It’s time for another mortgage match-up: “15-year fixed vs. 30-year fixed.”

As always, there is no one-size-fits-all mortgage solution because everyone is different and may have varying real estate and financial goals.

For example, it depends if we’re talking about a home purchase or a mortgage refinance.

Or if you’re a first-time home buyer with nothing in your bank account or a seasoned homeowner close to retirement.

Ultimately, for home buyers who can only muster a low down payment, a 30-year fixed-rate mortgage will likely be the only option from an affordability and qualifying standpoint.

So for some, the argument isn’t even an argument. It’s over before it starts.

But let’s explore the key differences between these two loan programs so you know what you’re getting into.

15-Year Fixed vs. 30-Year Fixed: What’s Better?

The 15-year fixed and 30-year fixed are two of the most popular home loan products available.

They are very similar to one another. Both offer a fixed interest rate for the entire loan term, but one is paid off in half the amount of time.

That can amount to some serious cost differences and financial outcomes.

While it’s impossible to universally choose one over the other, we can certainly highlight some of the benefits and drawbacks of each.

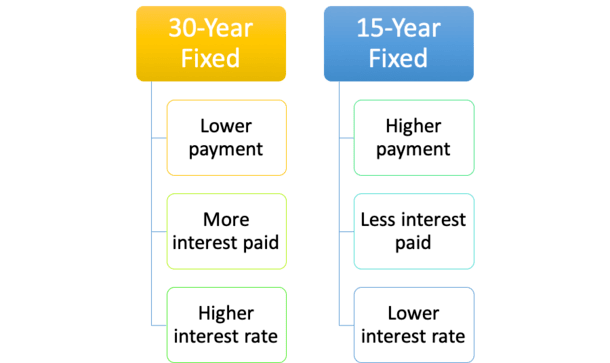

As seen in the chart above, the 30-year fixed is cheaper on a monthly basis, but more expensive long-term because of the greater interest expense.

The 30-year mortgage rate will also be higher relative to the 15-year fixed to pay for the convenience of an additional 15 years of fixed rate goodness.

Meanwhile, the 15-year fixed will cost a lot more each month, but save you quite a bit over the shorter loan term thanks in part to the lower interest rate offered.

15-Year Fixed Mortgages Aren’t Nearly as Popular

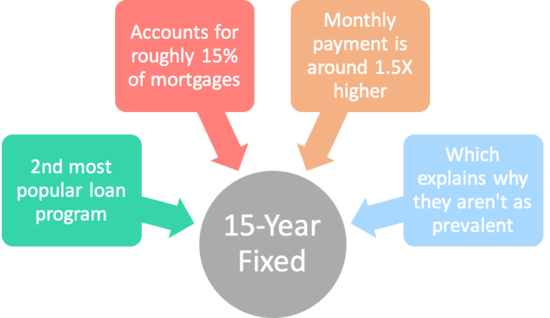

- The 15-year fixed is probably the second most popular home loan program available

- But it only accounts for something like 10% of all mortgages today

- Mainly because they aren’t very affordable to most people

- Monthly payments can be 1.5X higher than the 30-year fixed

The 30-year fixed-rate mortgage is easily the most popular loan program available, holding around a 70% share of the market.

Meanwhile, 15-year fixed loans hold about a 10% market share.

The rest are adjustable-rate mortgages or other fixed-rate mortgages like the lesser-known 10-year fixed.

While this number can certainly fluctuate over time, it should give you a good idea of how many borrowers go with a 15-year fixed vs. 30-year fixed.

If we drill down further, about 80% of home purchase loans are 30-year fixed mortgages. And less than 5% are 15-year fixed loans. But why?

Well, the simplest answer is that the 30-year mortgage is significantly cheaper than the 15-year because you get twice as long to pay it off.

And for new home buyers, it can be more difficult to muster a larger monthly payment.

Most mortgages are based on a 30-year amortization schedule, whether the interest rate is fixed or not (even ARMs), meaning they take 30 full years to pay off.

The 30-year fixed is the most straightforward home loan program out there because it never adjusts during its 30-year term.

The interest rate on a 15-year fixed also never changes. But payments need to be a lot higher due to the shorter loan term.

Shorter-Term Mortgages Are Too Expensive for Most Homeowners

The lengthy mortgage term on a 30-year mortgage allows home buyers to purchase expensive real estate without breaking the bank, even if they come in with a low down payment.

But it also means paying off your mortgage will take a long, long time…possibly extending into retirement and beyond.

Some financial pundits think you should only buy a home if you can afford a 15-year mortgage. But this just isn’t practical.

The enhanced affordability of a 30-year fixed explains why it’s heavily advertised and touted by housing counselors and mortgage lenders alike.

Simply put, you can afford more house, which explains that 80%+ market share when it’s a home purchase.

Meanwhile, the 15-year fixed-rate market share is significantly higher on refinance mortgages.

The reason is when borrowers refinance, they don’t want to restart the clock once they’ve already paid down their loan for a number of years.

It’s also more affordable to go from a 30-year fixed to a 15-year fixed because your loan balance will be smaller after several years. And ideally interest rates will be lower as well.

This combination could make a 15-year loan more manageable, especially as you get your bearings when it comes to homeownership.

15-Year Mortgage Rates Are Lower Than 30-Year Rates

- 15-year mortgage rates are lower than 30-year mortgage rates

- How much lower depends on the spread which varies over time

- It fluctuates based on the economy and investor demand for MBS

- You may find that 15-year mortgage rates are 0.50% – 1% cheaper at any given time

Despite the overwhelming popularity, there must be some drawbacks to the 30-year mortgage, right? Of course there are…

You get a discount for a 15-year fixed vs. 30-year fixed via a lower interest rate.

Even though both loan programs feature fixed rates, lenders can offer a lower interest rate because you get half the time to pay it off.

For that reason, you’ll find that 15-year mortgage rates are quite a bit lower than those on a 30-year product.

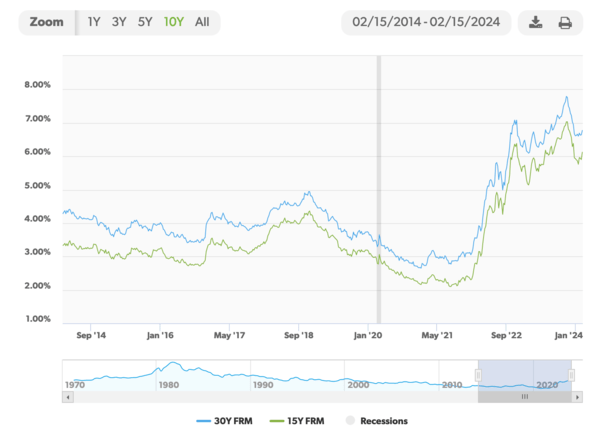

In fact, as of February 15th, 2024, mortgage rates on the 30-year fixed averaged 6.77% according to Freddie Mac, while the 15-year fixed stood at 6.12%.

That’s a difference of 0.65%, which should not be overlooked when deciding on a loan program.

In general, you may find that 15-year mortgage rates are about 0.50% – 1% lower than 30-year fixed mortgage rates. But this spread can and will vary over time.

You can see the difference between 15-year fixed mortgage rates and 30-year rates since 2000 in the chart above, based on Freddie Mac’s average.

In June of the year 2000, the 15-year mortgage rate averaged 7.99%, while the 30-year was a slightly higher 8.29%. But is also around 1% different in 2022.

So the 15-year fixed is currently priced at a decent discount historically, though that could narrow or widen over time.

Monthly Payments Are Higher on 15-Year Mortgages

- Expect a mortgage payment that is ~1.5X higher than a comparable 30-year fixed

- This isn’t a bad deal considering the loan is paid off in half the time

- Just make sure you can afford it before you commit to it

- There isn’t an option to make smaller payments once your loan closes!

While the lower interest rate is certainly appealing, the 15-year fixed-rate mortgage comes with a higher monthly mortgage payment.

Simply put, you get 15 less years to pay it off, which increases monthly payments.

When you have less time to pay off a loan, higher payments are required to repay the balance.

The mortgage payment on a $200,000 loan would be $400 higher because it’s paid off in half the amount of time.

Despite the lower interest rate on the 15-year fixed, the monthly payment is about 31% more expensive.

As such, affordability might be a limiting factor for those who opt for the shorter term.

Take a look at the numbers below, using those Freddie Mac average mortgage rates:

30-year fixed payment: $1,297.20 (6.75% interest rate)

15-year fixed payment: $1,701.25 (6.125% interest rate)

| Loan Type | 30-Year Fixed | 15-Year Fixed |

| Loan Amount | $200,000 | $200,000 |

| Interest Rate | 6.75% | 6.125% |

| Monthly Payment | $1,297.20 | $1,701.25 |

| Total Interest Paid | $266,992.00 | $106,225.00 |

Okay, so we know the monthly payment is a lot higher, but wait, and this is the biggie.

You would pay $266,992.00 in interest on the 30-year mortgage over the full term, versus just $106,225.00 in interest on the 15-year mortgage!

That’s more than $160,000 in interest saved over the duration of the loan if you went with the 15-year fixed as opposed to the 30-year mortgage. Pretty substantial, eh.

You’d also build home equity a lot faster, as each monthly payment would allocate much more money to the principal loan balance as opposed to interest.

But there’s another snag with the 15-year fixed option. It’s harder to qualify for because you’ll be required to make a much larger payment each month, meaning your DTI ratio might be too high as a result.

For many borrowers stretching to get into a home, the 15-year mortgage won’t even be an option. The good news is I’ve got a solution.

Most Homeowners Hold Their Mortgage for Just 5-10 Years

- Consider that most homeowners only keep their mortgages for 5-10 years

- Either because they sell the property or refinance their loan

- This means the expected savings of a 15-year fixed mortgage may not be fully realized

- But these borrowers will still whittle down their loan balance a lot faster in the meantime

Now obviously nobody wants to pay an additional $160,000 in interest, but who says you will?

Most homeowners don’t see their mortgages out to term. Either because they refinance, prepay, or simply sell their property and move. So who knows if you’ll actually benefit long-term?

You may have a well-thought-out plan that falls to pieces in 2-3 years. And those larger monthly mortgage payments could come back to bite you if you don’t have adequate savings.

What if you need to move and your home has depreciated in value? Or what if you take a pay cut or lose your job?

No one foresaw a global pandemic, and for those with 15-year fixed mortgages, the payment stress was probably a lot more significant.

Ultimately, those larger mortgage payments will be more difficult, if not impossible, to manage each month if your income takes a hit.

And perhaps your money is better served elsewhere, such as in the stock market or tied up in another investment, one that’s more liquid, which earns a better return.

Make 15-Year Sized Payments on a 30-Year Mortgage

- If you can’t qualify for the higher payments associated with a 15-year fixed home loan

- Or simply don’t want to be locked into a shorter-term mortgage

- You can still enjoy the benefits by making larger monthly payments voluntarily

- Simply determine the payment amount that will pay off your loan in half the time (or close to it)

Even if you’re determined to pay off your mortgage, you could go with a 30-year fixed and make extra mortgage payments each month, with the excess going toward the principal balance.

This flexibility would protect you in periods when money was tight. And still knock several years off your mortgage.

There are biweekly mortgage payments as well, which you may not even notice leaving your bank account.

It’s also possible to utilize both loan programs at different times in your life.

For example, you may start your mortgage journey with a 30-year loan. Then later refinance your mortgage to a 15-year term to stay on track if your goal is to own your home free and clear before retirement.

In summary, mortgages are a big deal so compare various scenarios and do lots of research (and actual math) before making a decision.

Most consumers don’t bother putting in much time for these mortgage basics, but planning now could mean far less headache and a lot more money in your bank account later.

Pros of 30-Year Fixed Mortgages

- Lower monthly payment (more affordable)

- Easier to qualify at a higher purchase price

- Ability to buy “more house” with smaller payment

- Can always make prepayments if wanted

- Good for those looking to invest money elsewhere

Cons of 30-Year Fixed Mortgages

- Higher interest rate

- You pay a lot more interest

- You build equity very slowly

- If prices go down you could fall into an underwater quite easily

- Harder to refinance with little equity

- You won’t own your home outright for 30 years!

Pros of 15-Year Fixed Mortgages

- Lower interest rate

- Much less interest paid during loan term

- Build home equity faster

- Own your home free and clear in half the time

- Good for those who are close to retirement and/or conservative investors

Cons of 15-Year Fixed Mortgages

- Higher payment makes it harder to qualify

- You may not be able to buy as much house

- You may become house poor (all your money locked up in the house)

- Could get a better return for your money elsewhere

Also see: 30-year fixed vs. ARM

- UWM Launches Borrower-Paid Temporary Buydown for Refinances - July 17, 2025

- Firing Jerome Powell Won’t Benefit Mortgage Rates - July 16, 2025

- Here’s How Your Mortgage Payment Can Go Up Even If It’s Not an ARM - July 15, 2025