If you’re in the market to buy a new home or condo, you’ve undoubtedly thought (or stressed) about the required down payment.

It’s one of the biggest roadblocks to homeownership, and an obstacle that never seems to get any better over time.

In fact, Zillow recently noted that it takes the average American over seven years to save up a 20% down payment. So much for instant gratification…

But how much should you put down when buying a home? Better yet, how much do you need to put down? Well, let’s talk about that.

How Mortgage Down Payments Used to Work

- It used to be common to put down 20% or more when buying real estate

- As home prices got expensive, lenders began offering zero down financing

- The mortgage crisis hit and low down payments were partially to blame

- But now we’re back to allowing a relatively low 3% to 3.5% down

Before the mortgage crisis unfolded, perhaps in the late 1990s and early 2000s, it was quite common for homeowners to come up with at least 20% of the sales price for down payment.

This was the traditional number banks deemed acceptable in terms of risk.

So prospective homeowners took their time, saved up money in the bank, and when the time was right, made a bid on a property.

The way the banks saw it, borrowers had “skin in the game,” and were therefore a pretty safe bet when it came to making timely mortgage payments.

Even if they did fall behind, those down payments ensured the bank wouldn’t be stuck holding a property that was worth less than the mortgage.

And there would be enough of a buffer to offload it without much if any loss.

Then Mortgages Got Risky…

- Lenders got aggressive as home prices shot higher and higher

- Most allowed home buyers to obtain a mortgage with zero out of pocket

- This became a major problem once home prices started to fall

- And explains why we saw so many underwater borrowers during the crisis

In the early 2000s, mortgage lenders got more and more aggressive, allowing homeowners to come in with little or even nothing down.

In fact, closing costs could be piled on top of the loan, so you could get a mortgage with absolutely no out-of-pocket expenses.

You may also recall the radio commercials about no cost refis, which were called the biggest no-brainer of all time!

Anyway, this was all predicated on the idea that home prices would appreciate up and up, forever and ever.

So even if you didn’t have much of a down payment to start, you could bank on some fairly instant home equity via guaranteed appreciation.

Of course, we all know how that turned out, and that’s why many of these types of loan programs are no longer available. This is probably a good thing.

Sure, there are still some programs kicking around that allow you to come in with nothing down, but there are a lot of eligibility requirements and income restrictions.

Today, the median down payment on a home is 8% for first-time buyers and 19% for repeat buyers, per the 2023 Profile of Home Buyers and Sellers from the National Association of Realtors (NAR).

These are the highest levels since 1997 and 2005, respectively.

What Is the Minimum Down Payment on a House?

| Loan Type | Minimum Down Payment | Availability |

| Conforming loan (Fannie Mae and Freddie Mac) | 3% | Anyone, loan limits apply |

| FHA loan | 3.5% | Anyone, loan limits apply |

| Portfolio loan | 0% | Guidelines vary by lender |

| USDA loan | 0% | Rural areas only, income limits apply |

| VA loan | 0% | Veterans and active duty only |

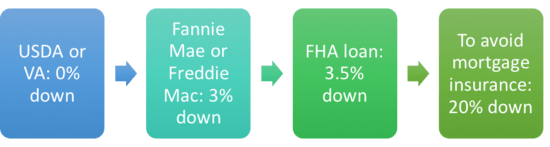

The most widely used zero down mortgage program currently available is offered by the U.S. Department of Veterans Affairs.

However, VA loans are only available to veterans and active duty military, which represents just a fraction of the population.

There’s also the USDA’s rural home loan program. But again, the reach is limited because they’re only available to lower-income home buyers outside major metropolitan areas.

Nowadays, for the vast majority of borrowers who didn’t serve this country or purchase a home in a rural area, a down payment will be required, though not necessarily a large one.

The one exception might be a portfolio lender, which keeps the loans it originates on its books, and thus can write any underwriting guidelines it sees fit. But again, these types of loans are few and far between.

Ultimately, if you’re looking to put very little down, the next closest thing is a Fannie Mae HomeReady mortgage or Freddie Mac Home Possible mortgage.

These programs allow borrowers to come in with as little as 3% down when purchasing a piece of property. And the down payment can be a gift, grant, or a loan from a non-profit organization or an employer.

To sweeten the deal even more, the mortgage insurance is cheaper and there are lower pricing adjustments.

This means you can obtain a lower mortgage rate than would otherwise be possible, and keep the total housing payment down thanks to cheaper PMI.

You can obtain these loans just about anywhere via white-label products like Wells Fargo yourFirst Mortgage and Bank of America’s Affordable Loan Solution, to name just two.

Tip: If you’re a real estate agent buying a home, your real estate commission from the subject property is an eligible source of funds for both the down payment and/or closing costs.

You Don’t Need a Down Payment Calculator to Run the Numbers

- It’s very easy to calculate potential mortgage down payments

- Just whip out a standard calculator

- And multiply the percentage by the purchase price

- For example 20% down would be .2 x $500,000 = $100,000

Now let’s talk about calculating a down payment when home shopping.

It’s actually very easy to calculate a down payment once you have a purchase price in mind, and no fancy mortgage calculator is required, honest.

Simply take a regular calculator (the one on your smartphone will suffice) and multiply the purchase price by the percentage you’d like to put down and you’ll get your answer.

For example, if you want to put down 20% on a $300,000 home purchase, just type in .2 and multiply it by 300,000. That would result in a $60,000 down payment.

Or if you want to put just 10% down, input .1 and multiply it by 300,000. That would give us a $30,000 down payment.

You can also do this in reverse if you know you have a certain amount saved up and earmarked for a house down payment.

Say you’ve got $50,000 in the bank and you won’t/can’t muster any more than that. Again, let’s assume you want to put down 20% because of the associated benefits.

To calculate the maximum purchase price, just input 50,000 into a standard calculator and divide it by .2.

This will result in a sum of 250,000, meaning if you’ve got $50,000 set aside, you can buy a $250,000 house and put 20% down.

Just don’t forget the closing costs, which can greatly increase your actual out-of-pocket expenses and require even more to be set aside.

Mortgage Insurance Often Required If Little Is Put Down

- If you put down less than 20% when buying a home

- Or opt for a government mortgage such as an FHA loan

- You will have to pay mortgage insurance

- Which is one of the disadvantages of a low down payment mortgage

For most home loan programs, mortgage insurance will be required by the lender if your loan-to-value ratio (LTV) exceeds 80%.

In other words, if you put down less than 20%, you’ll be stuck paying insurance to compensate for the increased risk to the lender.

This is on top of homeowners insurance, so don’t get the two confused. You pay both! And the mortgage insurance protects the lender, not you in any way.

Obviously, this extra fee will increase your monthly housing expense, making it less attractive than coming in with a 20% down payment.

But for many would-be home buyers, a 20% down payment just isn’t a reality, especially with home prices on the rise.

If you opt for an FHA loan, which allows down payments as low as 3.5%, you’ll be stuck paying an upfront mortgage insurance premium and an annual insurance premium.

And annual premiums are typically in force for the life of the loan. This explains why many opt for a FHA-to-conventional refi once their home appreciates enough to ditch the MI.

If you take out a conventional home loan with less than 20% down, you’ll also be required to pay private mortgage insurance in most cases.

This is less than ideal if you’re trying to keep your costs down, but a decent option for those with little in the bank.

If you don’t want to pay it separately, you can build the PMI into your interest rate via lender-paid mortgage insurance, which might be cheaper than paying the premium separately every month. Just be sure to weigh both options.

Tip: If you put less than 20% down, you’re still paying mortgage insurance.

Mortgage Rates Are Higher on Low Down Payment Loans

- If you put little to nothing down when purchasing a home

- Expect your mortgage interest rate to be higher

- All else being equal

- To account for the elevated default risk posed to lenders

Regardless of what you wind up paying in mortgage insurance premiums, know that your mortgage rate will likely be higher if you come in with less than 20% down.

Again, we’re talking about more risk for the lender, and less of your own money invested, so you must pay for that convenience.

Generally speaking, the less you put down, the higher your interest rate will be thanks to costlier mortgage pricing adjustments, all other things being equal.

And a larger loan amount will also equate to a higher monthly mortgage payment.

This can make qualifying more difficult if you’re close to the affordability cutoff.

So you should certainly compare different loan amounts and both FHA and conventional loan options to determine which works out best for your unique situation.

A Smaller Mortgage Down Payment Can Leave a Helpful Cushion

- You don’t necessarily need a large down payment to buy a home

- Especially if it will leave you with little in your bank account

- Sometimes it’s better to have money set aside for an emergency

- This can allow you to build your asset reserves over time

While a larger mortgage down payment can save you money, a smaller one can ensure you have money left over in the case of an emergency, or simply to furnish your home and keep the lights on!

Most folks who buy homes make at least minor renovations before or right after they move in. They also spend money on moving trucks and/or movers.

Then there are the costly monthly utilities to think about, along with unforeseen maintenance issues that tend to come up.

If you spend all your available funds on your down payment, you might be living paycheck to paycheck for some time before you get ahead again.

In other words, make sure you have some money set aside after everything is said and done.

The lender will probably require that you have some cash reserves in order to close your mortgage, but even if they don’t, it’s wise to make it a requirement for yourself.

Tip: Consider a combo loan, which breaks your mortgage up into two loans. Keeping the first mortgage at 80% LTV will allow you to avoid mortgage insurance and ideally result in a lower blended interest rate.

Or get a gift from a family member – if you bring in 5-10% down, perhaps they can come up with another 10-15%.