With 30-year mortgage rates now above 7%, a refinance likely isn’t in the cards for most homeowners.

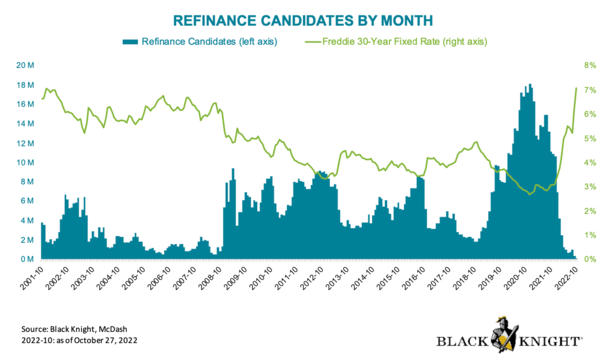

In fact, the total number of refinance candidates has plummeted as interest rates have more than doubled.

Previously, around 18 million homeowners stood to benefit from a refinance. Today, it might be less than 100,000, per Black Knight.

Either way, it’s clear that refinancing has fallen out of fashion big time. The math just doesn’t make sense for most.

The question is what are your options other than refinancing, assuming you want a lower rate or cash out?

Why a Mortgage Refinance Doesn’t Make Sense Right Now

Yesterday, the Mortgage Bankers Association (MBA) reported that mortgage rates hit their highest levels since 2001, matching those seen briefly in October 2022.

They noted that refinance applications were off two percent from a week earlier and 35% from the same week a year ago.

If you look at the graph above, you can see why. The number of refinance candidates has fallen off a cliff.

Meanwhile, Freddie Mac said nearly two-thirds of all mortgages have an interest rate below 4%.

As such, refinancing the mortgage just doesn’t work for the majority of homeowners out there.

Simply put, trading in a fixed interest rate below 4% for a rate above 7% isn’t very logical, even if you really need cash.

In fact, during the first half of 2023, nearly nine out of 10 conventional loan refinance originations were cash out refinances.

Ultimately, if you’re looking for a lower rate via a refinance, you’re likely going to need to wait for rates to fall.

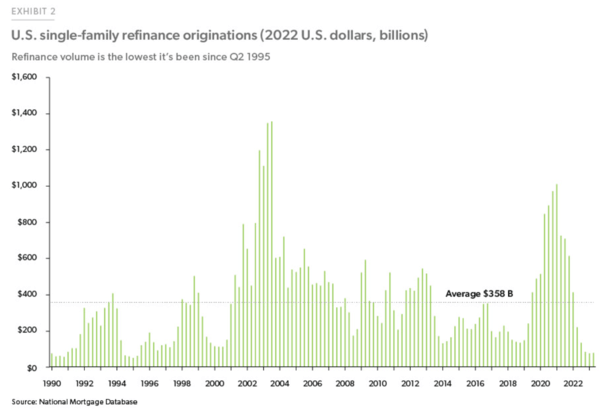

This explains why mortgage refinance volume has fallen to its lowest levels since the 1990s, as seen in the chart below.

Option 1: Open a HELOC

One popular refinance alternative is to take out a second mortgage, such as a home equity line of credit (HELOC).

The beauty of a second lien is that it doesn’t affect the terms of your first mortgage.

So if you’ve got a 30-year fixed locked in at 2-3% for the next 27 years or so, it won’t be disturbed.

You’ll continue to enjoy that low, low rate, even if you open a second mortgage behind it.

Another perk to a HELOC is that it’s a line of credit, meaning you have available credit like you would a credit card, without necessarily needing to borrow all of it.

This provides flexibility if you need/want cash, but doesn’t force you to borrow it all in one lump sum.

Closing costs are often low as well, depending on the provider, and the process tends to be a lot more streamlined than a traditional mortgage refinance.

Monthly payments are also typically interest-only during the draw period (when you pull out money) and only fully-amortized during the repayment period.

The major downside to a HELOC is that it’s tied to the prime rate, which has increased a whopping 5.25% since early 2022.

This means those who had a HELOC in March of 2022 saw their monthly payment rise tremendously, depending on the balance.

The potential good news is the Fed may be done hiking, which means the prime rate (which is tied to HELOCs) may also be done rising. And it could fall by next year.

So it’s possible, not definite, that HELOCs could get cheaper from 2024 onward.

Just pay attention to the margin, with combined with the prime rate is your HELOC interest rate.

Option 2: Open a Home Equity Loan

The other most common refinance alternative is the home equity loan, which like the HELOC is often a second mortgage (this assumes you already have a first mortgage).

It also allows you to tap into your home equity without resetting the clock on your first mortgage, or losing that low rate (if you’ve got one!).

The difference here is you get a lump sum amount when the loan funds, as opposed to a credit line.

Additionally, the interest rate on a home equity loan (HEL) is typically fixed, meaning you don’t have to worry about payments adjusting over time.

So it’s beneficial in terms of payment expectations, but those payments may be higher due to the lump sum you receive.

And you’ll likely find that HEL rates are higher than HELOC rates because you get a fixed interest rate.

Generally speaking, you pay a premium for a fixed rate versus an adjustable rate.

Also consider the origination costs, which may be higher if you’re pulling out a larger sum at closing.

It’s one thing if you know you need all the money, but if you just want a rainy day fund, a HELOC could be a better option depending on minimum draw amounts.

Be sure to compare the costs, rates, fees, and terms of both to determine which is best for your particular situation.

Lastly, note that some banks and lenders combine the features of these products, such as the ability to lock a variable interest rate, or make additional draws if you’ve paid back the original balance.

Put in the time to shop as rates and features can vary considerably compared to first mortgages, which are generally more straightforward aside from price.

Option 3: Pay Extra on Your First Mortgage

If you’ve been exploring a refinance to reduce your interest expense, e.g. a rate and term refinance, it likely won’t be a solution at the moment (as mentioned above).

Simply put, mortgage rates are markedly higher than they were just over a year ago.

Today, the 30-year fixed is averaging around 7%, more than double the 3% rates seen in early 2022.

This means most homeowners won’t be able to benefit from a refinance until rates fall significantly.

Of course, the more people who take out 7-8% mortgages today, the more opportunity there will be if and when they fall to say 5%, hopefully as soon as late 2024 if inflation gets under control.

In the meantime, there’s a solution and it doesn’t require taking out a loan, or even filling out an application.

All you have to do is pay extra each month, each year, or whenever you can. You can also set up a free biweekly mortgage payment system.

Whatever method you choose, each time you pay extra toward the principal balance of your mortgage, you reduce the interest expense.

So if you have a mortgage rate of 7% or higher, paying an extra $100 per month or more could lessen the blow.

You’d of course have to consider other options for your money, such as savings rates, investments, and other alternatives. And also your ability to devote more cash toward your home loan.

But this is a way to effectively reduce your mortgage rate without refinancing, which doesn’t pencil for most homeowners these days.

Just note that making extra mortgage payments does not lower future payments. So you’ll still owe the same amount each month unless you recast your loan.

But if and when rates do drop, you’d have a smaller outstanding balance thanks to those additional payments.

This could push you into a lower loan-to-value ratio (LTV) bucket, potentially making the refinance rate lower as well.

To sum things up, there are always refinance alternatives and strategies available, even if interest rates aren’t great.

And if history is any guide, there will come a time in the not-too-distant future when mortgage rates are favorable again.

Tip: One bonus idea to try is a so-called mortgage rate modification, where your lender/servicer will lower your rate to market for a fixed upfront fee. A lower rate and you can avoid all the paperwork!