What Is an FHA Loan?

“FHA loans” are government-backed mortgages insured by the Federal Housing Administration (FHA).

Congress established the FHA in 1934 in conjunction with President FDR’s New Deal aimed at overcoming the Great Depression.

The goal was to free up credit for home buyers and help lower-income borrowers obtain a mortgage who would otherwise have trouble qualifying.

In 1965, the FHA became part of the Department of Housing and Urban Development’s (HUD) Office of Housing.

Before the FHA was created, it was common for homeowners to put down a staggering 50% of the value of the property as a down payment on short-term balloon mortgages, which clearly wasn’t practical going forward.

The FHA changed this by insuring the loans if lenders offered long-term fixed-rate, fully-amortizing mortgages, such as the now popular 30-year fixed.

Unlike conventional home loans, FHA loans are government-backed, which protects lenders against defaults, making it possible to for them to offer prospective borrowers more competitive interest rates on traditionally more risky loans.

How Does an FHA Loan Work?

An FHA home loan works like any other mortgage in that you borrow a certain amount of money from a lender to purchase a home and pay it back monthly.

Typically, the term on an FHA loan is 30 years and the most common type of mortgage is a 30-year fixed.

They can be issued by any FHA-approved lender in the United States. And the majority of banks and lenders out there offer them.

As noted, they are government-backed loans, meaning lenders that originate them are insured in the case of borrower default.

In order to pay for this government guarantee, FHA loans charge both upfront and monthly mortgage insurance premiums, often for the life of the loan.

Despite that slight negative, FHA interest rates are some of the lowest around, generally cheaper than both VA loans and conventional options backed by Fannie Mae and Freddie Mac.

They also come with low down payment and credit score requirements, making them one of the easier home loans to qualify for.

You can purchase a home with an FHA loan, or refinance an existing FHA if you’re in need of cash or a lower interest rate.

Let’s explore some of the finer details to provide a better understanding of these mortgages to see if one is right for you.

Jump to FHA loan topics:

– FHA Loan Requirements

– FHA Mortgage Rates

– Types of FHA Loans

– FHA Loan Credit Score Requirements

– Do FHA Loans Require Mortgage Insurance?

– Are FHA Loans Assumable?

– Are DACA Recipients Eligible?

– FHA Loan Pros and Cons

FHA Loan Requirements

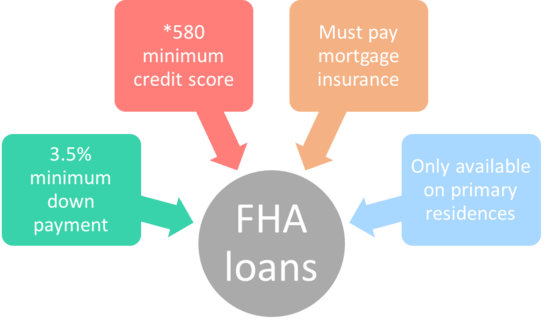

Because FHA loans are insured by the government, they have easier underwriting guidelines than most other home loans.

This includes relatively low credit score and down payment requirements.

What is the minimum down payment on an FHA loan?

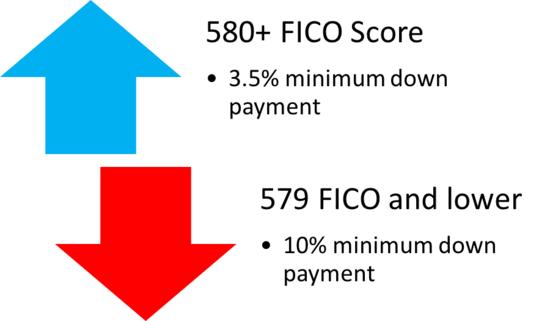

Wondering how much do you need down for an FHA loan? Your down payment can be as low as 3.5% of the purchase price, assuming you have at least a 580 credit score. And closing costs can be bundled with the loan. In other words, you don’t need much cash to close.

In fact, gift funds can be used for 100% of the borrower’s closing costs and down payment.

This makes them a truly affordable option for an individual with little cash on hand. However, you cannot use a credit card or unsecured loan to fund the down payment or closing costs.

Can you get an FHA loan with zero down?

Technically no, you still need to provide a 3.5% down payment. But if the 3.5% is gifted by an acceptable donor, it’s effectively zero down for the borrower.

For a rate and term refinance, you can get a loan-to-value (LTV) as high as 97.75% of the appraised value (plus the upfront mortgage insurance premium.)

If it’s a streamline refinance, you don’t need an appraisal and there is no max LTV.

However, it’s important to note that while the FHA has relatively lax guidelines for its loans, individual banks and lenders set their own FHA underwriting guidelines on top of those, known as lender overlays.

And keep in mind that the FHA doesn’t actually lend money to borrowers, nor does the agency set the interest rates on FHA loans. It simply insures the loans.

What is the max loan amount for an FHA loan?

The max loan amount is determined by either the national loan limit floor or ceiling, depending on if the county is considered high-cost or not.

The FHA floor is set at 65% of the national conforming loan limit, which for 2025 is $806,500. And high-cost area mortgage limits are 150% of that limit. This applies to one-unit properties.

There are higher limits on 2-4 unit properties and in some Hawaiian counties that go as high as $2.3 million.

However, many counties, even large metros, have loan limits at or very close to the national floor.

For example, Phoenix, Arizona only allows FHA loan amounts up to $546,250 because home prices aren’t as high there.

There are other counties that have a max loan amount somewhere in between the floor and ceiling, such as San Diego, CA, where the max is set at $1,077,550.

The same goes for Miami ($654,350), though it’s not much higher than the national floor.

In other words, you really have to check your county before assuming your loan amount will work with the FHA.

What are the 2025 FHA loan limits?

In 2025, the max loan amount in high-cost areas increased to $1,209,750 from $1,149,825, while the floor in lower-cost areas rose to $524,225 from $498,257.

Loan amounts above the ceiling are considered jumbo loans, and thus are not eligible for FHA financing.

What are the FHA loan income requirements?

Despite some misconceptions, there is no minimum or maximum income required for an FHA loan. This means both low-income and wealthy home buyers can take advantage of the program if they so choose.

However, there are debt-to-income ratio (DTI) limits that the applicant must abide by, like any other mortgage, though the FHA is relatively liberal in this department.

In fact, it’s possible to get approved for an FHA loan with a DTI ratio as high as 56.99% (back-end ratio including housing and other liabilities).

*It should be noted that some state housing finance agencies do have income limits for their own FHA-based loan programs.

Do I need to be a first-time home buyer to get an FHA loan?

Nope. The program can be used by both first-time home buyers and repeat buyers, but it’s definitely more popular with the former because it’s geared toward individuals with limited down payment funds.

For example, move-up buyers probably won’t use an FHA loan because the proceeds from their existing home sale can be used as a down payment on their new property.

And there are some limitations in terms of how many FHA loans you can have, which I explain in detail below.

Do you need reserves for an FHA loan?

No, reserves are not required on FHA loans if it’s a 1-2 unit property. For 3-4 unit properties, you’ll need three months of PITI payments. And the reserves cannot be gifted nor can they be proceeds from the transaction.

What banks offer FHA home loans?

If you’re wondering how to get an FHA loan, pretty much any bank or lender (or mortgage broker) that originates mortgages will also offer FHA loans. They are a very common type of loan.

While the FHA insures these loans on behalf of the government, private companies like Rocket Mortgage and Wells Fargo are the ones that actually make them.

My guess is that more than nine out of 10 lenders offer them, so you should have no trouble finding a participating lender. Check out my list of the top FHA lenders.

Who are the best FHA loan lenders?

The best FHA lender is the one who can competently close your loan and do so without charging you a lot of money, or giving you a higher-than-market rate.

There is no one lender that is better than the rest all of the time. Results will vary based on your loan scenario and who you happen to work with. Your experience can even differ within the same bank among different employees.

FHA Mortgage Rates Are Typically the Lowest Available

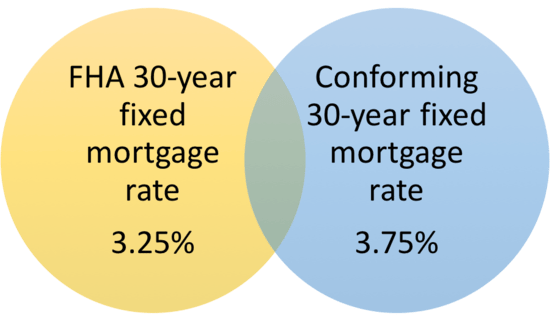

One of the biggest draws of FHA loans is the low mortgage rates.

They happen to be some of the most competitive around, though you do have to consider the fact that you’ll have to pay mortgage insurance.

That will obviously increase your overall housing payment, so be sure to look beyond the rate itself.

In general, you might find that a 30-year fixed FHA mortgage rate is priced about 0.25% to 0.75% below a comparable conforming loan (those backed by Fannie Mae and Freddie Mac).

So if the non-FHA loan mortgage rate is 6.75%, the FHA mortgage rate could be as low as 6%. Of course, it depends on the lender. The difference could be as little as an .125% or a .25% as well.

This interest rate advantage makes FHA loans competitive, even if you have to pay both upfront and monthly mortgage insurance (often for the life of the loan!).

The low rate also makes it easier to qualify for an FHA loan, as any reduction in monthly payment could be just enough to get your DTI to where it needs to be.

But if you compare the APR of an FHA loan to a conforming loan, you might find that it’s higher. This explains why many individuals refinance out of the FHA once they have sufficient home equity to do so.

Types of FHA Loans

- FHA loans are primarily used for home purchases (for the low 3.5% down payment)

- But their streamline refinance program is also very popular when mortgage rates drop

- You can get a fixed-rate home loan or an adjustable-rate mortgage

- Though most FHA borrowers tend to go with a 30-year fixed because it’s cheap

The FHA has a variety of loan programs geared toward first-time home buyers, along with reverse mortgages for senior citizens, and has insured more than 34 million mortgages since inception.

FHA loans are available for both purchases and refinances, including cash out refinances.

But their 3.5% down home purchase is probably the most popular reason people choose an FHA loan.

For those with existing FHA loans looking to refinance to another FHA loan to obtain a lower rate, the streamline refinance program is a quick and easy option.

The program provides a ton of flexibility, even for those who lack home equity as no appraisal is required.

If you’re looking to tap equity, the maximum LTV for a cash-out FHA loan is currently 80% (instituted in September 2019).

It had been as high as 95% before the mortgage crisis took place, but was later lowered to 85% due to a “weakening housing market” before dropping even more.

Mortgages with fewer than six months of payment history are not eligible for an FHA cash out refinance.

And the borrower must have made all mortgage payments on time in the preceding 12 months (or six if owned for a shorter time period) to be eligible.

Does the FHA offer ARM loans?

Yes, FHA loans can be either adjustable-rate mortgages or fixed-rate mortgages. The FHA 30-year fixed loan is certainly the most common.

However, many FHA lenders offer both a 5/1 ARM and a 3/1 ARM. If the interest rate is adjustable, it will be based on the 1-Year Constant Maturity Treasury Index, which is the most widely used mortgage index.

Does the FHA offer 15-year loans?

Absolutely! You can get a variety of different fixed-rate FHA products, including a 15-year fixed from most lenders, though the higher monthly payments would probably serve as a barrier to most first-time home buyers. Some may even offer a 10-year fixed product, a 20-year fixed, or even a 25-year fixed.

Does the FHA offer home equity loans?

No. The FHA does not offer home equity loans or home equity lines of credit (HELOCS). These products must be obtained via a conventional lender.

Can I get a second mortgage behind an FHA loan?

It’s possible, though most FHA loans have very high LTV ratios, and most home equity loans limit the CLTV (combined LTV) to around 85%-95%, so you’ll need some equity before taking out a second mortgage such as a HELOC.

A second mortgage may also come into play when getting down payment assistance during a home purchase, whereby the loan is subordinate to the FHA loan.

Can you use boarder income to qualify for an FHA loan?

Yes, but only if you have a two-year history of receiving boarder income, as evidenced by tax returns. And you must provide a copy of the current lease.

If being used for a home purchase, you will need to show documentation of the boarder history and the expectation for it to continue on the new subject property.

Can you use ADU rental income to qualify for an FHA loan?

Yes, up to 75% of the estimated ADU rental income as determined by the lesser of the actual rent or the fair market rent reported by the appraiser can be added to the borrower’s gross income for qualification purposes.

Does FHA do construction loans?

Yep. They have a construction program called a 203k loan that allows FHA borrowers to renovate their homes while also financing the purchase at the same time.

Fun fact – the standard FHA loan program is technically known as the “FHA 203b” in case you’re wondering where that name comes from.

There are also one-time close construction-to-permanent loans (FHA OTC loan) that allow FHA borrowers to combine construction and permanent financing into a single loan.

This means you only need to qualify once for an FHA loan while obtaining a fixed interest rate that won’t change.

Can FHA loans be used on 2-4 unit properties?

FHA loans can be used to finance 1-4 unit residential properties, including condominiums, manufactured homes and mobile homes (provided it is on a permanent foundation), along with multifamily properties.

However, FHA loans are generally only reserved for borrowers who intend to occupy their properties.

Does FHA have to be owner occupied?

Yes, the property you are purchasing with an FHA loan has to be owner-occupied, meaning you intend to live in it shortly after purchase (within 60 days of closing). You are also expected to live in it for at least a year. However, that doesn’t mean you can’t eventually turn your primary residence into a rental.

Can FHA financing be used for an investment property?

The FHA’s single family loan program is limited to owner-occupied principal residences only, meaning investment properties aren’t eligible. But as noted above, 1-4 units are permitted and those additional units can be rented out if you occupy one of the other units. And it may be possible to rent the property in the future.

Can you rent out a house with an FHA loan?

Generally, yes, but the FHA requires a borrower to establish “bona fide occupancy” within 60 days of closing and continued occupancy for at least one year. After that time, it’s basically fair game to rent it out though the FHA does say it will not insure a mortgage if it’s determined that the loan was used as a vehicle for obtaining investment properties.

Can I have more than one FHA loan?

Tip: Technically, you may only hold one FHA loan at any given time. The FHA limits the number of FHA loans borrowers may possess to reduce the chances of default. And simply because the program isn’t geared toward investors.

For example, they don’t want one individual to purchase multiple investment properties all financed by the FHA, as it would put more risk on the agency. But there are certain exceptions that allow borrowers to have multiple FHA loans at the same time.

Can I get an FHA loan on a second home?

A co-borrower with an FHA loan may be able to get another FHA loan if going through a divorce, and a borrower who outgrows their existing home may be able to get another FHA loan on a larger home, and maintain the old FHA loan on what would become their investment property.

It’s also possible to get a second FHA loan if relocating for work, whereby you purchase a second property as a primary residence and keep the old property as well.

Lastly, if you are a non-occupying co-borrower on an existing FHA loan, it’s possible to get another FHA loan for a property you intend to occupy.

But you’ll need to provide supporting evidence in order for it to work.

Can I get an FHA loan if I already own a home?

Yes, but you might run into some roadblocks if your existing home has FHA financing, as noted above.

If your existing home is free and clear or financed with a non-FHA mortgage, you should be good to go as long as the subject property will be your primary residence.

FHA Loan Credit Score Requirements

Can I get an FHA loan with bad credit?

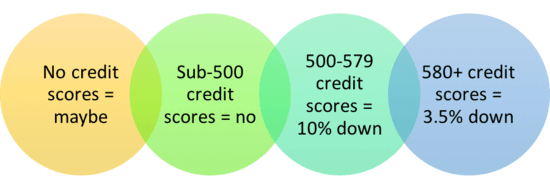

Borrowers with credit scores of 580 and above are eligible for maximum financing, or just 3.5% down. This is the low-down payment loan program the FHA is famous for.

And a 580 credit score is what I would define as “bad,” so the answer to that question is yes.

What if my credit score is below 580?

If your credit score is between 500 and 579, your FHA loan is limited to 90% loan-to-value (LTV), meaning you must put down at least 10%. This is why you’ll probably want to aim higher.

If your credit score is below 500, you are not eligible for an FHA loan. All that said, the FHA has some of the most liberal minimum credit scores around.

I can’t find a lender willing to give me an FHA loan with a 500 credit score.

As noted earlier, these are just FHA guidelines – individual banks and mortgage lenders will likely have higher minimum credit score requirements, so don’t be surprised if your 580 FICO score isn’t sufficient (at least one lender now goes as low as 500).

Can I get an FHA loan with no credit score?

Surprisingly, yes! The FHA makes exceptions for those with non-traditional credit and those with no credit scores whatsoever. You can even get maximum financing (3.5% down) as long as you meet certain requirements.

The FHA is a little tougher on this type of borrower, imposing lower maximum DTI ratios, requiring two months of cash reserves, and they do not permit the use of a non-occupant co-borrower.

If you have rental history, it needs to be clean. If not, you still need to create a 12-month credit history using Group I credit references (rent, utilities, etc.) or Group II references (insurance, tuition, cell phone, rent-to-own contracts, child care payments, etc.).

You are allowed no more than one 30-day late on a credit obligation over the past 12 months, and no major derogatory events like collections/court records filed in the past 12 months (other than medical).

Assuming you can muster all that, it is possible to get an FHA loan without a credit score. Of course, it’s probably a lot easier if you have a credit score (and a good one at that!).

Do FHA Loans Require Mortgage Insurance?

- FHA loans impose both an upfront and annual insurance premium

- This is one of the major downsides to FHA financing

- And it can’t be avoided anymore regardless of loan type or down payment

- Nor can it be cancelled in most cases for the entire loan term

One downside to FHA loans as opposed to conventional mortgages is that the borrower must pay mortgage insurance both upfront and annually, regardless of the LTV ratio.

This differs from privately insured mortgages, which only require mortgage insurance if the LTV is greater than 80%.

The upfront mortgage insurance premium:

FHA loans have a hefty upfront mortgage insurance premium equal to 1.75% of the loan amount. This is typically bundled into the loan amount and paid off throughout the life of the loan.

For example, if you were to purchase a $100,000 property and put down the minimum 3.5%, you’d be subject to an upfront MIP of $1,688.75, which would be added to the $96,500 base loan amount, creating a total loan amount of $98,188.75.

And no, the upfront MIP is not rounded up to the nearest dollar. Use a mortgage calculator to figure out the premium and final loan amount.

However, your LTV would still be considered 96.5%, despite the addition of the upfront MIP.

The annual mortgage insurance premium:

But wait, there’s more! You also must pay an annual mortgage insurance premium (paid monthly) if you take out an FHA loan, which varies based on the attributes of the loan.

Additionally, how long you pay the annual MIP depends on the LTV of the loan at the time of origination.

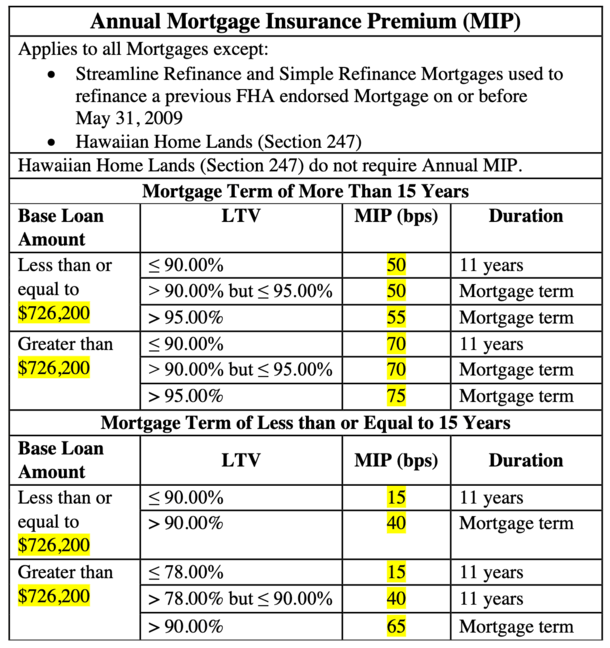

For FHA case numbers endorsed on or after March 20, 2023, the annual MIP pricing pictured in the table below applies.

The annual MIP was reduced by 30 basis points across all different LTVs and loan terms.

Most FHA borrowers will pay 0.55% in MIP annually because they tend to take out 30-year fixed mortgages and put down just 3.5% (96.5% LTV).

For loan terms of 15 years or shorter, the annual mortgage insurance premiums are significantly lower (see chart above).

Prior to this change, if the LTV was less than or equal to 95%, you had to pay an annual mortgage insurance premium of 0.80% of the loan amount. And for FHA loans with an LTV above 95%, the annual insurance premium was 0.85%.

And before that, the MIP was as high as 155 basis points!

How do you calculate the annual MIP on an FHA loan?

To calculate the annual MIP, you use the annual average outstanding loan balance based on the original amortization schedule. An easy way to ballpark the cost is to simply multiply the loan amount by the MIP rate and divide by 12.

For example, a $200,000 loan amount multiplied by 0.0085% equals $1,700. That’s $141.67 per month that is added to the base mortgage payment.

In year two, it is recalculated and will go down slightly because the average outstanding loan balance will be lower.

And every 12 months thereafter the cost of the MIP will go down as the loan balance is reduced (a mortgage calculator may help here).

However, paying down the loan balance early does not affect the MIP calculation because it’s based on the original amortization regardless of any extra payments you may make.

Note: The FHA has increased mortgage insurance premiums several times as a result of higher default rates, and borrowers should not be surprised if premiums rise again in the future.

Do FHA Loans Have Prepayment Penalties?

- They do not have prepayment penalties

- But there is a caveat

- Depending on when you pay off your FHA loan

- You may pay a full month’s interest

The good news is FHA do NOT have prepayment penalties, meaning you can pay off your FHA loan whenever you feel like it without being assessed a penalty.

Prepayment penalties aren’t very common these days, though they were quite prevalent on conventional loans during the housing boom in the early 2000s.

However, there is one thing you should watch out for. Though FHA loans don’t allow for prepayment penalties, you may be required to pay the full month’s interest in which you refinance or pay off your loan because the FHA requires full-month interest payoffs.

In other words, if you refinance your FHA loan on January 10th, you might have to pay interest for the remaining 21 days, even if the loan is technically “paid off.”

It’s kind of a backdoor prepay penalty, and one that will probably be revised (removed) soon for future FHA borrowers. If you’re a current FHA loan holder, you may want to sell or refinance at the end of the month to avoid this extra interest expense.

Update: As expected, they eliminated the collection of post-settlement interest. For FHA loans closed on or after January 21st, 2015, interest will only be collected through the date the loan closes, as opposed to the end of the month. Legacy loans will still be affected by the old policy if/when they are paid off early.

Are FHA Loans Assumable?

- An FHA loan can be assumed by another person

- Which is one advantage to choosing this type of loan

- But how often this option is actually exercised is unclear

- My guess is that it doesn’t happen frequently though it might with mortgage rates now much higher

Another benefit to FHA loans is that they are assumable loans, meaning someone with an FHA loan can pass it on to you if the interest rate is favorable relative to current market rates.

For example, if someone took out an FHA loan at a rate of 3.5% and rates have since risen to 6%, it could be a great move to assume the seller’s loan.

It’s also another incentive the seller can throw into the mix to make their home more attractive to prospective buyers looking for a deal.

Just note that the individual assuming the FHA loan must qualify under the same underwriting guidelines that apply to new loans.

Are DACA Recipients Eligible for FHA loans?

Yes. After some years of confusion (and politics), HUD officially announced that effective January 19th, 2021, individuals classified under the “Deferred Action for Childhood Arrivals” program (DACA) are eligible to apply for mortgages backed by the FHA.

Prior to the announcement (FHA INFO #21-04), there was a lot of uncertainty regarding the matter because the FHA handbook stated, “Non-US citizens without lawful residency in the U.S. are not eligible for FHA-insured mortgages.”

That entire subsection has now been removed from the handbook to avoid confusion and provide clarity.

The one caveat is that they must also be legally permitted to work in the United States, as evidenced by the Employment Authorization Document issued by the USCIS.

Other than that, you must occupy the property as your primary residence, have a valid Social Security Number (SSN), unless employed by the World Bank, a foreign embassy, or an equivalent employer identified by HUD.

And you must satisfy the same underwriting requirements, terms, and conditions set for U.S. citizens.

A new update via mortgagee letter 2025-09 released on March 26th, 2025 no longer allows non-permanent residents to get approved for an FHA loan. This may include those protected under DACA.

FHA Loan Pros and Cons

FHA Loan Advantages

- Can qualify with a FICO score as low as 580

- Only requires a 3.5% down payment

- Lowest mortgage rates

- No asset reserves required

- Can use gift funds to eliminate out-of-pocket costs

- High DTI ratios permitted

- Boarder income or ADU income can be used to qualify

- Can purchase a 1-4 unit property

- Available to first-time and repeat home buyers

- They are assumable

FHA Loan Disadvantages

- Only available on a primary residence

- Must pay mortgage insurance (often for the life of the loan)

- Loan limits may be low in your desired county

- Not offered by all banks and lenders

- Strict property/appraisal standards

- Can generally only hold one FHA loan at a time

- Sometimes difficult to close (longer timelines, more documentation)

Post-mortgage crisis, FHA loans have become increasingly popular, essentially replacing subprime lending because of their relatively easy underwriting requirements and government guarantee.

Very few types of mortgages allow sub-600 FICO scores. So that’s one of the main reasons a home buyer would choose one.

However, they have their cons too, like low loan limits and mortgage insurance, often imposed for the life of the loan.

But make sure you compare FHA loans with conventional loans as well. There will be cases when the benefit of one outweighs the other. Be sure to use a payment calculator to factor in all monthly costs.

FHA loans are not guaranteed to be a better deal than other mortgages, so take the time to shop around. And watch out for unscrupulous FHA-qualified lenders who may attempt to misinform you.

Sometimes certain types of loan benefit them more than you, so knowing which is best for you before you speak to an interested party might be the best way to go.

Read more: FHA vs. conventional loans

Why does.the FHA not allow you to obtain a loan from a bank for the down payment?

Brandi,

The FHA doesn’t allow unsecured loans (non-collateralized) as borrower funds, but other sources like down payment assistance and loans secured by other assets may be acceptable.

I’m in an underwriting and today I received the disclosures from the Lender. I notice they asked for tax transcripts. I owe 2015 taxes just haven’t gotten a bill yet and haven’t made payment arrangements. Can this be issue ? Our broker is away and we have this dilemma. I don’t want to start a payment plan and make the lender feel that I’m trying to be sneaky.

DRE

Dre,

If it were a tax lien or delinquent it could be an issue, but the lender may wonder why you haven’t paid them yet…do you actually need a “bill” sent to you in order to pay them? Are you delaying payment for some reason? Do you have the necessary funds to pay and still qualify for the mortgage?

I have been trying to get an FHA finance to close for almost 4 months. The delays have been tax transcripts and flood insurance. Finally were able to work out the flood insurance issue. Now, the issue is back to taxes. My husband became disabled and for various reasons, we took a while to get our taxes filed – 3 years of taxes were filed at the same time (2011, 2012, 2013). We only owed on 2013 and they were paid. My husband passed away last year and we failed to get our 2014 taxes filed in time due to his illness. I just filed the 2014 and owe. My lender had told me that I only needed two years of tax transcripts – so I provided 2013 and 2014. I have not filed for 2015 yet. Now, he’s come back to me for the 5th time telling me that I have to have 2015 filed – no way around it. Is this true?

Colleen,

Your 2015 tax return is pretty important because the lender needs to know what you most recently earned (to qualify you properly) and also to know if a tax bill is due or not. If you got an extension you can ask if there’s a way around it using other documentation but at that point you might feel it’s easier to file.

Wondering if my husband & I should apply for a FHA loan or wait until our score is a bit higher. My credit score is 615 while his is 640..I have 3 medical accounts on my credit report that are over 2yrs old and was told not to pay them because it would hurt my credit score. My husband has 1 medical bill and 1 car repo from 2011 on his credit report that has been charged off. We both are rebuilding our credit and both have 2 credit cards that are in good standing with no missed payments. Would we be approved for a FHA loan? Should we pay the collection accounts?

Hi Colin,

My girlfriend and I own a home 50/50 and she needs to move out of state for work reasons. I would be staying in the house. My question is how can I get the FHA loan we have all in my name so she can buy a house where she’s going to live? Ours is assumable, but how can I assume something I’m already part owner of? BTW, we have equity in the house and have paid always on time since January of 2013. Hope you can give us some ideas on this subject.

Luis,

Generally you’d refinance to remove one borrower from the loan while maintaining ownership of the property, but then you have to qualify for the mortgage on the original home on your own. Of course, this also means your girlfriend wouldn’t have to qualify for both mortgages when buying the new property. If you have sufficient equity a refinance may be beneficial and allow you to go with a conventional loan without having to pay mortgage insurance each month.

Maria,

Generally, getting credit scores above 620 means more lender options and lower interest rates. Perhaps someone can advise you on improving/cleaning up credit before applying to ensure you qualify and obtain a more favorable rate.

Colin,

I am currently going through a divorce. We have a FHA loan that my lender is going to let me assume to remove her name once I have the decree. However, I’m afraid now that I have a new job(within the last month, hardly any job history) and also probably a little higher DTI than they would like that I might be declined for the assumption. Can a friend “co-sign” the assumption to add more income to make it acceptable?

Daniel,

You may want to speak with your lender to determine how they qualify you for the assumption to ensure you in fact qualify, and if not, what your other options are.

Hey Collin,

I currently have an FHA loan in MD, and planning to buy another house with my fiance using an FHA loan. I realize I can not have 2 FHA loans but I am wondering if we have to close the first loan before we can start the FHA loan process on the new purchase.

THanks,

We are closing on our fha loan in two weeks,we were gifted 5k from my mother in law to pay off a debt in order to get approved for the loan. Will we still get approved if she took out a personal loan and gifted us the proceeds?

Crystal,

Good question…the underwriter will probably want a paper trail for the donor funds and they may scrutinize it further if it’s sourced from another loan, even if the donor isn’t a borrower for the mortgage.

Derrick,

The new lender will want to know the original FHA loan will be paid in full to obtain the subsequent loan, should be condition on new loan so discuss with them beforehand so they can arrange it.

Hi Colin, your blog is amazing, thank you for being here for everyone.

My fiance and I have found a house we want for 86,000. We have 6500 for closing/down/reserves that is seasoned 1 month(had the money in multiple accounts and cash until Aug 2). I have 1 account in collection that I am fighting. My credit score is around 640 and my fiances is around 700. It is a sale by owner deal. I am having issues getting approved. My current landlord is getting ready to raise my rent from 700 a month to 1000. I need this house as that rent is exorbitant for this area. I get so far with a lender and then communication seems to cease. Would my 1 collection account stop us from getting a loan? We are in Wisconsin and I have heard people suggest a FHA WHEDA loan or even a USDA Direct loan but had a lot of credit issues to clean up first; which we have done. What would be holding everything up?

Thank you for your time,

Steven

Steven,

Could be the collection, could be the reserves only being seasoned one month. Could be something else not mentioned. Have you asked what the specific issue(s) is? Best to get it straight from the horse’s mouth.

Hi Colin…

I am considering refinancing my FHA loan by either doing a FHA streamline or switching to a conventional loan to reduce my interest rate and current monthly payment. I’m leaning more toward the conventional loan because it will reduce my payment the most by eliminating the mortgage insurance. If I switch over to a conventional loan now, can I obtain another FHA loan later while I still have the conventional loan? Are there any potential pitfalls I need to consider when switching from an FHA to conventional loan?

Karen,

It’s pretty common to go conventional and drop the MI if you’ve got the necessary equity, so it makes sense. If you want to go FHA in the future, you’d have to make the old property a second home or investment property if you keep it. But that would be the case either way when buying another home with FHA financing and it would probably be more difficult if the loan on the original home is an FHA loan.

Got it….thank you Colin

I am in the process of finalizing my FHA loan. This is a first home purchase. I currently live in a single wide trailer that I own. I just received an email from my loan officer asking for proof of insurance for my trailer. I didn’t put any insurance since it was older and I only planned on living there for less than 5 years. Would me not having proof of insurance for my trailer stop me from completing my FHA loan? Just about everything else is done for the loan.

Ritza,

Not sure why it would if it’s not the subject property. You may want to ask the lender to be sure.

The lender underwriter for my FHA refi is telling me that I have to have a declaration page for my flood insurance before they will close on the loan. I have never had to have flood insurance in the past, so I applied for it and was told it could be escrowed as part of my loan. I submitted the quote to them with all the details of the flood insurance – telling me it’s not good enough, that they have to obtain a dec page. My insurance agent is telling me that the insurance has to be paid in full before they’ll provide a dec page (FEMA rules – not theirs). I can provide a signed application with start date for insurance (do you think this will work)? I’m ready to pull my hair out….I’ve been trying to get this closed for 6 months.

Colleen,

You’ll have to ask the lender – or just pay for the insurance to get the dec page…isn’t insurance refundable if canceled?

Our mortgage company is currently offering a no closing cost refinance and we are looking to refinance to combine a first and second mortgage at a lower interest rate of 3.65. The kicker is that I do not have enough equity in our home so the lender is recommending a FHA loan. My wife and I would like to sell our home in the near future but may not be able to do and are thinking if we refinance we could take advantage of the lower interest rate . By refinance to a FHA loan we would actually be increasing the amount of our current loan by about $5-6K because of the MIP up front cost. The loan specialist said that if we sell our home we would be refunded for what we’ve paid into it. Is this true? From what I have read we would be refunded starting at 80% after the first month after closing and would it reduce by 2 percentage points each month after that.

Ryan,

Per HUD, the Upfront Mortgage Insurance Premium (UFMIP) isn’t refundable unless refinancing to a new FHA-insured mortgage within 3 years.

https://hudgov.prod.parature.com/link/portal/57345/57355/Article/2924/Am-I-eligible-for-a-mortgage-insurance-refund

I had an appraisal come in under the contract price. The difference is just over what I can come up with out of pocket.

However – if I switch to a 203k there are some inexpensive repairs I can make which should (based on comments in the original appraisal) bump up the after improved value for more than the rehab costs due to the nature of the changes (it will cost very little to heat an existing unheated addition on the same heating unit as the rest of the house, thereby bumping up the Gross Living Area of the house.)

My question is – does the existing appraisal get used for the as-is value in the 203k or does the purchase price get used? If it is the existing appraised value, would I still need to make up the difference? Or not, if the after improved value were over the appraised value? Or – is this at the discretion of the lender?

If I change to a 203k with the same lender, does the FHA case number remain the same or does that change? The rules about when a FHA appraisal “sticks” and when it doesn’t are a little confusing to me – I hear that the appraisal sticks for 4 months, but that a new case number requires a new appraisal even within the 4 months.

Then again – in 4 months the appraised value should go up in this market and/or I’ll be closer to being able to make up the difference. I have an agreement with the seller (my landlord) that would allow me to try again after that time was up if I can’t come up with a way to make it work this time around.

Colin,

I want to thank you for this website that shows both the how and why of FHA loans. My wife and I are looking into getting a house once I secure a full time job outside of University (yeah grad school) and this has been really helpful. I really appreciate the fact that you are answering people’s questions over the years.

James

James,

Thanks for the kind note and good luck with your home purchase!

Under 15 U.S.C. § 1681 c, negative information over seven years old may be reported by CRAs for a credit transaction involving, or which may reasonably be expected to involve, a principal amount of $150,000 or more. How does that exclusion actually perform in a real-life situation, if the purchase amount is $137,000? Or does it relate to the actual mortgage amount (including interest)?

Hi Colin, I hope you can answer a FHA question?? I sold my home w/a rent back contract giving me up to 45 days to stay & pay $100 a day … Well when Mortgage Co was PIF up until 11/30/2016 doesn’t rent back start 12/1/2026?? Or does rent back start day of escrow?? Please advise

Hi Colin,

My wife and I are preapproved for an FHA loan. We have already provided 2 months worth of bank statements, paystubs, w2s, proof of down payment etc. We are continuing to put money in to our savings account(separate bank) which is withdrawn from our main bank. In process of doing this we had a miscommunication. We withdrew too much which caused a negative balance ($8) and nsf fees. We redeposited the money and begged the bank to return the nsf fees. They did but the nsf fees, negative balance and nsf fee return still show on our statement. Would this be something that would prevent us from continuing forward or would we be able to explain this to underwriting?

Thanks,

JB

JB,

Might (hopefully) just be a Letter of Explanation (LOE) from you to the lender to clear things up.

Hello, when a condo is not approved FHA because of the ratio of owner occupants vs. tenant occupied; what is the exception rule that states you CAN use FHA financing when the property is a HUD foreclosure?

M. Wilson,

Potentially HUD 4155.1 4.B.4.b FHA-Insured Mortgages on Investment Properties

Hello, I’m trying to get a FHA loan but more credit score is @ a 599 @ the moment. Any lenders that can help? Looking to move fast since my lease is up 01/31/17/ Location Dallas TX

Fs,

It’s possible to get an FHA loan with a 599 score, but you may want to work on improving it to score better pricing and expand your lender options…even getting it above 600 can help. Good luck.

I’m trying to do a refi and was approved by underwriting but when they entered the info into hud system and old case number came up from a house that I sold in 1991. Hud says I have to contact the company that held my mortgage. Unfortunately they have been out of business since 1993. So basically hud won’t help me to remove this error so I can close my loan. I don’t know where to go or start. I’m so stressed by this.

Kelly,

Ideally your loan officer can sort that out for you if they want to earn their commission.

Colin,

First off, thanks for continually providing everyone with information even though this article is from 2013. You’re the real MVP. Anyway, my question is how long does one have to own the FHA loaned home before one can sell it?

Anthony,

There are no prepayment penalties on FHA loans so there is no time limit, seasoning period, or penalty to sell.

My wife purchased a home with an FHA loan prior to our marriage about 12 years ago. We just did a conventional refi last year in my name. We’re now selling the house and looking to buy in another state. Even though I’ve never bought a home myself, am I still eligible for an FHA or does the refi disqualify me as a first time buyer?

Sean,

You don’t have to be a first-time buyer to get an FHA loan, but the property you’re buying has to be owner-occupied to get FHA financing.

i was speaking with my loan officer to get approved for the FHA Loan which i was approved with 3.5% down. She advised me not to spend any of my tax return at all to have it for the FHA loan. My question is do i need to put a down payment into escrow even thou i have not really started looking & if it takes me a yr or more to find a place it is sitting there building interest no on my side, how does this all work

Monique,

They probably just mean setting the money aside in your checking/savings account and not spending it so you have seasoned assets/reserves on hand if and when you find a suitable property.

can you get a fha loan without owning property? loan on a mobile home. have about 20 percent down.

Michael,

There are a lot of rules regarding mobile homes and FHA financing, one stipulating that borrowers aren’t required to purchase/own the land on which the manufactured home is placed.

I currently have a FHA loan on a 2 unit house. I am now refinancing to a conventional loan. So i am now looking for a new primary residence , i was told by my mortgage company (Quicken Loans) that i can use FHA on my 2nd home but it can only be a 2 unit home, but i was interested in a 3 unit home.. is that true?

Anthony,

Hmm. Did you refer to the new primary residence as your “2nd home?” It would need to be your primary, as you stated. It could be a lender overlay or a reference to you needing more reserves to qualify when it’s a 3-4 unit property. There’s also an FHA 3-4 unit self-sufficiency test. May want to seek clarification as to why Quicken can’t do it.

My husband and I were just told that we qualify for an FHA loan for a home cost of $200,000, MI, and property taxes of $600 a month for a total payment of $1720 with 3.5% of the $200,000 down.

We have been renting the last 8 years and the owners of this home informed us that they are putting the home on the market at the end of our current lease which is 5/1/17, but that we have the first option to purchase this home for $200,000 without having to move out if we close by 5/1/17.

The real estate agent that had the house listed 8 years ago when we moved in has been out local “go between” for repairs/issues with the house as the elderly owners live in England after they moved from the house we are currently living in 8 years ago. The real estate agent referred us to the mortgage broker who pre-approved us for a loan, although we have said for the past year that we have known that we would either have to purchase this house or move that we were opting to move as circumstances have changed with this house since we first moved in 8 years ago (annexation issues with the city and a nightmare of a neighbor) that staying here is not desirable.

The mortgage broker, even though I informed her that our intent was to shop for a house not purchase the one we were in, just happened to quote our pre-approval for the exact asking price and monthly property tax amount of the house we are in and not wanting to buy, so I feel like I am being a bit set up to purchase this house between the real estate agent and mortgage broker whom they each have stated that they know each other very well and work together often, so I am not very trusting in the response I would receive if I were to call and ask. While I know they have ethics rules they are to adhere to I also know that shady things do also happen, so I am skeptical.

My question is this, since property taxes are paid in with the mortgage as a part of the pre-approval, if I find a different house that is $225,000 but has property taxes that are only $400 a month instead of $600, which actually makes my total monthly payment a little lower would I be able to actually purchase the $225,000 home even though I was only pre-approved for $200,000 since the lower taxes actually makes the overall monthly payment slightly lower.

Buckeye,

It depends what your pre-approval included in the way of property taxes…basically look at the max PITI it allows for and also the down payment you’re capable of, etc.

I am about to close on a home next week with an FHA loan. They are now asking me to pay my personal taxes upfront even though the IRS has scheduled payment arrangements for this year. The amount owed is under $2000. My credit score is 710 and I’m paying half of the closing costs, with 4% down.

Is this common?

Lisa,

Hmm…you may be required to make at least 3 months of timely payments on the IRS debt in order to leave it unpaid. May want to ask your lender for specifics.

Hi Colin, my FHA mortgage was approved. Because I am in a different state I signed all the closing documents in the presence of a mobile Notary and my down payment money was wired to the title company (this was all done yesterday). My realtor called me today to let me know that the seller is having issues obtaining a loan for his new home so I am afraid he may back out. My question is: do i need to go through the whole loan approval process again if I find a home the cost the same amount or lower in a reasonable time frame?

Kelly,

If you’ve worked with a lender previously, they might be able to use some of your old documents again. But you’ll still have to sign new disclosures, get a new appraisal (if it’s a different house), update a lot of things like bank statements that age quickly, and so on. It might be slightly easier and fresh in your mind as to what you need to provide, but still a bit of work.

I have a question. If I’m approved for an FHA loan, who is authorized to live in the home? Can my husband live with me even though he’s not on the loan? I live in Texas.

Tywana,

Sure, the loan is just who is liable for repayment on the loan. The issue you might be thinking of is occupancy, whereby the borrower on the loan must reside in the home.

HI Colin,

I was told that an additional .8% would be added to the 3.75% I was quoted for pmi. I was also told that I would have to keep that on the loan for 11 years and then it would fall off and only be the 3.75%. Can I request it to be removed if my LTV got to a certain point? Or am I stuck for the 11 years? Thanks!

Chris,

The only way to get it off sooner would be refinancing away from the FHA assuming you could get a new LTV of 80% or less.

There’s still something I can’t find a definitive answer to. FHA is an insurance that I pay guaranteeing the lender will get their money (even though my home is the guarantee). If there was a default how does it work? If I’m paying insurance to FHA and default do they pay the lender and my home is paid for (after all this IS insurance) or what happens? Seems like I’m paying for insurance that’s not really insurance. I didn’t get 100% ltv on my home which means the lender would get their money back if they foreclosed. The lender only gave me about 80% of the value of my new home which means if I default they’ll have their money. For instance if I own a $200,000 home, I borrowed $130,000, paid $10,000 then defaulted ($120,000 bal) and for some reason it brought $80,000 at auction or whatever would they (fha) only pay $40,000 and I still lose my home. Why would they call it mortgage insurance if I still lose my home after paying premiums?

Roy,

My guess is most people that go FHA put down the minimum 3.5%, which after accounting for foreclosure fees won’t come close to covering the outstanding loan balance once sold as a fire sale. As you probably know, this insurance is in place for lenders, not borrowers, which offer low-down payment loans to homeowners in exchange for this protection. It’s not in place to protect borrowers if they can’t pay the mortgage. If a borrower does happen to put down 20%, often it’s not with the FHA, and doesn’t require mortgage insurance.

Hello, i have been at my home for about 12 years, i have an 80/20 loan with a flexible mortgage and a BALLOON attached to it! It is our first home and i didnt know what a balloon was and we have paid a measley 1500 in 12 years into the principle!! Then we got behind for a year and i decided to sign up for a modification and they told me if approved they would take off the balloon AND all the past late payments on my credit! Well neither was done and my balloon is up in about 2 years now and my score is only 614 and 643 after cleaning my credit! What are my options!! I need fast help!

Marcelli,

If you have two years before you absolutely have to take action, you may want to keep working on your credit scores so you can obtain a refinance at a reasonable rate, assuming you meet all other mortgage eligibility criteria like income, assets, appraisal, etc.

Hello, I am not wanting to live in my house anymore. My insurance company is going to drop insurance because I can’t afford to fix the roof and gutters. My credit is bad and can’t get a loan. There are other problems with the inside of the house that I can’t afford to fix. I have a first time home buyers loan, if the house goes into foreclosure, what will happen. I live in kansas

I got into an FHA three years ago. The housing market has since come up considerably. I have a manufactured home (not a trailer-no axles and on a foundation) on property. Everyone keeps contacting me to “stream-line” the mortgage. By the time you pay FHA the 1.75%, appraisals and closing costs the new loan amount come in much higher than the original mortgage price. Even though there is now easily 20% equity.

Is there other, Private, mortgage companies that refinance manufactured homes or is FHA the only option I have? I would like to lower my payments and reduce the interest rate.

Amy,

Have you considered selling it to avoid foreclosure? The market is pretty hot right now so it’s possible you might be able to unload it without hurting your credit. Not sure the first-timer aspect will have any effect, good or bad. Good luck!

Mindy,

If you have 20% equity, you can certainly try going the conventional route (Fannie Mae or Freddie Mac) instead to avoid the upfront MI and the monthly MI. Might want to start shopping around to see if they can do better than FHA.

my wife and i are in process of buying a house. when we applied for the loan the bank told us her income would be used. now that we are 1 wk from a 2nd closing…1st one had to be rescheduled, they “decided” not to use it. she has a low score because of bad car accidents which led to a lot of medical debt. with my debt im at just under 45% DTI. they said we have to be at 43%. with her income i know it wouldnt be a problem. can the bank just decide like that and put it all on me? the credit cards we have are in my name and bank says we cant go any farther keep in mind 1 week from closing, if those are paid off…$3100. can that be added to the loan?

Brad,

They might be structuring it that way to save the loan because you may not qualify otherwise. Her low score combined with her debt might jeopardize the loan, but that’s something you can discuss with your lender directly.

my marriage ended after over 40 years. I am in my late sixties. I want to buy me a home but my ex let our house go into foreclosure without my knowledge. In our divorce decree he was allowed to live in our home while it was up for sale and make the payments but he didn’t. I wasn’t aware of this until the sheriff department served me papers. Is there anything I can do. Is there any kind of program that can help a elderly woman to purchase a home.

Mable,

It’s possible, but they’ll have to consider your payment history and income/assets. You may want to reach out to a mortgage broker who is knowledgeable about a variety of loan programs, as opposed to a bank rep who may not know much more than what their own bank can offer. Good luck!

I am planning to purchase a home that is owned by a family member. I’ve been told that I would not need to have the down payment or closing costs to complete the loan paperwork. Can I still finance the house through an FHA loan under these circumstances?

Jennifer,

The FHA has what’s called an identity of interest transaction, which is defined as a sale between parties with family/business relationships. In those cases the LTV is limited to 85%, meaning a minimum 15% down payment would be necessary. The exception is if the borrower has been a tenant in the property for at least six months predating the sale.

I am looking to purchase a home and was looking into the down payment assistance program in FL but my middle score is only 610. So I am considering the FHA option. If I get a personal loan for the down payment, would it possibly affect my score more than 30 points? Also, I’m just looking for overall guidance in my options for obtaining the down payment.

Jes,

The FHA doesn’t allow personal loans, aka unsecured signature loans, as an acceptable source of funds. And as you mentioned, it could lower your credit scores even further. If using a loan, it would need to be collateralized, meaning secured by an asset. Alternatively, you could look into a grant or a gift for down payment.

Colin I am purchasing a home under FHA for 76k seller to pay up to 4K in closing. I am selling my home to my daughter who is selling her home. The sell proceeds will pay of mortgage of $53k and $33k Of debts. I am underselling this Home. The appraisal should be around $130k and she is borrowing 105000. the lender now is saying since I am selling to my daughter under FHA guidelines I cannot use proceeds to pay off debt and seller of new home can only contribute up to certain amount on purchase of their home. Lender is now saying to pay off my debt with proceeds of sell I would have to do conventional loan. I hope you can clarify. This would mean 5 percent down payment instead of 3.5 percent and closing cost much greater opposed to $2800 I don’t understand and is there anyway around this.

Teresa,

The sale of current home would be considered non-arms-length if to a family member. Conventional does allow 3% down, even lower than FHA.

Thank you. The appraisal for the property I am selling to my daughter came in at fair market value of $105000 and sale was for $104999. It is my understanding that this is considered an exception to the non arms length rule as it satisfies and proves by a third party that property was not undersold. Therefore my next question is this. The lender I have applied with for a new home is stating that on my purchase /closing I can not use funds from the sale of my property to close my new loan. Can you clarify please

Teresa,

HUD allows net proceeds from an arms-length sale of a currently owned property to be used for the cash investment on a new house. The sale to your daughter would be considered non-arms length, I’m assuming that’s what they’re referring to.

We purchased a home on 4/18 and did a 203k rehab. We are looking to refinance to pay off credit card debit from unexpected costs not covered by the rehab. I am assuming we are refinancing back into an FHA loan. Our 30k in credit cards are being paid off and we are getting 5k in cash. With the appraisal we are at 78% Ltv on the new loan. Would we still have to pay mip?

Mortgage insurance is compulsory on all FHA loans these days. Only way to avoid it at that LTV would be to go conventional, such as refinancing into Fannie Mae or Freddie Mac.

Can I qualify for an FHA loan if i work away from home 4 days per week? But it is still my primary residence? All my will be sent to primary residence

Louann,

It’s possible, but the burden will be on you to have it make sense to the underwriter to ensure occupancy is legit. You will likely have to explain the situation, why you travel for work, where you stay during that time, why you’re purchasing a home far from work, etc.

I defaulted on my fha loan over two years ago. I had to do a loan modification, and have been making on time payments for over a year now. What are my possibilities of selling this home and buying a new one? How long should I wait?

I’m in the process of getting approval for an FHA loan and I’ve found my perfect home! Only issue is it states ‘Conventional or Cash Out’ under terms. Is there a way to still make an offer on this home or am I out of luck due by only qualifying for an FHA loan? I don’t have a down payment so we are also trying to get a DPA loan in conjunction with the FHA loan. Thanks!

Karla,

You could have your agent reach out to the listing agent to see what the seller will accept. Sometimes information is just entered by default on the MLS.

Can I apply an FHA loan with 5% down and 6 months later I have enough money for 20% of the home value, is the mortgage insurance will be eliminated?

Bill,

You’d need to refinance the original loan out of the FHA to a conventional loan in order to drop the MI.

Does FHA restrict a Loan to a buyer who is a relative to the seller?

If so, what is the reasoning?

So I been planning to help my parents buy a house over 8 years. We believe now it’s the time. And we planning to get the FHA program, but I have a question. That was before I met my fiancé , and we would like to own a house in the future as well. So my question is can I get an FHA program with my parents. Than few years later apply for another FHA with my fiancé. Since it will be his first time buying a house?

Carol,

It’s possible for a non-occupying co-borrower on an existing FHA loan to get another FHA loan for a property they intend to occupy, but you may need to jump through some hoops and provide letters of explanation to get a second FHA loan. Additionally, the mortgage debt from the first house will likely count against your DTI if you plan to be on the second loan with your fiance. You could also look into Fannie Mae HomeReady, which requires only 3% down payment and/or speak to a mortgage broker to see the best way to approach it.

Do you have to get an inspection to get a FHA mortgage loan?

Ashley,

No, but HUD strongly recommends that home buyers order one for their own protection, and in fact require lenders to provide a form called “For Your Protection: Get a Home Inspection” (Form HUD-92564-CN). Conversely, a home appraisal IS required to determine the property value, ensure the property is marketable, and make sure the property meets FHA minimum property standards/requirements.

I currently am in the process to buy a 2 family home with an FHA mortgage, we are in contract, down payment, did all the necessary things for the mortgage, we are now waiting for the government to lift the eviction moratorium for one of the tenants to move. My seller is trying to get one or both of the tenants out. But because of the eviction moratorium they can’t. The seller wants to close in March, that would be 60 days and maybe the eviction moratorium will be lifted can I still close on the house? I won’t be able to occupy the home until the eviction moratorium is lifted. Has the government put a moratorium on the 60 day occupancy?

Hi Karen,

Not sure, but HUD just last week extended eviction moratoria through March 31st, 2021.

Can you borrow more than the selling price of the home with an FHA loan, for things like renovations? If yes, is there a percentage that you can go above the sale price?

Hollie,

Yes, if you take out an FHA 203k loan, which allows for up to 110% of post-renovated appraised value.

In the process of getting a fha loan now and the have requested tax transcripts for 2018 2019 and 2020 is there going to be a problem if 2018 isn’t filled yet ?

Mel,

That might depend on why they weren’t filed…

Was pre approved for fha mortgage and was told i needed tax transcripts, i hadn’t filed for 3 yrs !! On the road for work same employer for 6 yrs. So i rushed out and filed them all . will i be safe if closing if 45 days away?

My father is a widower in Texas and has an FHA loan. Can he write up a Will to transfer the house payments to me and have his bank notarize it, or does he need a lawyer to do this?

I’m a co borrower for my son. (FHA)

My name is on title but not on mtg on another property can lender use mtg payment against me on this loan I’m trying to get with my son?

Leivis,

A mortgage lender would consider a co-borrower’s income and liabilities (any other mortgages included) to determine affordability, otherwise the income calculation would be arbitrary.

Question: This year 2021 February I refinance I have FHA loan fixed 30-years loan. This month in November I was told my FHA mortgage insurance increase

please explain to me what makes FHA mortgage insurance increase.

FHA loan- Underwriter came back with get 3 charged off accounts settled or deleted off credit report. I was able to settle 2 of the 3 accounts by paying a settlement amount. The 3rd charge off was total of $25,000 due to fraud which I cannot prove and have disputed several times with no deletion from my credit report. The charged off account is over 24 months old. The company sent the account to collections. I informed collection agency I am disabled and on a fixed monthly income. They transferred my account to their hardship department. My account was sent back to the the original creditor. They informed me they have the account back and it is charged off. The monthly payment was 500.00 a month but since I’m on a fixed income the rep said I can pay what I can each month and it will be deducted from the balance. I can pay 50.00 a month. What are my chances of the UW moving forward with my loan.

Michelle,

It ultimately depends on the underwriter’s discretion. And perhaps if you get that minimum payment info in writing to prove to the UW you don’t owe 5% of that total amount (each month) and can pay a much smaller amount monthly. Your LO/broker should be able to help guide you.

Hi, The home I’ve found is about half of the cost of the preapproval amount ie 80k Preapproved Loan amount and the home is around 49K. Knowing that I can roll the closing costs into the remaining loan money, would I be able to use any of the additional funds from the loan to pay for a fence that I need around the property? I know it goes into an escrow account for home repairs etc, would that be allowed?

Does the FHA offer 1st Lien HELOC as a mortgage product?

Tanic,

Not to my knowledge, no.