A “HELOC” or “home equity line of credit,” is a type of home loan that allows a borrower to open a line of credit using their home equity as collateral.

They can then draw upon it to pay for anything they wish, such as home improvements, or to pay off credit card debt or student loans. The money can even be used for a down payment on a subsequent home purchase.

HELOCs are typically taken out as second mortgages that are subordinate to an existing loan.

This means you wind up with two monthly payments, but can access cash without disturbing the interest rate or loan term on the first mortgage.

As such, you can continue to enjoy your low fixed-rate if you secured a very cheap 30-year fixed mortgage at some point in the past.

Jump to HELOC topics:

– What Is a HELOC?

– How to Get a HELOC?

– Accessing Your Funds with a HELOC

– HELOC Interest Rates

– Downsides of Home Equity Lines of Credit

– Term of a Home Equity Line of Credit

– Can You Refinance a HELOC?

– Types of HELOCs

– Home Equity Line of Credit vs. Home Equity Loan

– Common HELOC Fees

– HELOC Pros and Cons

What Is a HELOC?

- A home loan with a twist because it’s actually a line of credit (as opposed to a set loan amount)

- Your property acts as collateral for the loan similar to a traditional mortgage

- Can draw upon it when needed like a credit card, which could be many times over the loan term

- Or never touch it (some homeowners simply open one as an emergency fund)

A HELOC, while also backed by real property, differs from a traditional home loan for several different reasons.

The main difference is that a HELOC is simply a line of credit a homeowner can draw from, up to a pre-determined amount set by the mortgage lender, based on the value of your home.

Conversely, with a typical mortgage, the amount borrowed is the total amount financed.

In other words, a HELOC is a lot like a credit card because of its revolving balance nature. When you open a credit card, the bank sets a certain credit limit, say $10,000.

You don’t need to pay interest on the total amount, or even withdraw or spend any of the $10,000, but it is available if and when you need it.

That’s also how a HELOC works. Your bank or lender will give you a line of credit for a certain amount, say $100,000, depending on the available equity in your home.

And you can draw upon it as much or as little as you’d like, up to that $100,000 limit, if and when you want.

Most people use the HELOC funds to pay for things like paying for college tuition, home improvements, and higher-interest rate debt like credit cards (debt consolidation).

Or to cover a down payment on another home purchase (instead of raiding their 401k or Roth IRA).

How to Get a HELOC

- You can apply for a HELOC at most banks and credit unions

- Nonbanks typically don’t offer them and push home equity loans instead

- Underwriting is faster and easier than getting a mortgage (no appraisal required in many cases)

- But you must provide income/asset documentation and a credit check will be performed

- Most companies don’t charge closing costs and funding can take place in under a week

Similar to a first mortgage, you can apply for a HELOC with any bank or lender that offers them.

It’s worth pointing out that HELOCs are mostly offered by depository banks, such as those that offer checking and savings accounts.

They are also typically available at credit unions. Conversely, most nonbanks do NOT offer them, and will likely try to sell you a home equity loan instead. So beware.

Once you’ve found a company offering one, you go through an underwriting process in order to get approved, similar to your first mortgage.

The big difference is the HELOC application is typically a much lighter version and often times doesn’t even require an appraisal.

However, you will need to provide income/asset documentation and a credit check will be performed.

Aside from it being easier to get through the process, it’s also quicker, with closings in less than a week possible!

The icing on the cake is HELOCs typically don’t come with closing costs either.

HELOC Initial Draw Requirement

Generally, you will be required to make an initial minimum draw on the HELOC, say $10,000 or $25,000, depending on the total line amount.

And the initial draw may need to be maintained for X number of months before you can pay it back.

This ensures the bank actually makes money on the transaction, and doesn’t just give you a line of credit you never touch. That would be a big waste of time for them.

Once you take your initial draw, you can put it in your bank account to use for specific expenses, borrow even more, pay it back, and then borrow again. Or never touch it and just set it aside for a rainy day.

The benefit of a HELOC is you only pay interest on the amount borrowed, not the total line amount.

Additionally, most HELOCs allow you to make just the interest-only payment, instead of having to pay back the principal balance.

This keeps monthly payments low while also giving homeowners access to much needed cash if and when they need it.

It’s a flexible choice because you get the option to use the line of credit if you need it, without having to pay interest on it if you don’t.

With a typical mortgage refinance or home equity loan, you pay interest on the total loan amount from the get-go, even if the money just sits in your bank account.

Accessing Your Funds with a HELOC

- You may be given an access card (like an ATM/credit card)

- An option to transfer funds online to your bank account

- A physical checkbook where you can write checks

- Or a bill pay option to make specific payments

Once your HELOC is open, you’ll have a variety of options to access the funds up to your pre-determined credit limit.

Most banks and mortgage lenders will provide you with an access card that works kind of like an ATM debit/credit card. You can make purchases with it and/or withdraw cash at a branch location.

You may also be given the option to transfer funds to a linked bank account, or be given checks that can be written to anyone for any purpose, which are deducted from your credit line.

There may be a bill pay option if you want to use the funds to pay bills, or an option to transfer funds over the phone/via mobile banking.

In any case, it should be pretty easy and convenient (and usually free) to access your money.

Interest Rate on a Home Equity Line of Credit

- HELOC rates are always variable

- Because they are tied to the prime rate

- Prime moves whenever the Fed raises or lowers the fed funds rate

- To figure out your interest rate simply add your margin to the current prime rate

Now let’s talk about HELOC interest rates.

A HELOC’s interest rate is determined by the prevailing prime rate plus the margin chosen by the bank or lender.

The margin, which can vary from bank to bank, is typically fixed throughout the loan term.

And as you may already know, the prime rate is variable and can change whenever the Fed makes a monetary policy decision. You can see the current prime rate here.

Some banks offer HELOCs to borrowers at the prime rate with zero margin, or even less than prime, at least initially.

You’ll often see bank ads that say “prime -1%” or something to that effect. Of course, this is usually an introductory rate, and will often go up after the first few months or year once the rate discounts no longer apply.

After the promo period ends, expect a margin greater than zero plus prime.

When reviewing HELOC rates, you’ll likely see the annual percentage rate (APR) listed alongside it, along with the word “variable,” because as noted, it’s tied to prime, which can change whenever the Fed decides to raise or lower rates.

When Do HELOC Rates Change?

As noted, your HELOC rate will only change if the prime rate changes. And prime only changes when the Federal Reserve makes an interest rate decision.

When they raise or lower the federal funds rate, banks follow along and raise or lower prime by the same amount.

This can happen several times per year, or not at all depending on monetary policy. For example, there were no changes to prime from March 2020 to March 2022, followed by 11 changes from March 2022 through mid-2023!

And these decisions can take place at the beginning of the month, mid-month, or the end of the month, depending on when the Fed meets (here are those meeting dates).

Typically, the new prime rate will only go into effect on the 1st of the month following the change.

The Fed just cut rates 50 basis points on September 19th, 2024, and prime was also lowered by 0.50%. But the changes won’t affect existing HELOCs until October 1st.

Expect a payment change at that time, or reach out to your bank/lender to inquire about when the rate change will go live.

Tip: Can you refinance a HELOC to get a lower rate?

How HELOC Pricing Is Determined

Like mortgage rates on a home loan, your credit history will come into play in determining your HELOC rate. So strive for excellent credit, aka a 780+ FICO score, to obtain the lowest rate.

Your loan-to-value ratio is also quite important, so the more equity in your home, the better.

Simply put, a lower LTV, or CLTV if the HELOC is a second mortgage, is key to a low HELOC rate.

For example, if you borrow up to 80% of your home’s value, instead of 90%, the margin might be lower.

The loan amount might also dictate the rate, and you could be required to order a home appraisal over certain loan amount thresholds.

Like any mortgage you shop for, be sure to compare rates to ensure you don’t miss out on a good deal.

HELOC promos vary widely from bank to bank. Credit unions often offer great deals, and should be on your list of places to shop.

For example, you might see something like prime + 2%. Prime is currently 8%, so the fully-indexed rate would be 10%. A well-qualified borrower may get a rate as low as prime + 0.5%.

If your loan scenario is a bit more high-risk, it could carry a margin of 4% or more, which when combined with the prime rate, can be quite hefty.

That would make the interest rate 12%, which isn’t a very desirable rate.

When comparison shopping for a HELOC, pay close attention to the margin since it’s the one number that you can control. The prime rate is the same for everyone.

Tip: Ask for the margin during the draw period and the repayment period. Sometimes lenders will impose a higher margin during the latter period, which can get expensive!

Downsides of Home Equity Lines of Credit

- The rate is adjustable and tied to prime

- It can go up significantly during periods of inflation

- Rate adjustments can be frequent relative to other ARMs (multiple times per year)

- Higher interest rate caps

There are a number of reasons to steer clear of HELOCs. The main reason being that it’s an adjustable-rate mortgage.

Whenever the Fed moves the prime rate, the rate on your HELOC will change.

Usually it’s only .25% at a time, but the Fed raised the prime rate about 20 times in a row since 2004, pushing the rate from 4% to 8.25%, before it began to move the other way.

Then recently raised rates 11 times from early 2022 to mid-2023, pushing prime up more than five percentage points in the process.

So your interest rate can fluctuate greatly, even if the Fed moves prime in so-called “measured” amounts.

HELOCs generally adjust either monthly or quarterly, depending on the terms specified by the lender.

Check your paperwork so you know what to expect after the Fed makes a move.

Also note that HELOCs don’t have periodic interest rate caps like standard adjustable-rate mortgages, just lifetime caps, so the rate can fluctuate as much as the Fed allows it to, up to 18% in California (it varies by state).

Term of a Home Equity Line of Credit

- Typically begins with a 5-10 year draw period

- Where you can make interest-only payments each month

- Followed by a 10-20 year repayment period

- Where you must pay back principal and interest to satisfy the loan

A HELOC normally has a 25-year term, with a draw period and a repayment period. The draw is typically the first 5 to 10 years, followed by the repayment period of 10 to 20 years.

But it can vary, with some HELOCs offering longer draw and repayment periods to lessen the payment burden. And some shorter draw periods between 3-5 years.

During the draw period, the homeowner can borrow as much as they’d like within the line amount, and can make interest-only payments on the amount drawn upon.

There is usually a minimum payment, just like a credit card.

After the draw period, the borrower must pay off the principal of the HELOC, along with the interest. This period is known as the repayment period.

Typically the loan balance is broken down into monthly payments, but there could also be a balloon payment because of the way the loan amortizes.

Also note that some HELOCs don’t have a repayment period, so full payment is simply due at the end of the draw period.

HELOC Paydown vs. Payoff

If your HELOC is still in the draw period, you can pay down the balance and borrow more. Or you can pay off the balance in full and retain access to the funds if and when needed.

Your account will remain open despite having zero balance, similar to a credit card.

During the repayment period, bringing the account balance down to zero will effectively satisfy the debt obligation and result in the closure of the HELOC. This will also release the associated lien.

It’s possible to close your HELOC ahead of time if it has a zero balance, though be aware of any early closure fees if closed within the first few years.

These fees are sometimes in place to recapture any closing costs associated with the loan.

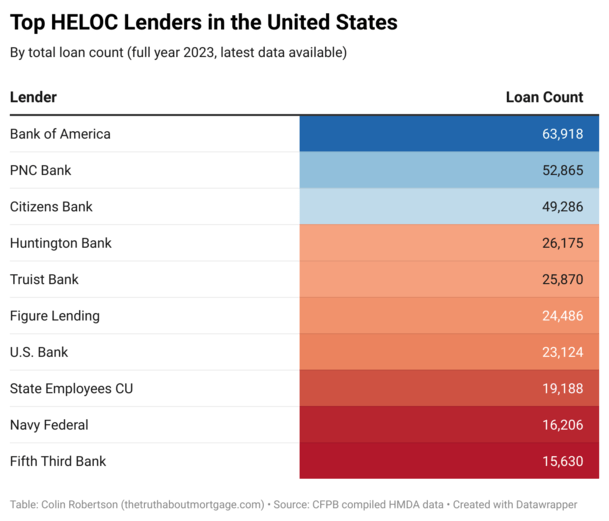

[Top HELOC Lenders in the Nation]

Can You Refinance a HELOC?

- It’s possible to refinance a HELOC like any other home loan

- The most common method is a cash out refinance that combines your first mortgage and home equity line

- Another option is to take out a new HELOC that pays off the old HELOC

- Or pay off the HELOC with a home equity loan instead

Now you might be wondering if it’s possible to refinance a HELOC, especially if the draw period has come to an end and the repayment period is in effect.

It can be a shock if you were used to making interest-only payments, then all of a sudden have to make fully-amortized payments over a shorter remaining term.

In fact, your HELOC’s monthly payment could jump by a few hundred bucks or more depending on the interest rate and loan amount.

The good news is it is possible to refinance your HELOC, just like your first mortgage.

The most common way to extinguish a HELOC is to pay it off via a cash out refinance, combining your first mortgage and second mortgage, which is the home equity line.

FYI, it’s considered cash out because you’re paying off a non-purchase money loan.

Let’s look at a quick example:

Home value: $500,000

First mortgage (outstanding balance): $300,000

HELOC (outstanding balance): $65,000

In this scenario, you’d have total outstanding liens of $365,000 on a property valued at $500,000.

That would put your LTV ratio at 73%, which leaves plenty of equity to take advantage of a refinance.

If interest rates were favorable at the time of refinance, you could ideally get a new blended interest rate that saves you money each month.

And since HELOCs are variable-rate, you could fix your interest rate at the same time.

Best of all, you’d have just one mortgage again, instead of two.

Refinance Your HELOC Into a New Line of Credit

If mortgage rates aren’t great and you want to refinance your HELOC, you could look into simply getting a new HELOC to replace the old one.

Again, you’ll want to ensure you have sufficient equity in your home to allow for a new HELOC. And the new financing should make sense, aka a cheaper payment or lower rate.

Another option is to pay off your HELOC with a home equity loan, the latter of which comes with a fixed interest rate and loan amount, as opposed to a variable rate and revolving balance.

This might be attractive if the fixed rate is relatively low, though you may want to compare loan costs to a standard refinance.

Finally, some lenders will offer the option to switch from a variable rate to a fixed rate on all or some of your outstanding line of credit. This might be another way to avoid higher costs if the prime rate keeps increasing.

But ultimately, a standard refinance is generally the way to go in most cases because interest rates tend to be a lot lower on first mortgages.

Types of HELOCs

- HELOCs are often utilized as piggyback second mortgages

- These extend financing if you don’t have sufficient down payment funds

- Can also be used as a non-purchase money second mortgage after you close on your first mortgage

- They are also less commonly taken out as first-lien mortgages

Most HELOCs are opened behind an existing first mortgage as a source of funds to pay down credit cards or other revolving debt, or for home improvements and other household costs.

These are known as standalone HELOCs, which provide flexibility at a relatively low interest-rate compared to a standard credit card or other means of financing.

They can also be used as purchase-money second mortgages (piggyback) to extend financing and allow a homeowner to put less money down on a home purchase.

In this fairly common scenario, the HELOC utilizes the entire credit line as the down payment, and the borrower must pay interest on the full amount from day one.

For example, if a borrower wanted a zero-down mortgage on a $100,000 property, they could open an $80,000 first mortgage for 80% LTV and a second mortgage (the HELOC) to cover the remaining $20,000, or 20%.

Another option might be a post-close piggyback where a HELOC is opened shortly after loan closing to boost liquidity if the homeowner used the funds to plunk down a larger down payment, perhaps to win a bidding war.

Lastly, some borrowers may even open a HELOC as a first mortgage, although it is less common and can be somewhat risky for a homeowner if the prime rate rises rapidly, which it has been known to do in times when inflation is high.

Note that HELOCs taken out as first liens might come with a lower margin and thus a cheaper interest rate. This is due to loans in the first position being less risky for lenders.

Home Equity Line of Credit vs. Home Equity Loan

- A HELOC is adjustable

- And you’re given a line amount similar to a credit card

- A home equity loan is generally fixed

- And the loan amount is the amount borrowed from day one

If you’ve been shopping for a HELOC, you may have come across a home equity loan as well. They aren’t the same.

With a home equity loan, you receive the full lump sum and make monthly mortgage payments on that total amount of borrowed money immediately, usually at a fixed rate.

A HELOC, on the other hand, not only gives the borrower the freedom to decide when and if to use the money, but also how much they need to pay back and when.

In a sense, it might be a good alternative to a reverse mortgage because it provides cash if and when needed, with no payments if it’s not accessed.

Borrowers generally choose HELOCs as purchase-money second mortgages because the interest rate and payment is lower than closed-end fixed home equity loans.

And HELOCs have an interest-only option which many fixed-end seconds don’t offer. HELOCs also don’t carry prepayment penalties, whereas many fixed-end seconds do.

Once the borrower pays down the HELOC, they also have the option to draw upon it again if they need additional funds, something a home equity loan doesn’t offer.

With a home equity loan, it’s a one-time use that must be paid back over a set period of time, just like a traditional home loan.

Common HELOC Fees

- You may have to pay closing costs with a HELOC

- Similar to a standard mortgage

- But in most cases they’re free to open

- Just watch out for annual fees and early closure fees!

Another negative to HELOCs are the associated fees. Some of them require you to order an appraisal, which can amount to several hundred dollars. Others will charge closing costs and an origination fee.

There may also be an annual fee on your HELOC, which could range from $50 to $100 or more per year. Over time that can add up.

HELOCs also tend to come with early closure fees of around $300-$500, although they don’t usually carry an explicit prepayment penalty.

This means if you close your equity line just 1-3 years into the loan, the bank will charge this fee. Again, they want to make money off the deal, so if you close the line too quickly, they’ll probably charge you for it.

Sometimes the fee will be equivalent to what they would have charged for closing costs.

For example, they may say you can get a HELOC without closing costs, but charge you those fees later if the line isn’t kept open for a minimum period of time.

Can You Keep a HELOC with a Zero Balance?

If you happen to pay down your HELOC to a zero balance during the draw period, you can keep borrowing from it until the repayment period begins.

If you pay it down to zero during the repayment period, it will simply close because there’s no reason for it to remain open if you can no longer borrow from it.

Assuming it’s at a zero-balance during the draw period, your bank/lender shouldn’t close it because HELOCs are designed to be drawn upon more than once.

But you can always call them and make sure they don’t close it (if you want it to remain open).

Can the Bank Freeze My HELOC?

Under certain circumstances, a bank can freeze your HELOC or reduce the line of credit available, similar to a credit card.

This might happen if you didn’t keep up with minimum payments, or if you experienced a major drop in your credit score.

It can also happen if the value of your property declines by a substantial amount, as there would technically no longer be any equity to tap. Or not enough cushion between the value and what you owe.

Note that banks only need to inform you after they reduce or freeze your HELOC within three business days after the action is taken.

In that notice, they must provide the reason why the HELOC was frozen or reduced.

The takeaway here is that while some recommend opening a HELOC as a lifeline, there’s no guarantee it will stay open or that the line won’t be reduced.

HELOC Are a Good Option to Tap Equity without Touching Your First Mortgage

- You can tap home equity without messing with your low-rate first mortgage

- Record equity means you can access cash while leaving a safety net if/when you sell/refi

- HELOC rates may drop in 2025/2026 as the Fed cuts rates (your rate can go down when they cut)

- Limited or no closing costs and multiple draws make them an appealing option

- Flexible payments including interest-only during the draw period is a plus

- And interest might be tax-deductible for home improvements, up to IRS caps

In conclusion, a HELOC can be an attractive option to tap into your home equity without disturbing your low-rate first mortgage, which is especially pertinent today.

Most homeowners have fixed rate mortgages in the 2-5% range and likely don’t want to touch them anytime soon.

At the same time, homeowners are sitting on record equity, meaning a HELOC could allow you to access a good amount of cash while leaving a reasonable cushion if you were to sell.

And with HELOC rates expected to ease this year and next, your interest rate could go down as the Fed continues to reduce rates.

The typical lack of closing costs on HELOCs also makes them a favorable option relative to other loan types, and the ability to draw on the line multiple times is a plus as well.

Payment flexibility is another plus, with most offering the ability to make just the interest-only payment during the draw period, before the repayment period starts.

Lastly, the interest on HELOCs might be tax deductible if the line is used for home improvements and it falls under the maximum cap allowed.

HELOC Pros and Cons

HELOC advantages:

– lower interest rate than a fixed home equity loan

– easy to access funds

– interest-only option

– usually no prepayment penalty

– ability to choose draw amount you want, when you want

– don’t need to borrow more than you need and pay interest on it

– able to borrow multiple times from same credit line

– lower or no closing costs

HELOC disadvantages:

– adjustable interest rate tied to prime

– no periodic caps on interest rate

– rate can adjust much higher over time

– early closure fees may be applicable

– minimum draw amounts with some lenders

– annual fees may apply

- Will Mortgage Rates Be Higher or Lower by the End of 2025? I Asked AI. - July 2, 2025

- Rocket Mortgage Completes Redfin Takeover, Offers $6,000 Home Buyer Credit - July 1, 2025

- Mortgage Rates Quietly Fall to Lows of 2025 - June 30, 2025

Thank-you Colin. What you said is what I thought but it made the world of difference to me to have your credibility behind it.

Sure hope bankers don’t bundle HELOCs and sell them to pension funds and the government.

I am a spec in the world of finance, but I need to watch out for that spec big time!

Colin,

Thank you! The information you have provided has been very educational. May I have an opportunity to speak with you privately?

Donna,

I can barely keep up with the comments, but if you have a question go for it. I feel the public ones at least benefit more than just the person who asked.

Elizabeth,

I think the banks keep their HELOCs, which was a major problem for them until property values went back up. But fully-amortizing resets are still a potential problem for them.

Colin,

Of course….I understand. Looking for options to restructure an HELOC interest only into a term loan with a lower interest rate. HARP is in place to help consumers refinance Fannie Mae or Freddie Mac mortgages that are 80% loan-to-value and tied to higher interest rates than the current market. In this case, the Lender is not offering a “dig out” plan. Do you know of any recourse that a consumer would have against a situation whereby they have been disadvantaged and held to a high interest rate by the terms of a “variable” HELOC (6.75% floor rate), yet meet and exceed the qualifications outlined for HARP – specifically, never missed or was late on a payment, good credit score rating and 80% LTV? The Lender’s only “negotiation” with the borrower is to take further advantage of the situation and place them in a higher interest ARM plan.

Donna,

I assume most people who couldn’t get a loan mod or some sort of relief on their HELOC either walked away, foreclosed, short sold, or perhaps were able to gain enough equity over the years to consolidate the first and second mortgage into one new loan at a lower rate.

Colin,

Why do banks almost insist you open a HELOC especially when they are aware you have paid off the mortgage.?

Jane,

Probably to make more money like any other company that attempts to cross-sell products with the pitch that you can tap into your equity at any time to pay expenses and unforeseen costs that come up.

If i already have a reverse mortgage…how can i still get a small loan using my house? would i have to have good credit?

Verna,

I suppose it depends on how much money you need, but a HELOC behind a reverse mortgage might be a no go regardless of credit. Not sure any lenders offer that. Other options might include refinancing the reverse mortgage into another reverse mortgage or a standard mortgage (but you may not want a monthly payment).

My question: in 2006, Bank A originated a first (80% conventional) and 20% HELOC as a 100% purchase as the sale of our first property had not completed. The first was securitized as an 80% LTV, conveniently forgetting the HELOC.

In 2007 the ownership and servicing rights for the HELOC passed to Bank B.

The DOT references MERS, and the HELOC agreement was indorsed in blank (does this permit Bank B to alter the terms of the HELOC agrement – unlike the conventional note, there is no language in the HELOC agreement relating to transfer of the contract .

There seems to be some debate as to whether a HELOC is a negotiable instrument.How can bank B become creditor and servicer of the HELOC when the “note” stipulates it is an agreement with Bank A. I never took out a new HELOC with Bank B to pay off Bank A, so what obliges me to pay Bank B?? As for the note, I have no idea who holds it, although Bank C claims to by virtue of taking over Bank B (although the HELOC may have been securitized by Bank B).

So, who should I be paying – or who could foreclose if I stop??

Hi Colin,

I have applied for ARM 5/5 which has been approved for my house 338K @ 3.75 % with 2% change up or down every 5 yrs. Our Credit union is giving 5% down payment option with no PMI also no Closing Cost. It sounds too good to be true but it is something that suits my current situation Fixed Rate Loans being very close to 4% am I going for the correct option?

What happens if a HELOC is a first mortgage and the home owner takes out a second mortgage and the homeowner defaults on the Heloc and the property is foreclosed.

Paul,

There are 5/1 ARMs that are in the high-2% range as far as I know, so once you factor in MI being paid by the lender rates could be in the low-mid 3% range. The rate also moves based on how much you’re paying in closing costs. If you can get a 30-yr fixed for say 4% the savings may not justify the risk of the rate increasing on the ARM, but that’s up to you and also dictated on what you plan to do with the mortgage/home over the long-term.

Williams,

It depends what action the investor (of the HELOC) wants to take. The HELOC lender will probably still be in the first-lien position in terms of recovering funds.

Hi Colin,

It appears that you have a lot of knowledge regarding HELOC’s. So, here is one for you if you don’t mind. I am refinancing my home using VA and have had a HELOC currently in a repayment mode. The bank with the HELOC when asked to approve a subordination is saying they won’t approve when total closing costs are greater than 4% of the loan amount. Have you heard of such a thing and how can a bank providing a line of credit dictate this? when it is a small HELOC compared to the “big picture”?

Thanks so much!

I have a rental condo with a Variable rate line of credit for $250,000. The current rate is 5.75% with a current principal balance of $240,453 which paid for the condo. I also have a regular home mortgage on my permanent address. Can you refinance a HELOC? Or do you suggest I look for a better rate HELOC to replace this one??

Lyn,

Yes, it’s possible to refinance a HELOC, aka pay it off with a traditional first mortgage. It’s pretty common to do actually; a borrower will refinance their first and second into one loan once the balances are low enough to allow it. You could look at another HELOC but the Fed has been pretty open about raising rates (which will raise the prime rate tied to the HELOC).

If I have cash in a taxable brokerage account that I was waiting for a dip in market to invest but also have equity in house (appraisal is $500,000 and I owe $220,000) does it make sense to take a HELOC so I don’t need to take money away from brokerage. We are doing home improvements and have 12 years left on mortgage…I would also repay HELOC over the same 12 years. I would take a $100,000 HELOC even though I only need $40,000 for work so my ratios aren’t out of line. Does this make sense for me or do I just grab cash from brokerage and dollar cost average payment back each month…are there tax deductions in new tax bill that would be advantageous for HELOC? Thanks.

Jay,

I get what you’re saying and I’m sure others have done what you’re proposing to avoid timing the market, but it’s a personal preference as to how you’d approach your investment and what vehicle would be best. HELOCs are actually losing their tax deductibility status as a result of the new tax law.

Colin,

I am planning to put an addition on my home. when i start the addition, i will have about 4 years left on my 1st mortgage. i was thinking about taking out a HELOC to minimize my mortgage payment rather than a home equity loan. assuming i have to start paying on the HELOC in 5 years, by the time i begin the payments on the HELOC, my original mortgage will be paid off. then i could have a smaller monthly nut, rather than rolling my existing mortgage into a refinance / 2nd mortgage or home equity loan. i know this would probably be a personal preference, but what are your thoughts?

David,

If your first mortgage is nearly paid off, it’s generally prudent not to mess with it and start the amortization period over again. By paying the HELOC, do you mean making fully-amortized payments as opposed to interest-only? A HELOC isn’t necessarily better than a home equity loan, you’d have to compare rates. The HELOC does provide more flexibility in terms of borrowing only what you need, and giving you an interest-only option typically. However, HELOCs are also slated to get more expensive as the Fed raises rates throughout the year.

thanks for the quick response! I was thinking about paying interest only on the HELOC for the first few years until my first mortgage is paid off. Then I’d start paying the full payments on the HELOC. I definitely would like to pay off the first mortgage and not roll it into another mortgage. The HELOC may help me buy some time so I can pay off the first mortgage before I have to start making full payments on the addition. If I did a home equity loan I would have to start paying it earlier and having two mortgages could be hard for me to manage.

David,

Understood…that makes sense from a cash flow/affordability point of view.

Can a HELOC mortgage continue to be used when a debt is converted to an amortizing schedule? If not, why not?

I am closing on my mortgage on Friday and cannot take out more than the purchase price of the home. I am going to try and get a home equity line of credit because they are major repairs needed in order to make the home livable. Will my credit be pulled again when I apply for this or will be use what has already be pulled from the mortgage since it will only have been days since closing on my home loan?

Emma,

Different creditors will likely pull fresh credit reports, though if both are pulled in a short time period and for a similar purpose FICO may treat it as a single hard inquiry.

Hi Colin;

I have a heloc. I am in the payment mode now. I am making the interest payments on the loan but was also putting 25 or so extra dollars per week towards the loan. I noticed that those payments were only going to interest. I went into the credit union and asked if those payments could be applied to principle. The teller said sure, there is a check box that allows me to put your payments to principle. YAY. Well I go into my loan online and notice that again: those extra payments are only going to interest. I go into the branch again and inquire. I was told- opps we can do that because of daily interest? What gives? Ugh. I remember back in the day: my first mortgage I made bi-weekly payments and it cut my mortgage payment years in half. This kinda stinks because I find it easier to come up with smaller weekly payments… (don’t ask why…hehe :) ) Any words of wisdom from you would be greatly appreciated.

What if my mortgage is paid. Does the heloc vendor file against the house just like a mortgage?

Bob,

A HELOC with a zero balance can remain open for future use if still in the draw period. If you want it closed, may need to contact lender and county clerk’s office to release the lien on your property.

Hi Colin, do I understand correctly that a HELOC out of the draw period with zero balance can closed without any further obligations?

Gary,

That would make sense, though you may need to be proactive and reach out to the lender.

Hello,

I am applying for an interest only HELOC which has a fixed rate for the first 5 years of my initial withdrawal. If I make payments on the principal during that time, will my monthly minimum payments be reduced?

For example, I withdraw $50k for monthly interest only payment of $122 (2.99%). If I pay off $10k after a year, will my monthly interest only payment be reduced or will I pay the same $122/month for the entire 5 years unless I pay off the entire balance?

Thanks for any assistance! I have searched online and can’t find an answer anywhere.

Michael

Michael,

I believe the minimum payment due would be lower if you paid some of it off since it should calculate the interest daily based on the outstanding balance, similar to a credit card. But may be best to ask loan officer or bank directly.