Gone are the days of the zero-down mortgage. At least for the typical home buyer.

Instead, the 2023 Profile of Home Buyers and Sellers from the National Association of Realtors (NAR) revealed that down payments haven’t been higher in decades.

This, despite the widespread availability of low-down and zero-down home loan options.

As for why, it could be because inventory remains low, which has kept competition lively in spite of much higher mortgage rates.

Another reason might be those high interest rates themselves, which make it less attractive to take out a large loan.

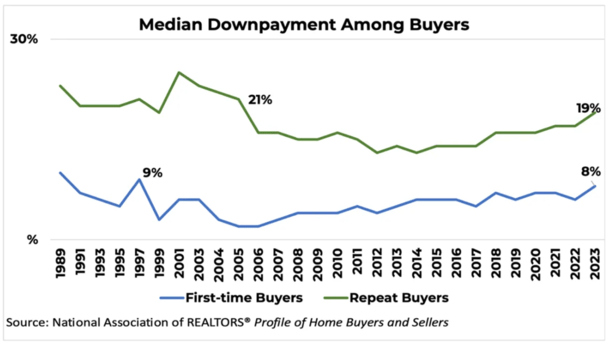

Median Down Payments Highest Since 1997 for First-Time Home Buyers

Per the NAR report, the typical down payment for a first-time home buyer was 8%, which might not sound like a lot.

But it is the highest figure since 1997, when it stood at 9%. If you look at the chart above, you’ll notice it dipped pretty close to zero in those bad years back in 2005-2006.

At that time, creative financing and lax underwriting (aka no underwriting at all) allowed home buyers to purchase a property with nothing down.

While that may have been risky on its own, they could also use stated income to qualify for the loan.

And they could choose a super toxic loan type, such as the now forgotten option ARM, or qualify via an interest-only payment.

That may explain why we experienced the worst mortgage crisis in recent history, followed by the nastiest housing market crash in generations.

So certainly some good news there, with down payments on the rise despite unaffordable conditions.

To that end, home buyers could be opting to put more down to get a more favorable mortgage rate, and/or to avoid mortgage insurance (PMI) and unnecessary pricing adjustments.

Back when mortgage rates were hovering around 3%, it made sense to put down as little as possible and enjoy the low fixed-rate financing for the next 30 years. Not so much today.

Another reason home buyers might be putting more money down is due to competition. While the housing market has certainly cooled this year, there is still a dearth of supply.

This means if and when something decent pops up on the market, there may still be multiple bids.

And those who are able to muster a larger down payment will generally be favored by the seller.

The one worrisome thing was how first-time buyers were securing their down payments recently.

They’ve had to increase “reliance on financial assets this year,” including the sale of stocks or bonds (11%), a 401k or pension (9%), an IRA (2%) or the sale of cryptocurrency (2%).

Always a bit questionable if selling retirement assets to purchase a home.

Typical Down Payment for Repeat Home Buyers Up to 19%

Meanwhile, the typical repeat buyer came in with a 19% down payment, which is the highest number since 2005 when it was 21%.

Down payments for repeat buyers also tanked prior to the early 2000s housing crisis because underwriting was so loose at the time.

There was really no reason to come in with a large down payment at the time given the wide availability of flexible loan products, and the notion that home prices would just keep on rising.

This explains why homeowners at the time also favored negative amortization and interest only home loans.

They all assumed (or were told) that the home would simply appreciate 10% in a year or two and they could refinance over and over again to better terms.

Today, it’s more in line with levels prior to that fast and loose era, and appears to be steadily climbing.

This could also have to do with a large number of all-cash home buyers, such as Boomers who are eschewing the 7% mortgage rates on offer.

But it is somewhat interesting that the median number was 19% and not higher.

After all, a 20% down payment on a home comes with the most perks, like lower mortgage rates and no private mortgage insurance requirement. But I digress.

Note that all the figures from the survey only apply to buyers of primary residences, and do not include investment properties or vacation homes.

How Much Do You Need to Put Down on a Home These Days?

As noted, low and no-down mortgages still exist, though they are typically reserved for select applicants, such as VA loans for veterans and USDA loans for rural home buyers.

However, you can still get a 3% down mortgage via Fannie Mae or Freddie Mac, which virtually every lender offers.

There are also FHA loans, which require a slightly higher 3.5% down payment, but lower credit score requirements.

On top of this, there are countless homebuyer assistance programs, including silent second mortgages that can cover the down payment and closing costs.

In other words, there is no shortage of affordable loan options today.

But there is an advantage to putting more down, such as eliminating the need for mortgage insurance and having a smaller outstanding loan balance.

With mortgage rates so high at the moment, the less you finance the better.

This could also make it easier to apply for a rate and term refinance if and when rates do fall, thanks to a lower LTV ratio.

Regardless, it’s good to see down payments rising as home prices become more expensive.

This contrasts the bubble years back in 2004-2006 when homeowners put less and less down as property values increased. It didn’t turn out well.