It’s nearly 2023, which means it’s time for a fresh batch of mortgage and real estate predictions for the new year.

My assumption is everyone wants 2022 to come to an end as quickly as possible, as it hasn’t been kind to anyone.

Much higher mortgage rates have completely derailed the housing market, leading to lots of layoffs and closures across the industry.

And there remains a lot of uncertainty about what next year will bring, though I’m somewhat optimistic.

Read on to see what I think 2023 has in store for the housing market and the mortgage industry.

1. Mortgage rates will move lower in 2023

Let’s start with the elephant in the room; mortgage rates.

They’ve been the story of 2022, without question. Sadly, because they increased at an unprecedented clip and derailed the hot housing market’s decade-long bull run.

Of course, this was by design as the Fed believed the U.S. housing market was in bubble territory and unsustainable.

However, I believe interest rates overshot the mark and are due to see some relief in 2023.

The 30-year fixed has already fallen from its 2022-highs, and could continue to drop back in the 5% range and even the high-4% range.

So that’s something to look forward to. See my 2023 mortgage rate predictions for more details on that.

2. The housing market won’t crash in 2023

Related to lower mortgage rates is the health of the housing market. Ultimately, the housing market only really stalled because of much higher mortgage rates.

It’s not struggling due to questionable mortgage underwriting, dubious loan programs, or massive unemployment.

Ultimately, the Fed saw that demand for housing was too strong and took measures to address it.

If you remove the mortgage rate piece from the equation, we don’t have a big drop in home prices.

So if mortgage rates continue to improve, or even stay flat, home prices don’t plummet and there isn’t a housing crash in 2023.

At the same time, areas of the country that saw massive home price increases may be more susceptible to price declines.

The good news is home prices increased so much in the past couple years that even a 20% decline is just a paper loss for most homeowners.

In other words, your home is still worth way more than you bought it for, but perhaps not as much as it once was.

3. But we’ll see more consolidation in the mortgage market

Sadly, there have been tons of mortgage layoffs and lender closures in 2022, pretty much all thanks to the sharp rise in mortgage rates.

It was the perfect storm of record low mortgage rates meeting the highest mortgage rates in decades, all within half a year.

Simply put, lenders hired and hired to deal with unprecedented refinance demand, but once that ran dry, had to let a lot of staff go to cut costs.

Demand is down so much that many lenders have had to close down permanently, especially those focused solely on mortgage refinances versus purchases.

While more companies exit the mortgage space, we’ll see consolidation at the top as the big players get bigger and gobble up market share.

This means fewer lenders to choose from and a more commoditized product.

4. Home prices will be mostly flat in 2023

While there’s been a lot of doom and gloom lately, there have been bright spots, like a positive CPI report and an easing in inflation.

Perhaps home price declines will also slow as we enter the new year. If the damage already done is enough to re-balance the housing market, we could see falling home prices steady.

After all, we’ve already experienced a big drop in prices from spring until now, so the ice-cold housing market could warm if rates drop and prospective buyers renew their interest.

While I’m not convinced of the NAR (Realtor) prediction of a 5.4% increase in home prices next year, I do believe flat or nearly positive prices is a possibility.

Zillow’s prediction of home values posting 0.8% growth by the end of October 2023 sounds right. The MBA also puts YOY home prices up 0.7%.

Of course, price movements will be local, as they always are, with some markets faring better (or worse) than others.

Get to know your local market to determine the temperature if you’re in the market to buy or sell.

5. The spring home buying market will actually be decent

Despite a lot of recent headwinds, the 2023 spring home buying season will be alright.

No, it’s not going to be riddled with bidding wars and offers above asking. Nor will total home sales be as high as they were in 2022, and certainly not 2021.

But I do think a combination of lower asking prices and improved interest rates will bolster the market.

Remember, there are a ton of prospective, coming-of-age home buyers out there who want and need a house.

If mortgage rates were 7% in 2022, and fall to the high-5% range, that, coupled with a 20% haircut on price could re-energize the stalled housing market.

So much so that home prices could steady in 2023 after seeing some pretty big markdowns in the second half of 2022.

6. Buy downs and ARMs will become more common

As mortgage rates remain elevated, mortgage buydowns and adjustable-rate mortgages will gain in popularity.

The ARM share is already around 9%, but there’s a lot of room for it to grow if lenders continue to offer products like the 5/1 ARM or 7/1 ARM.

That’s the rub though – if lenders don’t offer ARMs, or don’t extend a significant discount on the ARM, most borrowers will be forced to go with more expensive fixed-rate mortgages.

To offset some of the pain related to higher-rate 30-year fixed mortgages, buydowns will become more and more commonplace.

A lot of home builders are already offering buydowns, and even big lenders like Rocket Mortgage have their so-called Inflation Buster.

These buydowns provide payment relief for the first year or two before reverting to the higher note rate.

The question remains whether that’ll be enough time to bridge the gap to lower interest rates.

7. The underwater share of mortgage holders will rise

Because home prices have been under intense pressure lately, there will inevitably be more underwater homeowners soon.

Black Knight recently noted that 8% of those who purchased a home in 2022 “are now at least marginally underwater.”

And nearly 40% of these home buyers have less than 10% equity in their home, which if property values fall a bit more would plunge these folks into negative equity positions.

It’s most pronounced with FHA and VA borrowers, with more than 20% of 2022 of home buyers in negative equity positions, and nearly two-thirds having less than 10% equity.

This illustrates one of the problems with ARMs, buydowns, and other ostensibly temporary financing solutions. They work until they don’t.

If these homeowners are underwater, it’ll be difficult to refinance aside from leaning on streamline refinance programs that allow high loan-to-value (LTV) ratios.

8. Foreclosures and other distressed sales will continue to be rare

Those looking to snap up a bargain will need to be patient. Despite decelerating appreciation and markdowns on existing inventory, prices remain historically high.

At the same time, mortgage defaults and foreclosure starts remain very low, despite recent increases.

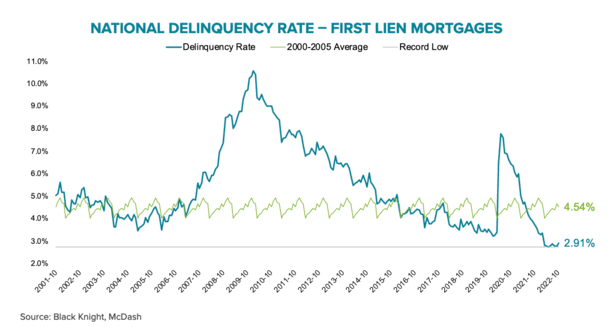

Per Black Knight, the national delinquency rate rose to 2.91% in October, well below the 4.54% average seen between 2000-2005.

And the 19,600 foreclosure starts in October were a full 55% below “pre-pandemic norms.”

It’s not to say homes won’t be lost, especially if home prices plummet and unemployment worsens, but it’s not 2008 all over again.

In short, today’s homeowner has a lot more equity to work with and there are better loss mitigation options that were born out of the prior mortgage crisis.

They may also have the option to rent out their property and cash flow positive.

9. Home equity lending and the home improvement trend will stay hot

One bright spot in the mortgage financing space might be home equity lending, including home equity loans and lines of credit (HELOCs).

This plays into the trend of keeping the property instead of selling it, since selling isn’t nearly as sweet as it once was.

There’s also the issue of where to go next if you sell. And because first mortgage rates are so high relative to levels a year ago, most will opt to finance improvements with a second mortgage.

While not a 2-3% interest rate, home equity rates will still be better than most other options, and allow homeowners to freshen things up while enjoying their ultra-low first mortgage rate.

This should be a boon to banks, mortgage companies, and fintechs that are able to sell a compelling product.

It may also benefit the likes of Home Depot and Lowe’s as more folks stick with what they’ve got and make improvements.

Of course, it’ll mean fewer home sales, which is a clear negative for real estate agents.

10. iBuyers will offer you lowball prices for your home

In case you’re not aware, your home isn’t worth quite as much as it was.

Of course, you may have never noticed if you didn’t attempt to sell earlier this year. Or obsess over your Zestimate or Redfin Estimate.

What you might see in 2023 is more bargain hunters, especially iBuyers trying to make up for perhaps paying too much in 2022 and earlier.

These companies will give you a cash offer on the spot (basically) for your home without having to jump through hoops or use an agent.

The tradeoff is that the price will likely be a lot lower than what you might fetch on the open market.

This is probably how these types of businesses should operate in theory, but we didn’t see that in a rising home price environment.

You might see more realistic offers from iBuyers and other companies/agents that approach you to buy your home in 2023.

It’s ultimately a reinforcement of the new reality in the housing market. There’s more of an equilibrium where neither buyer or seller have much of an upper hand.

But those who must sell in 2023 might get a raw deal with uncertainty in terms of which way the housing market is headed.