Mortgage Q&A: “What credit score do I need to get a mortgage?”

If you’re thinking about purchasing a new home or refinancing an existing mortgage, you should know that your credit score is going to be a huge factor.

In fact, it can make or break your loan approval and carries the most weight when it comes to determining your mortgage rate.

Why are credit scores so important to mortgage lenders, you ask?

Well, they use credit score(s) to measure your payment default risk, coupled with things like down payment, income, assets, and property/occupancy type.

While credit scores aren’t perfect, and were even partially blamed for the mortgage crisis of the early 2000s, they do tell lenders a lot about you.

Simply put, the higher your credit score, the lower your interest rate, all else equal. And the more loan options you’ll have. So be sure to get it right!

Which Credit Score Do Mortgage Lenders Use?

| Credit bureau | Equifax | Experian | TransUnion |

| FICO score version | FICO Score 5 | FICO Score 2 | FICO Score 4 |

| Also known as | Equifax Beacon 5.0 | Experian/Fair Isaac Risk Model v2 | TransUnion FICO Risk Score 04 (Classic 04) |

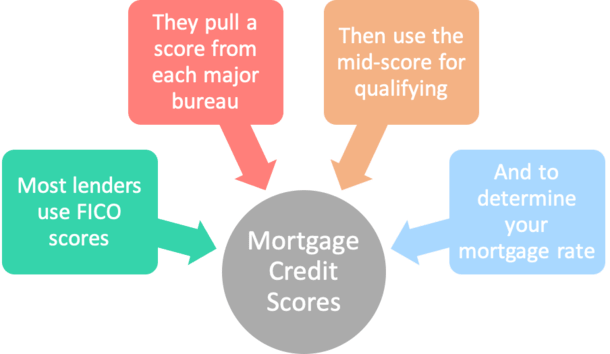

Are mortgage credit scores different?

- Mortgage lenders use FICO scores just like other finance companies

- But they pull one version from each of the three major credit bureaus

- This creates what is known as a tri-merge credit report

- The middle score is used for qualifying and mortgage rate purposes

First and foremost, you might be wondering which credit score mortgage lenders use, seeing that there’s no sense focusing on something they won’t actually look at to determine your creditworthiness.

I’ll save you the suspense. The short answer is FICO scores, which are the industry standard and relied upon by just about everyone.

I believe something like 9 out of 10 lenders use FICO, and it’s pretty much 100% in the mortgage world.

As for the version of FICO, I don’t know if any mortgage lenders use the newer FICO 8 or FICO 9 scores, which are the latest iterations available.

Even those updated scores are an option, lenders tend to upgrade slowly to avoid any unwelcome risk.

This also explains why FICO is pretty much the only game in town – it’s hard to change the status quo because there are a lot of moving parts (and investors) in the mortgage space, so one seemingly small alteration could have major ramifications.

Which mortgage lenders use VantageScore?

- VantageScore isn’t used by any mortgage lenders right now

- But the company finally received approval for Fannie/Freddie loans after many years of lobbying

- The VantageScore 4.0 score was developed by Equifax, Experian, and TransUnion

- It creates a newly scoreable population of 3.8 million minorites with 620+ scores

At the moment, no mortgage lenders use competitor VantageScore, but the company is working very hard to change that.

They finally received approval from the FHFA (the overseer of Fannie Mae/Freddie Mac) back in late 2022.

VantageScore claims that nearly 4 million more borrowers will be scoreable via their new model, which incorporates things like rental history, utilities, and cell phone payments.

And because these consumers have 620+ FICO scores, they could be potential mortgage applicants.

For the record, the new FICO 10 T got approved at the same time as VantageScore 4.0. It too incorporates non-traditional credit history.

So chances are mortgage lenders will continue to use FICO.

Those Free Credit Scores Might Differ from Your Lender-Pulled Scores

The credit scores you receive for free, such as via Credit Karma or your bank, often aren’t the same as the ones the lenders pull. However, they’re typically not far off.

So they can be beneficial to give you an estimate of where you stand. Just don’t be surprised if they’re a bit different.

And notice I wrote scores, not score. There are three FICO scores you need to be concerned with, including one from Equifax, one from Experian, and one from TransUnion, which are the three main credit bureaus, as seen in the table above.

Don’t expect a mortgage lender to only use Experian, or only use TransUnion, like some credit card issuers might do. This is a big loan so they’ll want to assess risk across as many platforms as possible.

The models in the table above are the most commonly used, though there are mortgage industry-specific versions of FICO scores that may also come into play.

Credit scores range from a low of 300 to a high of 850. The higher you score the better, though you don’t need a perfect score to get approved for a mortgage, or to obtain an excellent rate.

Know Your Credit Scores Long Before Applying for a Mortgage

- It’s very important to check all 3 of your credit scores before applying for a mortgage

- Do this at least 3-6 months before you apply for a home loan

- This way you’ll have a very good idea of where you stand credit-wise

- It also provides time to fix any errors/problems that may come up

Before you actually head out to get a mortgage, it’s good practice to view your credit scores long before you apply.

I’m talking several months in advance because any necessary credit score changes/improvements take time. Potentially a lot of time. Think months, not weeks.

For example, any mistakes (or legitimate issues) holding your credit score down may take 90 days or longer to get cleared up.

And you won’t want to leave anything to chance. Yes, the credit bureaus are bureaucratic, so nothing happens all that quickly.

Mortgage Lenders Use a Tri-Merge Credit Report

- Unlike most other creditors such as credit card issuers and auto loan lenders

- Mortgage lenders pull all 3 of your credit scores

- Then use the middle score for qualification purposes

- So all 3 need to be in good shape in order to receive the best pricing

If you want to know where you stand beforehand, be sure to go with a service that allows you to see all 3 credit scores from Equifax, Experian, and TransUnion.

As mentioned, mortgage lenders typically pull a tri-merge credit report, which includes credit scores from all three of those bureaus.

The bureaus each report information a little differently, so knowing just one score won’t do you (or your lender) much good.

Aside from the scores, payment history and amounts may differ, so it’s important to see them all.

As far as lenders are concerned, it basically allows them to triple-check your credit before making the decision to hand over a large sum of money.

They use the mid-score for pricing/qualification, so it’s imperative that all 3 credit scores are in tip-top shape.

Borrower credit scores: 650,680,720

For example, if your credit scores are 650, 680, and 720, a mortgage lender would use the 680 score, which is a decent but below-average credit score.

You basically don’t get credit for the 720 score, though they throw out the 650 score as well.

Alternatively, if you had scores of 710, 720, and 730, they’d use the 720 score and you’d be in much better shape.

*If you only have two credit scores, lenders will use the lower of the two for qualifying purposes.

If you only have one, they will use that one, though not all mortgage lenders approve borrowers with a single credit score, aka limited credit history.

Tip: It might be possible to get approved for a mortgage without a credit score, but again not all lenders are willing to extend such financing.

Additionally, stricter requirements will accompany such approvals, including higher minimum down payments and lower maximum loan amounts.

Co-borrower credit scores: 610,640,655

If there is a co-borrower involved, the lender will typically take the lowest mid-score of both borrowers.

So using our example from above, if the co-borrower has credit scores of 610, 640, and 655, the 640 credit score would be used, seeing that it’s lower than the primary borrower’s mid-score.

Assuming a co-borrower has poor credit, and isn’t absolutely necessary for qualification purposes, it might be in your best interest (literally) to keep them off the loan (you can still add them to title).

That way you’ll get better pricing and their questionable credit history won’t hold you back in any way. Just note that they won’t be liable on the mortgage itself!

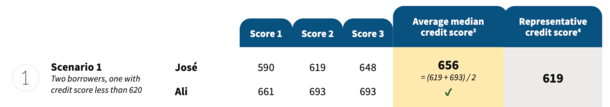

Note: Fannie Mae will now allow two borrowers to use their average credit score (both mid-scores combined and divided by two) for qualifying purposes only.

This means it’s possible for a co-borrower with a sub-620 mid-score to qualify for a conforming loan, as seen in the image above.

In the past, 620 FICOs were the minimum accepted by Fannie Mae and Freddie Mac, meaning you’d have to go a different direction such as an FHA loan if your scores were lower.

But loan pricing will still be based on the lower of the two mid-scores, so it’s best to aim higher before you apply if possible.

Lower Credit Score = Higher Mortgage Rate

- A lower credit score will usually result in a higher mortgage rate

- And greater difficulty obtaining a home loan

- A higher credit score will typically lead to a lower mortgage rate

- And make it easier to qualify for your mortgage

Simply put, a lower credit score will lead to a higher mortgage rate, and vice versa. That means you’ll probably pay more each month if your credit score is low.

This all has to do with risk. The lower your credit score, the higher the chance you’ll default on your mortgage. At least that’s what the statistics say.

So if your credit score is too low, you probably won’t even get approved for a mortgage (how to get a mortgage with a low credit score). Lenders simply won’t want your business. It’s just too risky.

But assuming you are approved with sub-par credit, why accept an inflated interest rate and a much higher monthly mortgage payment? You’d be throwing money out the window.

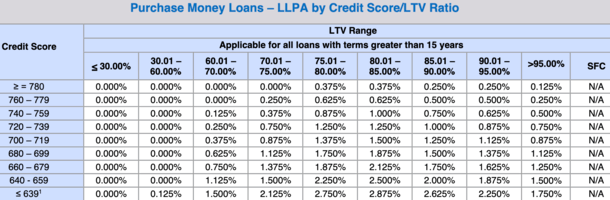

For example, if your mid-score is 650, as opposed to 660, you could wind up with a higher mortgage rate because lenders typically have a pricing threshold at 660. There’s another one at 720.

In other words, you’ll want to be at 660+, or 720+, as opposed to 659 or 719, in order to receive the most favorable pricing.

Work on Your Scores If You’re Close to a Credit Score Threshold

As noted, there are credit scoring buckets separated by 20 points. So there’s a 680-699 bucket, a 700-719 bucket, and even a 780+ bucket!

Those who find themselves just below a certain cutoff should try to improve their credit scores before applying.

Chances are you can save yourself money each and every month you hold your mortgage if you’re able to increase your score just 10 points (or less). That could equate to a lot of cash over 360 months.

It’s one of the few things you might be able to control that can make a big difference.

Note that banks and lenders have become more stringent lately, and require higher credit scores than they have in the past.

This means credit has gotten much more important and should not be taken for granted.

[Do mortgage inquiries affect credit score?]

FHA Minimum Credit Score

- The FHA allows FICO scores as low as 500

- But you need at least 10% down payment if your score is that low

- If you have a 580 FICO score or higher

- You can qualify with just a 3.5% down payment

There is now a minimum credit score of 500 on FHA loans. In the past, there was no minimum whatsoever, which is hindsight sounds like a horrible mistake.

A 500 credit score is pretty dismal, but many individual banks require higher-than-minimum credit scores for FHA financing that better suit their own risk appetite, such as a 600 credit score.

So the minimum score is a bit deceiving, and your odds of getting approved with a 500 credit score are pretty slim.

The same goes for VA loans and USDA loans, both of which have no minimum credit score requirement.

Keep in mind that if you want to qualify for the FHA’s flagship 3.5% down loan program, you need at least a 580 credit score, otherwise you’ll need to put at least 10 percent down.

Credit Scores Below 620 Considered Subprime

- The industry regards a 620 FICO score as the subprime cutoff

- Credit scores of 619 and lower are considered subprime

- And may not be eligible for approval by Fannie Mae and Freddie Mac

- Interest rates will also be higher if you score below this key level

As far as conventional mortgage loans go, a credit score below 620 is typically considered subprime.

This means you’ll have a difficult time qualifying for a mortgage, and if you do, you’ll receive a subprime mortgage rate. By subprime, I mean higher.

A 620 FICO score is the absolute minimum allowed for home loans backed by Fannie Mae and Freddie Mac. But there are some exceptions for nontraditional credit (and if average credit score is used).

So make sure you have at least a 620 score to keep your loan options open.

Credit scores between 620 and say 680 may be considered “near-prime,” meaning they aren’t bad but they’re not necessarily good either.

Aim for a 780 Credit Score or Higher for Best Pricing

- A 720 FICO score used to be good enough for the best rates

- Then a 740/760 FICO was needed to secure the lowest pricing

- The latest change requires a 780 FICO to ensure you qualify for the lowest rates

- Shoot for the sky to increase your chances of securing the lowest rate possible

In the recent past, a credit score of 720 and above was good enough to qualify for most home loan programs and avoid any negative pricing adjustments.

Then a 740 or even 760 credit score was the new rule if you wanted the best possible terms and lowest rates.

As of May 1st, 2023, a 780 FICO score is needed for the best mortgage rate pricing.

The same goes for qualifying for the cheapest mortgage insurance, if applicable to your loan.

While this may sound excessive, note that FICO scores go as high as 850, so it’s not perfection by any means.

And though credit scoring is just one of the many criteria used to judge your borrowing capacity, it impacts how much you can borrow, your max loan-to-value ratio, and even what you can do (cash-out refinance vs rate and term refinance).

In summary, your credit score is probably the one thing you have complete control of, whereas things like occupation, income, and assets can be at the mercy of external forces.

So do your best to strive for perfection in order to get the best deal on your mortgage.

Some Useful Credit Score Tips for Those Shopping for a Mortgage

- Credit scores are the single most important factor in determining your mortgage rate

- Aim for a 780+ credit score to get the best pricing and to avoid underwriter scrutiny

- Credit scores aren’t everything, what’s on your credit report matters as well!

- Don’t mess with your credit before or during the loan application process!

- Know the contents of your credit report and what your scores are long before your lender does

- Any mistakes or missteps can be corrected, but take time, often several months!

- The FHA now requires a minimum credit score of 500, or 580 if you put less than 10% down

- Conventional loans generally require a minimum credit score of 620

- VA loans and USDA loans have no min. credit score, but most lenders want 640+

- Credit scores below 620 are considered subprime and will be priced much higher

- Lenders pull all three of your credit scores and use the median score for qualification

- Low credit scores can also disqualify you for certain loan programs and/or limit your options

Read more: What mortgage rate can I get with my credit score?

My sister and I were trying to apply for a mortgage, in Maryland. We never found any mortgage company willing to go by your credit score. Every one of them has told us they go by the income to debt ratio, and that only. They have told both of us they would not care if we have money or a high credit score, if we do not have BIG incomes we can forget it.

Laura,

Credit scores matter a lot to mortgage lenders, but as you stated, without income, assets, and a solid job, even an excellent score won’t mean much.

help my score is 546 however I have been at my job over 4 years

Gina,

You may want to use a free service like Credit Karma or similar to see why your score(s) are that low and what you can do to remedy the situation. You may just need to pay down balances and/or dispute some items to get it a little higher. Even if a lender is willing to approve you, which most won’t at those levels, the interest rate will be significantly higher as a result.