So you’re thinking about buying your first piece of real estate? Congratulations! It’s an exciting time…and a nerve-racking one.

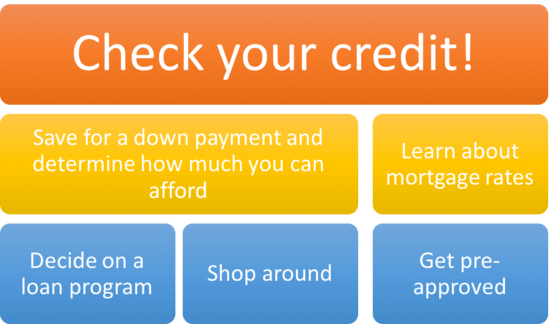

But before you even begin to comb through real estate listings and attend open houses, you need to make sure you actually qualify for a mortgage on your dream home.

And I hope you took a moment to compare renting to buying just to make sure you’re cut out for it.

By the way, I recommend searching for a mortgage before a home to ensure you actually qualify to buy one!

The following are some useful tips for both newbies (first-time home buyers) and seasoned home buyers alike who are looking to experience a mortgage process with as few surprises as possible.

Because those types of surprises aren’t fun…

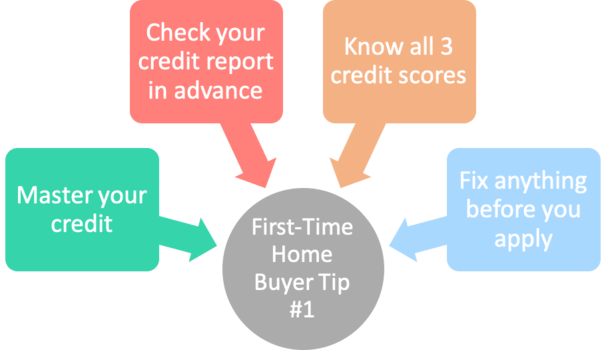

First-Time Home Buyer Tip #1: Check Your Credit Report and Know Your Credit Scores!

- Check all 3 of your credit reports from Equifax, Experian, and TransUnion

- Do this several months before you apply for a home loan (90+ days in advance)

- Get all 3 credit scores from these bureaus as well to see where you stand numerically

- Scour the reports and resolve anything that needs fixing ASAP

- Aim for a FICO score of 780 or above to obtain the best loan pricing

The first thing any prospective homeowner should do, especially a first-time home buyer, is obtain a free credit report and view their credit scores.

This can be accomplished either from AnnualCreditReport.com (which is backed by the CFPB) or via a free service of some kind, such as Credit Karma.

Nowadays, a lot of credit card issuers provide genuine FICO scores for free as well. In other words, you shouldn’t have to pay for anything! Nor should you have trouble tracking down your scores.

However, it’s important that you see all three of your credit scores because mortgage lenders pull all three and then use the middle credit score for qualifying purposes.

You’ll need to know your credit scores from Equifax, Experian, and TransUnion to see the complete picture.

The Annual Credit Report website only provides consumers with free credit reports, which can be extremely helpful, but you shouldn’t apply for a mortgage without knowing your credit scores as well.

Put simply, you’ll need to get your hands on both your credit report(s) and your credit scores to ensure you know where you stand and to determine what your monthly liabilities are.

Add Up Your Monthly Liabilities to Determine Purchasing Power

Your liabilities are things like credit cards, auto loans/leases, an existing mortgage you have and will keep (if any), and any other loans that show up on your credit report.

Once you’ve got your credit report at your fingertips, you’ll need to determine what all those monthly expenses are.

You will see a monthly payment next to each liability on your credit report. Add up all those payments and jot them down somewhere. This total and will be important when determining how much house you can afford.

While you’re at it, scan the credit report for derogatory accounts and clean them up as best you can. If you’ve got delinquent accounts, resolve them.

If you see collections/charge-offs, call the associated creditors and ask to get them removed (or dispute them online).

If everything looks good, you can move on. If not, you may want to work on your credit before applying for a mortgage and attempting to buy a house.

A credit score of 620 or higher is the recommended minimum you’ll need before beginning your property search, though both FHA loans and VA loans allow for lower scores.

Just know that the lower your credit score, the higher your mortgage rate, assuming you are able to qualify at all.

And as noted, mortgage lenders use the mid-score, so if your credit scores are 620, 580, and 610, they’ll use the 610 score for qualification purposes. So check your credit with all three bureaus!

*Important note: Do NOT open any new credit accounts of any kind or make any large purchases using your credit cards while or before applying for a mortgage.

This includes buying that new 80 inch OLED TV using a Best Buy credit card for your new crib.

Doing so could tank your credit scores, resulting in a higher mortgage rate or potentially even a last minute declined mortgage. Wait until your loan funds to furnish your home!

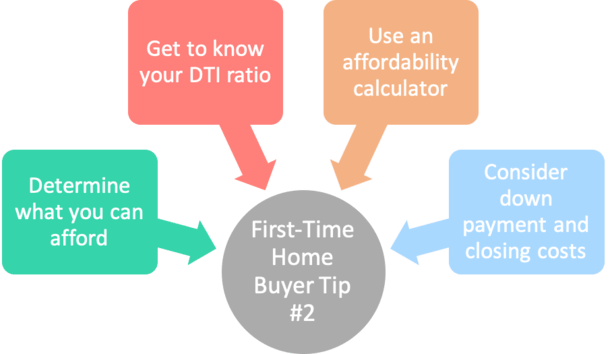

First-Time Home Buyer Tip #2: See What You Can Really Afford

- Mortgage lenders determine affordability by calculating your debt-to-income ratio (DTI)

- All your monthly liabilities and proposed housing payment are divided by your gross income

- Lenders typically want this number to be 43% or less to qualify for most home loans

- Down payment, closing costs, and reserves needed to close will also be considered

Now that you’ve got your credit in order, it’s time to figure out how much house you can afford. This will be dictated by both the purchase price and those monthly liabilities we talked about.

Most mortgage lenders allow borrowers to have a debt-to-income ratio up to 43%, though that number can vary based on the type of home loan and by lender.

If you take your total liabilities from your credit report and add them to your proposed monthly housing payment, then divide that number by your monthly gross income, you’ll come up with your DTI ratio.

You can read a more in-depth article about debt-to-income ratios if you’d like to learn more.

Let’s take a look at an example:

$10,000 monthly gross income

$1,500 total monthly liabilities

We know from the above example that your total monthly payments including the new mortgage can’t exceed $4,300, or 43% DTI based on your $10,000 gross monthly income.

So if you already have $1,500 in total monthly liabilities thanks to an auto loan and some credit card debt, you can add a housing payment of up to $2,800 a month.

Let’s look at the same example with the proposed housing payment, including property taxes and homeowners insurance, based on current mortgage rates:

Loan Scenario:

$300,000 purchase price

$240,000 loan amount

$60k down payment

6% interest rate

Monthly Mortgage Payment:

$1,438.92 mortgage payment

$312.50 monthly taxes

$85 monthly homeowners insurance

$1,836.42 total monthly housing cost

In the above scenario, a prospective homeowner making $10,000 in gross monthly income can easily afford a $240,000 home loan.

This factors in the mortgage payment, property taxes, homeowners insurance, and their other monthly liabilities.

A basic mortgage calculator will only give you the principal and interest, sans the taxes and insurance.

Anyway, our hypothetical borrower would have a DTI ratio around 33%, which is great because it’s well below the maximum.

It also provides a buffer in case mortgage rates rise from application to rate lock. Or if any estimates wind up running higher than expected. This happens frequently!

Always make sure you leave some room for the unexpected and don’t buy more house than you afford.

Aside from financing costs, homes come with a lot of maintenance. Keep those in mind and use a cost calculator to factor in things like gardening, utilities, pool service, repairs, etc. into the equation.

Why the 20% Down Payment?

For the record, I used a 20% down payment in the example above. Many first-time home buyers come in with significantly less. As such, their mortgage payment will be higher for a variety of reasons.

If you put down less than 20% on a home purchase, you’ll have to pay mortgage insurance, your loan amount will be larger (obviously), and your mortgage rate will probably be higher as well (to compensate for additional risk).

For example, FHA loans require just 3.5% down payment, but carry both an upfront mortgage insurance premium and an annual premium.

Fannie Mae and Freddie Mac have similar loan programs that require an even lower 3% down payment.

So your DTI can easily shoot higher if your down payment is minimal, greatly limiting how much you can afford. Consider that when determining an appropriate purchase price.

A mortgage calculator worth its salt will include all these potential costs.

[See: Mortgage Affordability Calculator]

A lot of prospective homeowners out there live paycheck-to-paycheck and have very little set aside in savings. In the eyes of banks and lenders, this simply isn’t good enough.

If you want to borrow a few hundred thousand dollars, be prepared and set realistic expectations.

You should be able to afford the fully-amortized mortgage payment, and any payment increase if it’s an adjustable-rate mortgage. Otherwise, you’ll need to lower your loan amount and do better to live within your means.

So now you’ve got an idea of what you’ll be able to afford. There are a number of mortgage calculators out there that will give you an accurate picture of what you can qualify for.

It’s also important to budget for closing costs, while leaving an emergency fund in place to ensure monthly mortgage payments can be made if/when something unexpected comes up.

[Which mortgage is right for me?]

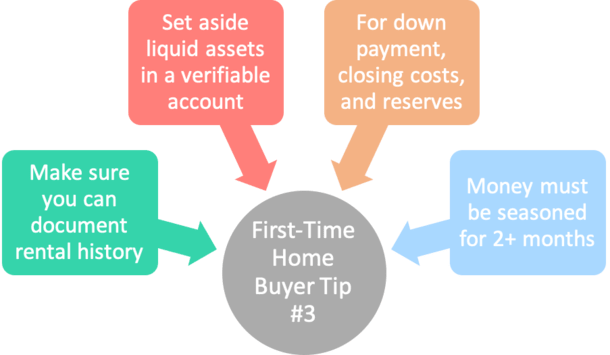

First-Time Home Buyer Tip #3: Prepare to Document Rental History and Assets

- Make sure you’re able to document rental history for the most recent consecutive 12-month period

- Be sure your assets are seasoned for at least 2 months prior to application

- They must be in verifiable accounts that you’re willing to share with the lender

- Mattress money or any cash you have lying around the house won’t fly

Now that you’ve got your credit profile in check and you know what you can reasonably afford, you’ll need to make sure you’ve got a verifiable housing history and seasoned assets.

Most lenders will ask that you verify your previous 12 months housing history, unless you live with mom and dad.

You can do this with cancelled checks or a VOR (Verification of Rent) from your landlord. This is important to determine any payment shock.

Liquid assets, such as those readily accessible in a checking or savings account, are always helpful when applying for a home loan. However, funds in a retirement account such as a 401k or Roth IRA may also work.

These days you may not necessarily need reserves if you’re a first-time home buyer purchasing a one-unit, owner-occupied property. But it can certainly make your loan file stronger if you do.

As a rule of thumb, be sure you have savings to cover at least two months PITI (principal, interest, taxes and insurance for the proposed mortgage payment), the down payment, and closing costs.

Also make sure the money has been in a verifiable account for at least two months to ensure it is “seasoned.”

Banks and mortgage lenders don’t give any weight to unseasoned assets, as any friend, relative, or even an unscrupulous mortgage broker or mortgage loan officer could easily dump money into your account before you apply for a mortgage to boost your net worth.

Same goes for so-called mattress money, it just won’t fly!

Save for Your Down Payment Well in Advance

It’s also important to sock away money for your down payment in that same savings account several months, or even years, in advance.

Saving enough for the down payment is a common roadblock for prospective home buyers. And sometimes they miss out on their dream home as a result.

So saving early and often is key to achieving the dream of homeownership. Remember, you’ll have other expenses too, like closing costs, moving/relocation fees, new furniture, etc.

If you don’t have adequate down payment funds, you may be able to use gift funds from an acceptable donor to cover your down payment, closing costs, and even reserves.

Now that you’re prepared, it’s time to be vigilant and proactive. Avoid predatory lenders and do your interest rate homework.

Check out a rate sheet from the bank or lender you’re being quoted from. Ask what the interest rate adjustments are. How they came up with the rate.

Ask if the loan carries a prepayment penalty and for how long? Get all the facts from your broker or loan officer before you sign anything. And once you like it, lock it!

[How to find the best mortgage rates.]

With all this preparation behind you, the loan flow should be a relatively comfortable process with few surprises.

It might not be perfect, but if you follow these rules and study up on how mortgages work, you might save some money and reduce stress!

The Definition of a First-Time Home Buyer

One important note about first-time home buyers and how they’re defined.

Some entities, including Fannie Mae and Freddie Mac, define first-time home buyers as those who haven’t owned (sole or joint) a residential property during the three-year period preceding the date of the home purchase.

This means you can be a previous homeowner who just hasn’t owned for a few years, and take advantage of programs intended only for those buying their first home.

For example, if you sold your old home three years ago, you might qualify as a “first-time home buyer” today.

Additionally, Fannie Mae considers displaced homemakers or single parents as first-time home buyers if they had no ownership interest in a principal residence (aside from joint ownership interest with their spouse) during this preceding three-year time period.

So if you just recently went through a divorce, or another unexpected life event took place, it’s possible to earn the first-time buyer distinction even if you recently owned a home.

What Is a First-Generation Homebuyer?

Recently, loan programs have been rolled out specifically for what’s called “first-generation homebuyers.”

The initiative is aimed at increasing homeownership rates for underserved groups, such as those who are new to the United States.

As the name implies, a first-generation homebuyer extends the first-time home buyer definition to include the parents of the borrower as well.

This means a borrower who has had no ownership interest in a property for the past three years, whose parents have also had an ownership interest (sole or joint) in a property in the last three years.

For example, if you’re buying your first home and your parents both rent, you should meet this definition.

The same would be true if you sold a home over three years ago and your parents also sold any properties they owned three years prior to the note date on the new mortgage.

Like a first-time buyer, they must occupy the property and use it as their primary residence

What types of mortgage loans are available to first time home buyers?

- Conventional loans such as those backed by Fannie Mae and Freddie Mac

- Government loans such as FHA, USDA, and VA loans

- Proprietary loan programs offered by individual lenders and credit unions reserved solely for first-time home buyers

- Down Payment Assistance Programs from state Housing Finance Agencies

As a first-time home buyer, you basically have access to the widest array of loan programs available, including those restricted just to first-timers.

This means you can apply for a conventional loan, such as those backed by Fannie Mae and Freddie Mac, including the 3% down payment loans offered by the pair.

Same goes for government loans including FHA, USDA, and VA loans.

Additionally, select lenders offer special financing to first-time home buyers, so you’ll have access to those loan programs as well.

Finally, you may also be able to take advantage of Down Payment Assistance (DPA) for down payment and closing costs via your state’s Housing Finance Agency (HFA).

In other words, you’ll have plenty of financing options if you’ve never owned a home before. Just make sure your credit score is in good shape and that you qualify otherwise to ensure you aren’t shut out.

The one caveat is that you might have to complete first-time home buyer education if you apply for one of these programs.

But it’s generally a pretty short and easy course, and should make you a better borrower!

Key tips for first-time home buyers in review:

- Order a free credit report from each credit bureau

- Find out what your three credit scores are (mid-score used to qualify)

- Review your credit report and clear up any derogatory accounts in advance

- Do NOT open any new credit accounts or make any large purchases before/during the loan process

- Calculate your total monthly bills/liabilities from your credit report (minimum payments)

- Determine how much you are able to put down on a home purchase

- If you put down less than 20% you will have to pay mortgage insurance (PMI)

- Calculate your DTI ratio to determine what you can afford

- Make sure you have a 12-month verifiable housing history (document your rent)

- Put at least two months PITI in a verifiable account several months before you apply

- Set aside money for a down payment and closing costs in a verifiable account in advance

- Decide what loan type or loan program best suits you before interested parties chime in

- Get pre-approved for a mortgage and obtain a pre-approval letter before viewing homes

- Shop around with multiple banks and lenders, not just the one that pre-approved you

- Compare mortgage rates extensively with online lenders, brokers, banks, and credit unions

- Lock your mortgage rate when you’re satisfied to ensure it doesn’t increase before you close

- Get a better understanding of mortgage closing costs so you know what to expect in the way of fees

- Breathe!

Read more: How to get a mortgage from start to finish.

- UWM Launches Borrower-Paid Temporary Buydown for Refinances - July 17, 2025

- Firing Jerome Powell Won’t Benefit Mortgage Rates - July 16, 2025

- Here’s How Your Mortgage Payment Can Go Up Even If It’s Not an ARM - July 15, 2025

The credit-related tips are the most important. You really need to know where you stand credit score-wise before applying for a mortgage. And you absolutely should not apply for any new credit (other than your mortgage) when trying to obtain a mortgage.

This would have been nice to know a few months ago. I opened up a new credit card before I started shopping for a home to put expenses on a 0% APR card so I’d have more cash in my account for a down payment. But my credit score has taken a dive as a result if accruing all that debt.

How much do you typically need for a down payment as a first-time buyer? Does it differ from what you’d need if you already own a home, or purchased a home in the past?

It depends. Most homeowners try to put down 20% to avoid mortgage insurance and obtain a lower interest rate, but plenty of buyers will come in with just 10% down or less. The FHA allows as little as 3.5% down payment, and there are select programs that require even less (or nothing down). It doesn’t really matter if you’re a first timer or not, just that you qualify otherwise based on income, job, credit, rental history, etc. However, there are state programs that offer incentives to first-time buyers, so inquire with a local housing counselor to ensure you don’t miss out on these programs.

Great tips! I’m currently looking to purchase my first home and feel a lot more confident now knowing most of these. Hope it makes the closing process a lot smoother. Now if only I could actually find a property!

What is the easiest type of mortgage to qualify for as a first-time buyer?

FHA loans have the lowest down payment requirement at 3.5%, but they also have sizable mortgage insurance premiums, which could make it a more expensive option. So be sure to compare all your options from a down payment, qualification, and monthly payment standpoint.

Thank you for the REALITY check. As I read the First-Time Home Buyer tips I started to laugh at my self because I know better but you get hooked in with the beautiful homes and future vision of living in one of these homes. Also I want to truly Thank you for the more then informative yet easy to understand info regarding this complex process.

You’re very welcome Sue. It does get very emotional, which makes a difficult and time-consuming process all the more challenging. But you’ve got to stick to your guns to avoid winding up with too much house/mortgage, or a house/mortgage that isn’t right for you.

It’s also advisable to pay off credit card debt a few months before the mortgage process if you’ve got a lot of debt. It will improve your credit score and DTI. Just make sure you have enough assets to do so. You’ll need plenty leftover for a down payment and reserves.

Are mortgage rates lower or higher for first-time buyers?

Will,

There’s no difference, though many lenders offer purchase specials, aka slightly better pricing for purchases as opposed to refinances, whether you are a first-timer or not. There are also special state-funded programs for first-time buyers that might result in lower closing costs or down payment requirements. Be sure to research them in your particular state.

As you pointed out, it’s extremely important for prospective buyers to look at their TOTAL housing payment, not just mortgage, which is generally much, much cheaper. Mortgage rates are cheap, but insurance and taxes are not. Nor is HOA!

If it makes more sense saving a large down payment even if you have to wait longer to buy a home then do so. It would help to know the different loan programs requiring different percentages that will be best suited for you. What a higher or a lower down payment will mean for you can help you decide with confidence.

2 questions/issues:

1. My son is a 1st time home buyer and was told that he didn’t have enough credit, ( The only credit he has is from 2 vehicle purchases that he has paid off) — it was suggested he get a credit card — Any other advice?

2. The house he wants to buy is a fixer upper and is only $45,000.00 – Chase said they would only approve for a mortgage that is greater than $60,000.00 — Are you aware of anyone that approves mortgages for less than $60,000.00??

Thank You!

Hi Brenda,

It can be difficult to get financing on smaller loan amounts like that, so perhaps shopping around a bit more (think credit unions, mortgage brokers) might help. It is also tricky to get a mortgage with very limited credit history, though a lender may be able to use alternative credit like rent, utility, and other bills that don’t show up on a traditional credit report. If none of that works co-signing may be necessary. Also have him look into state housing programs.

I have 20% to put down, but I need my mom to Co sign so I can include her income to mine. I know fha will allow co-borrowers, but is there a conventional loan I can qualify for? It would save me so much not paying that monthly insurance. I’m just wondering what options I might have?I thought Freddie Mac did? I think the loan might have to be manually underwritten. I’ve been reading a lot trying to educate myself, but you can’t always believe what you read.

Donna,

Fannie Mae’s DU (automated underwriting) does not consider the income of a non-occupant co-borrower, and manual underwrites allow a max DTI of 43% using only the occupying borrower’s income. If you want to go conventional, Freddie Mac does allow non-occupying co-borrower income but specific rules may vary from lender to lender.

Do you know a lender in Maryland that will do conventional loans that allows my mom’s income and not to live in the home. I have 20% to put down and both have good credit. I just need that extra income to get me the amount I need. I don’t want to pay PMI if I don’t have to. FHA will require it for the life of the loan no matter what I put down. Maybe I should get a arm and then refinance in a couple years to conventional and then put 20% down. Do you have any suggestions or know any lenders in Maryland that can help me. Everyone I’ve talked to said conventional won’t allow non occupant Co borrowers. I already have a home I just need to make a decision which way I’m gonna go. I’m trying to save and have the cheapest payment system as possible.

Donna,

I can’t vouch for any individual lenders. Best to do your own research and shop around.

I have a foster daughter that lived with me from 15-18 years. She is now 30. We were closing on the 25th of June but underwriters needed an extension due to survey issues. They fixed it but now they are saying that we have to have 12 months of cancelled checks. We do have 12 months of deposits but not checks. Also I did sign a VOE. Broker says well I don’t think its going to work because of …..(Yes that will be considered a non arms-length transaction because you have a pre-existing relationship prior to her being your tenant.) I am the seller and she is the buyer. HELP!!

Cindy,

Did you ask the lender if proof of deposits to your account and monthly withdrawals from her account would suffice? Basically showing the paper trail from/to the accounts. Your bank doesn’t scan the checks when they are deposited?

I’d like to bring down my debt to decrease the DTI. But by doing so it would cut into my savings for the downpayment. Do you recommend I decrease my debt by using what I’ve saved?

I have 2 car payments and I am in the process to buy a house, can I add them to the mortgage loan and how that’s gonna affect me?

Hi Colin. I came across this looking for more information and i really enjoyed reading your site. My question is, what do you suggest for someone who owns their own business? I am a sole proprietor of a small brick and mortar game store. As a small business who has been opened for over 2 years, for my tax return i was always told to write EVERYTHING off, because deductions is key. So doing that, it showed my adjusted gross income not near where i could quality for a loan. But my monthly deposits were over 7k a month in my personal account, not including my business account (so roughly 80k a year). Is there ANY programs that do NOT require you to show your tax return adjusted gross income, but rather proof of not only enough money being made, but also using that to get my home loan? I am also not looking for anything above 250k (so roughly 1100-1300 per month in mortgage) and id like to try and have a $0 down, but i coud afford a 3.5% down. I am also a first time home buyer, with 700 credit score and almost no debt (cept my truck payment $320 a month).

Any helpful suggestions?

Dylan,

Yeah, common problem for the self-employed who want to maximize deductions and qualify for big loans. Might be a lender that allows alt-doc, but rates may be higher and down payment requirements higher, so bit of a catch-22. Shop around to see which lenders allow what.

Hi Colin,

Wanting your opinion…I have a sizeable down payment for a first time home/mortgage in TX. The down payment will be 100k-120k. My budget for the home is $180-$185k Does having a big down payment help get a lower mortgage rate?

I am concerned if my income/credit score is sufficient enough -my income is only $35k a year and my credit score is around 660 with a couple collections getting ready to fall off soon. Are most banks going to turn me away like the previous commenter because my loan amount will only be around 60k and my income and credit are meh, okay looking? The 2 things I have going for me is a sizeable down payment and lots of good standing credit card accounts for 8+ years.

Amber,

Sometimes it can be tricky to get a small loan amount approved with marginal credit if the lender must avoid offering you a high-cost loan. Maybe you can work on your credit a bit more to improve it. As for the interest rate, the LTV will be low if you put a ton of money down, which does generally lead to a lower rate. But at a certain point it’s no longer beneficial to keep putting more money down in that respect.

Thank you for writing this article, Colin. Very concise with excellent information.

My husband and I are looking to buy our first home. Credit scores are above 760 and we are just over 50 years old. We have 2 credit cards and no car payments. We have an emergency fund, and are looking to have a small down payment for a townhouse or condo. What issues may arise in securing a mortgage because of our age?

Appreciate any advice you are willing to share. Thank you!

Maggie,

Age isn’t necessarily an issue if you have good jobs, credit, and assets to qualify. 50 isn’t that old! Good luck!

Hi Colin,

My wife and I are the first time buyers with credit scores somewhat around 810. We’re currently on the mortgage market (in fact, we’ve just been preapproved a month ago). Unfortunately however, one of these days (after actually being preapproved) we happened to take a $54,000 6 year car loan. While reading your article, I started asking myself whether the new car loan was actually a bad move in terms of resulting in an increased mortgage rate. You specifically advised against large purchases paid by cards, but would a car loan qualify as a “no-no” as well? Thank you so much in advance.

I have a question concerning getting approved for a loan. My fiance and I were pre-approved by our bank, but now he told me that we need to watch what we spend for the next few months before we get ready to buy. We are planning on buying in the next 4-5 months and will begin looking again in the spring. The problem is, I’m a little worried about not making large purchases for the next 4-5 months. I need to have gum surgery that requires I pay 2000 dollars to start off with, and we also need to book our honey moon. Both of these will require pretty large sums of money. Do you think this will effect us getting approved for our mortgage?

Rachel,

Be careful making large purchases before obtaining a mortgage. For one, it will deplete your savings needed for reserves, closing costs, and down payment. And if you use a credit card it could lower your credit score, at least temporarily. If you must make those purchases be sure you have the necessary cash to purchase a home as well and always budget for more than you need because of unexpected costs that tend to come up. Good luck.

Leon,

Your credit scores will probably be fine since they were so high and an installment loan isn’t necessarily a big hit or a hit at all, but you will have to contend with another issue…a higher DTI ratio as a result of a new monthly liability. The monthly payment on the auto loan basically cuts into how much you can afford, which if cutting it close, could be an issue.

My husband is finally making enough to the point that we can buy our first home! The only thing is we don’t know how to get a good interest rate. Although, I think seeing how much a can really afford is a good step. Do I need to take in my credit score when I go to take out a mortgage?

I want to apply for a VA loan. Do you have to work where you buy? I have a good job but want to move my family about 5 hours away in the same state and commute. Is that an option?

Scott,

That’s quite a drive and you’ll probably need a pretty good letter of explanation so they don’t think you’re buying a second home or investment property.

I guess you have shared some helpful tips for first time home buyers to make the whole process smooth and stress free. Great job!

Hi,

I want to get a home and I will be a first time home buyer I am looking for a 0% down loan. Can you point me in the right direction?

I had someone helping me with an FHA but I feel like he is giving me the run around I can get a small amount as a gift from my family but he is telling me it wont be enough because I will have to pay taxes up front and the closing cost separately.

So I am loosing all help as a single mom it is hard to save a lump sum and paying 1250 rent a month is so not worth it. I would prefer to pay for my own home especially that the rent will soon be going up again.

It’s interesting to see a number fixed to an acceptable debt to income ratio. It makes sense that a lender wouldn’t want to loan money to someone if all of their income is going toward paying debts. The lender needs to get their money back to make a profit. They aren’t going to make that investment if they have reason to believe that they won’t get it back.

Sir,

First, THANK YOU VERY MUCH! I was a nervous wreck before coming across your helpful tips for first time home buyers. Financing has me more worked up than actually looking for a home.

I was thinking about going through my credit union. Here is what they have to offer 1st time home buyers. Would this be an okay option to keep on my list as I look for a few more comparisons?

Save with no money down, no PMI – private mortgage insurance, and a low fixed rate.

Low fixed rate

20 year term

No down payment

Maximum contract price of $200,000

Existing Home construction in a platted subdivision only

No mobile, modular, manufactured, log homes or metal constructed homes

Owner occupied only

Real Estate must be in Oklahoma

No Private Mortgage Insurance (PMI) required.

First Time Home buyer

20 year fixed, 0% down payment, Rate 3.750%, APR 3.858%, Loan to value is 100%,

Sal,

Rate seems pretty good, though it’s a 20-year fixed so payments will be higher than the typical 30-year loan term. But that means it’s paid off a lot faster too. Also PMI is just built into the interest rate despite not having to pay it directly when you put less than 20% down.

As a first time homebuyer this will probably be one of the biggest financial decisions you’ll ever make. Here are a few questions you need to ask yourself.

How much debt do I have?

Before you can take on a huge financial responsibility that a home is — you need to pay down, or you’re your existing debt load. Consider consolidating loans and getting rid of credit cards. Perhaps most importantly, you need to make sure that as you reduce debt, you increase your credit score. For more information, good contacts would be a financial advisor, a good mortgage broker, or your bank manager.

Where will I be living in 2 to 5 years?

If you are planning on being in a particular place for a short time (2 years or less), then renting may be a reasonable financial option. Buying and/or selling a home comes with associated costs. Your home may not build enough equity in 2 years to justify paying real estate and legal fees twice.

What are the market conditions in your area?

Because of appreciation, you will could realize an approximate increase in property value of 4-6 percent per year, that means over the next 5 years you’ll have a home that’s worth about 30% more than when you purchased it. This would provide additional cash to pay off student loans and other expenses, as well as building a good credit rating at the same time. The thought behind buying real estate is to get a head start on building up your financial future. If you are planning on being in a location for 2 years or more, then you should consider buying. Not only will your home increase in value, but you’ll be saving money on a monthly basis. Becoming involved in the real estate market becomes less scary when you educate yourself. There are benefits to being a homeowner, such as a stable lifestyle and watching your investment appreciate in value. Real estate has always had more security than the stock market, but unfortunately there is no sure way to determine the right time to buy, that decision should be based on personal factors and finances. But you don’t have to do this alone, a good broker or bank manager and a knowledgeable real estate agent will help.

I have a question – if I entered the program as a single first time homebuyer, and now am engaged, is it possible to add someone to this program with me? Or get approved for more based on there being additional income to the housing costs?

Kelsey,

Probably shouldn’t be an issue – though one thing you might have to worry about is having too much income if a program has maximum income limits. But keep in mind both borrowers don’t always have to be on the mortgage if it’s not favorable.

Question my husband and l want purchase a home as first time buyers we where thinking FHA. l have many credit cards l am getting my balance downs and about to pay a loan l have off so we can get our score ups. When we first sat down with a mortgage company, they said we wasn’t far from where we needed to be in score wise by doing this do you think this will help my husband and I. We want to be in our new home within a year from now.

Anne,

Paying down balances can improve your credit scores a lot…it’s hard to say how much without knowing all the details but it is generally very helpful. It may also allow you to borrow more once you have less outstanding debt.

Last year I was going through FHA and had a plan set up to pay $150 a month for 6 months. I was able to make the first 3 payments but had to cancel due to my job closing down. My question is: is the money lost that I already paid? I feel like my question keeps being avoided. I received no help from FHA during this time. I could not follow through on my obligation. So am I entitled to a refund or can I pick up where I left off?

Esmerelda,

I don’t really understand your question. What was the $150 going towards? And what did you cancel?

Do you know anything about getting approved if have income and then not working due to COVID?

Audra,

Mortgage lenders are well aware of income disruptions due to COVID-19 and are heavily vetting ap;applicants at the moment. This includes multiple employment checks from start to finish to ensure your job/income is stable.