People constantly ask me if a particular lender is good, bad, or should be avoided at all costs.

They also ask who the best mortgage lender is, often citing some customer satisfaction survey or what not. Or whether they should use a mortgage broker or a bank.

And my answer is pretty much always the same – it depends on how your particular loan goes.

You might end up hating the company or loving them, all based on how things go when it’s your turn.

So yes, two individuals can wind up with completely different opinions, even when working with the same company, and perhaps even the same exact employees.

The problem with the mortgage industry is that it’s very regulated, dynamic, and complex, and as such, it’s very difficult to please everyone all of the time, even with the best of intentions.

In other industries, such as the credit card industry for example, customer service reps can “make things right” if something goes wrong, usually just by pushing a button.

You didn’t like our service? Okay, how about a $25 statement credit?

The same goes for your cable company, who you have to call each month to ask for a billing adjustment after they attempt to gouge you.

With home loans, it’s a little different.

Aligning Expectations with Reality in the Mortgage Biz

- Thanks to the widespread “the customer is always right” policy

- Consumers are almost guaranteed to be dissatisfied with the home loan experience

- Because it doesn’t work the same way in the mortgage industry

- Things rarely go according to plan and loans can’t always be approved regardless of how much you complain

Unfortunately, it is these very companies mentioned above that create lofty expectations for all other businesses, whether they can live up to them or not.

So when a consumer applies for a mortgage, they often go into it thinking they can complain if anything goes wrong and automatically get it fixed.

Or simply argue until fees are lowered or waived, and the interest rate reduced.

Sadly, it’s not so simple when it comes to mortgage lending. There are so many hands involved in a single loan, and so many guidelines that must be met. Many are black and white, and often not up to your lender.

For example, the loan might need to meet the guidelines of Fannie Mae, Freddie Mac, or the FHA, and whining about it won’t change that fact.

There are also many technical aspects, and mortgage pricing is very involved.

Sure, some junk fees might be waived without too much of a fight, but adjusting your mortgage rate lower will be a lot trickier.

If you’re not a great borrower, even the best lender won’t be able to get you the low advertised rate you saw on TV or the Internet.

You know the old adage, “the customer is always right.” In mortgage, this doesn’t necessarily hold true, as you and your lender will be at the mercy of external forces.

Enter frustration here.

Complications May Come Off as Lies

- While there are certainly unscrupulous players in the mortgage industry like any other line of business

- Even those who tell the truth might be questioned due to the complexities involved with obtaining a mortgage

- But if you inform yourself early on you can spot the difference

- And better understand when you’re being strung along and when you might need to act

Let’s take a common scenario, where you are quoted a certain mortgage rate at the beginning of the home loan process.

It is at this very moment the lender gets you in the door. After all, without the promise of a low mortgage rate, why would you choose them? They must be somewhat competitive to move forward.

You have a great conversation with the loan officer and feel really good about everything.

The fees are explained in detail, and the interest rate you’re set to receive is going to shave hundreds off your monthly mortgage payment!

Then, out of nowhere, you’re told your mortgage rate will be .50% higher than originally quoted.

Turns out something came up on your credit report that wasn’t originally disclosed, pushing your credit score into a lower tier, and thus raising your rate.

This is but one example of how rates can change in a flash, and it has nothing to do with the lender originating your loan. It’s not a bait and switch.

And that’s completely ignoring the fact that mortgage rates can change daily among all lenders.

Another common scenario is an appraised value coming in low. It pushes your loan-to-value ratio higher, and your low mortgage rate isn’t so low anymore.

Once again, this has nothing to do with the lender. It has to do with your property value, which the lender doesn’t dictate.

Love Them or Hate Them…

- As noted, your home loan experience may vary considerably from another borrower who uses the same exact lender

- Simply due to luck (or a lack thereof) when it comes to your particular loan scenario

- And often it may be completely outside your lender’s control

- The difference might be how your lender communicates when things do come up

Here’s another one. Let’s assume you decide to float your rate, only to see rates rise.

You may blame the lender for not locking your rate early on. But the exact opposite could also happen, making you a very happy borrower.

Again, your lender is not the culprit here, but rather timing is. So luck is involved as well, which as we all know, can go both ways.

You may also find out that your loan is declined after weeks of back and forth with your lender.

Again, things come up, and the more documentation you provide to your lender, the more things can change, for better or worse.

Your mortgage doesn’t operate in a vacuum. If you send in a document that happens to raise a red flag with the underwriter, everything may change in a heartbeat.

They only know as much as you tell them, and if you hold something back or aren’t forthright, it can turn your application on its head.

Again, it’s not your lender in many cases, it’s just reality in the mortgage world.

Lenders are held accountable for mistakes made during the loan process, and so yes, they may ask for a document more than once. Or a blank page that seems entirely insignificant.

And they may ask for a letter of explanation. And they might ask for an explanation to your previous explanation.

But it’s all done for a reason. Lenders aren’t in business to play games with you.

They want to fund loans just as much as you want yours funded, so cooperation often works better than endless arguing.

If they ask for a document twice, sometimes it’s better just to oblige (but document the process while you’re at it).

Also try to put yourself in the shoes of the loan officer, processor, or underwriter? The mortgage business is very stressful and riddled with timelines and red tape.

The only caveat here might be how the lender communicates this with you.

Are they transparent about all that happens? Do they pick up the phone when you call? Are they friendly and happy to explain what’s going on? Are they proactive or reactive?

These characteristics can certainly separate the good lenders from the bad.

There Are Always Exceptions

- If you educate yourself on mortgages you’ll have a better idea of who’s full of it

- Or attempting to take you for a ride and give you the old bait and switch

- Comparison shop before you commit and vet each lender carefully before you proceed

- Also feel out the loan officer you speak with and check out their reviews so you feel good about working with them beforehand

While I just did my best to defend mortgage lenders, there are shady and unscrupulous banks, lenders, mortgage brokers, and loan officers out there.

Just like any industry, there are bad apples among the good, and you do need to navigate extremely carefully to avoid such individuals.

This is especially important when obtaining a mortgage, as a bad deal can cost you a lot more than a bad deal elsewhere. Would you rather overpay for a car or your mortgage?

You certainly don’t want to be stuck with an inflated mortgage rate for years, or a loan type that doesn’t make sense for you (hello option arm).

Nor do you want to miss out on a home purchase because the lender failed to deliver what they promised.

So ask a lot of questions, and make sure your loan rep takes the time to explain anything that might be causing confusion or concern. Or what may arise and how they’ll deal with it.

It is their job, and they should be more than willing to help you out, especially if you’re a first-time buyer.

Just remember that it is indeed a job, and they need to get paid for assisting you. How much money they make will depend on how well you shop and negotiate.

In other words, YOU affect the outcome of your mortgage as well.

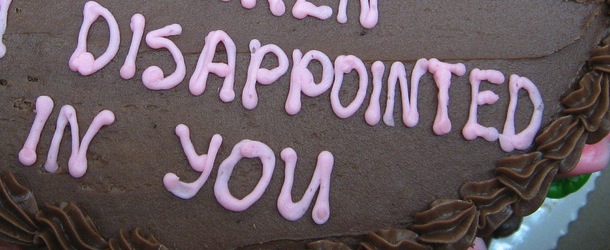

Prepare, do your homework, address any red flags before you apply, be cooperative, and put in the time to ensure you don’t walk away disappointed.

(photo: attercop311)

- Mortgage Rates Quietly Fall to Lows of 2025 - June 30, 2025

- Trump Wants Interest Rates Cut to 1%. What Would That Mean for Mortgage Rates? - June 30, 2025

- What the Fannie Mae and Freddie Mac Crypto Order Really Means - June 26, 2025