Mortgage Q&A: “How to pay off the mortgage early.”

If you’re looking to pay off your mortgage quickly, now might be a good time to do so because mortgage interest rates are no longer rock bottom.

However, if you’ve had your existing mortgage for a while, there’s a good chance your current interest rate is significantly lower than today’s prevailing rates.

In this case, it could make sense to just pay your mortgage back on schedule. After all, why rush repayment if the interest rate is a super low 2-4%?

Ultimately, you need to look at extra mortgage payments as an investment. And your mortgage rate is the rate of return.

For example, if your rate is 2.75% but a high-yield savings account pays around 5%, why put more of your money toward the mortgage?

Conversely, if you took out a home loan more recently and the rate is closer to 7%, paying it off early could be a winning move.

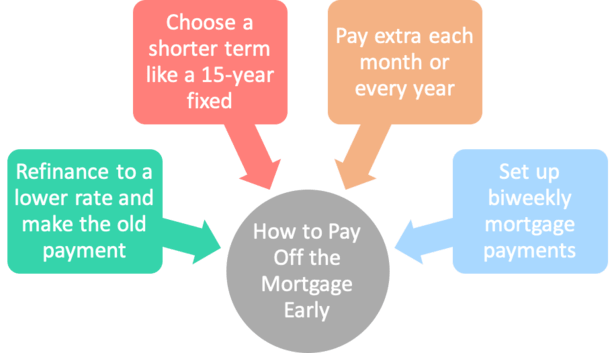

Key Points to Consider If You Want to Pay Off the Mortgage Early

- You always have the option to pay the mortgage off ahead schedule

- Just be sure there isn’t a prepayment penalty for doing so (not common today)

- Homeowners can allocate extra funds toward principal each month if they choose

- Ask your loan servicer if you’re unsure of how this works (they can help)

- If you’ve got a high interest rate, it can make sense to pay off the loan sooner

- If you have a low rate, it might be smarter to invest any extra money instead

- You can also refinance to a shorter term to reduce interest in exchange for a higher payment

- Either way, watch out for “accelerators” and other fancy programs that aren’t necessary

- An easy biweekly hack allows you to make half-payments every two weeks to reduce debt and shorten your loan term

- Borrowers with 30-year fixed rates in the 2-4% range might not want to rush to pay off the mortgage

Pay Off the Mortgage Early Without Increasing Your Monthly Payment

- If your current interest rate is much higher than today’s mortgage rates

- You may be able to refinance to that lower rate for free or little cost

- Then continue to make your old, higher monthly payment

- And save thousands while paying off your home loan much earlier!

Let’s start with one simple and effective method used by lots of savvy homeowners to save big bucks on their home loans.

According to Freddie Mac, the popular 30-year fixed mortgage is currently priced around 6.85%.

While much higher than the 3% average seen back in 2022, it’s down quite a bit from late 2023 when it stood at nearly 8%.

For some, this could spell opportunity. One method to save is exchanging your existing high-rate loan for a shiny new one via a rate and term refinance.

Then instead of making the new lower payment, continue making the old, higher monthly payment.

How This Early Mortgage Payoff Strategy Works

Let’s pretend you originally got a loan amount of $300,000 on a 30-year fixed mortgage set at 7.5%.

Your monthly principal and interest payment is $2,097.64. If today’s mortgage rates are a much lower 6.5% for the same loan, you could take advantage of this trick.

The new monthly payment would be $1,896.20, but it you continued to make your old payment each month, you’d chip away at the mortgage a lot faster.

Loan amount: $300,000

Loan program: 30-year fixed

Current mortgage rate: 7.5%

Current mortgage payment: $2,097.64 <===== keep making this payment

Refinance mortgage rate: 6.5%

New mortgage payment: $1,896.20

If you were able to refinance your mortgage as described above, your new monthly mortgage payment would be roughly $202 cheaper per month, assuming you stayed with the same loan program.

While such a move clearly provides monthly payment relief, it could also shorten the term of your mortgage tremendously if you made your old mortgage payment on the newly refinanced mortgage.

This is one trick to pay off your mortgage very quickly without breaking the bank.

If you simply made the old monthly payment of $2,097.64, the $202 or so a month in overpayment would go toward the outstanding principal balance, shortening the amortization period from 30 years to about 23 years.

Yes, you read that right. In this example, you could shave seven years off your mortgage simply by making the payment you’ve always been making. But wait, it gets even better.

You’d Pay a Lot Less Interest Too!

- Paying the mortgage early to own your home sooner is one benefit

- But you’ll also save a ton on interest when you shorten the term of your home loan

- Because a quicker payoff means you don’t have to pay the full amount of interest due

- So it’s actually a double win for very little effort

By paying extra, the total amount of interest paid over the life of the home loan would also decrease from over $382,000 to less than $279,000.

That’s a total savings of nearly $105,000, not factoring in tax deductions and the interest you paid on the original loan.

Not bad for continuing to make the same monthly mortgage outlay you were making before, right? Where else are you going to save nearly $100k?

Shorten Your Loan Term Without Paying Extra

If you wanted to get even more aggressive, you could refinance into a shorter-term fixed mortgage, such as a 15-year fixed.

The 15-year payment is a more significant jump that not all homeowners would be comfortable with, let alone qualify for.

But if there’s a wider spread between your existing mortgage rate and the current market rates, it could be possible to shorten the loan term with little or no monthly payment increase.

We aren’t there yet because mortgage rates have remained stubbornly high to start 2025. But it could eventually become a reality.

This is a pretty neat way to pay off your mortgage early without actually paying anything extra each month.

But even if you’re not able to benefit from a refinance, there are still countless other (easy) ways to pay off a home loan faster.

For example, you could leave your existing mortgage intact and just make larger monthly payments (toward principal), or look into biweekly mortgage payments.

Just keep in mind that if you make larger payments each month on your original mortgage, it WILL NOT lower your payment due the next month.

The way mortgages are paid off, extra payments simply reduce your interest expense and shorten your loan term, they do not affect the amount of future monthly payments.

In other words, if you paid an extra $100 each month, you would still owe the same amount the following month, despite having a smaller outstanding balance.

Tip: Making extra payments earlier in the loan term will amount to greater savings, so if you plan to pay your mortgage off early, do it sooner rather than later! A payoff calculator will demonstrate this.

30+ Mortgage Payoff Tricks You Can Utilize Right Now

- Make extra payments to principal

- Make an extra payment each quarter, semi-annually, or annually

- Make biweekly mortgage payments

- Round up your mortgage payments

- Increase extra payments as salary rises

- Apply your tax refund (or any other windfall) to your principal balance

- Refinance your mortgage to a lower rate and make the old higher payment

- Refinance to a shorter-term mortgage such as a 15-year or 10-year fixed loan

- Refinance out of FHA to drop mortgage insurance

- If you have bad credit, improve your credit score then refinance to a lower rate

- Don’t reset the clock when refinancing

- Consolidate two loans to a lower blended interest rate

- Go with an ARM that has a lower interest rate but beware of resets

- Start with a lower rate by buying it down and pay closing costs out-of-pocket

- Put more money down to avoid PMI and get a lower rate

- Sell another property and use the proceeds to pay off a different mortgage

- Sell stock or other investments and use the proceeds to pay down the mortgage

- Find a roommate and use their rent to pay down the mortgage early

- Rent out a garage and use the funds to pay off the mortgage

- Put your property on Airbnb

- Cash in your credit card rewards/points and apply them to your mortgage balance

- Apply a bank sign-up bonus ($500 in some cases) to your mortgage balance

- Pay your mortgage with a credit card and put cash back amount toward principal

- Use some form of interest rate arbitrage, like a 0% APR balance transfer credit card, to pay a chunk of the mortgage now

- Put loose change in a collection jar and periodically deposit it and use it to pay down the mortgage

- Get a side job (hello real estate agent!) and use the earnings to pay down the mortgage faster

- Host a garage sale and apply proceeds to the mortgage balance

- Ask for a no-interest loan from a family member and apply it to the mortgage balance

- Ditch your car if you can get by without one, use extra cash on hand to pay off your mortgage early (I’ve done this)

- Be a cord-cutter and stop paying for cable, then put the difference toward the mortgage each month (I do this)

- Know which mortgage to pay first to save the most money!

Should I Pay Off My Mortgage Early in 2025?

- There are definitely pros and cons to paying off the mortgage early

- The clear advantage is saving lots of money on interest and shortening the loan term

- The obvious disadvantage is having to pay more each month

- And potentially having too much of your money locked up in your home

- Another consideration is many homeowners today have ultra-low fixed mortgage rates that are cheaper than what you can earn in a simple high-yield savings account

- So there isn’t much reason to speed up the loan payoff if there’s no financial benefit

Clearly there are pros and cons to an early mortgage payoff, and not everyone will benefit from paying off their mortgage ahead of time.

There is certainly the emotional win of getting rid of a home loan once and for all, but you may not want to get caught up in all that.

Any extra money might be better served paying off more expensive student loans, an auto loan, investing in the stock market, or just setting aside cash in you savings account so you’re able to buy more real estate in the future.

Just keep in mind that mortgages are very cheap at the moment, and you might be able to get a better return for your money simply by investing it or contributing to a 401k, Roth IRA, or similar retirement account.

That may actually be a better method of investing in your future.

When mortgage rates are low, paying the mortgage off faster isn’t as beneficial because you’re not necessarily saving all that much.

Conversely, when interest rates are high, paying the mortgage off early can be even more lucrative.

You may also get a tax break for paying mortgage interest. And if you factor in inflation, which will probably surge in the coming years, you’ll essentially be paying off your mortgage with cheaper money of the future.

Remember, a dollar today is worth more than it will be tomorrow.

Do You Want Your Money Trapped in Your Home?

- Real estate is illiquid (difficult and time-consuming to sell)

- It’s hard and potentially expensive to get your money out

- And today’s dollars are worth more than tomorrow’s dollars

- So paying more today could actually cost you in the long run

Additionally, real estate is an illiquid asset, so if you pay off your mortgage and experience some kind of financial emergency, having all your cash tied up in your home and none on hand could put you in a tough spot.

Yes, you need to be able to qualify for a mortgage to tap your equity, so if you prepay your mortgage and later need that cash back, you might be out of luck if you can’t get approved.

Also note that if you have credit cards and other more expensive debt, you’ll want to attack those first as opposed to paying extra principal.

There’s no sense in paying down your mortgage quicker than you have to if there are other debts hanging over your head.

At the same time, if you don’t want to pay all that extra interest and take any investing risks, it may make sense to pay off the mortgage early.

This can be especially true if you’re close to retirement and anticipate living on a fixed income. Peace of mind has quite a bit of value too you know…

Do the Math Before You Commit to Paying Early

Before deciding whether to pay your mortgage down early or not, do the math.

Consider retirement planning, maybe run it by your financial advisor (if you have one), and look at all possible scenarios to see what will work best for you and your unique financial position.

To make your job a little easier, check my early mortgage payoff calculator, which allows you to run different scenarios to compare potential savings.

There might be a good middle ground where you can pay a little bit extra while still maximizing your retirement account(s) and setting aside money for a rainy day.

Every situation is different, so don’t assume what works for someone else will work for you.

Personally, I’m in no hurry to pay off my low-rate mortgages. But the math has changed for new home buyers facing 6-8% mortgage rates.

Either way, be money smart and take the time to carefully consider all options and outcomes.

Tip: Watch out for mortgage accelerators and money merge accounts that promise to shed years off your mortgage. These programs are often riddled with fees and could wind up doing more harm than good.

When It Makes Sense to Pay Off the Mortgage Faster

- You don’t have other higher-APR debt (mortgages are generally cheap!)

- You are maximizing or at least contributing to retirement account(s)

- You have an emergency fund set aside for unexpected expenses

- You have money set aside for home maintenance

- There’s not a better place for your funds

- You’re close to retirement and will be living on a fixed income

- If it will give you peace of mind to pay off your mortgage

- Just remember you’ll still have to pay insurance/taxes forever, even if mortgage-free

- UWM Launches Borrower-Paid Temporary Buydown for Refinances - July 17, 2025

- Firing Jerome Powell Won’t Benefit Mortgage Rates - July 16, 2025

- Here’s How Your Mortgage Payment Can Go Up Even If It’s Not an ARM - July 15, 2025

How do I find a good mortgage broker in Orange County? Thank you for your most informative blog!

Hey Pat,

Probably best to speak to some friends/family who have used a broker there recently and ask for a referral. I can’t vouch for any specific person in the OC or elsewhere unfortunately.

Hi Colin,

I am in the process of purchasing a home. I was told that I can decrease the years if I put a payment down at closing cost. for instance a mortgage loan for the amount of 130,000, FHA, FOR 30 YEARS,with a closing cost of $6500.00. And at the end of closing the loan put another amount toward the principal $3,000 toward the principal will cut the years of the loan. Is this possible

Jessie,

If you have extra money to put down before you actually close, you could actually get a lower LTV and a better deal on your mortgage, possibly even avoid things like mortgage insurance. Once the loan is active you can make extra payments to principal whenever so long as there isn’t a prepayment penalty. The earlier extra payments are made the better.

if i pay 100 extra a month i pay off mortgage 5 years earlier / why does 200 monthly only bring down 8 years earlier

James,

It doesn’t double the savings, just like a 15-year payment isn’t double a 30-year payment.

Hello Colin,

We are purchasing a new home and plan to pay off the loan in a few years. My wife just retired and has taxable pension benefit from her work which we want to use buy the house in full. Currently we are in a high tax bracket because of her salary and because of the tax consequence we opt to take a mortgage for now instead of paying it in full using the money from the pension. We then plan to pay it off within a few years. Isn’t the 5/1 arm mortgage advantageous for us than the 30-yr fixed with our current situation? Appreciate your advise. Thanks. Dave

Dave,

If you truly plan to pay it off soon, a short-term ARM can be advantageous because you don’t have to worry about the rate resetting higher later (because the loan will be paid off in full before it adjusts). Conversely, you pay a premium to lock-in an interest rate for 30 years that you won’t actually benefit from once it’s paid off in a few years.

I’ve just started to get my first refinance on my house. My brother builds and sells homes and he said that I should get multiple quotes from different lenders. Is there a way to find out customer satisfaction with mortgage companies? I’d like to save as much as possible. is it a big difference to refinance with FHA or a conventional loan? Will the bank that loans the money sell my loan after a year? If I accept the conventional loan, and later find a lower fixed rate will I be able to refinance again?

Anne,

You’ve got a lot of questions…a lender may or may not sell your loan…most do these days. You can refinance after a refinance as long as you still qualify in the future. JD Power does a customer satisfaction survey but it only seems to include the biggest lenders. I have specific articles on the other questions if you search my site. Good luck.

Looking at my amortization schedule say payment #125. If I pay the principal payment for # 126, will it eliminate that payment interest and all?

Lance,

It wouldn’t eliminate the subsequent payment, it would just lower your outstanding principal balance, so the loan would be paid off sooner and with less interest. But you’d have to continue making normal monthly payments until that point.

I’m not really sure what the value of this article really is. Nearly every one of your solutions to pay off the mortgage early boils down to three words: get another job. If people had time, energy, didn’t have to watch kids, were able to have energy after working full time at a regular job then just getting another job really isn’t a solution to paying off your mortgage early.