever the weekly average yield on US Treasury securities (I believe the 10-year CMT index) is plus a margin of two percent, rounded to the nearest eighth.

So based on today’s CMT of 2.90%, you’d be looking at a rate of around 4.90% once it becomes adjustable.

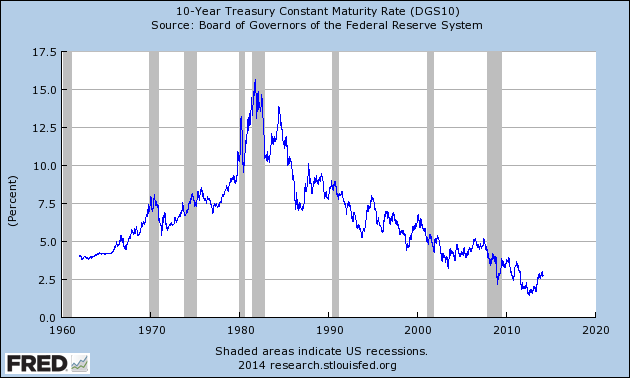

Of course, in 15 years that could change significantly. Take a look at the chart of the 10-year yield above.

It fell as low as 1.40% in mid-2012, but has since risen to around 2.90%. Go back to before the mortgage crisis and it was closer to 5%, meaning the fully indexed rate could easily be around 7% or higher if we return to those levels.

So if yields on Treasuries do increase, which they most likely will over the next 15 years, you’ll be stuck with a higher rate at the time the 15/15 ARM adjusts.

And it won’t adjust again; you’ll be stuck with that rate for the remaining 15 years of the 30-year loan.

However, the yield could also fall or remain constant, seeing that 15 years is a very long time, so your rate could actually improve.

Just note that there is both a cap and a floor; the adjusted rate cannot be more than 6% above the initial rate (10.625%) and cannot be lower than the floor rate of 2%.

Does the 15/15 ARM Make Any Sense?

- If the starting rate is lower than alternative loan programs

- It’s worth looking into to save money each month and pay your loan faster

- But it appears rates aren’t much lower than 30-year fixed rates

- Making it less attractive and perhaps not worth the risk

Before the housing crisis reared its ugly head, you could get your hands on all types of “innovative” loan products.

Of course, most of them just got homeowners into trouble because they highlighted the good and ignored the bad.

The 15/15 ARM certainly isn’t the highest risk adjustable-rate mortgage out there, but it could be a bad move if the 10-year yield surges over the next decade and change.

Still, with a reduced, fixed rate for 15 years, you could save a decent chunk of money before refinancing your mortgage or selling prior to that first adjustment.

But considering rates on the 30-year fixed mortgage are close to about 4.5% at the moment, you’d be getting a rate nearly identical to current 30-year fixed levels.

If you’re not saving any money each month, there’s not much of a reason to go with the 15/15 ARM over a standard 30-year fixed. After all, the whole point of an ARM is to pay less interest and own more of your home in a shorter period of time.

So make sure the interest rate is actually lower relative to other options to determine if it’s a worthwhile loan program.

Assuming the start rate is lower, and you’re willing to take a little risk, you could apply the payment savings to the principal balance each month to pay off the mortgage even faster.

Note that the 15/15 ARM is only available on primary residences and second homes, but works for both purchases and refinances. There is a 1% loan origination fee and loan amounts of up to $453,100 are available (higher in Alaska, Guam, and Hawaii).

It also comes in a jumbo variety with loan amounts up to $2 million.

For the record, the company also has a 5/5 ARM, which as the name suggests, is fixed for the first five years before adjusting every five years after that. The mortgage interest rate on that loan program starts at 3.875%.

All in all, PenFed mortgage rates seem pretty competitive, and their unique mix of loan programs might suit a homeowner looking for something a little different.

Also check out the HarmonyLoan, which is an adjustable-rate mortgage you can reset with the click of a mouse.

Do you know if you can sign up with PenFed as a broker?

Jaqui,

Not sure if they have a wholesale department themselves, but they might have wholesale partners you can work with to offer such products.

We wholesale this product. ALL in house. It’s a great financial tool.

Pen fed no longer offers this product as of 4/28/2022.