Before the mortgage crisis, it was common practice for borrowers short on down payment funds or home equity to take out two mortgages simultaneously to finance their home purchase or home refinance. This was known as a “combo loan.”

There is some indication that this practice is becoming popular again, and if you decide to go with a combo, the way you structure your loans could save you a ton of money on your mortgage payment every month.

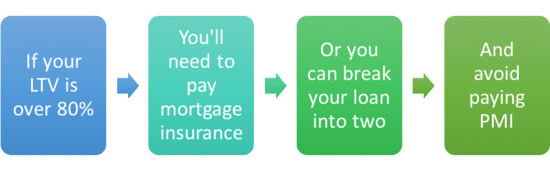

Most banks and mortgage lenders only allow loan-to-value ratios (LTVs) up to 80% because loan amounts exceeding 80% LTV aren’t eligible to be purchased or securitized by Fannie Mae and Freddie Mac, which makes them less liquid on the secondary market.

This is important, seeing that most banks quickly sell off their loans shortly after origination.

Additionally, loans with a LTV ratio greater than 80% typically require private mortgage insurance (PMI), making them a more expensive option compared to loans kept at or below 80% LTV.

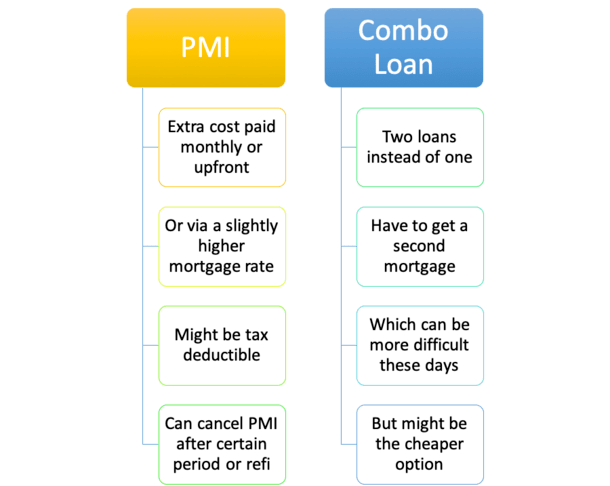

When private mortgage insurance (PMI) was tax-deductible (from around 2006 through 2016), many borrowers opted for a single home loan instead of tacking on a “piggyback” second mortgage because of the perceived savings.

In short, PMI is required for any single home loan over 80% loan-to-value, though it can be avoided if you structure a combo loan, keeping the first mortgage at 80% LTV, while putting the remainder of the balance on a second mortgage.

Put simply, if a homeowner breaks up their mortgage into two separate loans, even with two completely different banks, they can avoid paying PMI. On top of that, they can also enjoy a lower blended rate than simply going with one loan at say 90-100% LTV.

However, you have to take into consideration the closing costs and mortgage rate of that second mortgage. So, which method makes better sense for you? Let’s look at some of the pros and cons of each.

Combo Loans Eliminate the Need for Mortgage Insurance

- Combo loans are commonly used to avoid PMI

- Since you can keep the first mortgage at 80% LTV

- And extend the total amount of financing with the use of a second mortgage

- Could result in big savings depending on blended rate

The most obvious benefit of utilizing a mortgage combo is that you can avoid paying mortgage insurance each month.

By breaking the loan amount up into two loans, you can circumvent the mortgage insurance requirement, which in turn can save you hundreds of dollars a month depending on the cost.

A common example would be an 80/10/10 loan, which is expressed as an 80% first mortgage with a 10% second and a 10% down payment or equity stake.

Together, it is 90% combined-loan-to-value (CLTV), but since the first mortgage stays at 80%, PMI is not required.

Combo Loans Often Yield Lower Blended Interest Rates

- A combo loan may also result in a lower blended rate

- Which takes into account both interest rates and their corresponding loan amounts

- Allows you to determine your total interest expense

- And decide if a combo loan is a better deal than one large loan

Now let’s look at an example to illustrate the combo loan in action.

One mortgage at 90% LTV:

Purchase price: $500,000

Loan amount: $450,000 @8% interest rate

*You also need to pay PMI monthly, upfront, or via a higher mortgage rate

Two mortgages at 90% CLTV:

Purchase price: $500,000

First mortgage: $400,000 @6.5% interest rate

Second mortgage: $50,000 @9% interest rate

Blended rate: 6.778%

Hypothetically speaking, a borrower could finance one loan at 90% LTV at an interest rate of 8% and pay PMI.

Or the borrower could take out a first mortgage for $400,000 at 80% LTV at a rate of 6.5%, and a “piggyback” second mortgage for the remaining $50,000 at 90% CLTV at a rate of 9%.

Often, these second mortgages are HELOCs, which are actually lines of credit you can draw upon.

If we blend the two mortgage rates together, we come up with a combined rate of 6.778%. This is a considerable savings compared to 8% for a single loan that also requires PMI.

More often than not, a blended rate can save you money. While a rate of 9% may seem high, the second mortgage is only ten percent of the purchase price or appraised value, so the blended rate is quite a bit lower.

The saving grace to second mortgages is that they tend to be small, which means the monthly payments are still quite low comparatively, even if the interest rate isn’t.

That’s considerably cheaper than the 8% interest rate you’d get with a single loan, and that’s without even factoring in mortgage insurance.

Check out my blended rate calculator to determine if two loans price out better than one.

Combo Loans Allow More Financing Options

- If you have limited funds a combo loan may allow you to put little or nothing down

- It can also be useful to stay at/below the conforming loan limit

- If you can’t qualify for or don’t want a jumbo loan

- That could result in a lower mortgage rate as well!

Sometimes a blended rate is a necessity, and sometimes a blended rate is a cost-saving measure.

Some banks and lenders don’t allow LTVs over 80% period, so anyone financing more than 80% LTV will need to take out two loans or look elsewhere.

And while you might be able to get a single loan up to 97% LTV, a combo loan may be required to finance up to 100% of the purchase price.

In addition, you might be able to keep your first loan under the conforming loan limit, which will allow you to receive more favorable pricing relative to a jumbo mortgage, while also avoiding PMI.

Mortgage combos also offer the flexibility to structure your loan in a variety of different ways, such as 65/25, 75/15, 80/10, and so on.

This means you can play around with interest rates to find a blended rate that suits your situation best. You can also put less money down and get a more expensive home without the need for mortgage insurance.

Mortgage Insurance Can Help You Avoid High-Cost Second Mortgages

- Sometimes mortgage insurance is cheaper than a second mortgage

- It can also be more convenient to hold a single home loan

- Rather than having two loans to qualify for and worry about paying each month

There are situations where a second mortgage rate can be as high as 12%, which is a pretty nasty interest rate.

If you elect to stick to one loan with mortgage insurance, rates will be more reasonable, often not exceeding 6% for average to good credit borrowers.

Along with a lower interest rate, you’ll also avoid fees that come with second mortgages, such as underwriting, doc drawing, origination fee, and anything else a broker or mortgage lender may charge you.

And you won’t need to worry about a prepayment penalty or early closure fee that second mortgages often carry.

Mortgage Insurance Streamlines the Loan Process

- The process might be smoother if you work with just one lender and a PMI company

- Possibly a greater chance of loan approval as well

- And an easier time after the fact in terms of making payments

Sometimes breaking up the mortgage into two separate loans can be a lot more work, especially if the loans are being handled by two different banks.

It’s not unusual for a bank to originate your first mortgage and have the second outsourced to another bank.

This can make things difficult if the two banks are not in sync, and can often create twice the amount of work, and subsequent headaches.

Also consider post-closing, when you’ll need to make out two separate checks each month for the first and second mortgage.

And if you’re ever late, you may be hit with two mortgage lates instead of just one, which could make future financing extremely difficult.

Mortgage Insurance Can Be Temporary

- PMI doesn’t have to last forever

- Even if you have to pay it initially, you can always get rid of it in the future

- Via a refinance, sale, or when your LTV drops to a certain level

- Factor in how long you might need it when making the decision

While mortgage insurance does increase your mortgage payment each month, it does so only until your mortgage balance reaches 78% of the original purchase price of your home. At that point, PMI is automatically canceled by the lender.

And if your loan-to-value reaches 80%, you can initiate the cancellation yourself even earlier by asking your lender to remove it.

So if you decide to finance a single loan at 85%, it may only take a few years to eliminate the need for PMI and lower your monthly housing payment.

It’s also possible to refinance and ditch the PMI if home prices have risen enough since origination to get your LTV down below 80%.

Private Mortgage Insurance Is Still Tax-Deductible

- PMI continues to be tax deductible (through tax year 2020)

- But this may no longer be the case unless it gets renewed again

- Like it did last year at the last minute

- So keep an eye on changes at the IRS and/or inquire with your loan servicer

For about a decade, PMI was tax deductible after a bill was passed by Congress in December 2006. However, it required approval to remain in place for subsequent years.

During those years, PMI was fully tax-deductible for borrowers if their adjusted gross household income was $100,000 or less. The amount you could write off was then incrementally lower as your household income increased.

Clearly this made PMI more attractive, but like all tax write-offs, it’s often better not to pay anything to begin with.

Receiving a share of the money back is great, if you must pay it, but not having to pay it at all is even better.

Anyway, Congress did renew this benefit at the last minute for the 2017 tax year, and also did so in 2018, 2019, and 2020.

But don’t bank on it being as advantageous thanks to other tax changes like a higher standard deduction.

So Which Option Is Better?

- You have to sit down and run the numbers for your specific loan scenario

- Use a mortgage calculator or two to figure out what’s best, assuming you have options

- In some cases you might only have one choice if you only qualify one way

- Consider your timeline in terms of ownership of the home as well (e.g. will you sell in five years or keep forever?)

PMI companies highlight the fact that mortgage insurance is predictable, affordable, and cancelable.

They also say that second mortgages are often adjustable-rate mortgages and that you’re stuck with the loan until you pay it off.

You can argue for or against PMI and combo loans, but the only way to decide what’s best for you is to do the math. You really need to shop around and crunch the numbers to see which scenario makes more sense for you.

There will be cases when each is more attractive based on a variety of factors including loan amount, down payment, transaction type, credit score, income tax bracket, and much more.

You also need to consider how long you’ll be in the property, and what you plan to do with the home.

Be sure to factor in home prices in your area, and whether they are appreciating or dropping.

If prices are on the rise, you may reach that 80% loan-to-value mark quickly and you’ll be free of PMI with only one loan to worry about. If prices drop, you could be stuck with PMI for years to come.

If you don’t like the idea of PMI or a second mortgage, there are always products like the Bank of America No Fee Mortgage, which promises no mortgage insurance even if your loan exceeds 80% loan-to-value.

Similar loan programs are out there as well, and while they don’t explicitly charge PMI, it is typically passed along to the homeowner via a higher mortgage rate.

- UWM Launches Borrower-Paid Temporary Buydown for Refinances - July 17, 2025

- Firing Jerome Powell Won’t Benefit Mortgage Rates - July 16, 2025

- Here’s How Your Mortgage Payment Can Go Up Even If It’s Not an ARM - July 15, 2025