For some reason, folks always want to know if you can do X, Y, and Z with bad credit. Which begs the question, why not improve your credit first!

Okay, I get it, time is sometimes of the essence, especially if you have bad credit, so it’s not always an option to get things back on track before seeking out financing.

There’s also that pesky thing known as patience, which seems to be lacking in the world today.

The good news is it’s entirely possible to secure new credit, including a new mortgage, even if you have what’s known as “bad credit.”

So if you’ve got your eye on those record low mortgage rates, but aren’t sure if you qualify, read on.

First Off, What’s Bad Credit?

- Fannie and Freddie require a credit score of 620 or better to get a home loan

- VA loans and USDA loans don’t have minimum scores, but most mortgage lenders still require 620+

- FHA can go as low as 500 if you have 10% equity in your home

- Otherwise you need at least a 580 FICO score for max financing

While opinions may vary, bad credit is typically defined as a sub-620 FICO score in the eyes of mortgage lenders, though even scores a bit higher might be viewed with some disdain.

But ultimately, 620 is the hard line in the sand, and the minimum score accepted by both Fannie Mae and Freddie Mac, which back or buy the majority of home loans today.

For government home loans, such as USDA loans and VA loans, there isn’t a minimum credit score, but lenders impose them anyway to mitigate their risk.

These will vary by bank and lender, with many requiring scores above 600, and some allowing scores in the 500 range.

When it comes to FHA loans, you need a 580 FICO or higher to get maximum financing (3.5% down), otherwise you’ll be required to put down 10% or have 10% equity for scores down to 500.

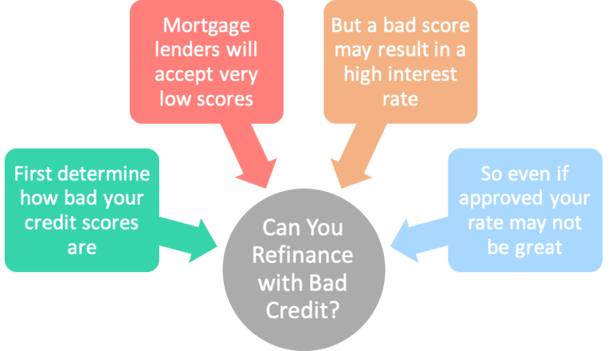

So first you need to determine where you actually stand credit-wise, then you can assess how bad the situation is and who will accept you.

Some may think they’re in worse shape than they really are, and vice versa. Knowing what your particular credit score means will help you better understand your options.

As seen above, the majority of mortgage lenders are going to want a minimum FICO score of 620 or better.

There might be individual lenders willing to go into the 500s, but your options will shrink pretty fast if your scores are that bad.

Additionally, you’ll pay a price if your scores are that poor, which could put the usefulness of the refinance into question.

If You Have Bad Credit, Expect a Higher Mortgage Rate on Your Refi

- Mortgage lenders use pricing adjustments to determine your interest rate

- Credit score is one of the biggest components of mortgage loan pricing

- If you have bad credit, expect a much higher rate than what’s advertised

- This is to account for greater risk of default as bad credit is highly correlated with missed mortgage payments

Now that we have a clearer picture of what bad credit is, and you still want to proceed with your mortgage refinance, you need to understand that your interest rate isn’t going to be as low as it could be.

So if you think you’re going to get that 1.99% mortgage rate, think again.

And really, when you’re refinancing, you’re mostly doing so to obtain a lower interest rate on your mortgage, even if tapping your home equity at the same time.

A refinance is intended to save you money either by lowering your interest rate or shortening your loan term, or both in some cases.

You never really want to increase your mortgage rate via a refinance unless you’re desperately trying to get out of an ARM, or for some other urgent matter.

Unfortunately, the pricing adjustments can be quite steep when you’ve got bad credit, so even though mortgage rates are very low at the moment, you might not actually qualify for them.

In other words, adjust your expectations, quickly. Those rates you see advertised on TV or the internet are for well-qualified borrowers, of which you are not if you have bad credit.

They make the best assumptions about you as a borrower, such as a 760 FICO score, plenty of equity, conforming loan amount, and so on.

Once you tell them you’ve got a 640 FICO score, the interest rate shoots up and your refinance may not make a lot of sense anymore.

Refinancing with Bad Credit Makes Less Sense Than Buying a Home with Bad Credit

- Refis are driven mostly by the underlying interest rate

- Because the motivation is to save money and lower your existing rate

- A home purchase can make sense even with bad credit

- If you don’t want to miss out, or if you simply need a home today

I wrote another post about how to get a mortgage with a low credit score, which discusses both home purchases and refis.

To expand on that, I think there are cases where it makes sense to buy a home with bad credit because you might not get the opportunity again (you found your dream home).

Or you’re wasting more money on rent each month, you need more space because of a growing family, etc.

Sure, it’s not ideal, but you found a house you love and you want it. Okay, your interest rate won’t be great, but if you can still qualify for the mortgage, you might be happy enough.

And the beauty of the home purchase loan is the ability to refinance it down the road, once you improve your credit.

With an existing mortgage, it makes less sense to chase after a new mortgage if you haven’t even taken the time to address your credit issues.

You’ve already got the house, but haven’t resolved what’s holding you back. Why would lenders give you better terms?

As noted, the point of a refinance is to save money – chances are you won’t save much if anything if your credit is truly bad.

Conversely, if you’ve improved your credit significantly since first taking out your mortgage, the value of a refinance will really shine.

It’s an incredible time to lock in a ridiculously low mortgage rate for 30 years. If you do have bad credit, now more than ever you should be working on ways to improve it before seeking out a refinance loan.

These low rates should be around for a while, so it’s okay to take a little time to fix what’s wrong, improve your credit history, then apply.

Read more: Borrowers with Low Credit Scores Should Shop Their Mortgage More

- Trump Wants Interest Rates Cut to 1%. What Would That Mean for Mortgage Rates? - June 30, 2025

- What the Fannie Mae and Freddie Mac Crypto Order Really Means - June 26, 2025

- Powell Says They’d Still Be Cutting If There Weren’t Tariffs, and Chances Are Mortgage Rates Would Be Lower Too - June 25, 2025