An “adjustable-rate mortgage” is a type of home loan that features a variable interest rate that can move higher or lower during the loan term.

It differs from a fixed-rate mortgage, such as the 30-year fixed, which features an interest rate that does not change.

All adjustable-rate mortgage programs come with a pre-set margin, and are tied to a major mortgage index.

Together, these two numbers determine the fully-indexed rate on the ARM once it becomes adjustable.

Common mortgage indexes today include the Secured Overnight Financing Rate (SOFR), which replaced the London Interbank Offered Rate (LIBOR), the Cost of Funds Index (COFI), and the Monthly Treasury Average (MTA).

Many of today’s ARMs are fixed for some period of time initially before becoming adjustable, typically five or seven years.

After that, the interest rate is subject to change on a semi-annual or annual basis.

ARMs Got a Bad Name in the Early 2000s

Prior to the housing crisis in 2008, adjustable-rate mortgages were synonymous with subprime mortgages. But they aren’t inherently bad, especially today’s hybrid ARMs.

Those older adjustable-rate mortgages were often option ARMs, which allowed for negative amortization.

This meant homeowners back then weren’t even paying down their mortgages. Instead, they were actually accruing interest.

And many of those home buyers then had insufficient income, bad credit, and/or put little to nothing down.

Today’s ARMs are much more sound, and mortgage lenders actually qualify borrowers properly. In fact, even FHA loans are offered with adjustable rates!

In addition, most come with a fixed interest rate for the first five or seven years before their first rate adjustment.

So they’re certainly worth considering, especially if you can snag a much lower mortgage payment as a result.

Jump to adjustable-rate mortgage topics:

– How an ARM works

– ARM interest rate caps

– Types of ARMs available

– ARM interest rates

– ARM qualifying rate

– How to calculate an ARM

– Why choose an ARM

– Is it a good idea to choose an ARM?

– Pros and cons of adjustable-rate mortgages

How Does an Adjustable-Rate Mortgage Work?

Initial rate: 5.75% (won’t change during the initial fixed period of the loan)

Margin: 2.25 (won’t ever change)

Index: 5.5 (can go up and down)

Caps: 2/2/5 (limits how much interest rate can go up/down in certain time periods)

As noted, an adjustable-rate mortgage will typically offer an initial rate, or teaser rate, for a certain period of time, whether it’s the first year, three years, five years, or longer.

During this time, the interest rate is fixed, meaning it won’t change. It will operate just like a fixed-rate mortgage.

But after that initial fixed-rate period ends, the ARM will adjust to its fully-indexed rate. And it will remain adjustable for the remainder of the loan term.

Like fixed-rate mortgages, ARMs typically come with 30-year loan terms. So a 5-year ARM will be adjustable for the remaining 25 years.

To figure out what your fully-indexed interest rate will be each month, simply add the margin to the associated index.

You’ll be able to look up the current index price online or perhaps in the newspaper. The margin, which is set in stone, should be found within your loan documents (check the Closing Disclosure).

Note that both Freddie Mac and Fannie Mae don’t allow the margin to exceed 300 basis points (3.00%).

You also have to factor in payment caps to see when and how often your adjustable-rate mortgage actually adjusts. That is discussed in more detail below.

What Happens to the Adjustable-Rate Mortgage After Year Five?

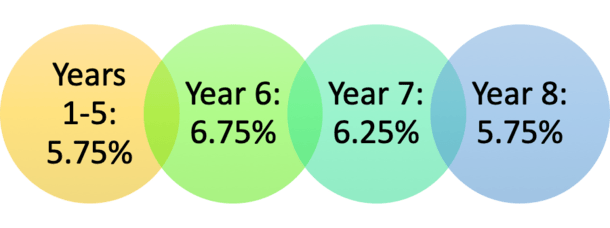

The illustration above features a typical 5/1 ARM, which is fixed for the first five years before becoming adjustable. The rate holds steady at 5.75% during this time. It can’t go up or down.

But in year six, the start rate (which had been fixed) disappears and the rate becomes the sum of the index and margin (2.25 + 5.5 = 7.75%).

This means your fully-indexed mortgage rate would be 7.75% beginning in year six (payment 61).

In year seven, we pretend the index increases by another .50%, raising your mortgage rate to 8.25%. In year eight, a big jump in the index increases your rate another two percentage points to 10.25%.

This is where ARMs can get scary in a hurry, and why most homeowners prefer fixed rates instead.

Tip: You can look up current SOFR rates here to find your index. Most of today’s ARM are tied to SOFR.

Your ARM Rate Could Reset Lower Too

Of course, this is just one scenario – the rate could also go down or stay the same, and even remain lower than comparable fixed-rate mortgages.

For example, imagine the index is 4.50% when year six begins. That’d put the fully-indexed rate at 6.75% using our 2.25 margin.

Then in year seven the index falls to 4% and the rate goes down to 6.25%. In year eight it gets even better, falling back to the 5.75% start rate.

Note that many lenders use the start rate as the “floor.” This means the rate can’t go any lower, even if the index were to fall to zero. So the downside potential might be limited.

But the point is it can goes both ways, it’s just that you’re taking a risk with an ARM as opposed to a fixed-rate product that never changes. That’s why you receive a mortgage rate discount initially.

It is equally important to take note of both the index and margin when selecting a mortgage program from your bank or mortgage broker.

Many consumers overlook the margin, or simply don’t even realize it’s an active component of the adjustable-rate mortgage.

But as you can see, it plays a major role in the pricing of an ARM. Margins can vary by over 1% from lender to lender, so it can certainly affect you mortgage payment in a significant way.

If you want a lower interest rate, inquire about the margin and try to find a bank offering a lower one.

The same can be true of the index. If you’re savvy, pick an index you think might be lower than others if you plan to hold your ARM long enough to where it becomes adjustable.

And ask what the floor is while you’re at it. If there is no floor, your rate could drop a ton if the stars align.

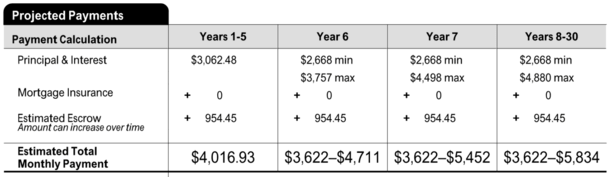

Pay Attention to Your Projected Payments

As you can see from the sample table above, a $4,000 monthly payment could turn into a near-$6,000 payment over time, assuming the borrower kept the loan, and projections hold true.

You can find this information on your Loan Estimate (LE) or Closing Disclosure (CD) if you’re taking out an ARM and curious what may happen to the monthly payment in the future.

Just keep in mind that these are estimates and may not actually materialize.

And many borrowers sell their homes or refinance their mortgages before the loans actually adjust.

Adjustable-Rate Mortgage Interest Rate Caps (ARM Caps)

- ARMs feature caps to limit interest rate movement throughout the life of the loan

- This way borrowers won’t face payment shock if their ARMs adjust higher

- There are initial, periodic, and lifetime caps on ARMs

- While caps are intended to keep payments from spiraling out of control, they still allow for big payment swings

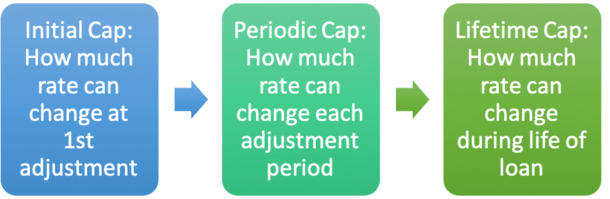

Now some good news. Adjustable-rate mortgages carry “rate caps,” which limit the amount of rate change that can occur in certain time periods.

There are three types of rate caps to take note of:

Initial cap: How much the rate can change at the time of first adjustment. In the 5-year ARM examples above, it would be the initial adjustment after the first 5 years of the loan.

Periodic cap: The amount of rate change during each period, which in the case of a 5/6 ARM is every six months, or just once annually for a 5/1 ARM.

Lifetime cap: Total rate change during the life of loan. So throughout the full 30 year loan term, it can’t exceed this amount.

*You may also see “maximum interest rate,” which is the highest the rate can go during the loan term. The “minimum interest rate” is often just the margin. So the rate can never fall below the margin, or 2.25% in our example.

Typically, you might see caps structured like 2/2/5. This means the rate can go up/down 2% when it first becomes adjustable, another 2% periodically (with each subsequent rate change), and 5% total throughout the life of the loan.

So if the start rate were 5.75%, it could jump to 7.75% upon first adjustment, then to 9.75%, and eventually to 10.75%. But it wouldn’t be able to move any higher because that’s the lifetime cap.

Keep in mind that the rate can also move less than 2%, do nothing at all, or even go down during these adjustment periods. The caps merely dictate the maximum movement during each period.

In the past, it was also common to see caps like 6/2/6. This means the rate can change a full 6% once it first becomes adjustable, 2% periodically (with each subsequent rate change), and 6% total throughout the life of the loan.

So if the start rate were 2.75%, it could jump as high as 8.75% upon first adjustment, but it wouldn’t be able to move any higher because that’s also the lifetime cap.

And remember, the caps allow the interest rate to go both up and down. So if the market is improving, the interest rate on your adjustable-rate mortgage can go down!

But again, it would be limited by the caps, so your rate will never swing higher or lower more than the caps allow.

Additionally, many lenders put in interest rate floors that often coincide with the initial rate, meaning your rate will never go below its start rate.

[Check out the top adjustable-rate mortgage lenders in the country based on loan volume.]

Hybrid Adjustable-Rate Mortgages

- Many of today’s ARMs are actually both fixed and adjustable

- They feature a period of time where the interest rate doesn’t change

- Which can range from as little as six months to as long as 10 years

- Followed by an adjustable-rate period for the remainder of the loan term

Nowadays, most adjustable-rate home loans are hybrids. This means they carry an initial fixed period followed by an adjustable period.

Most are based on a 30-year amortization, which means they last 30 years like fixed mortgages and are paid off similarly.

For example, you may see mortgage programs advertised like a 5/25 ARM or 3/27 ARM, just to name a couple.

A 5/25 ARM is a 30-year mortgage where the interest rate is fixed for the first five years and adjustable the remaining 25 years.

A 3/27 ARM is fixed during the first three years and adjustable the remaining 27 years.

You may also see programs such as a 5/6 ARM. The interest rate is fixed for the first five years, variable for the remaining 25 years, and will adjust every six months.

If you see a 5/1 ARM, it is exactly the same as the 5/6 ARM, except it adjusts only once a year after the five-year fixed period.

Types of Adjustable-Rate Mortgages

- There are a dozen or more ARM choices available to homeowners today

- But not all banks and lenders may offer each type of ARM

- The 5/1 and 7/1 tend to be the most common these days, along with the 3/1 and 10/1

- You may find many additional choices if you take the time to shop around

There are many different types of adjustable-rate mortgages, ranging from one-month ARMs to 10-year ARMs.

Obviously this represents quite a range of risk, so be careful when comparing different loan products.

1-month ARM: First adjustment after one month, then adjusts monthly

6-month ARM: First adjustment after six months, then adjusts every six months

1-year ARM: First adjustment after one year, then adjusts annually

2/2 ARM: First adjustment after two years, then adjusts every two years

3/1 ARM: First adjustment after three years, then adjusts annually

3/6 ARM: First adjustment after three years, then adjusts every six months

5/1 ARM: First adjustment after five years, then adjusts annually

3/3 ARM: First adjustment after three years, then adjusts every three years

3/5 ARM: First adjustment after three years, then adjusts every five years

5/5 ARM: First adjustment after five years, then adjusts every five years

5/6 ARM: First adjustment after five years, then adjusts every six months

7/1 ARM: First adjustment after seven years, then adjusts annually

7/6 ARM: First adjustment after seven years, then adjusts semi-annually

10/1 ARM: First adjustment after 10 years, then adjusts annually

10/6 ARM: First adjustment after 10 years, then adjusts semi-annually

15/15 ARM: First and only adjustment after 15 years

Which Adjustable-Rate Mortgage Is Best?

As you can see, an ARM can give you as long as 15 years of fixed-rate payments, or as little as one month. Then you’re looking at adjustable rates from there on out.

The biggest discounts should be on the shortest-term ARMs, such as a 1-month or 6-month ARM.

And the smallest discount on products like the 10/1 or 10/6 ARM.

Simply put, the longer the fixed-rate period, the smaller the rate discount because it’s less risky. This is why 10-year ARMs often price fairly similarly to 30-year fixed mortgages.

Those who want a longer fixed-rate period, perhaps because they’re risk-averse, may favor the 7/1 or 10/1 ARM. It provides a good amount of time before the first adjustment.

Conversely, a very wealthy individual may be okay with a 1-year ARM if they receive a big rate discount in return. Of course, this person can probably pay off the entire loan ahead of time if need be.

A 5/1 ARM could be a good option as well, as it will likely provide a bigger rate discount since the fixed period is more middle of the road.

Note that there are other types of ARMs out there, and they may be advertised differently.

For example, you might see a 2/28 ARM, or a 3/27 ARM, which are fixed for two and three years, respectively, before becoming adjustable. These might adjust every six months as opposed to annually.

ARM Interest Rates Should Be Lower Than Fixed-Rate Options

- The main draw of an ARM is the lower interest rate compared to a fixed-rate mortgage

- Discount depends on both the type of ARM and how competitive the lender is who is offering the product

- Timing can also come into play since spreads between ARMs and FRMs may widen or contract based on market conditions

- Take the time to shop around because ARM rates can vary considerably from one lender to the next

Pretty much the only reason homeowners take out ARMs is for the initial interest rate discount.

Yes, they are priced lower than fixed-rate mortgages, all else being equal.

This means homeowners can save some money and pay off their home loans faster if the interest rate is lower.

While it depends on the ARM in question, you should see a substantial discount on ARM mortgage rates versus fixed rates.

For example, a 30-year fixed might be priced at 7% on a given day, while a comparable 5/6 ARM is priced at 5.5%.

This spread will depend on the lender in question. Some may be more or less competitive on certain types of loan products. And spreads can change over time based on wider economic issues.

As a rule of thumb, the longer the initial fixed-rate period on the ARM, the lower the interest rate discount.

A 7/6 ARM might be priced at 5.75%, and a 10/6 ARM at 6%, relative to the rates discussed above.

Conversely, a 3/6 ARM might be priced closer to 5.25%, and a one-year ARM could be priced even lower.

Of course, that means there’s a lot more risk of a mortgage rate adjustment in the very near future. As such, those products are really only good for a homeowner who needs short-term financing.

ARM Qualifying Rate

In the past, lenders could qualify borrowers at the start rate on the ARM. For example, if the ARM was priced at 3% for the first five years, they could use that low rate to calculate the DTI ratio.

This could artificially boost purchasing power, but land the borrower in trouble if the loan adjusted higher in year six. As such, this is no longer permitted.

Today, if the ARM has an initial fixed-rate period of three years or less, the maximum interest rate that could apply during the first five years is used for qualification purposes (Fannie Mae source).

If the initial rate is fixed for five years, lenders must use the greater of the note rate plus first rate change cap or the fully indexed rate.

And if the ARM has a initial fixed period greater than five years, the note rate can be used.

In other words, only 7-year ARMs can be underwritten using the start rate.

Home buyers can no longer qualify for a larger mortgage amount due to the lower rate on the ARM because lenders use a fully-indexed or even higher rate for qualification purposes.

How to Calculate an ARM Loan

- To calculate an ARM once it goes adjustable

- Simply combine the preset margin and the current index price

- Then multiply it by the outstanding loan amount

- Be sure to use the remaining loan term in months to determine the correct payment

Now that you’ve seen the many ARM loan options available, you might be wondering how to calculate an ARM adjustment.

After all, there’s a chance you might face a rate adjustment if you hold onto your mortgage beyond the fixed period.

Fortunately, it’s not too difficult to calculate, you just need a few key pieces of information.

This includes the fully indexed rate (index+margin), the outstanding loan balance, and the remaining loan term.

For example, if you took out a 5/1 ARM with a rate of 2.5% and a loan amount of $200,000, the monthly payment would be $790.24 for the first 60 months.

After 60 months, the principal balance (remaining mortgage amount) would be $176,150.87.

Now let’s assume your margin is 2.25 and the index is 1.50. Together, that’s a new rate of 3.75%

We then have to apply that new rate of 3.75% to the remaining balance of $176,150.87 over the remaining term, which would be 300 months (25 years).

That results in a monthly payment of $905.65, at least for the 12 monthly payments during year six.

The loan will then re-amortize again at the start of year seven, and the monthly payment will be generated using the new outstanding balance and interest rate at that time. And so on down the line…

It’s good to know the math so you can compare your notes to your loan servicer’s to ensure everything is as it should be.

Why Choose an Adjustable-Rate Mortgage?

- The number one reason to choose an ARM is to obtain a lower interest rate

- This can save you money each month via less interest paid

- And decrease your monthly housing payments (more affordable)

- But it’s not without risk if interest rates rise significantly

You might be wondering why anyone would get an adjustable-rate mortgage. Well, the main advantage of an ARM is the lower mortgage rate relative to a fixed-rate home loan.

This spread can differ over time and might be wider if fixed rates are high, making ARM rates more attractive to homeowners.

There aren’t really many pros and cons to adjustable-rate mortgages outside the interest rate offered.

Most homeowners get into adjustable-rate mortgages for the lower initial payment, and then usually refinance the loan when the fixed period ends.

They have the option to refinance into another ARM or a fixed-rate mortgage, pay off the mortgage entirely, or sell the home outright.

Or they can just stick with the ARM if the rate and payment are favorable after the initial fixed-rate period ends.

Is It a Good Idea to Get an Adjustable-Rate Mortgage?

Ultimately, it depends on a number of factors.

Some homeowners may choose an adjustable-rate mortgage if the property is simply a short-term investment. Or if they don’t plan on owning the home for more than say five years.

In this case, they can take advantage of the initial fixed-rate period and never deal with a rate adjustment.

Of course, plans change and they could be stuck with the loan longer than anticipated.

It also depends on what happens with interest rates during the time they hold the loan. If rates go down, they can keep their ARM or refinance.

If rates rise significantly and they still have the ARM, they could be in trouble.

Personally, I’ve taken out ARMs and saved money for several years before refinancing into a fixed-rate loan.

But the timing worked out. Things could have easily gone sideways too. So proceed with caution.

Of course, the savings realized during the fixed-rate period can eclipse any subsequent payment increases, at least for a while.

For the record, a home equity line of credit (HELOC) is also considered an adjustable-rate mortgage because it’s tied to prime, and that can change whenever the federal funds rate changes.

In summary, make an interest rate plan before you purchase real estate.

Decide what you want to do with the home over the next five years, and from there, you’ll be able to decide if an adjustable-rate mortgage is right for you.

Pros and Cons of Adjustable-Rate Mortgages

Adjustable-Rate Mortgage Pros

- Reduced mortgage rate

- Cheaper monthly payment

- More of each payment goes toward principal balance

- Many ARMs are fixed for 5-10 years before first adjustment

- May only keep the loan during the initial fixed-rate period

- Can refinance if rate expected to reset higher

Adjustable-Rate Mortgage Cons

- The interest rate is not fixed for the full loan term

- It can increase significantly once it becomes adjustable

- Monthly payments may become unaffordable

- May require a refinance to obtain a lower interest rate

Read more: Fixed-rate mortgage vs. adjustable.

- Rocket Mortgage Completes Redfin Takeover, Offers $6,000 Home Buyer Credit - July 1, 2025

- Mortgage Rates Quietly Fall to Lows of 2025 - June 30, 2025

- Trump Wants Interest Rates Cut to 1%. What Would That Mean for Mortgage Rates? - June 30, 2025